This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-213

for the current year.

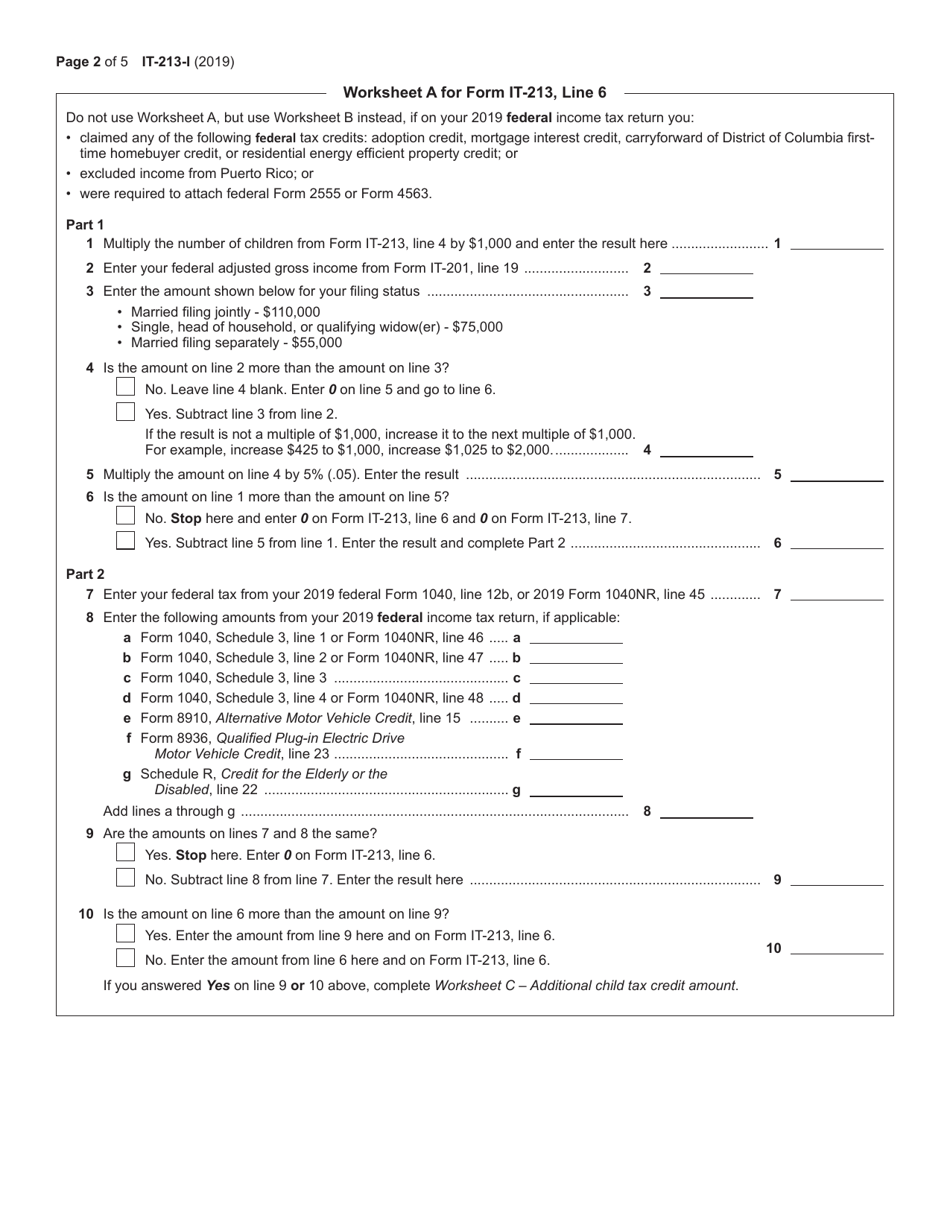

