This version of the form is not currently in use and is provided for reference only. Download this version of

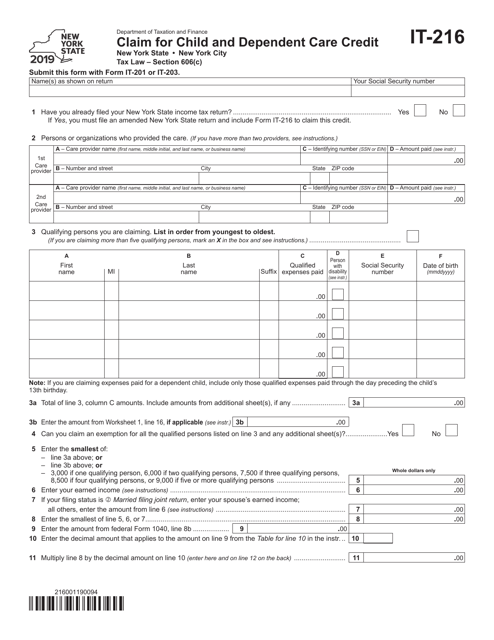

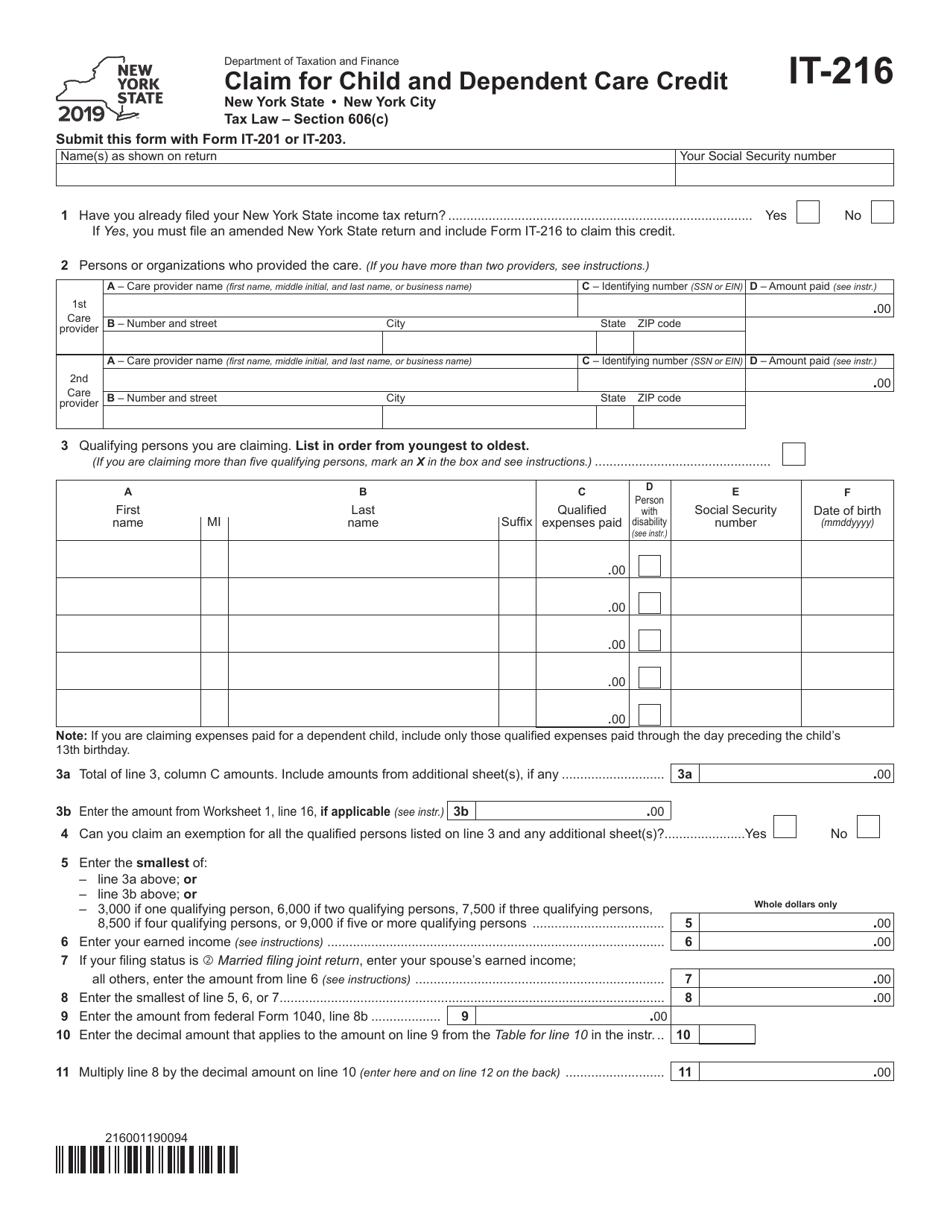

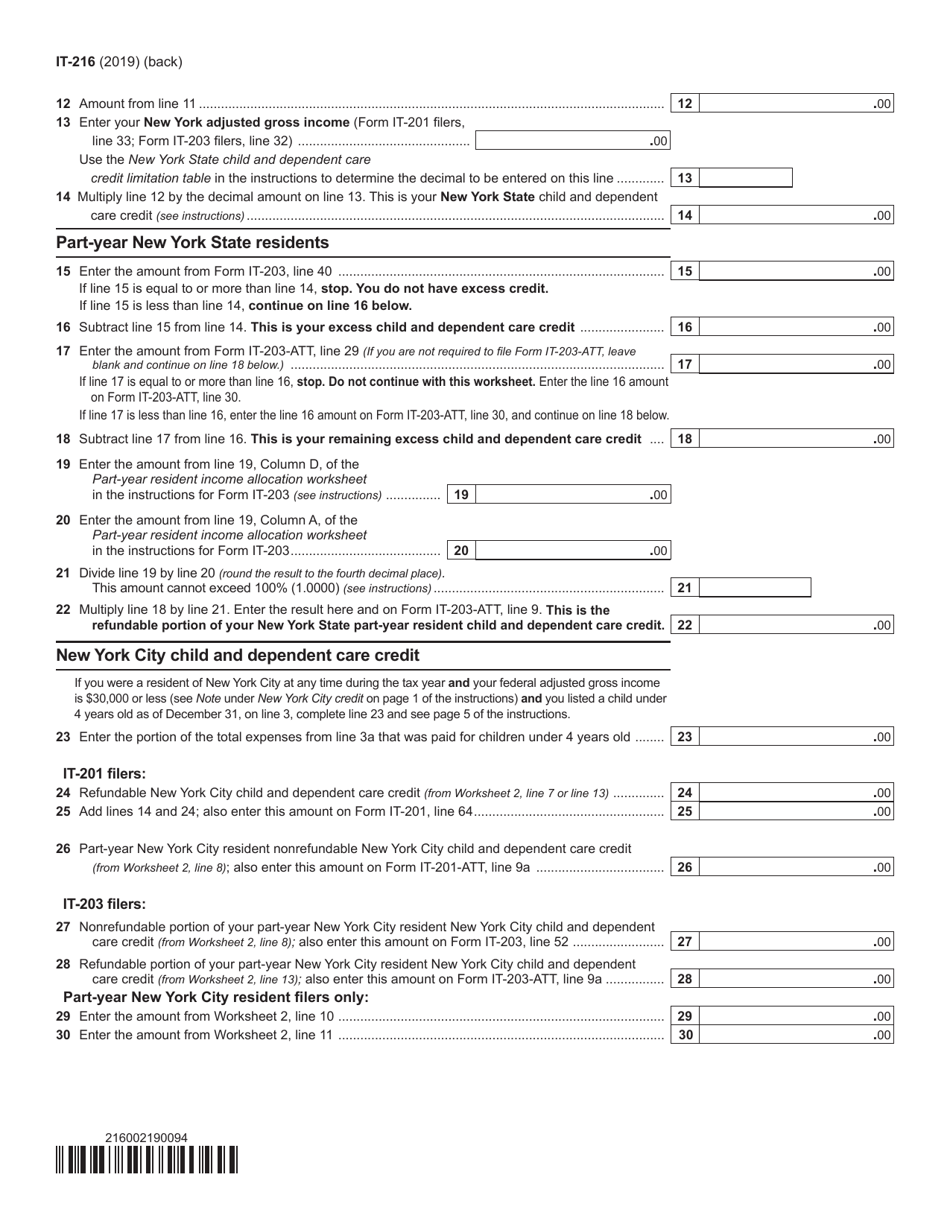

Form IT-216

for the current year.

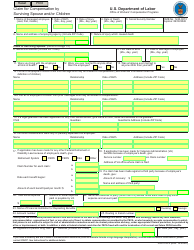

Form IT-216 Claim for Child and Dependent Care Credit - New York

What Is Form IT-216?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

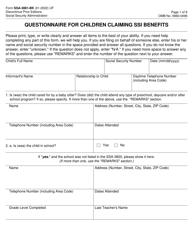

Q: What is Form IT-216?

A: Form IT-216 is a document used in New York to claim the Child and Dependent Care Credit.

Q: What is the Child and Dependent Care Credit?

A: The Child and Dependent Care Credit is a tax credit that can help offset the expenses of child or dependent care.

Q: Who is eligible to claim the Child and Dependent Care Credit?

A: You may be eligible to claim the credit if you paid for the care of a qualifying child or dependent while you worked or looked for work.

Q: What expenses can be included in the Child and Dependent Care Credit?

A: Qualifying expenses can include the cost of daycare, babysitting, and certain summer camps.

Q: How do I fill out Form IT-216?

A: You will need to provide information about yourself, your child or dependent, and the child care provider. You may also need to include supporting documentation.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-216 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.