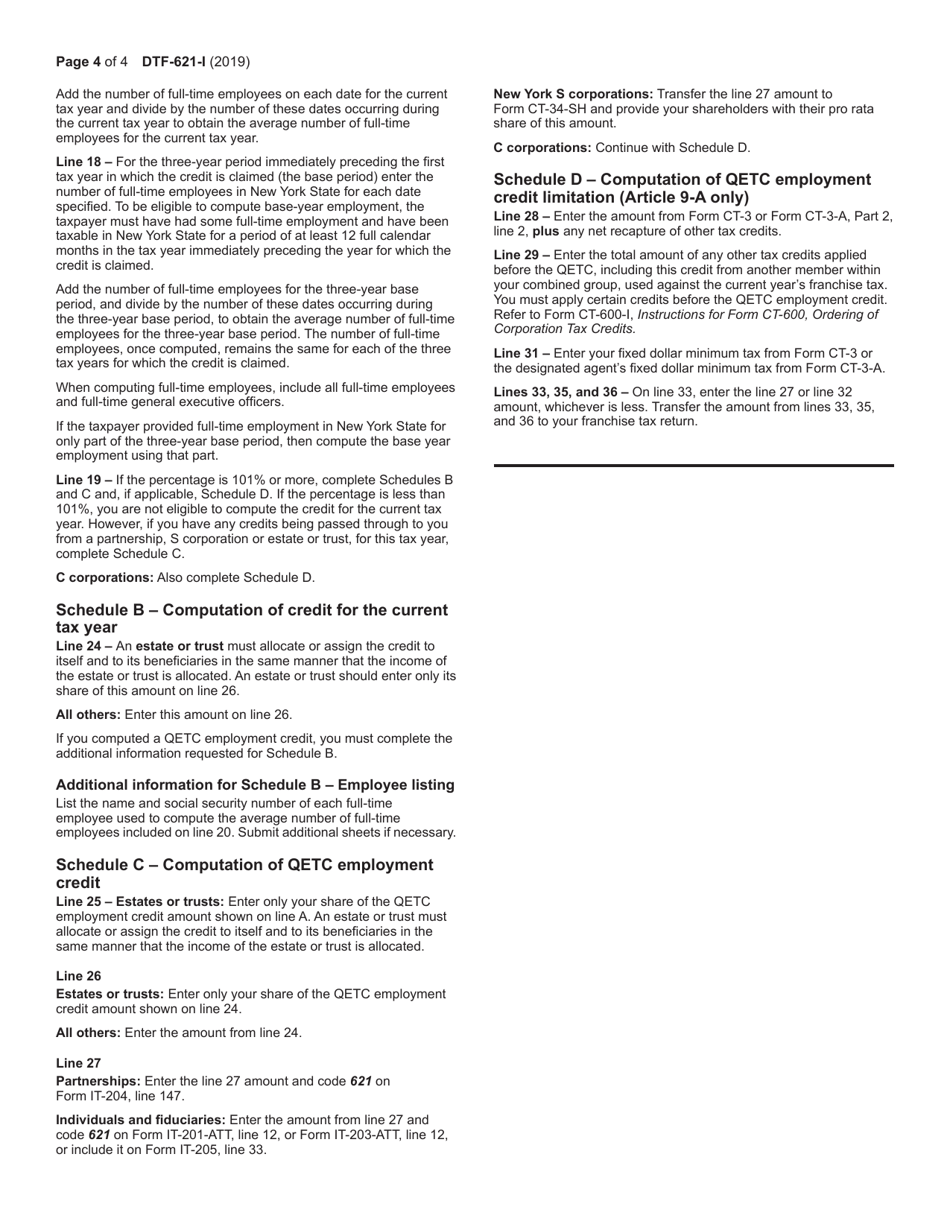

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form DTF-621

for the current year.

Instructions for Form DTF-621 Claim for Qetc Employment Credit - New York

This document contains official instructions for Form DTF-621 , Claim for Qetc Employment Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form DTF-621 is available for download through this link.

FAQ

Q: What is Form DTF-621?

A: Form DTF-621 is a claim for QETC Employment Credit in New York.

Q: What is the purpose of Form DTF-621?

A: The purpose of Form DTF-621 is to claim the QETC Employment Credit in New York.

Q: What is the QETC Employment Credit?

A: The QETC Employment Credit is a tax credit provided to qualified emerging technology companies (QETCs) in New York.

Q: Who can claim the QETC Employment Credit?

A: Qualified emerging technology companies (QETCs) can claim the QETC Employment Credit.

Q: What documentation is required for Form DTF-621?

A: You may need to provide supporting documentation such as employment records and financial statements.

Q: Is there a deadline for filing Form DTF-621?

A: Yes, the deadline for filing Form DTF-621 is generally the same as the deadline for filing your New York State tax return.

Q: Can I file Form DTF-621 electronically?

A: No, at this time Form DTF-621 cannot be filed electronically.

Q: Are there any fees associated with filing Form DTF-621?

A: There are no fees associated with filing Form DTF-621.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.