This version of the form is not currently in use and is provided for reference only. Download this version of

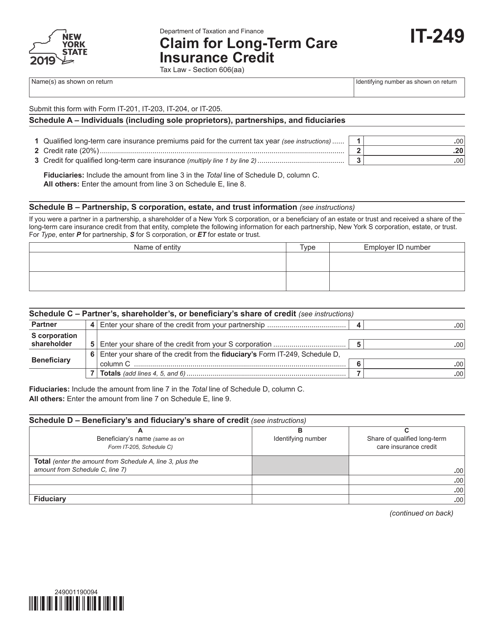

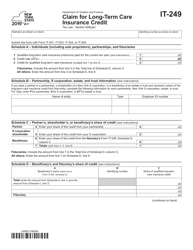

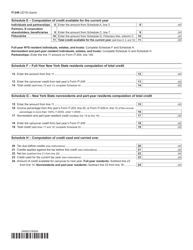

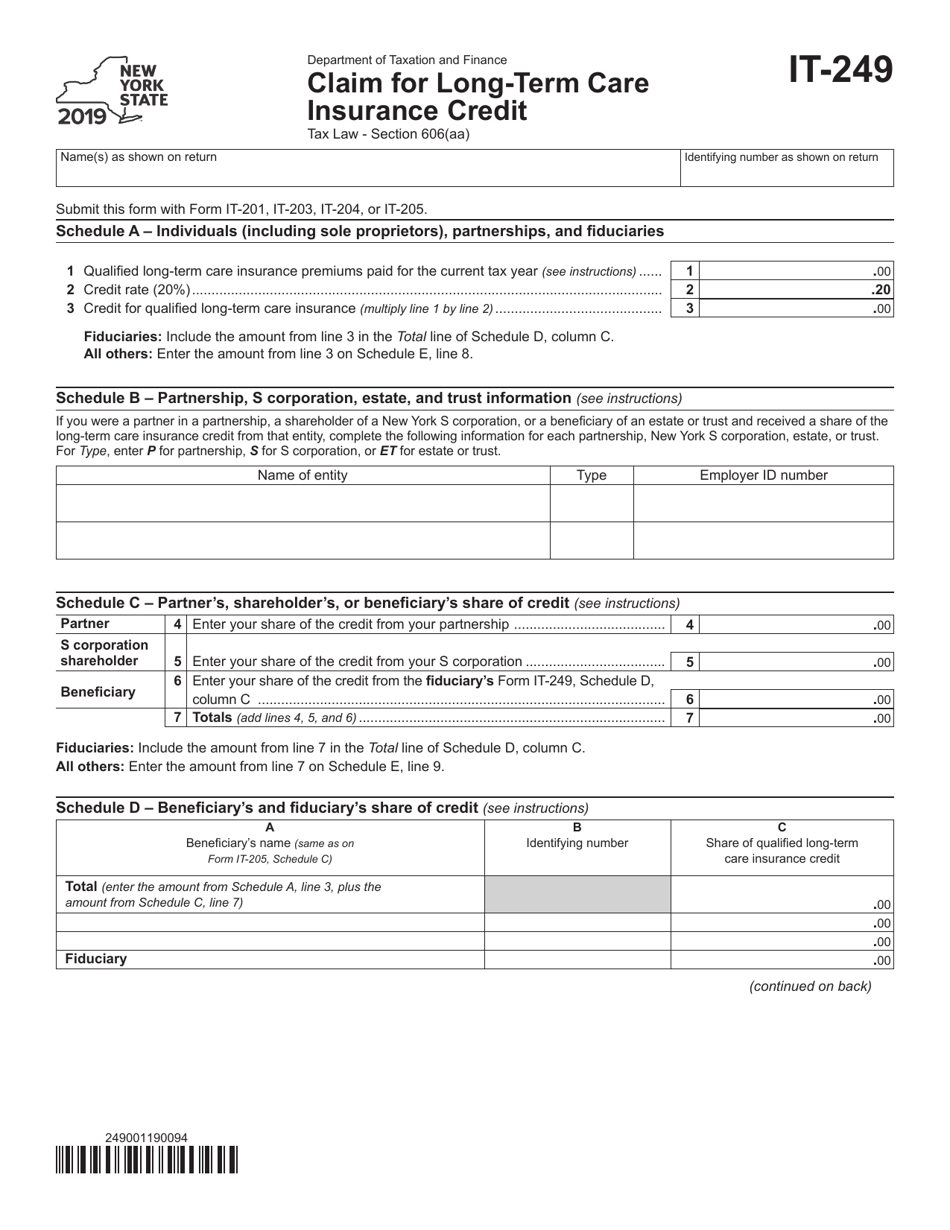

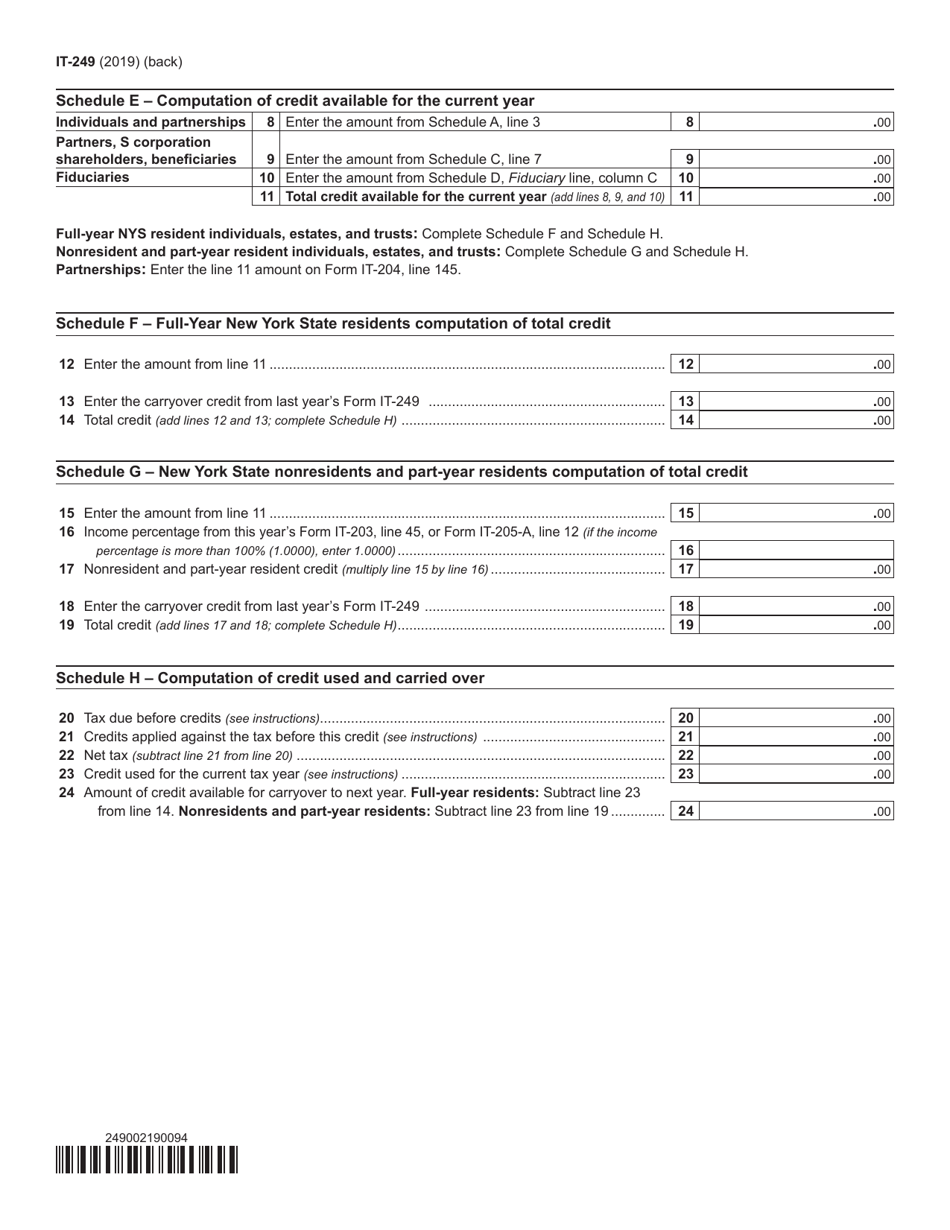

Form IT-249

for the current year.

Form IT-249 Claim for Long-Term Care Insurance Credit - New York

What Is Form IT-249?

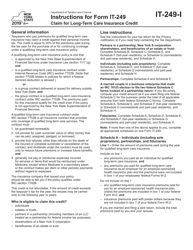

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-249?

A: Form IT-249 is a tax form used to claim the Long-Term Care Insurance Credit in the state of New York.

Q: What is the Long-Term Care Insurance Credit?

A: The Long-Term Care Insurance Credit is a tax credit available to New York residents who have purchased long-term care insurance.

Q: Who is eligible to claim the Long-Term Care Insurance Credit?

A: New York residents who have purchased qualifying long-term care insurance policies are eligible to claim the credit.

Q: What are the requirements for the Long-Term Care Insurance Credit?

A: To qualify for the credit, the long-term care insurance policy must meet certain criteria set by the New York State Department of Financial Services.

Q: When is the deadline to file Form IT-249?

A: The deadline to file Form IT-249 is the same as the deadline to file your New York State income tax return, typically April 15th.

Q: Is the Long-Term Care Insurance Credit refundable?

A: No, the Long-Term Care Insurance Credit is non-refundable, meaning it can reduce your tax liability but will not result in a refund.

Q: Are there any income limits for claiming the Long-Term Care Insurance Credit?

A: No, there are no income limits for claiming the Long-Term Care Insurance Credit in New York.

Q: Can I claim the Long-Term Care Insurance Credit if I live in a different state?

A: No, the Long-Term Care Insurance Credit is specific to New York residents.

Q: Can I claim the Long-Term Care Insurance Credit if I have a different type of insurance?

A: No, the credit is only available for qualifying long-term care insurance policies.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-249 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.