This version of the form is not currently in use and is provided for reference only. Download this version of

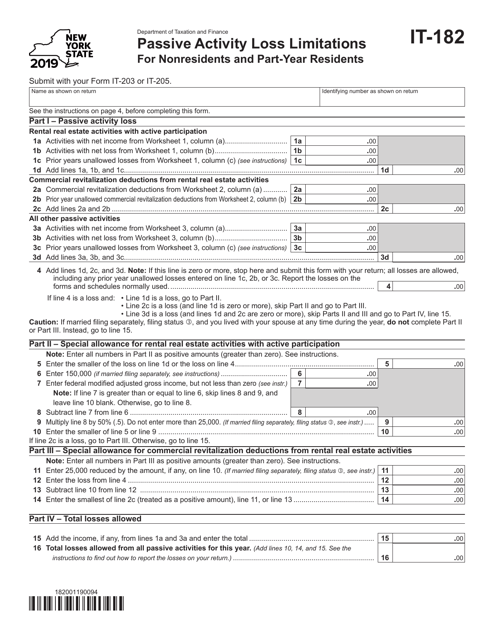

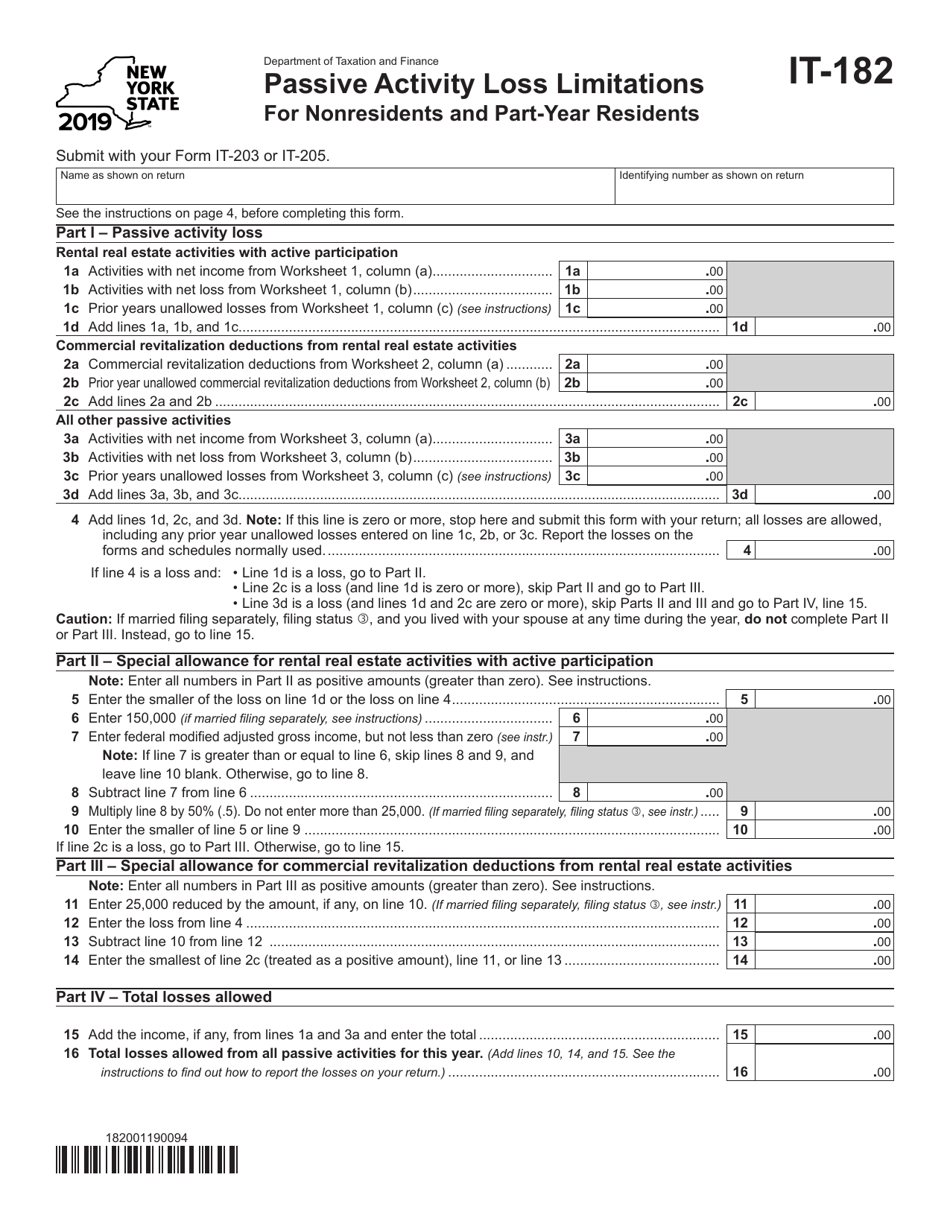

Form IT-182

for the current year.

Form IT-182 Passive Activity Loss Limitations for Nonresidents and Part-Year Residents - New York

What Is Form IT-182?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form IT-182 in New York?

A: Nonresidents and part-year residents who have passive activity losses.

Q: What is the purpose of Form IT-182?

A: To calculate and report passive activity loss limitations for nonresidents and part-year residents in New York.

Q: What are passive activity losses?

A: Passive activity losses are losses from rental real estate and other passive activities.

Q: How do passive activity losses affect tax liability?

A: Passive activity losses can only offset passive income, and any excess losses are subject to limitations.

Q: What are the limitations on passive activity losses?

A: The limitations depend on the individual's tax filing status and adjusted gross income.

Q: Are there any penalties for not filing Form IT-182?

A: Yes, failure to file Form IT-182 can result in penalties and interest on the unpaid taxes.

Q: Can I e-file Form IT-182?

A: Yes, Form IT-182 can be e-filed if you are using approved software or working with a tax professional.

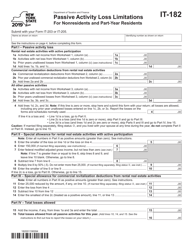

Q: Do I need to attach any other documents with Form IT-182?

A: You may need to attach supporting documents such as Form IT-203 or Schedule E.

Q: When is the deadline to file Form IT-182?

A: The deadline to file Form IT-182 is the same as the deadline for your New York state tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-182 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.