This version of the form is not currently in use and is provided for reference only. Download this version of

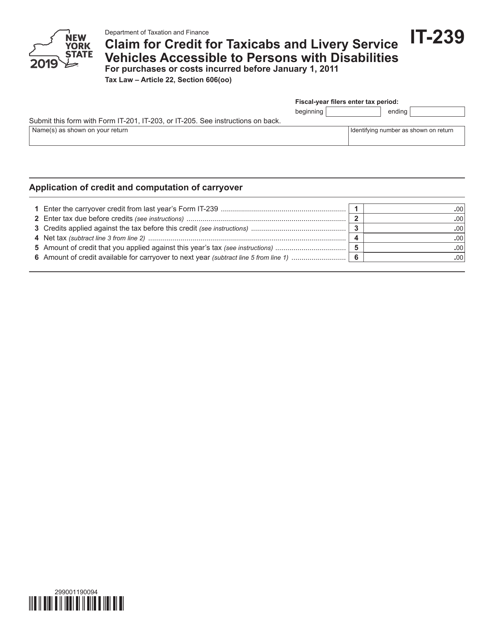

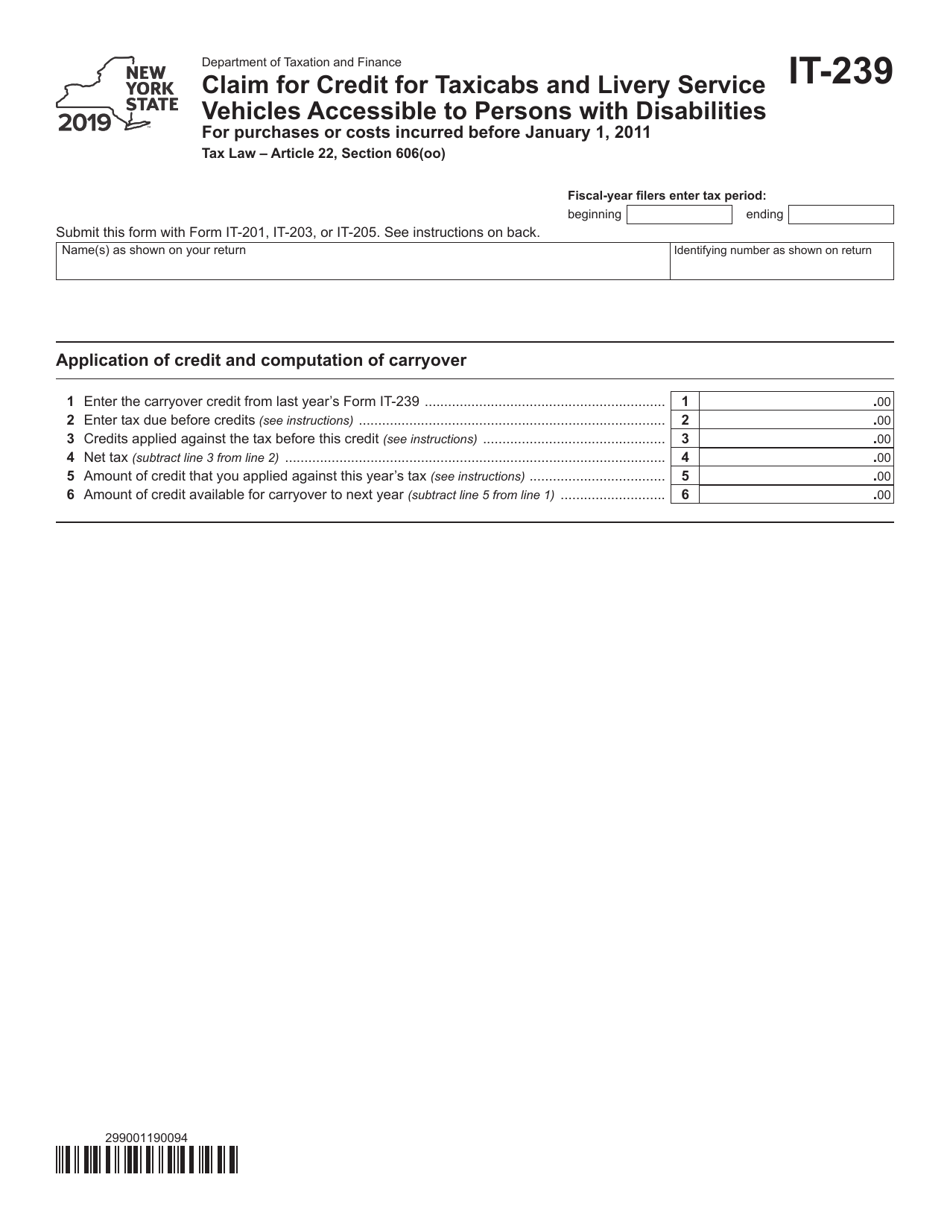

Form IT-239

for the current year.

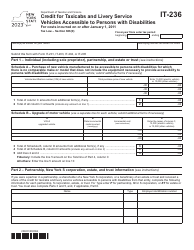

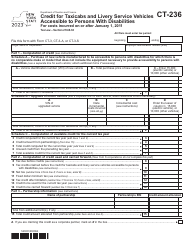

Form IT-239 Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities - New York

What Is Form IT-239?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-239?

A: Form IT-239 is the Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities in New York.

Q: Who can use Form IT-239?

A: This form can be used by taxicab and livery service vehicle owners in New York who provide accessible transportation options for persons with disabilities.

Q: What is the purpose of Form IT-239?

A: The purpose of this form is to claim a tax credit for the costs associated with providing taxicabs and livery service vehicles that are accessible to persons with disabilities.

Q: What expenses are eligible for the tax credit?

A: Expenses such as vehicle acquisition costs and modifications to make the vehicles accessible may be eligible for the tax credit.

Q: How is the tax credit calculated?

A: The tax credit is calculated as a percentage of the eligible expenses incurred.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-239 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.