This version of the form is not currently in use and is provided for reference only. Download this version of

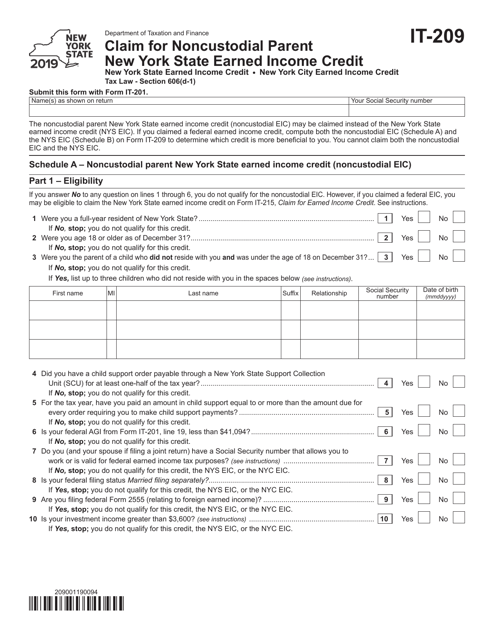

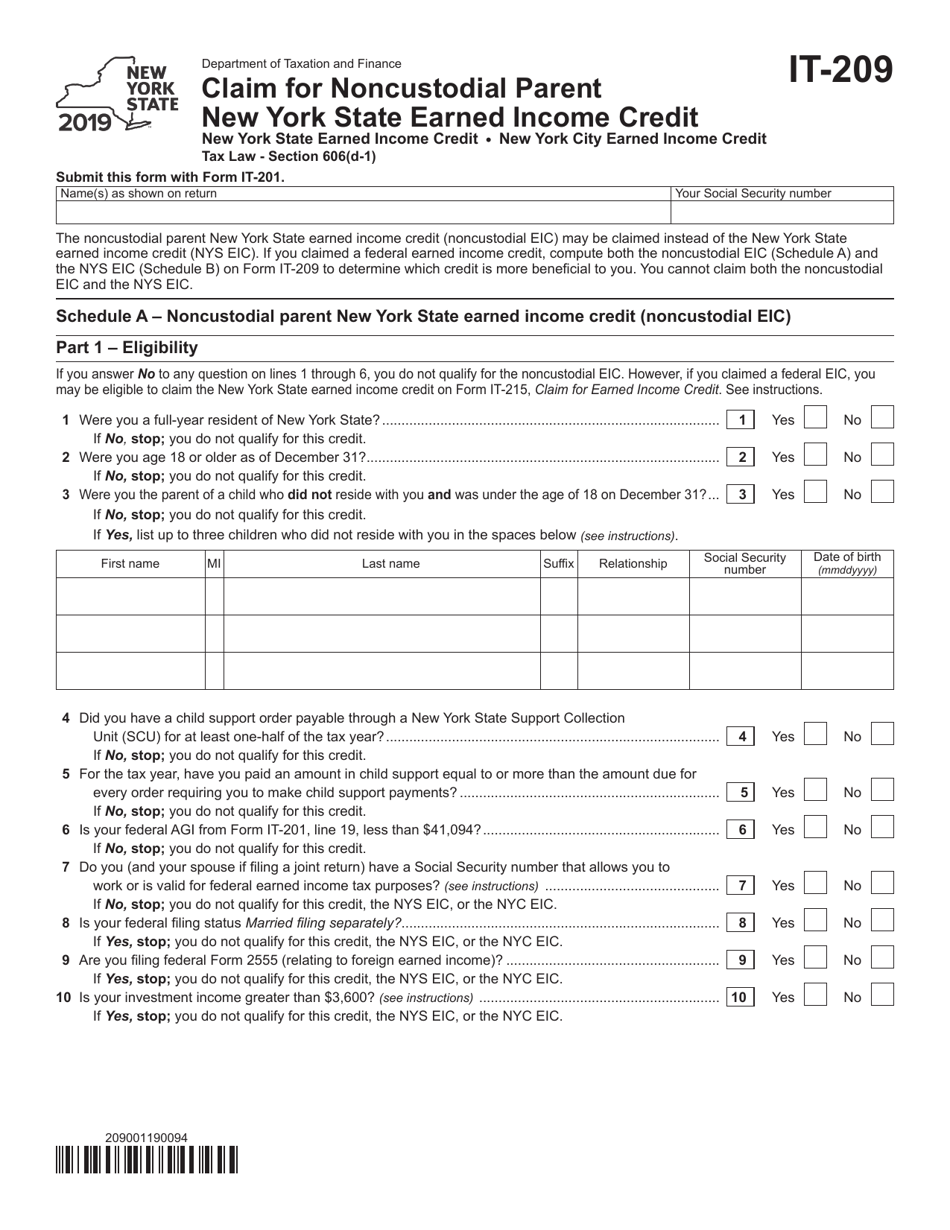

Form IT-209

for the current year.

