This version of the form is not currently in use and is provided for reference only. Download this version of

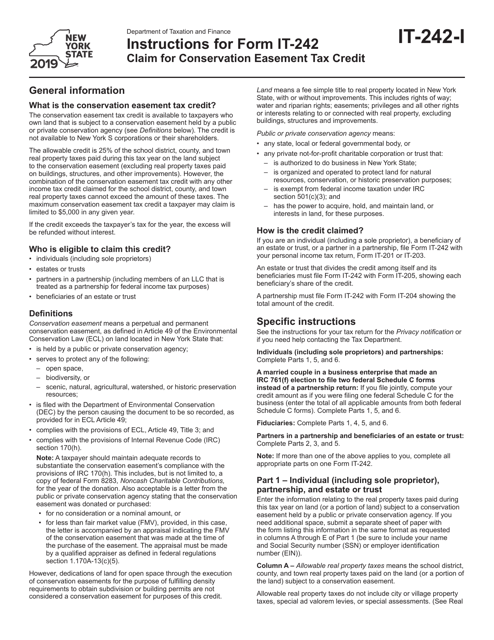

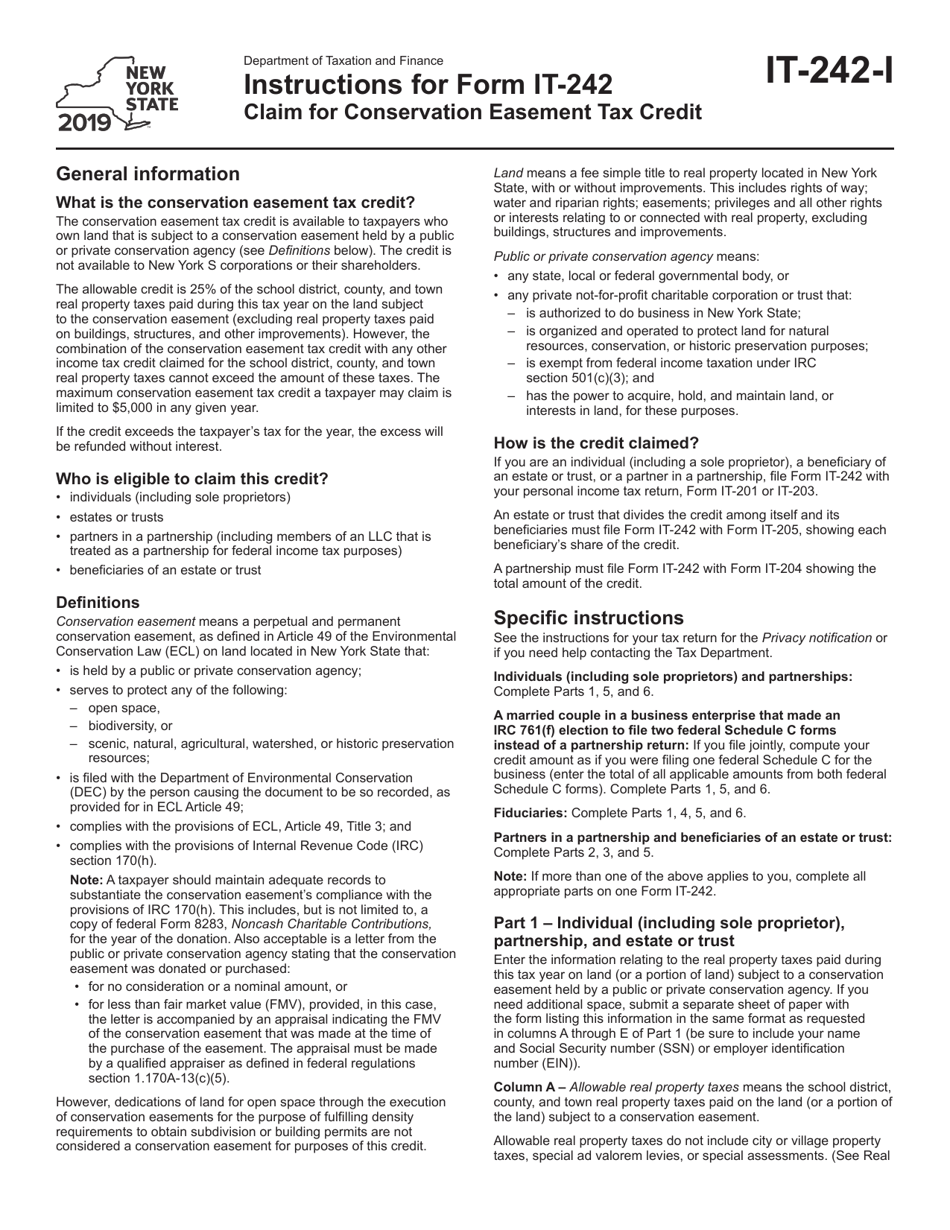

Instructions for Form IT-242

for the current year.

Instructions for Form IT-242 Claim for Conservation Easement Tax Credit - New York

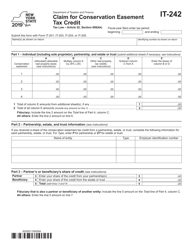

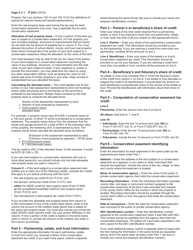

This document contains official instructions for Form IT-242 , Claim for Conservation Easement Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-242 is available for download through this link.

FAQ

Q: What is Form IT-242?

A: Form IT-242 is the Claim for Conservation Easement Tax Credit form for New York.

Q: What is the purpose of Form IT-242?

A: The purpose of Form IT-242 is to claim a conservation easement tax credit in New York.

Q: Who should use Form IT-242?

A: Individuals and corporations who have made a qualified conservation easement donation in New York can use Form IT-242.

Q: What is a conservation easement?

A: A conservation easement is a legal agreement between a landowner and a qualified organization to protect the land's conservation values.

Q: What is the tax credit for conservation easement in New York?

A: The tax credit for conservation easement in New York is 25% of the eligible amount, up to a maximum credit of $5 million.

Q: What are the eligibility requirements for the tax credit?

A: To be eligible for the tax credit, the conservation easement must be donated to a qualified organization, and the donor must meet certain criteria set by the New York State Department of Environmental Conservation.

Q: Are there any deadlines for filing Form IT-242?

A: Yes, Form IT-242 must be filed within three years from the due date of the tax return for the year in which the qualified conservation easement donation was made.

Q: Are there any additional documentation required?

A: Yes, along with Form IT-242, you must also include a copy of the appraisal report, a copy of the completed federal Form 8283, and other supporting documentation as required.

Q: Can the tax credit be carried forward?

A: Yes, any unused tax credit can be carried forward for up to 15 years.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.

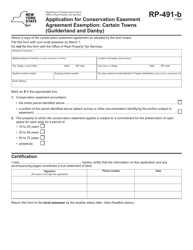

![Document preview: Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

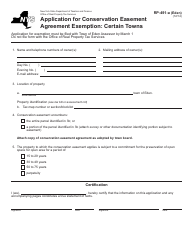

![Document preview: Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)