This version of the form is not currently in use and is provided for reference only. Download this version of

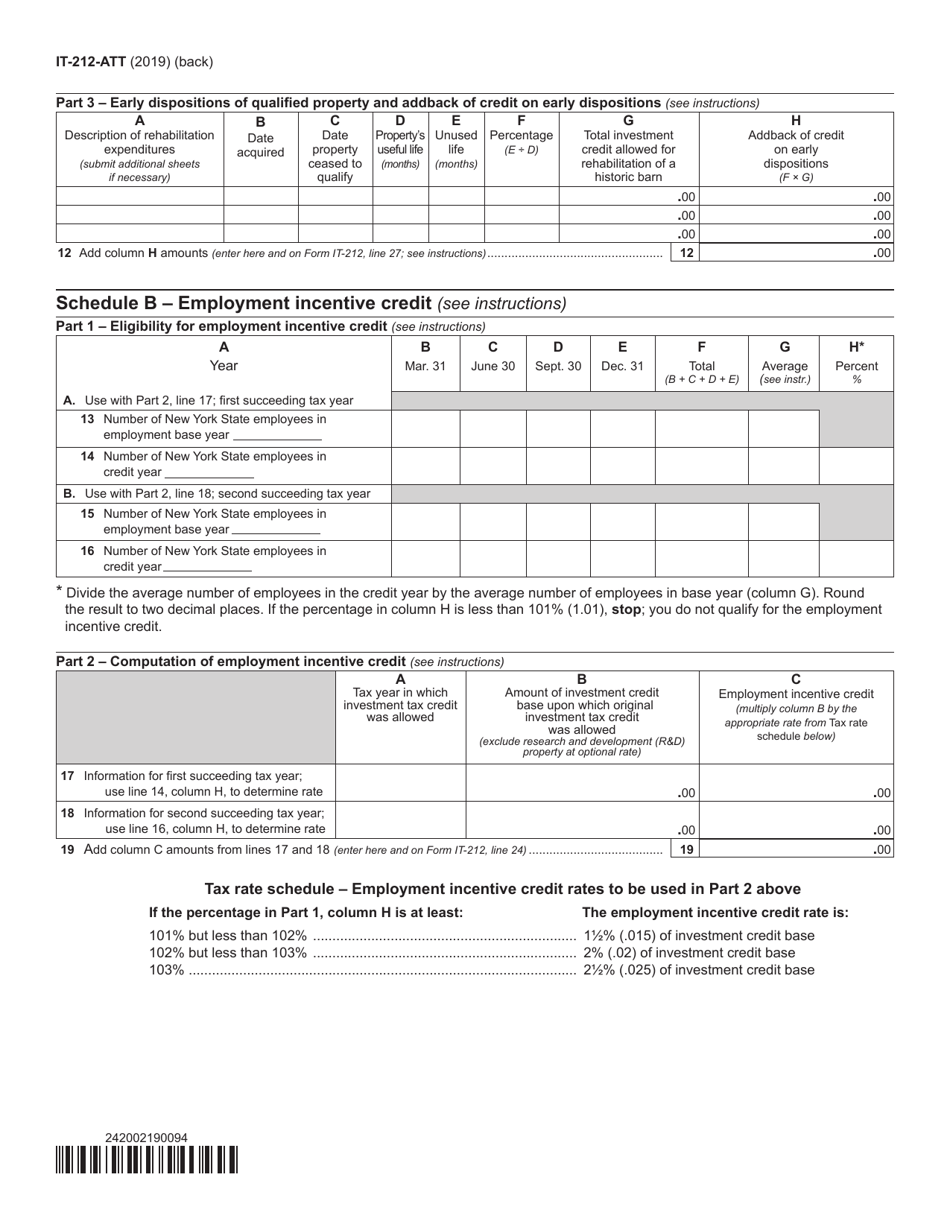

Form IT-212-ATT

for the current year.