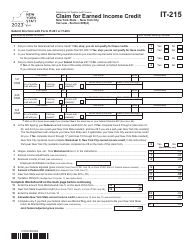

Form IT-209 Claim for Noncustodial Parent New York State Earned Income Credit - New York

What Is Form IT-209?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-209?

A: Form IT-209 is a document used to claim the New York State Earned Income Credit by the noncustodial parent.

Q: Who can use Form IT-209?

A: The Form IT-209 can be used by noncustodial parents who meet the eligibility requirements for the New York State Earned Income Credit.

Q: What is the New York State Earned Income Credit?

A: The New York State Earned Income Credit is a tax credit available to eligible individuals to help reduce their tax liability.

Q: What is the purpose of Form IT-209?

A: The purpose of Form IT-209 is to allow noncustodial parents to claim the New York State Earned Income Credit if they qualify.

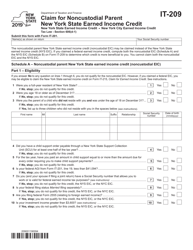

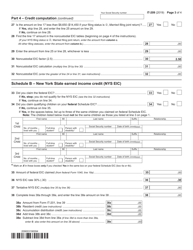

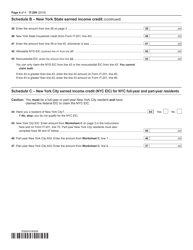

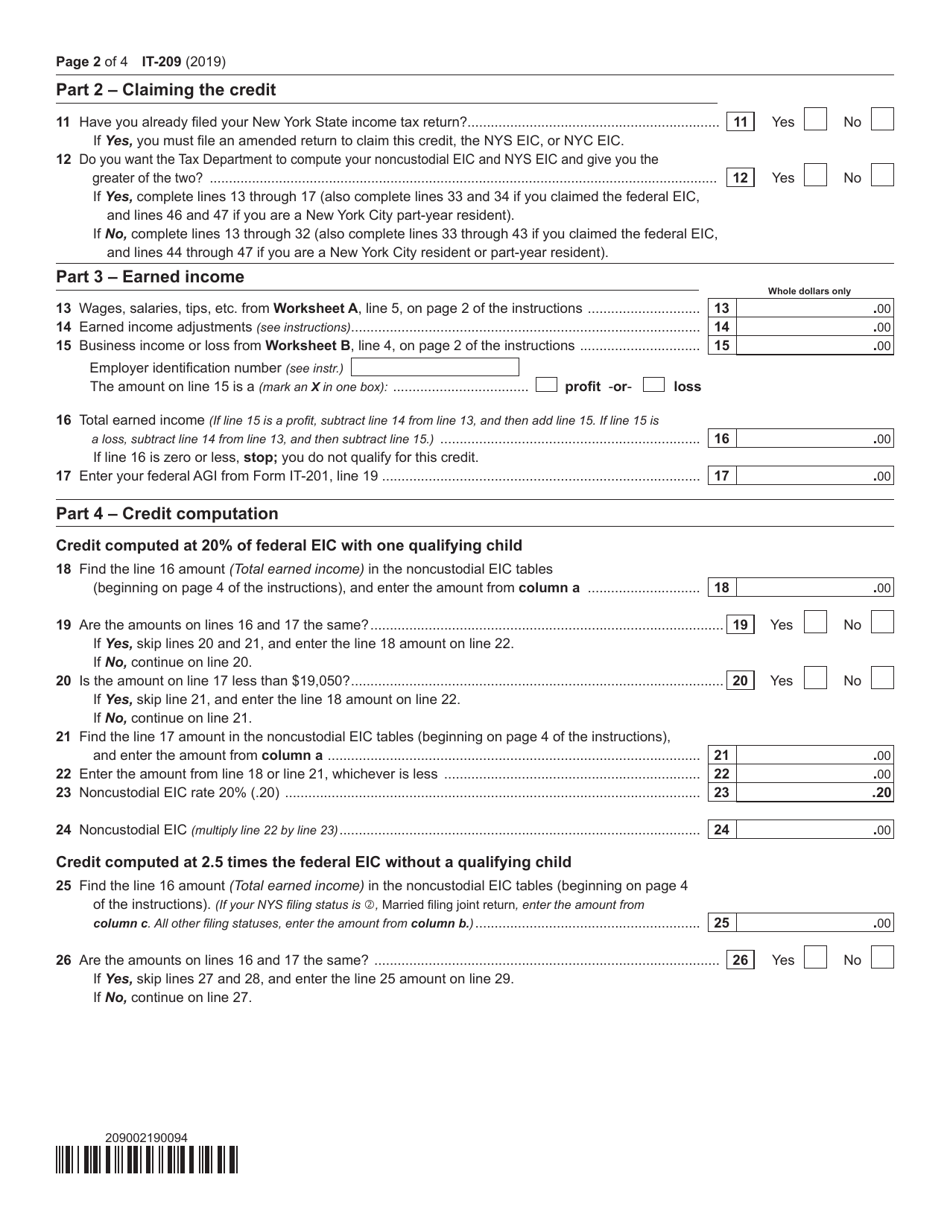

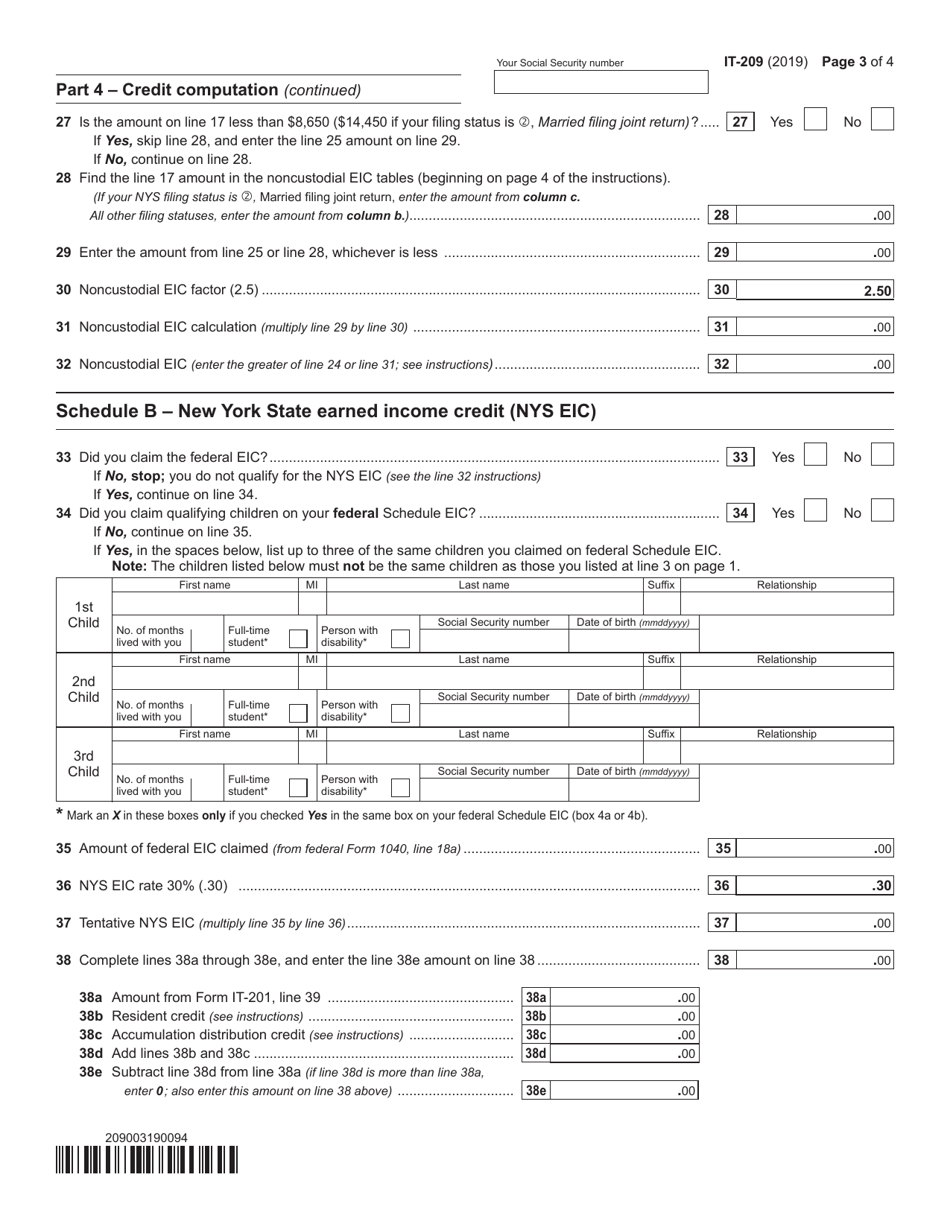

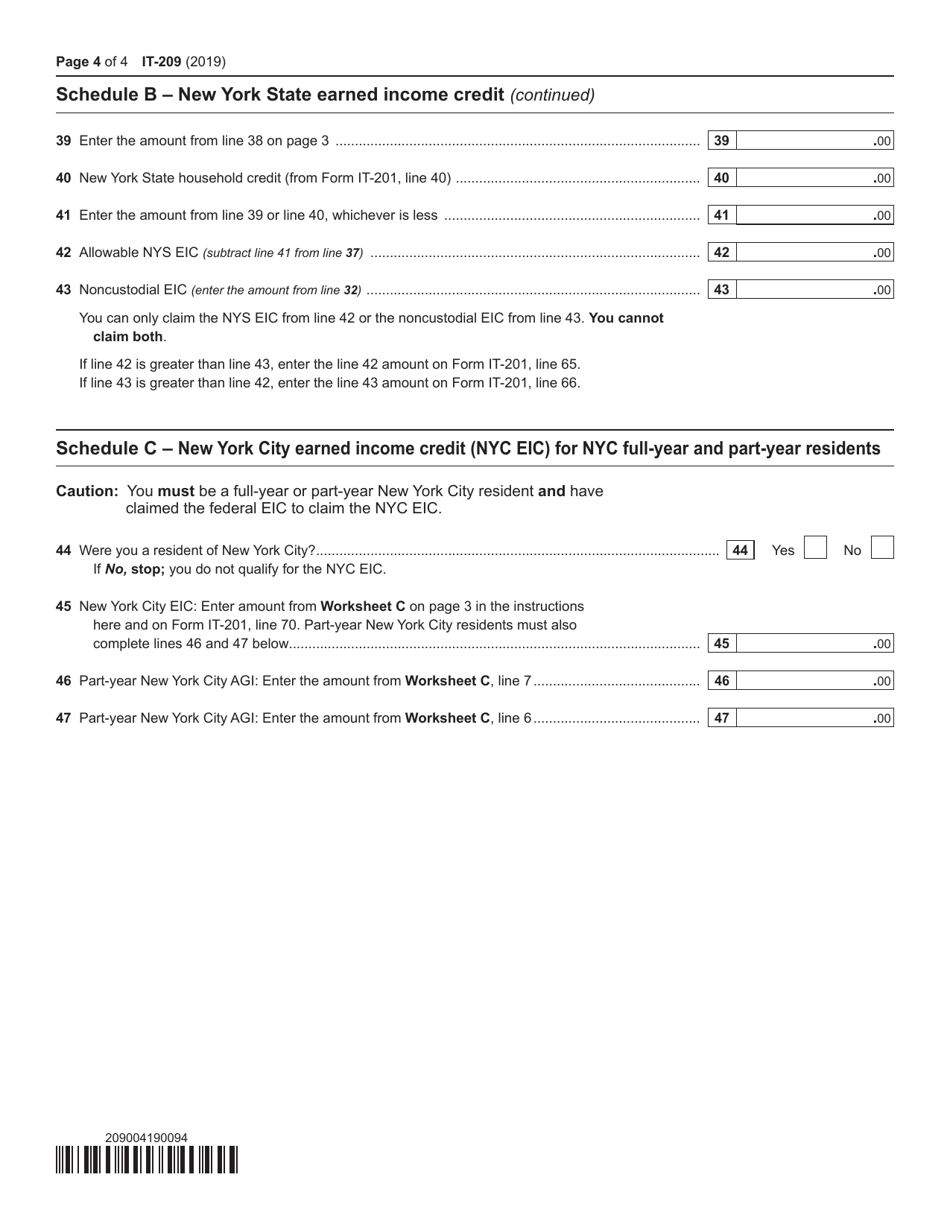

Q: How do I fill out Form IT-209?

A: Form IT-209 requires you to provide personal and income information to determine your eligibility for the New York State Earned Income Credit.

Q: When is the deadline to file Form IT-209?

A: The deadline to file Form IT-209 is the same as the deadline to file your New York State tax return, usually April 15th.

Q: Can I file Form IT-209 electronically?

A: Yes, you can file Form IT-209 electronically if you are using tax software that supports electronic filing for New York State tax returns.

Q: What other documents should I include with Form IT-209?

A: You may need to include supporting documents such as W-2 forms and other income statements when filing Form IT-209.

Q: What happens after I file Form IT-209?

A: After filing Form IT-209, the New York State Department of Taxation and Finance will review your claim and determine if you are eligible for the Earned Income Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-209 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.