This version of the form is not currently in use and is provided for reference only. Download this version of

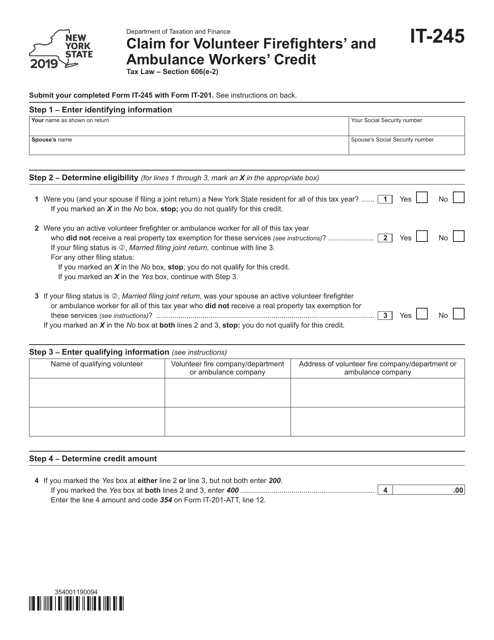

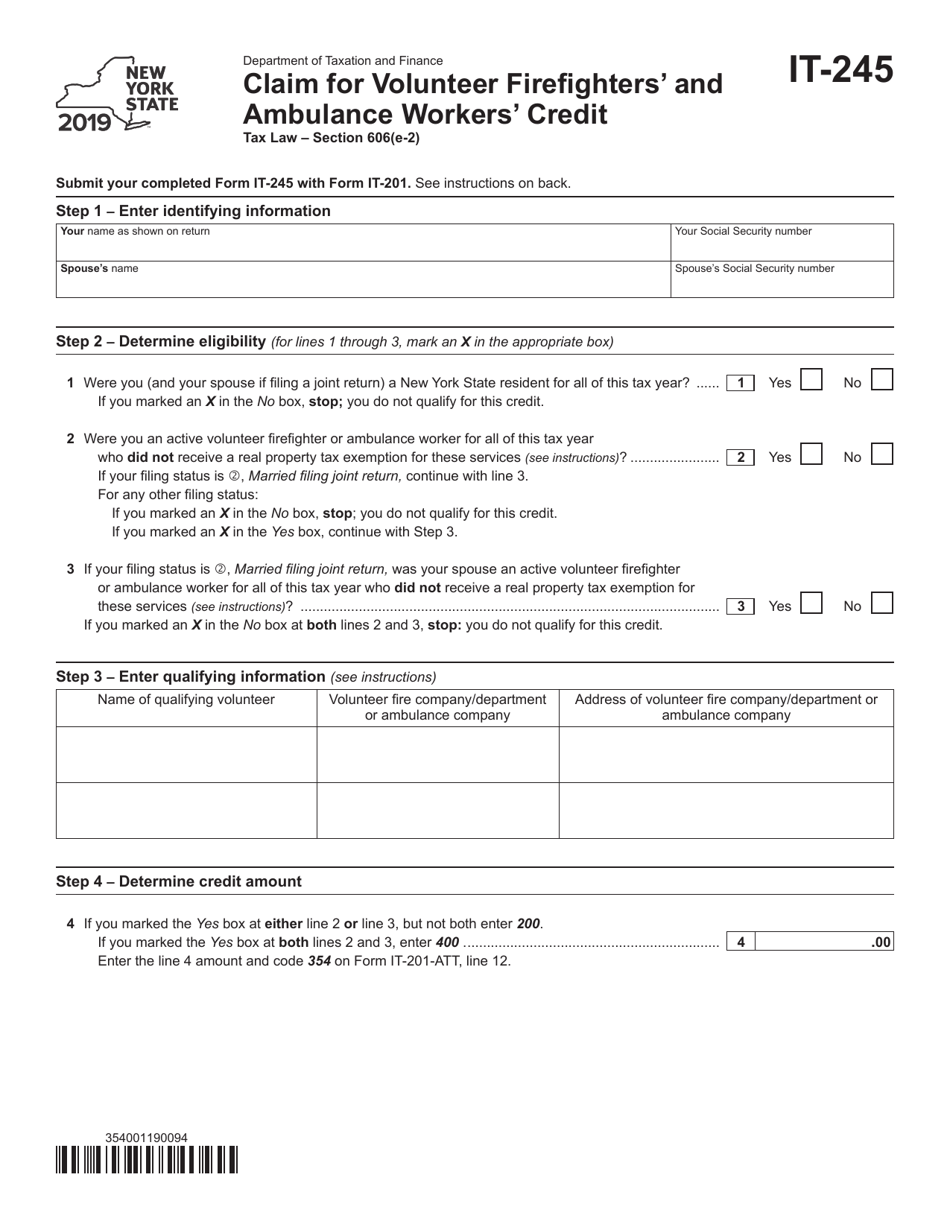

Form IT-245

for the current year.

