This version of the form is not currently in use and is provided for reference only. Download this version of

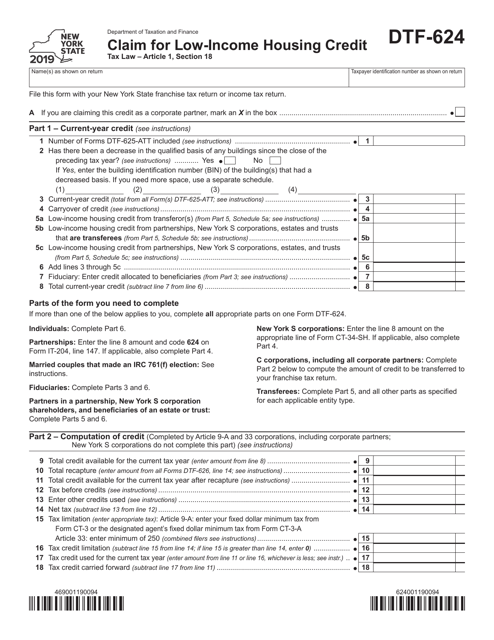

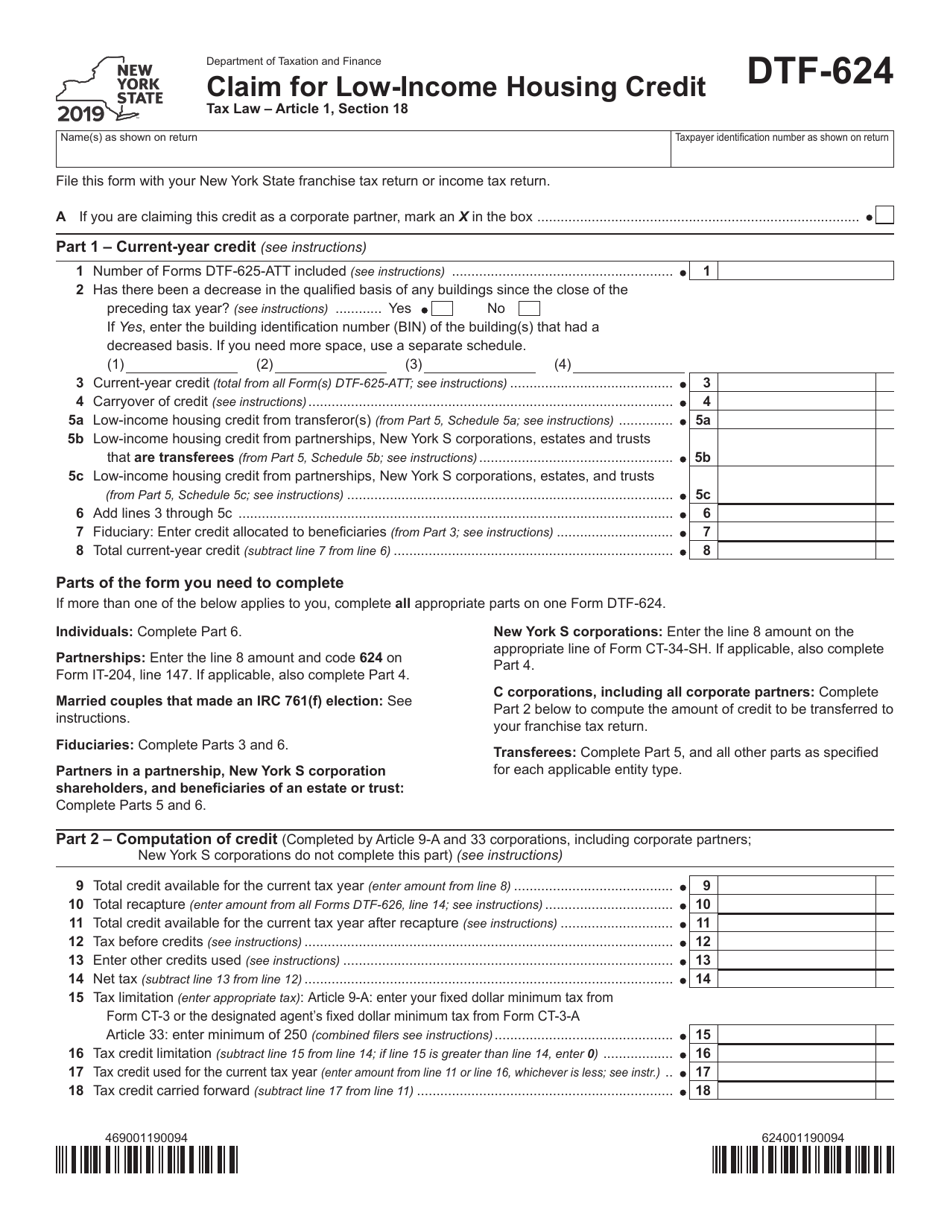

Form DTF-624

for the current year.

