This version of the form is not currently in use and is provided for reference only. Download this version of

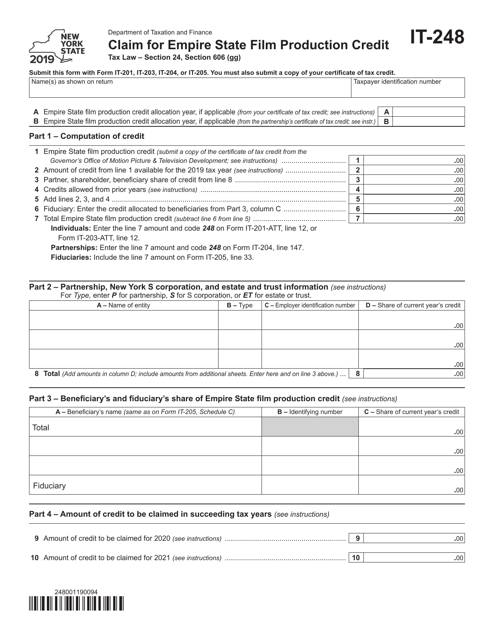

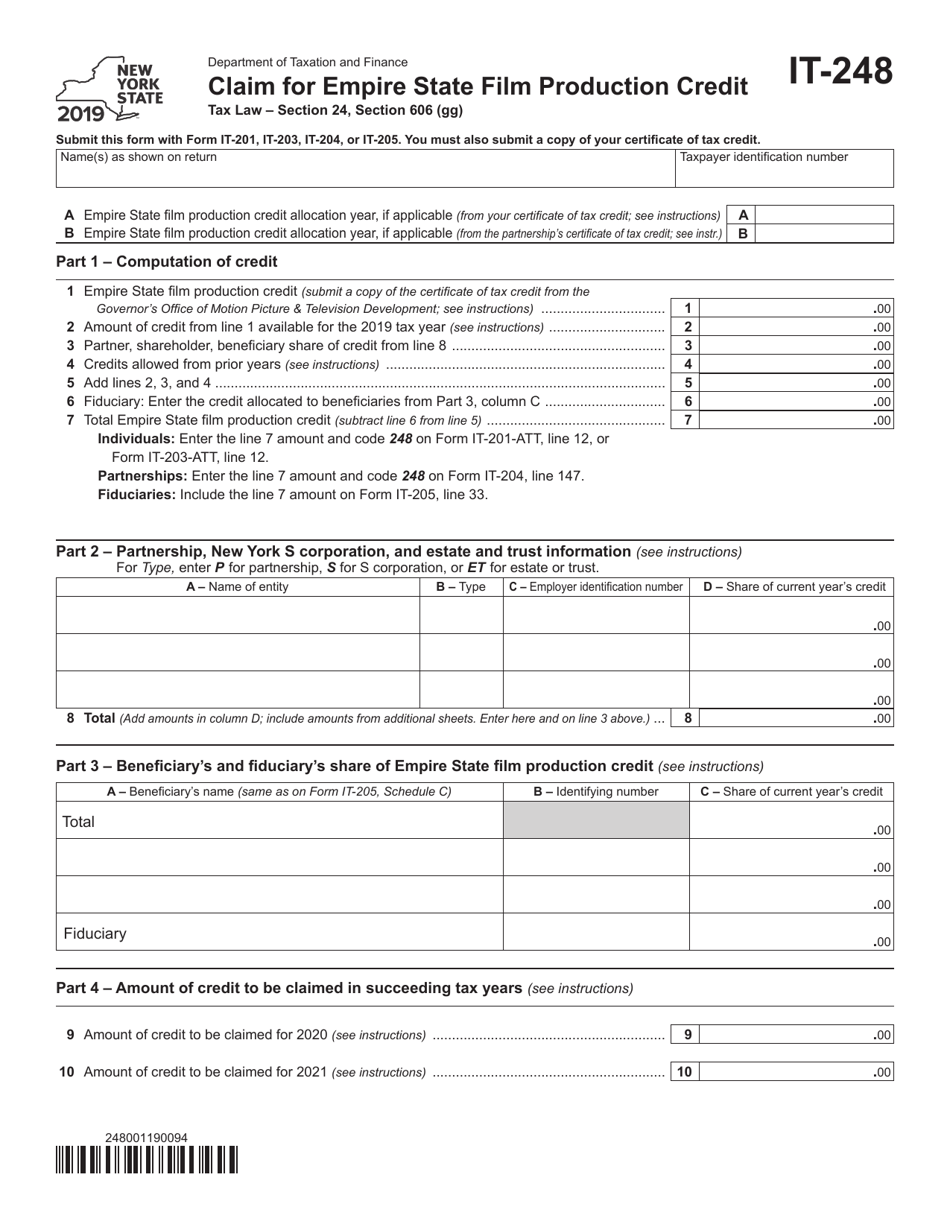

Form IT-248

for the current year.

Form IT-248 Claim for Empire State Film Production Credit - New York

What Is Form IT-248?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-248?

A: Form IT-248 is the Claim for Empire State FilmProduction Credit in New York.

Q: What is the Empire StateFilm Production Credit?

A: The Empire State Film Production Credit is a tax credit available to qualified film production companies in New York.

Q: Who can file Form IT-248?

A: Qualified film production companies in New York can file Form IT-248.

Q: What is the purpose of Form IT-248?

A: The purpose of Form IT-248 is to claim the Empire State Film Production Credit.

Q: What information is required on Form IT-248?

A: Form IT-248 requires information about the film production company, the production project, and the expenses incurred.

Q: When is Form IT-248 due?

A: Form IT-248 is generally due on the same date as the New York business tax return, which is generally March 15th for calendar year filers.

Q: Are there any specific eligibility requirements for the Empire State Film Production Credit?

A: Yes, there are specific eligibility requirements for the Empire State Film Production Credit, including minimum spending thresholds and production criteria.

Q: Is there a limit to the amount of credit that can be claimed?

A: Yes, there is a limit to the amount of credit that can be claimed, which is based on eligible production costs and other factors.

Q: Can the Empire State Film Production Credit be carried forward or refunded?

A: Yes, any unused credit can be carried forward for up to 5 years or refunded in certain circumstances.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-248 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.