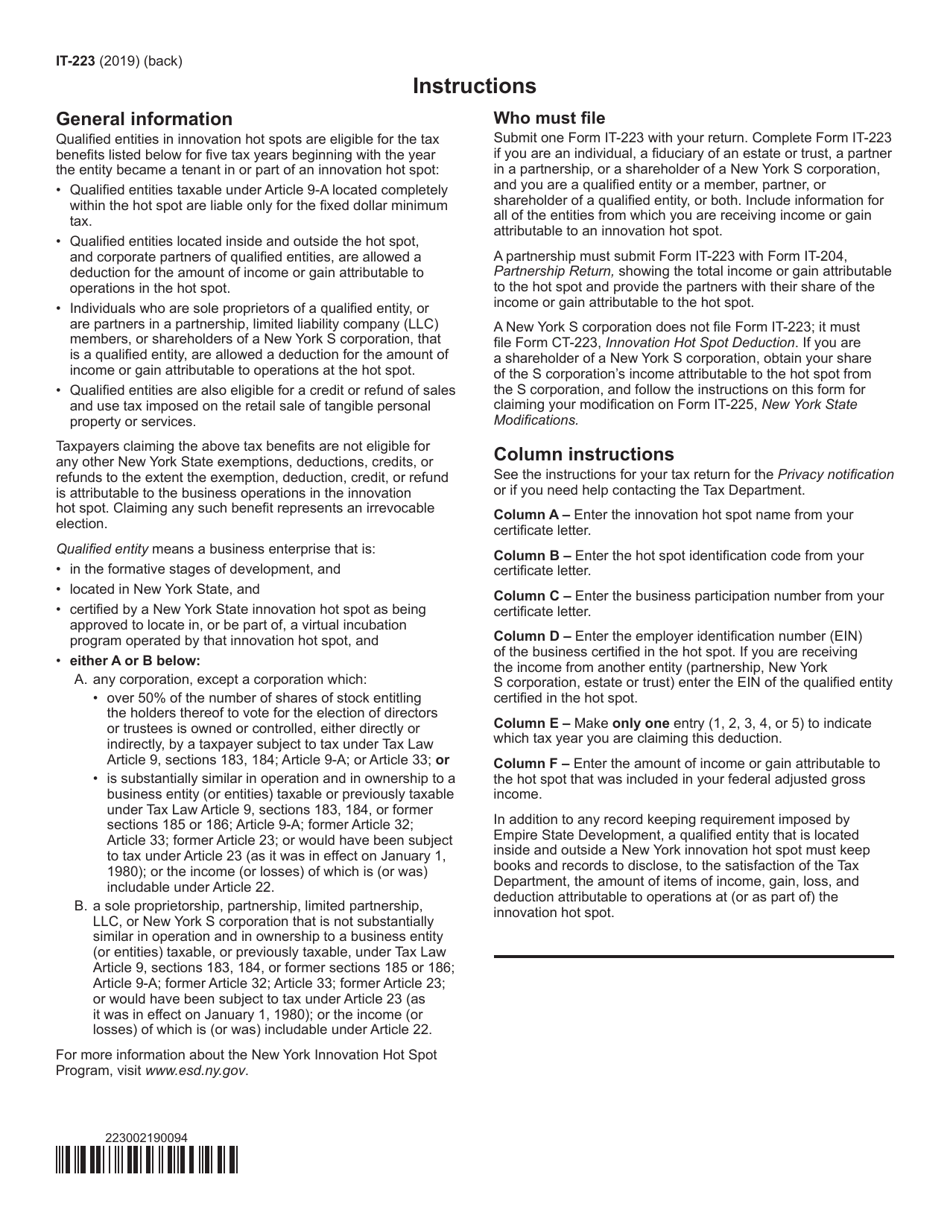

This version of the form is not currently in use and is provided for reference only. Download this version of