Form DTF-624 Claim for Low-Income Housing Credit - New York

What Is Form DTF-624?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-624?

A: Form DTF-624 is the claim form used for the Low-Income Housing Credit in New York.

Q: Who can use Form DTF-624?

A: Form DTF-624 can be used by individuals and businesses in New York who are eligible for the Low-Income Housing Credit.

Q: What is the Low-Income Housing Credit?

A: The Low-Income Housing Credit is a tax credit designed to encourage the development of affordable housing for low-income individuals and families.

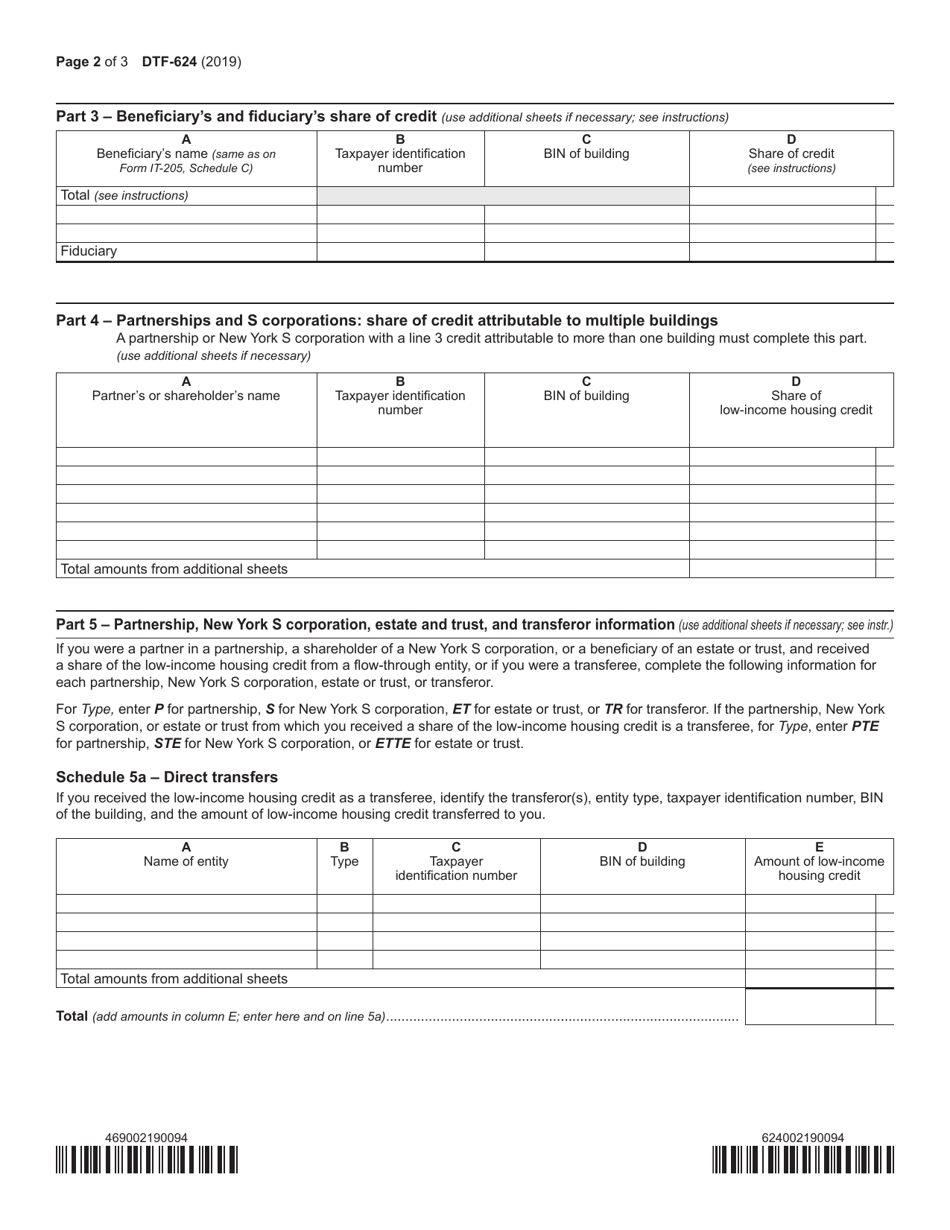

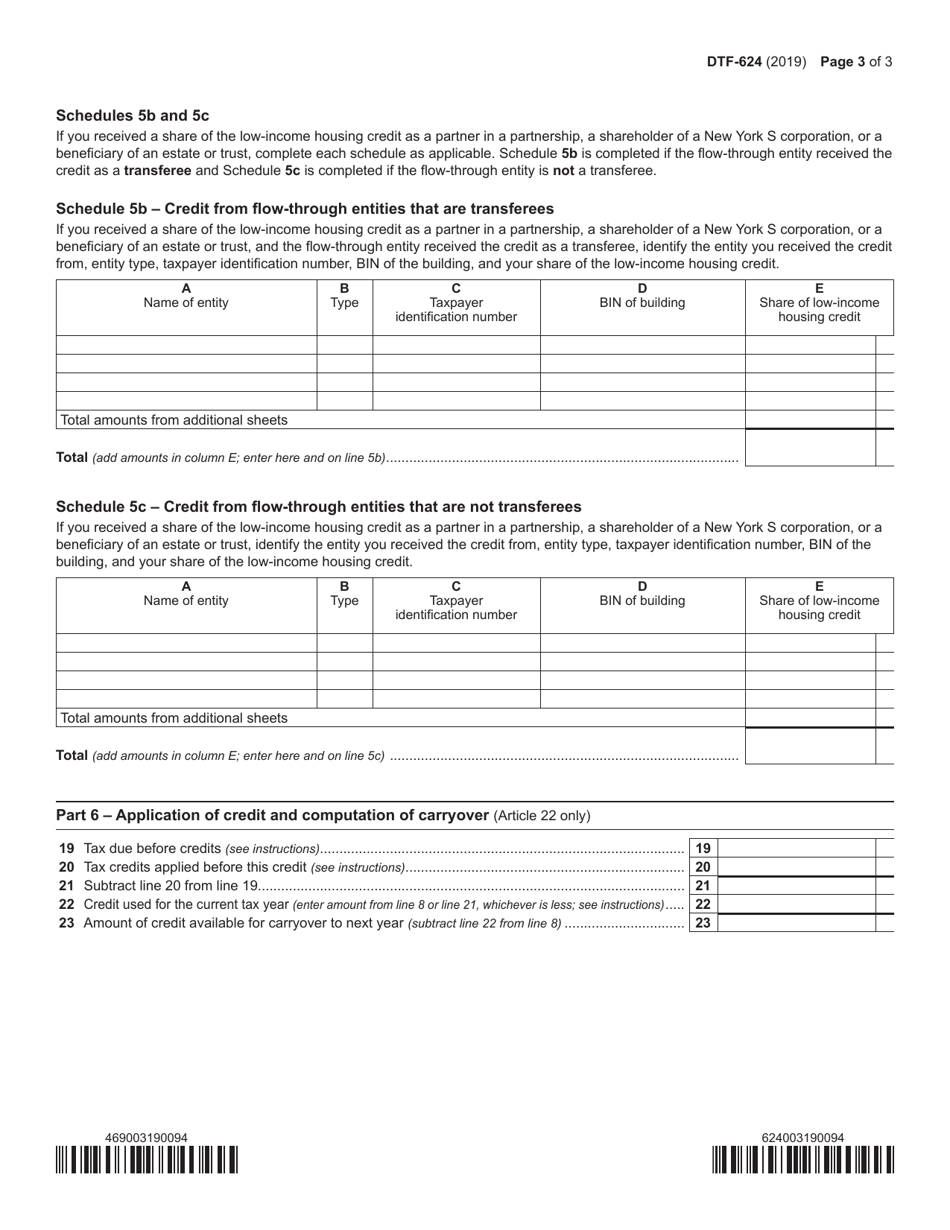

Q: What information is required on Form DTF-624?

A: Form DTF-624 requires information about the low-income housing project, the eligible basis of the building, and the qualified basis of the building.

Q: Are there any deadlines for filing Form DTF-624?

A: Yes, Form DTF-624 must be filed within 12 months from the end of the taxable year in which the low-income housing credit is claimed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-624 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.