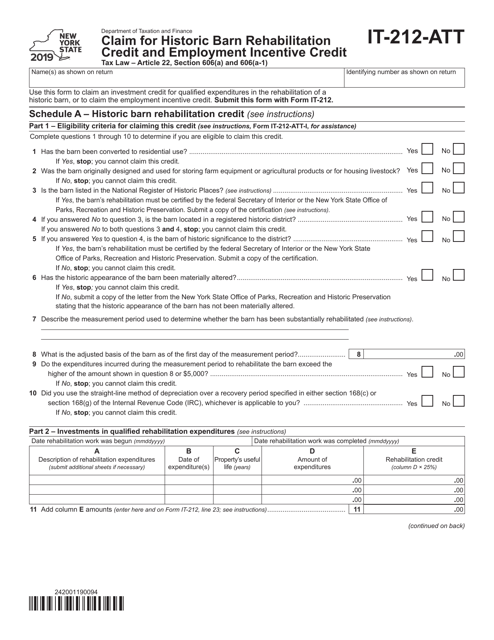

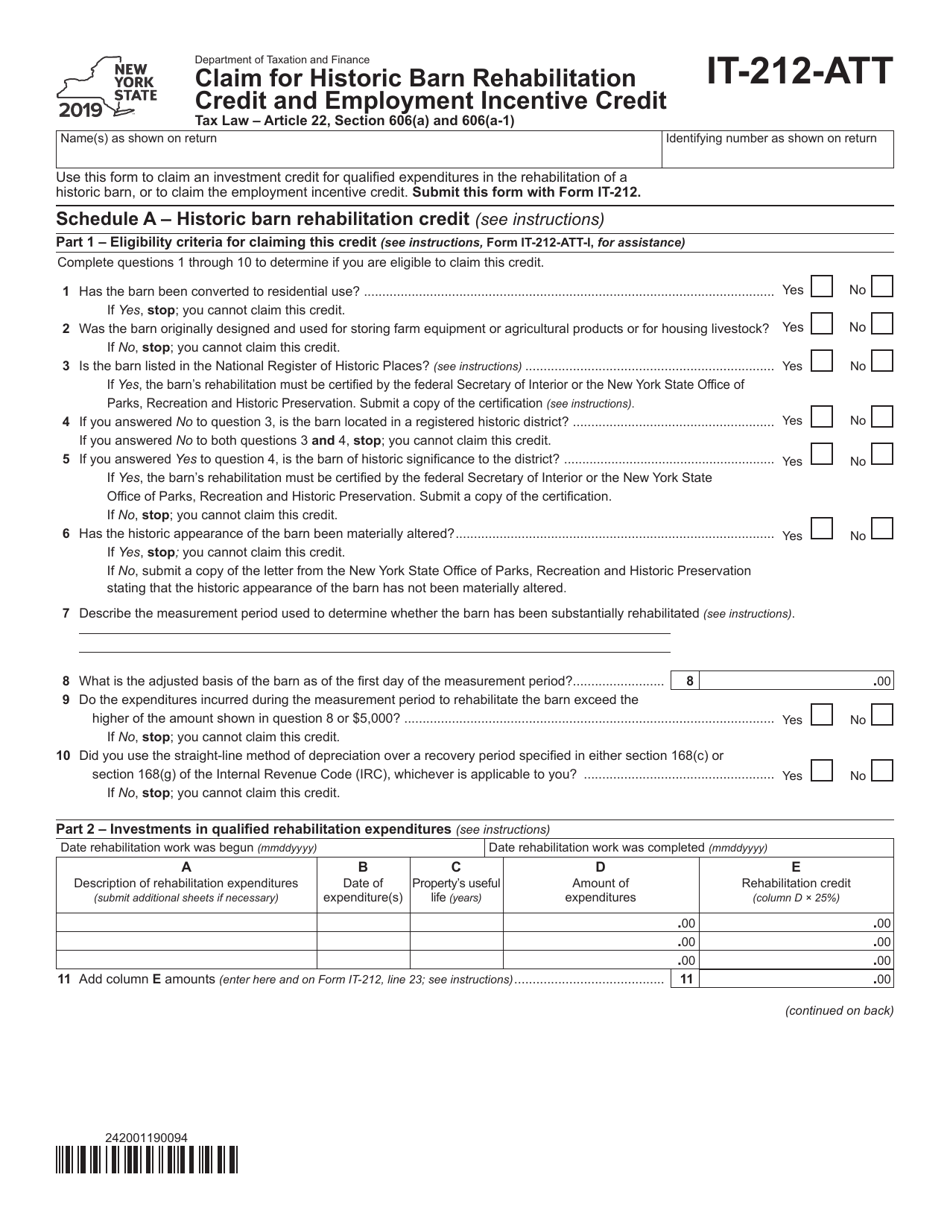

Form IT-212-ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit - New York

What Is Form IT-212-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-212-ATT?

A: Form IT-212-ATT is a tax form used in New York to claim the Historic Barn Rehabilitation Credit and Employment Incentive Credit.

Q: What is the Historic Barn Rehabilitation Credit?

A: The Historic Barn Rehabilitation Credit is a tax credit in New York that incentivizes the rehabilitation of historic barns.

Q: What is the Employment Incentive Credit?

A: The Employment Incentive Credit is a tax credit in New York that incentivizes the creation of new jobs.

Q: How do I claim these credits?

A: You can claim the Historic Barn Rehabilitation Credit and Employment Incentive Credit by filling out Form IT-212-ATT and attaching it to your New York state tax return.

Q: Are there any eligibility requirements for these credits?

A: Yes, there are specific eligibility requirements for both the Historic Barn Rehabilitation Credit and the Employment Incentive Credit. Please refer to the instructions on Form IT-212-ATT for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-212-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.