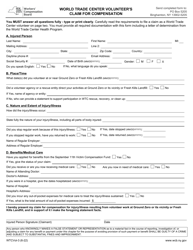

Form IT-245 Claim for Volunteer Firefighters' and Ambulance Workers' Credit - New York

What Is Form IT-245?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-245?

A: Form IT-245 is a form used by volunteer firefighters and ambulance workers in New York to claim a tax credit.

Q: Who can use Form IT-245?

A: Volunteer firefighters and ambulance workers in New York can use Form IT-245 to claim a tax credit.

Q: What is the purpose of Form IT-245?

A: The purpose of Form IT-245 is to claim a tax credit for volunteer firefighters and ambulance workers in New York.

Q: What is the tax credit for volunteer firefighters and ambulance workers in New York?

A: The tax credit available for volunteer firefighters and ambulance workers in New York is up to $200.

Q: What are the requirements to claim the tax credit on Form IT-245?

A: To claim the tax credit on Form IT-245, you must meet certain eligibility requirements, such as being an active volunteer firefighter or ambulance worker for the entire tax year and meeting specific training and participation requirements.

Q: When is the deadline to file Form IT-245?

A: The deadline to file Form IT-245 is the same as the deadline for filing your New York state income tax return, which is typically April 15th.

Q: Can I claim the tax credit if I volunteer in a different state?

A: No, Form IT-245 is specifically for volunteer firefighters and ambulance workers in New York, so you must be volunteering in New York to claim the tax credit.

Q: Is the tax credit refundable?

A: No, the tax credit for volunteer firefighters and ambulance workers in New York is nonrefundable, which means it can reduce your tax liability but will not result in a refund if your tax liability is already zero.

Q: What other documents do I need to submit with Form IT-245?

A: You may need to submit additional documentation, such as a signed statement from your fire department or ambulance company verifying your volunteer status and the number of hours you volunteered during the tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-245 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-466-E [LEWIS] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Lewis County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733901/form-rp-466-e-lewis-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-lewis-county-only-new-york.png)

![Document preview: Form RP-466-C [PUTNAM] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Putnam County Only) - New York](https://data.templateroller.com/pdf_docs_html/1731/17310/1731027/form-rp-466-c-putnam-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-putnam-county-only-new-york.png)

![Document preview: Form RP-466-F [ORANGE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Orange County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733906/form-rp-466-f-orange-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-orange-county-only-new-york.png)

![Document preview: Form RP-466-H [ULSTER] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Ulster County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733907/form-rp-466-h-ulster-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-ulster-county-only-new-york.png)

![Document preview: Form RP-466-I [ALBANY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Albany County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733909/form-rp-466-i-albany-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-albany-county-only-new-york.png)

![Document preview: Form RP-466-J [CLINTON] Application for Volunteer Firefighters/ Volunteer Ambulance Workers Exemption (For Use in Clinton County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733910/form-rp-466-j-clinton-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-clinton-county-only-new-york.png)

![Document preview: Form RP-466-C [SUFFOLK] Application for Volunteer Firefighters / Ambulance Workers Exemption(For Use in Suffolk County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17335/1733577/form-rp-466-c-suffolk-application-volunteer-firefighters-ambulance-workers-exemption-use-in-suffolk-county-only-new-york.png)

![Document preview: Form RP-466-F [SULLIVAN] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Sullivan County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17336/1733642/form-rp-466-f-sullivan-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-sullivan-county-only-new-york.png)

![Document preview: Form RP-466-G [ONONDAGA] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Onondaga County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733908/form-rp-466-g-onondaga-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-onondaga-county-only-new-york.png)

![Document preview: Form RP-466-E [SCHOHARIE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schoharie County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733903/form-rp-466-e-schoharie-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schoharie-county-only-new-york.png)

![Document preview: Form RP-466-F [MONTGOMERY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Montgomery County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733905/form-rp-466-f-montgomery-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-montgomery-county-only-new-york.png)

![Document preview: Form RP-466-E [SCHENECTADY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schenectady County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733899/form-rp-466-e-schenectady-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schenectady-county-only-new-york.png)

![Document preview: Form RP-466-D [WESTCHESTER] Application Form for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Westchester County Only) - New York](https://data.templateroller.com/pdf_docs_html/359/3598/359812/form-rp-466-d-westchester-application-form-volunteer-firefighters-ambulance-workers-exemption-use-in-westchester-county-only-new-york.png)

![Document preview: Form RP-466-A [ROCKLAND, STEUBEN] Application for Volunteer Firefighters / Ambulance Workers Exemption in Certain Counties (For Use in Rockland or Steuben County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733888/form-rp-466-a-rockland-steuben-application-volunteer-firefighters-ambulance-workers-exemption-in-certain-counties-use-in-rockland-or-steuben-county-only-new-york.png)