This version of the form is not currently in use and is provided for reference only. Download this version of

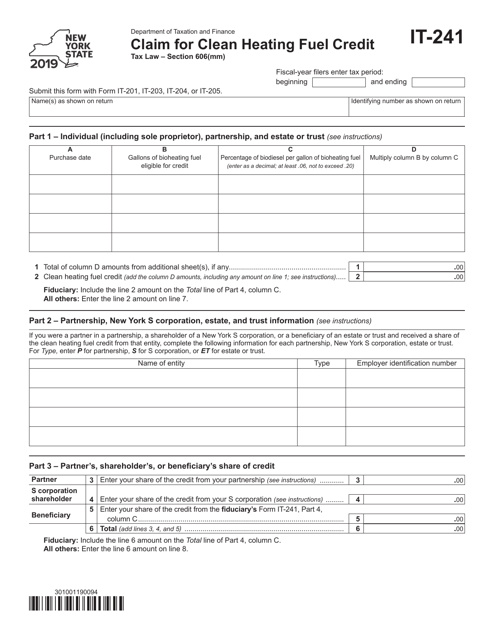

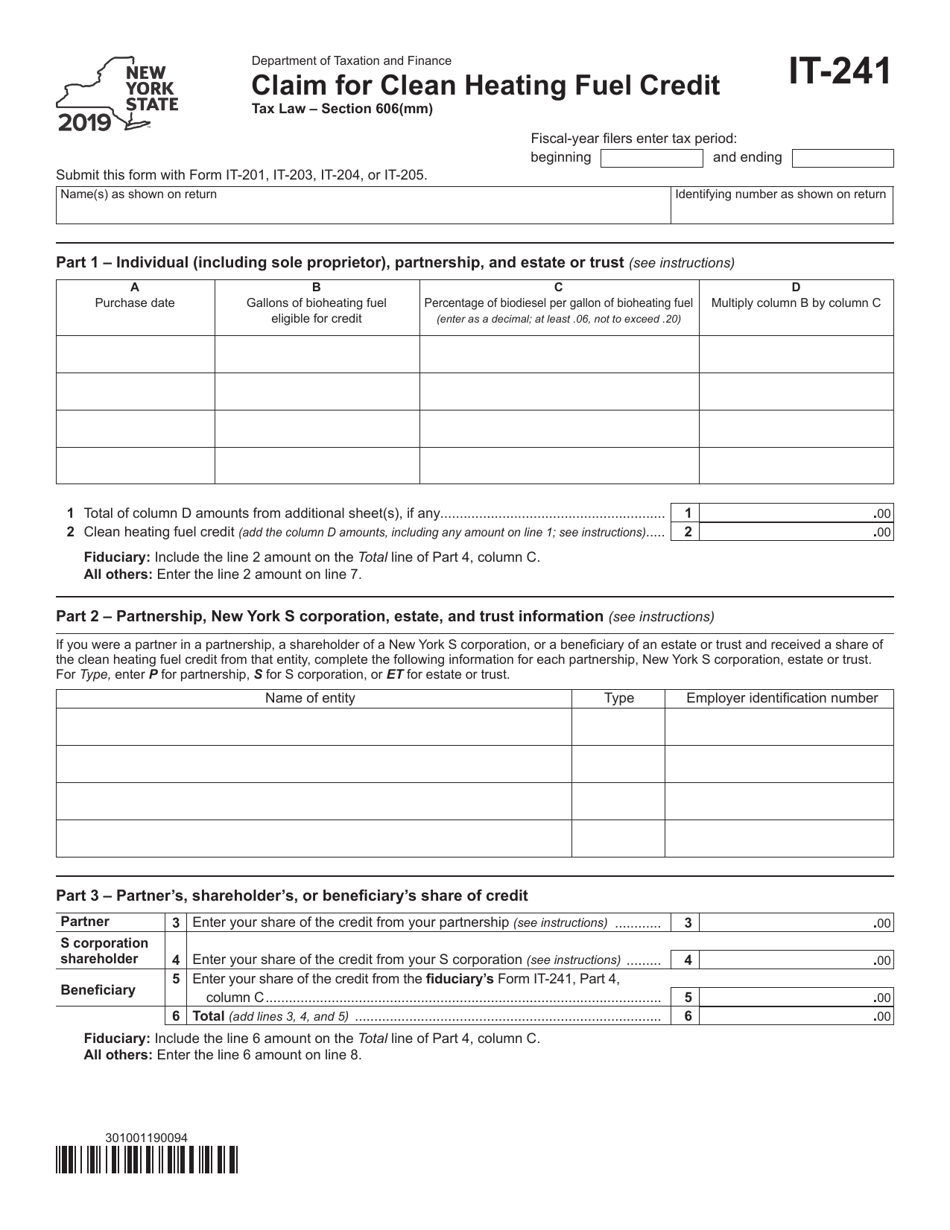

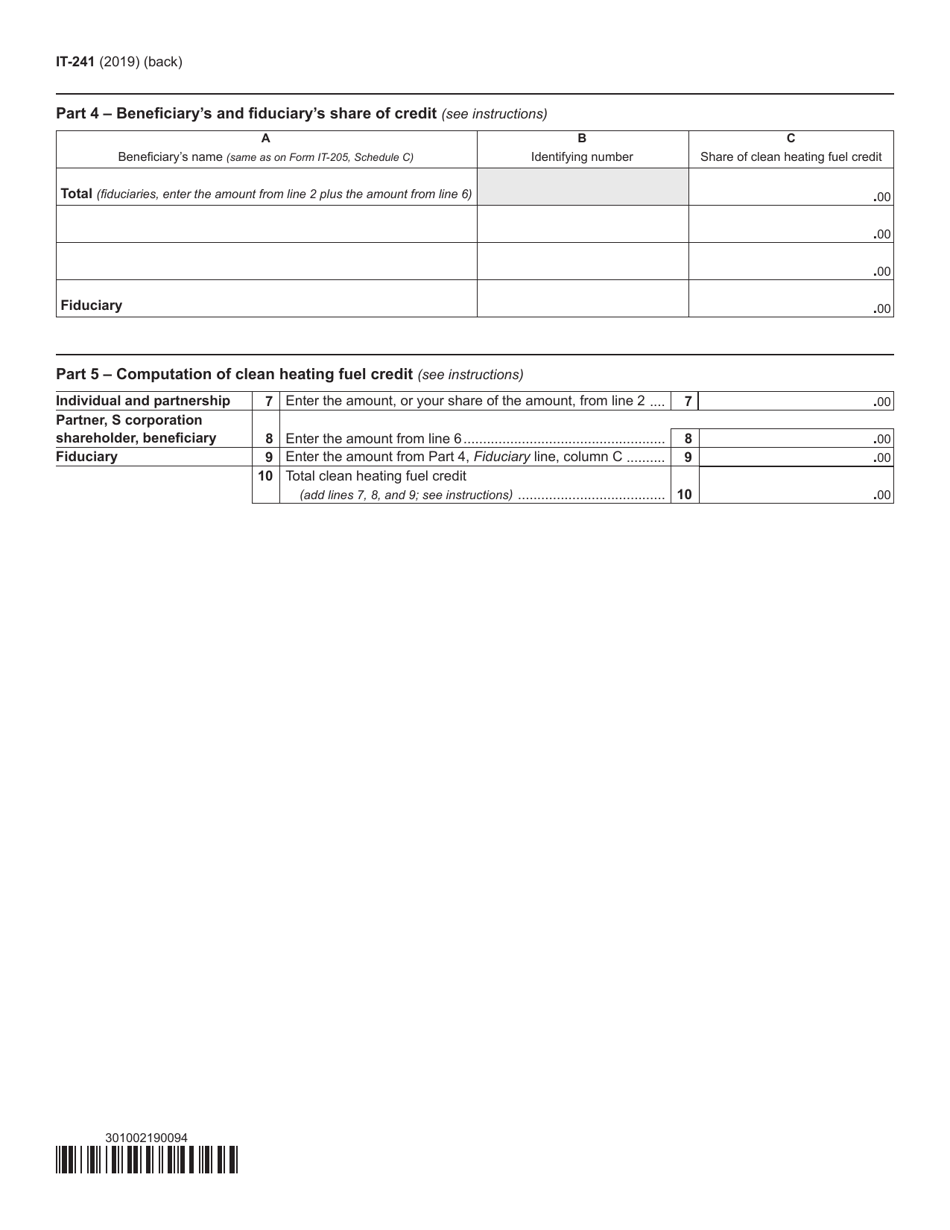

Form IT-241

for the current year.

Form IT-241 Claim for Clean Heating Fuel Credit - New York

What Is Form IT-241?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-241?

A: Form IT-241 is a claim form for the Clean Heating Fuel Credit in New York.

Q: What is the Clean Heating Fuel Credit?

A: The Clean Heating Fuel Credit is a tax credit available in New York for using certain clean heating fuels.

Q: Who can claim the Clean Heating Fuel Credit?

A: Residential taxpayers in New York who use eligible clean heating fuels can claim the credit.

Q: What fuels are eligible for the Clean Heating Fuel Credit?

A: Eligible clean heating fuels include biodiesel, waste oil, and natural gas.

Q: How do I claim the Clean Heating Fuel Credit?

A: You can claim the credit by filling out Form IT-241 and submitting it to the New York State Department of Taxation and Finance.

Q: When is the deadline to file Form IT-241?

A: The deadline to file Form IT-241 is generally April 15th.

Q: Are there any income limitations for claiming the Clean Heating Fuel Credit?

A: No, there are no income limitations for claiming the credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-241 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.