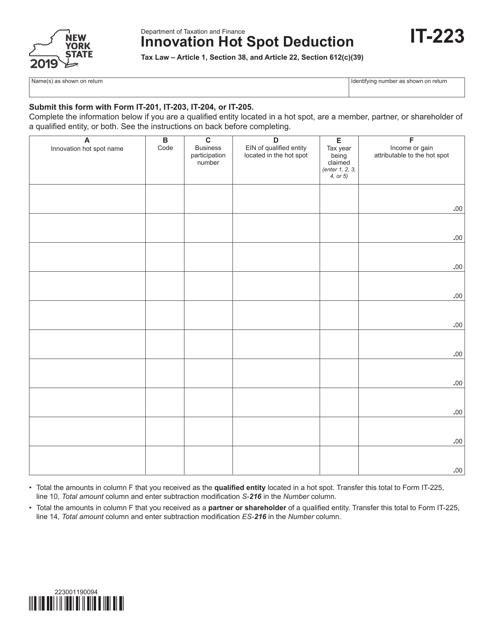

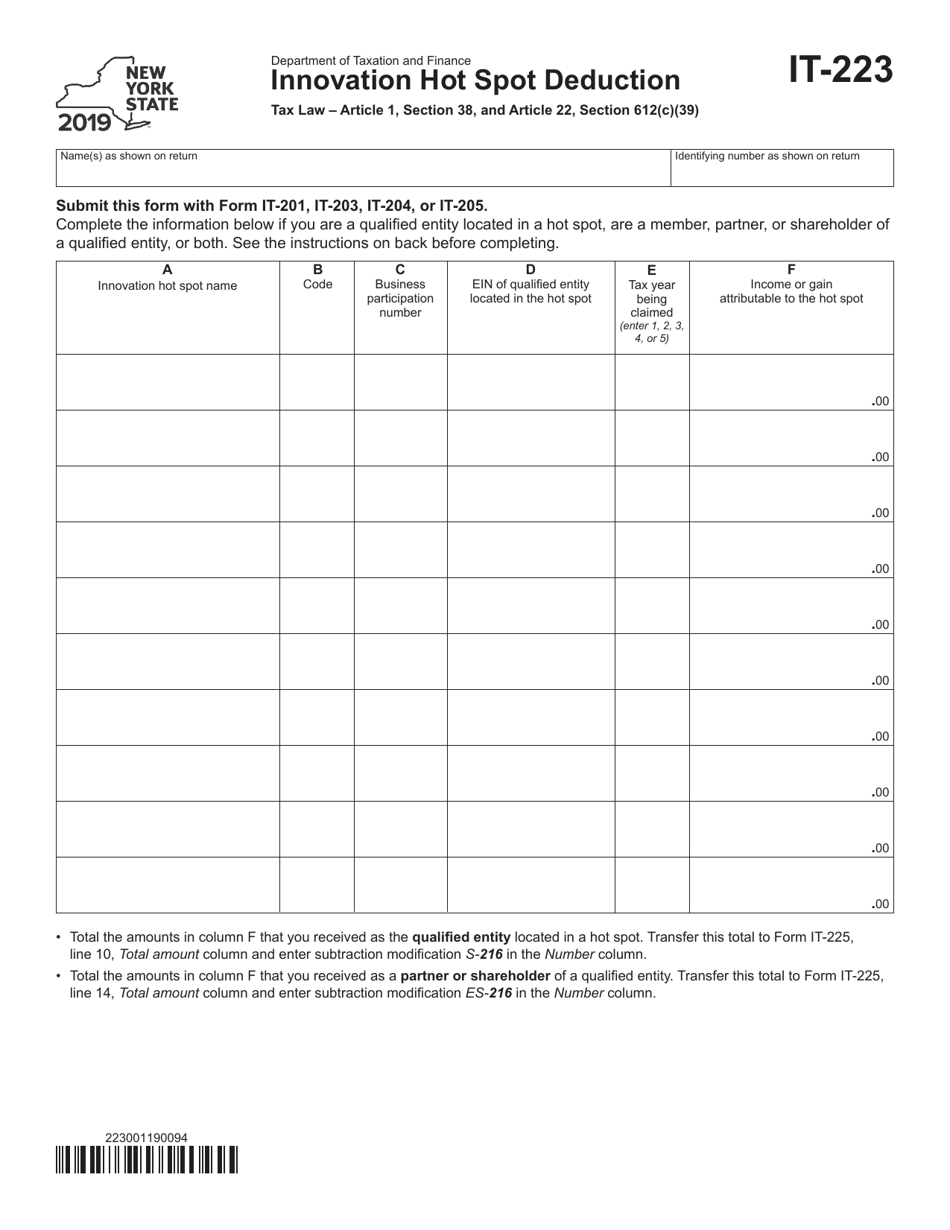

Form IT-223

for the current year.

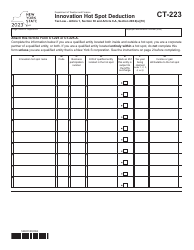

Form IT-223 Innovation Hot Spot Deduction - New York

What Is Form IT-223?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-223?

A: Form IT-223 is a tax form for claiming the Innovation Hot Spot Deduction in New York.

Q: What is the Innovation Hot Spot Deduction?

A: The Innovation Hot Spot Deduction is a tax benefit in New York that allows eligible businesses to claim a deduction for qualified research expenses.

Q: Who is eligible to claim the Innovation Hot Spot Deduction?

A: Eligible businesses include qualified emerging technology companies and certified venture capital companies.

Q: What are qualified research expenses?

A: Qualified research expenses include expenses for research and development activities conducted within a designated Innovation Hot Spot area.

Q: What is a designated Innovation Hot Spot area?

A: A designated Innovation Hot Spot area is a geographic area in New York that has been identified as having a concentration of research and development activities.

Q: How do I file Form IT-223?

A: Form IT-223 should be filed with your New York state income tax return.

Q: Are there any deadlines for filing Form IT-223?

A: Yes, Form IT-223 must be filed by the due date of your New York state income tax return, including any extensions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-223 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.