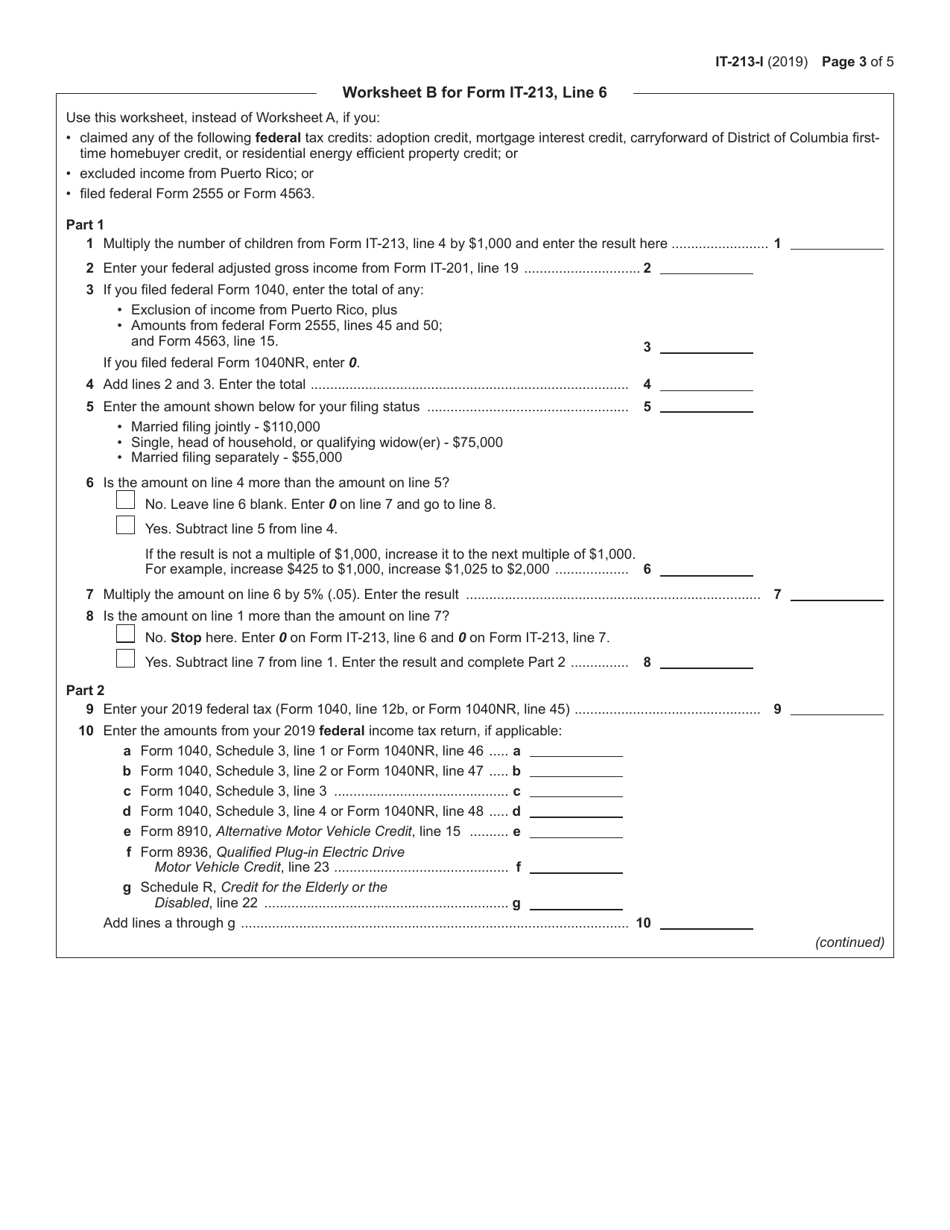

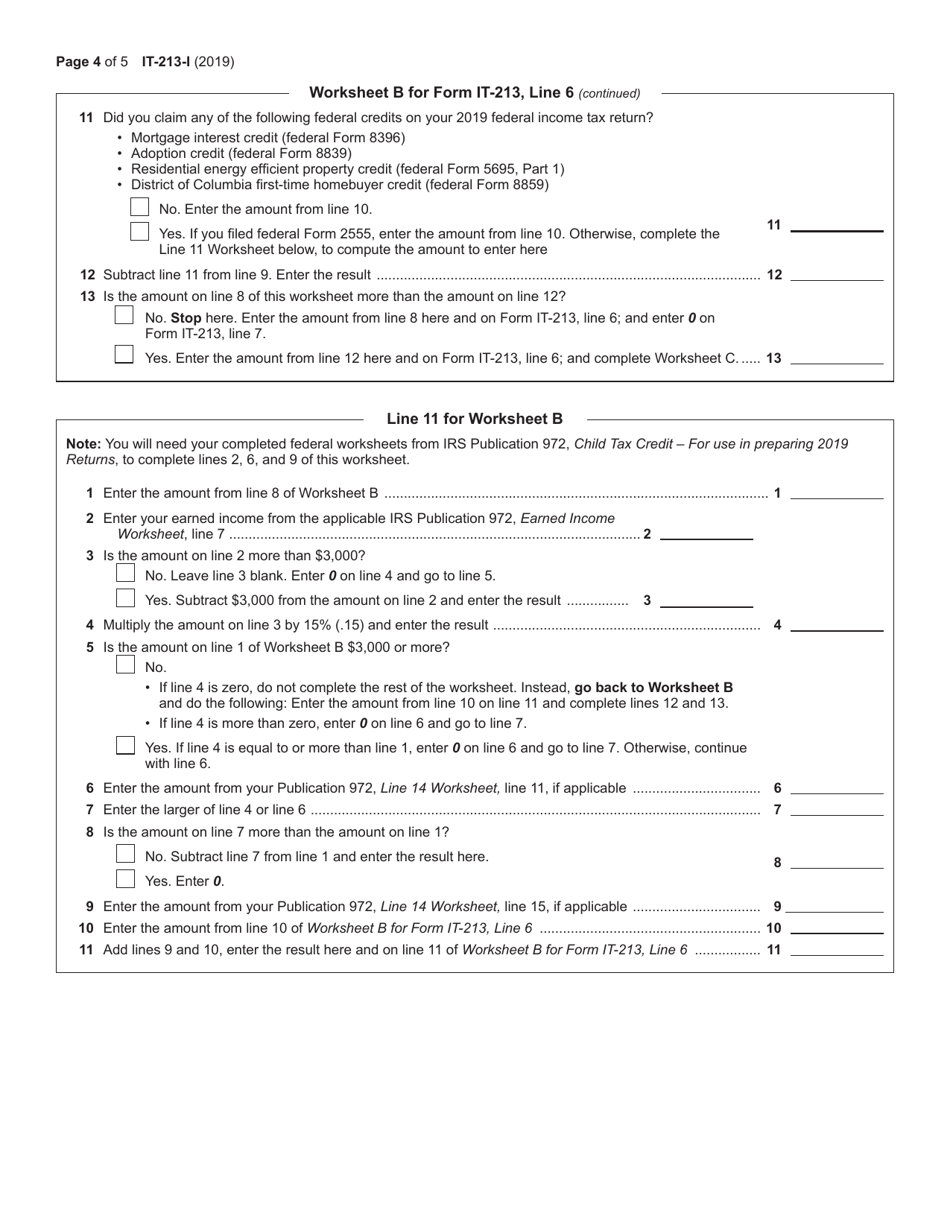

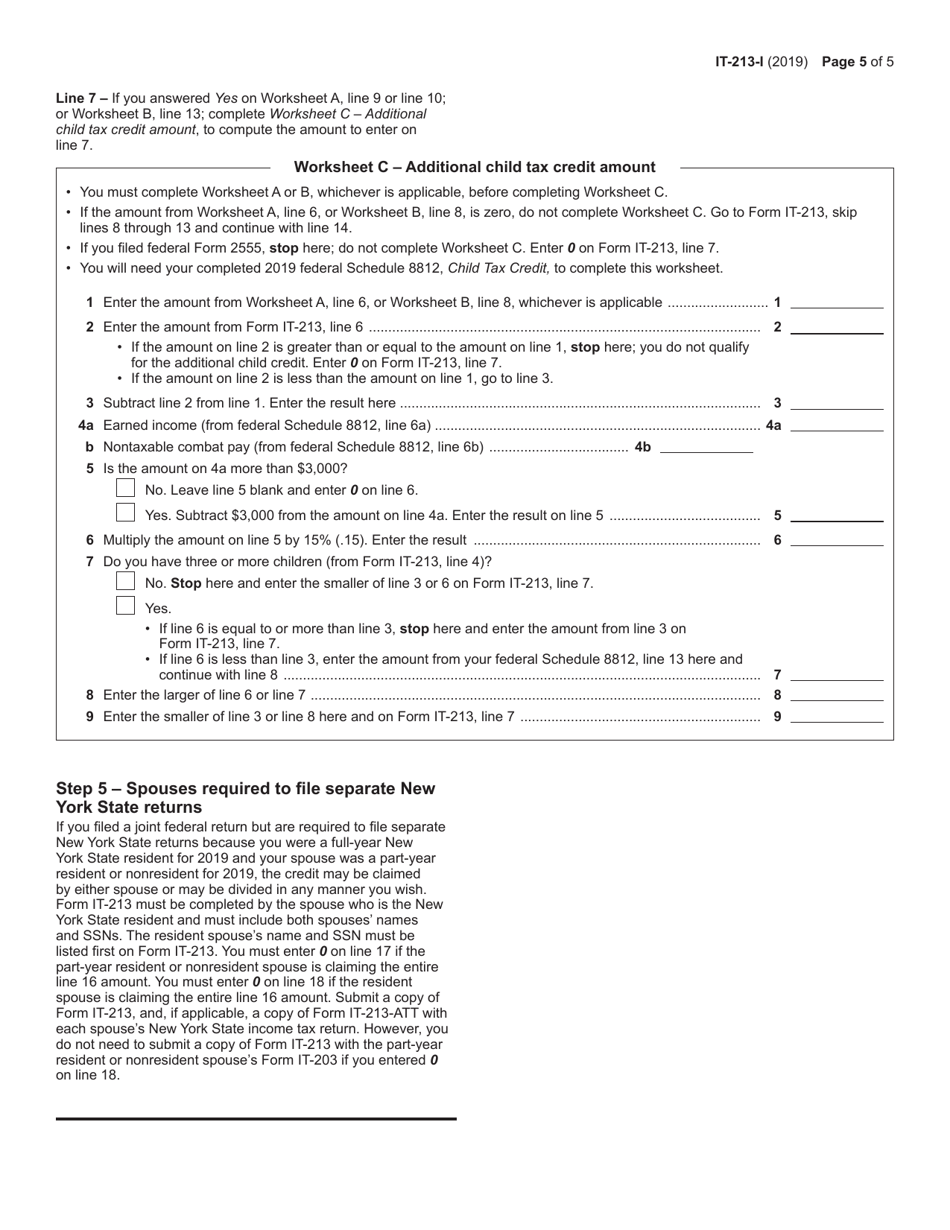

Instructions for Form IT-213 Claim for Empire State Child Credit - New York

This document contains official instructions for Form IT-213 , Claim for Empire State Child Credit - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

