This version of the form is not currently in use and is provided for reference only. Download this version of

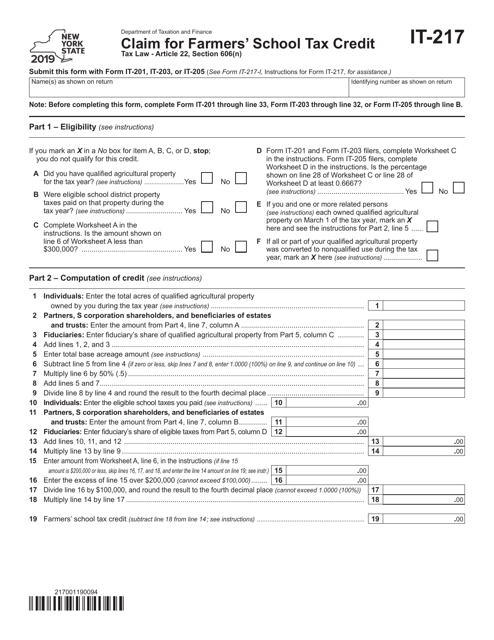

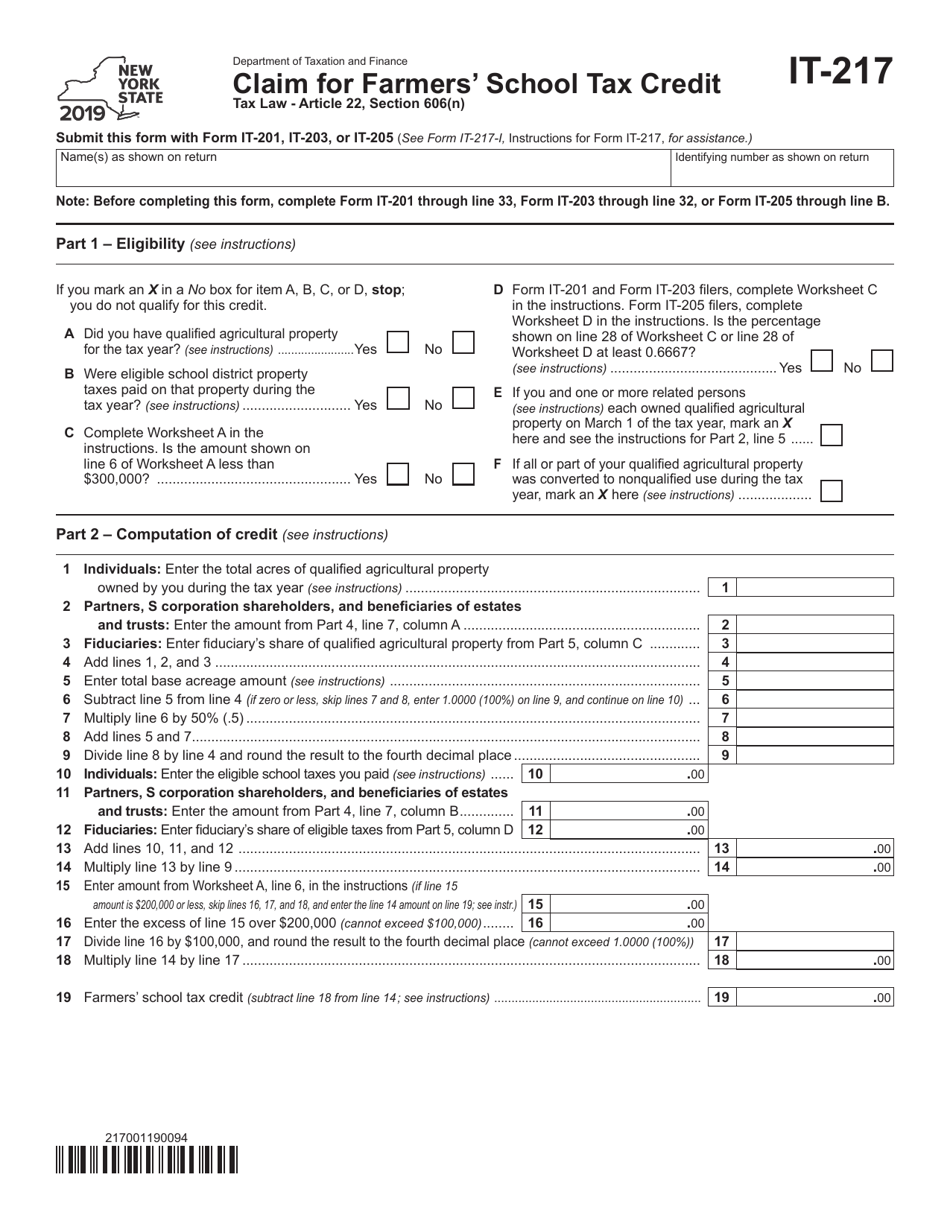

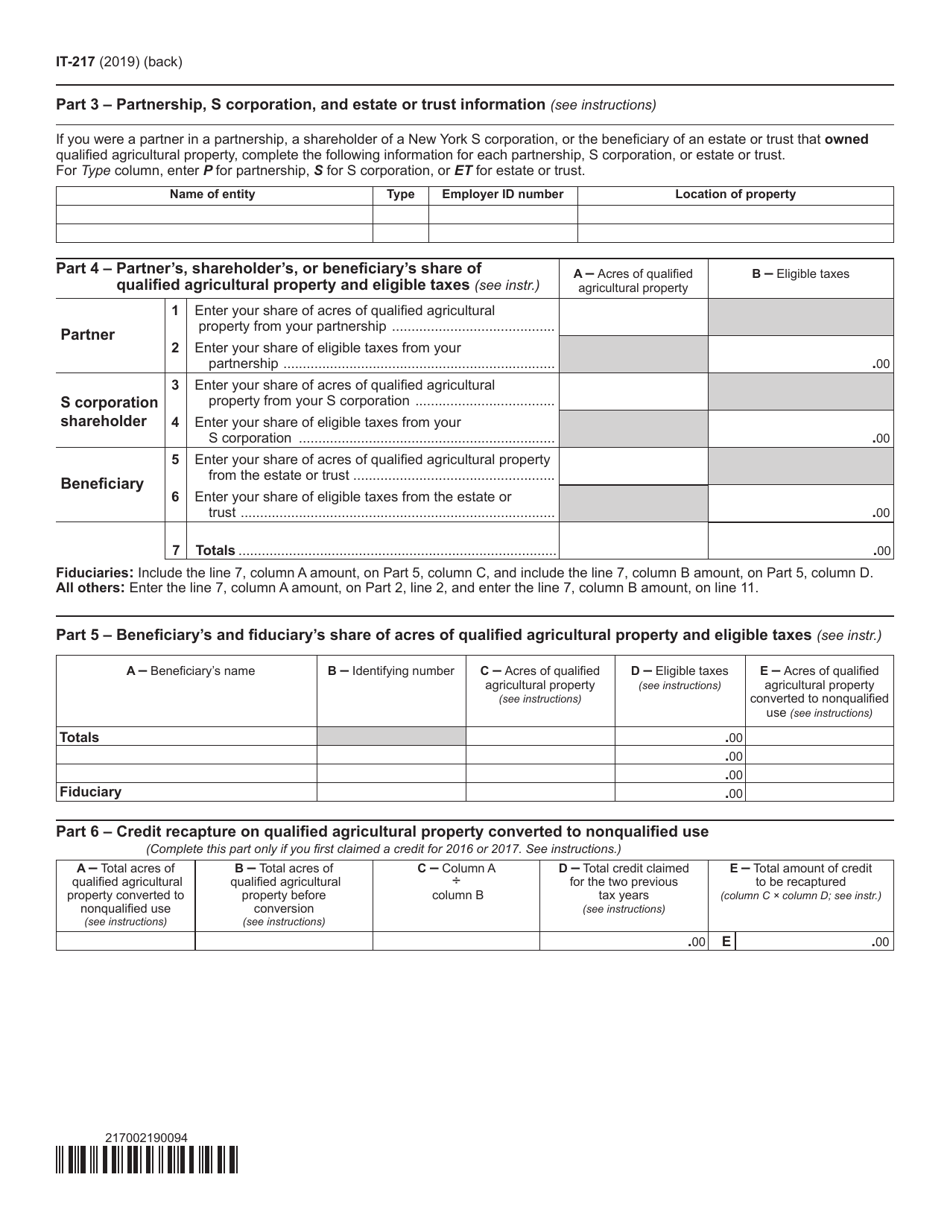

Form IT-217

for the current year.

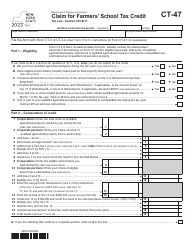

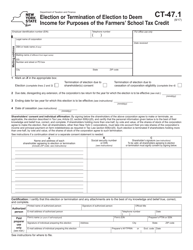

Form IT-217 Claim for Farmers' School Tax Credit - New York

What Is Form IT-217?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-217?

A: Form IT-217 is a tax form in New York used to claim the Farmers' School Tax Credit.

Q: Who is eligible to claim the Farmers' School Tax Credit?

A: Farmers who own or lease qualified agricultural property in New York may be eligible to claim the Farmers' School Tax Credit.

Q: What is the purpose of the Farmers' School Tax Credit?

A: The Farmers' School Tax Credit aims to provide tax relief to farmers who pay school taxes on their agricultural property.

Q: How can I claim the Farmers' School Tax Credit?

A: To claim the Farmers' School Tax Credit, you need to fill out and submit Form IT-217 along with your New York state income tax return.

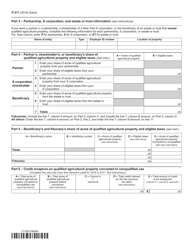

Q: What information do I need to provide on Form IT-217?

A: On Form IT-217, you will need to provide details about your farming operations, such as the amount of school taxes paid and the number of acres used for agricultural purposes.

Q: Is there a deadline to submit Form IT-217?

A: Yes, Form IT-217 must be submitted along with your New York state income tax return by the filing deadline, which is usually April 15th.

Q: Are there any limitations or restrictions on the Farmers' School Tax Credit?

A: Yes, there are certain limitations and restrictions on the Farmers' School Tax Credit, including income limitations and specific requirements for agricultural property.

Q: Can I claim the Farmers' School Tax Credit if I am not a farmer?

A: No, the Farmers' School Tax Credit is specifically for farmers who own or lease qualified agricultural property in New York.

Q: What is the benefit of claiming the Farmers' School Tax Credit?

A: By claiming the Farmers' School Tax Credit, eligible farmers can reduce their tax liability and potentially receive a refund for school taxes paid on their agricultural property.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-217 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.