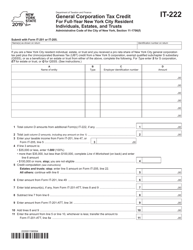

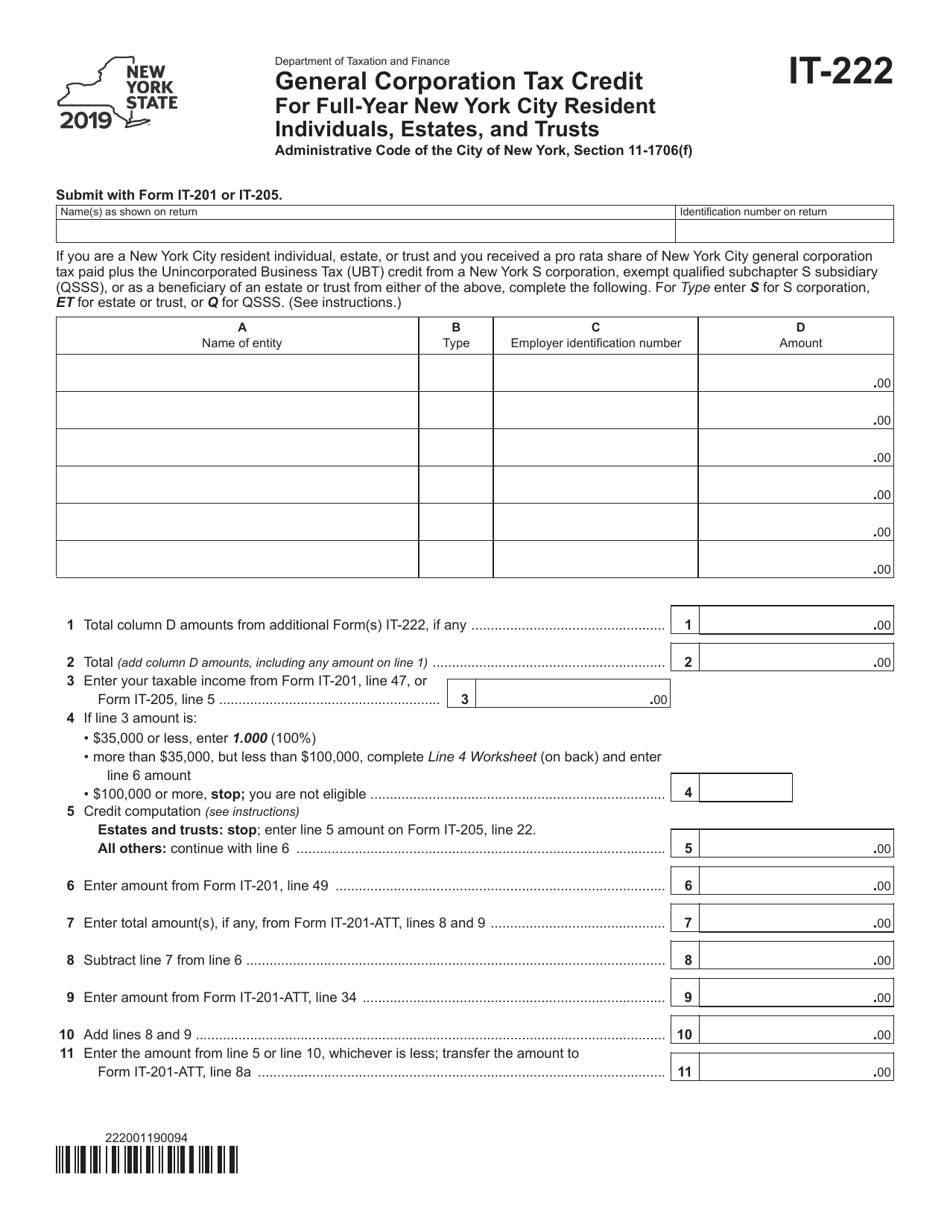

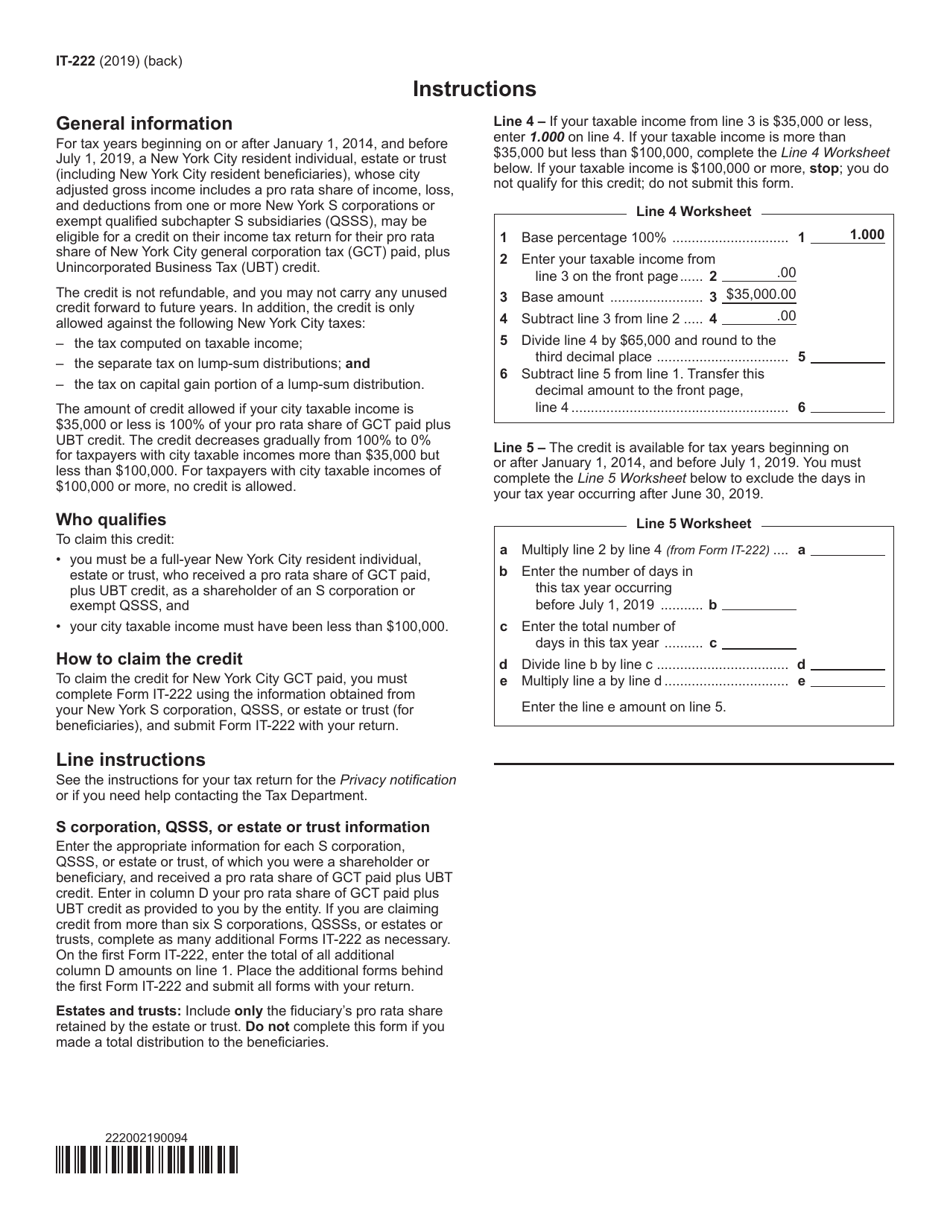

Form IT-222 General Corporation Tax Credit for Full-Year New York City Resident Individuals, Estates, and Trusts - New York

What Is Form IT-222?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-222?

A: Form IT-222 is the General Corporation Tax Credit for Full-Year New York City Resident Individuals, Estates, and Trusts.

Q: Who is eligible to use Form IT-222?

A: Full-year New York City resident individuals, estates, and trusts are eligible to use Form IT-222.

Q: What is the purpose of Form IT-222?

A: The purpose of Form IT-222 is to claim a general corporation tax credit for full-year New York City resident individuals, estates, and trusts.

Q: What information is required to complete Form IT-222?

A: To complete Form IT-222, you will need information related to the general corporation tax credit, including the certificate of eligibility.

Q: When is Form IT-222 due?

A: Form IT-222 is due on the same date as the New York State income tax return, typically April 15th.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-222 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.