This version of the form is not currently in use and is provided for reference only. Download this version of

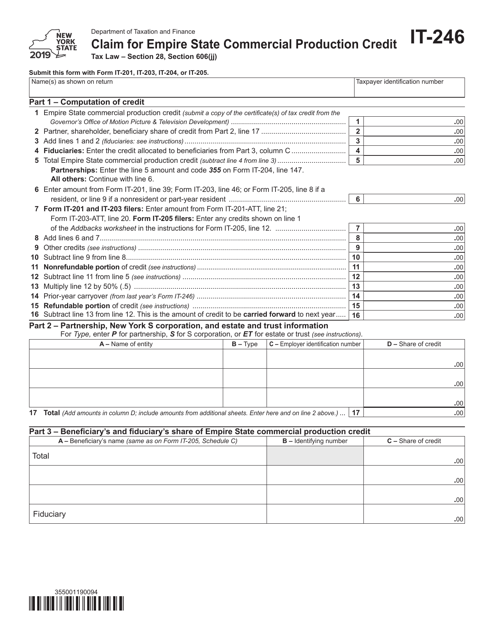

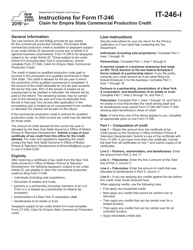

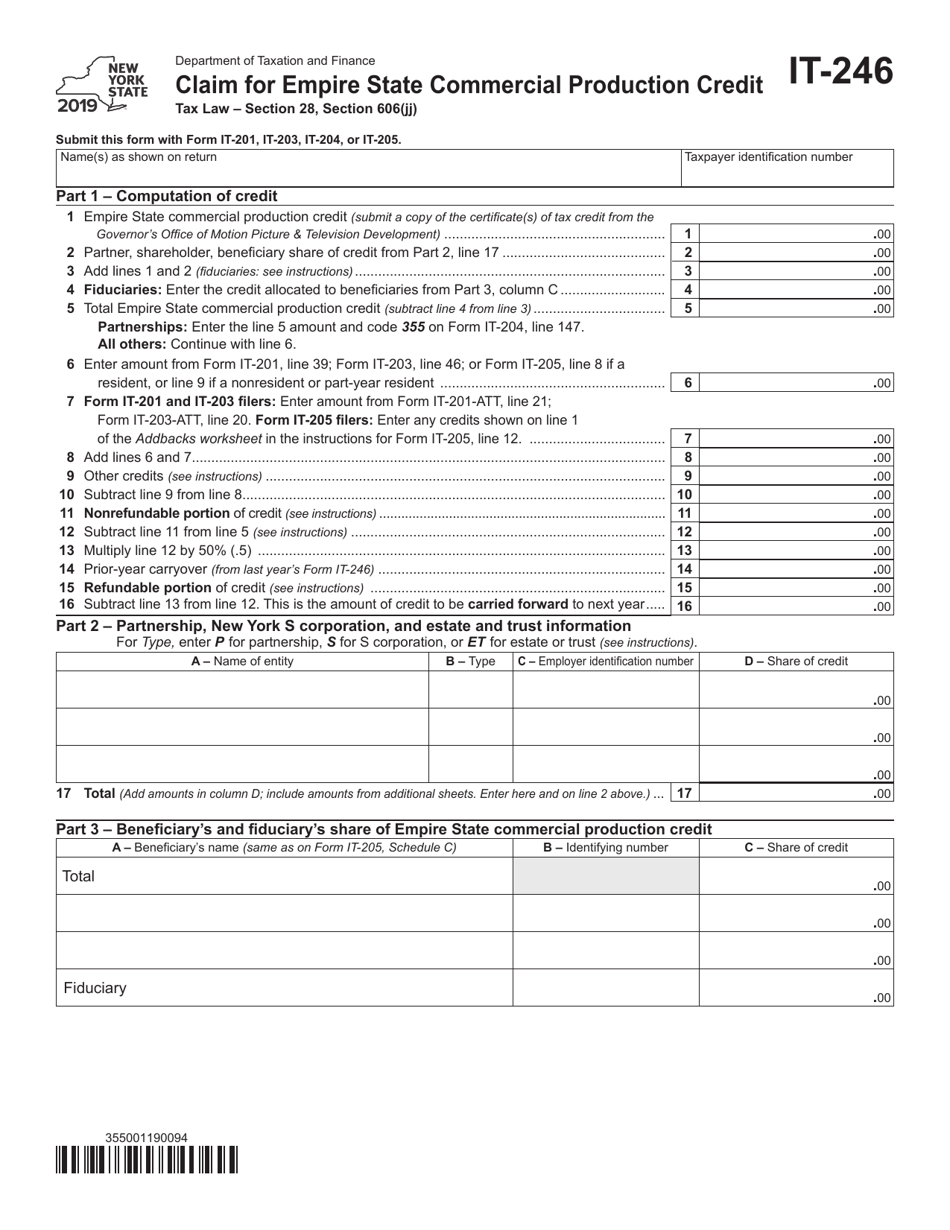

Form IT-246

for the current year.

Form IT-246 Claim for Empire State Commercial Production Credit - New York

What Is Form IT-246?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-246?

A: Form IT-246 is the Claim for Empire State Commercial Production Credit in New York.

Q: What is the Empire State Commercial Production Credit?

A: The Empire State Commercial Production Credit is a tax credit available to qualified commercial production companies in New York.

Q: Who is eligible to claim the Empire State Commercial Production Credit?

A: Qualified commercial production companies in New York are eligible to claim the Empire State Commercial Production Credit.

Q: What expenses qualify for the Empire State Commercial Production Credit?

A: Expenses related to qualified commercial productions in New York, such as production costs and post-production costs, may qualify for the credit.

Q: How do I claim the Empire State Commercial Production Credit?

A: You can claim the Empire State Commercial Production Credit by filing Form IT-246 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for claiming the Empire State Commercial Production Credit?

A: Yes, the deadline for claiming the credit is generally within three years from the original due date of the tax return for the year the credit is being claimed.

Q: Are there any supporting documents required to file Form IT-246?

A: Yes, you may be required to submit supporting documents, such as production cost reports or other relevant documentation, along with Form IT-246.

Q: Can I claim the Empire State Commercial Production Credit if I am not a New York resident?

A: No, the credit is specifically available to qualified commercial production companies located in New York.

Q: Is the Empire State Commercial Production Credit refundable?

A: Yes, the credit is refundable, which means that if the credit exceeds the tax liability, the excess can be refunded to the taxpayer.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-246 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.