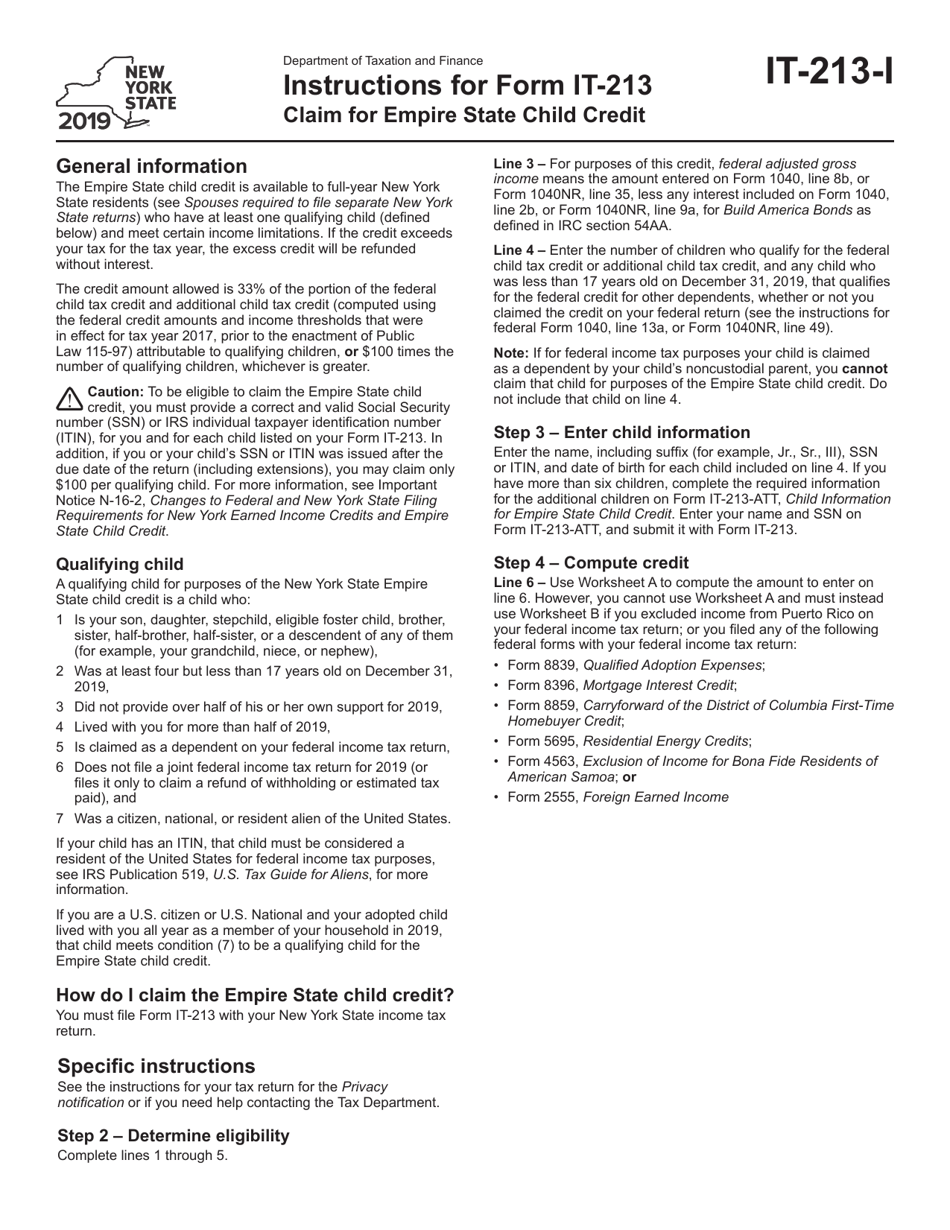

Q: What is Form IT-213?

A: Form IT-213 is a form used to claim the Empire State Child Credit in New York.

Q: Who is eligible to claim the Empire State Child Credit?

A: New York residents with qualifying children are eligible to claim the Empire State Child Credit.

Q: What is the purpose of the Empire State Child Credit?

A: The purpose of the Empire State Child Credit is to provide a tax credit for eligible taxpayers who have qualifying children.

Q: How do I qualify for the Empire State Child Credit?

A: To qualify for the Empire State Child Credit, you must meet certain income requirements and have a qualifying child.

Q: What is a qualifying child?

A: A qualifying child is a child who meets certain criteria, such as being under the age of 17 and being claimed as a dependent on your tax return.

Q: What expenses does the Empire State Child Credit cover?

A: The Empire State Child Credit covers certain child-related expenses, such as child care expenses and dependent care expenses.

Q: How much is the Empire State Child Credit?

A: The amount of the Empire State Child Credit varies depending on your income and the number of qualifying children you have.

Q: How do I claim the Empire State Child Credit?

A: You can claim the Empire State Child Credit by completing and submitting Form IT-213 along with your New York state tax return.

Q: Can I claim the Empire State Child Credit if I already claimed the federal Child Tax Credit?

A: Yes, you can claim both the Empire State Child Credit and the federal Child Tax Credit, as long as you meet the eligibility requirements for each.

Q: What documents do I need to include when claiming the Empire State Child Credit?

A: When claiming the Empire State Child Credit, you may be required to include documents such as proof of income and proof of dependent children.

Instruction Details:

- This 5-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.