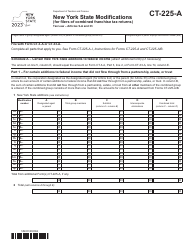

This version of the form is not currently in use and is provided for reference only. Download this version of

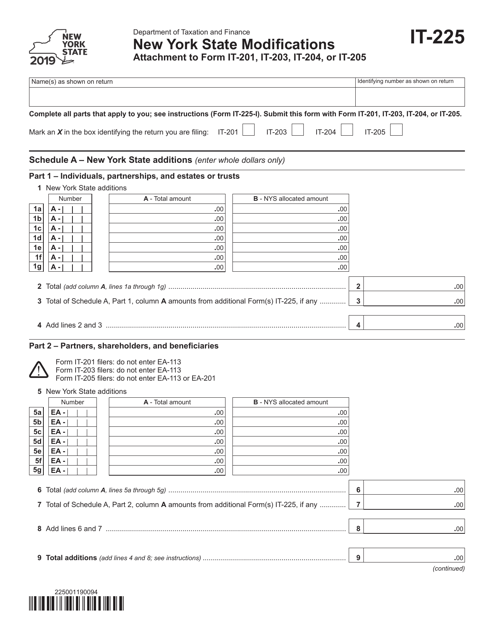

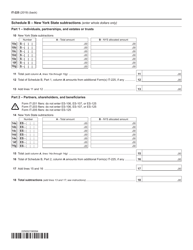

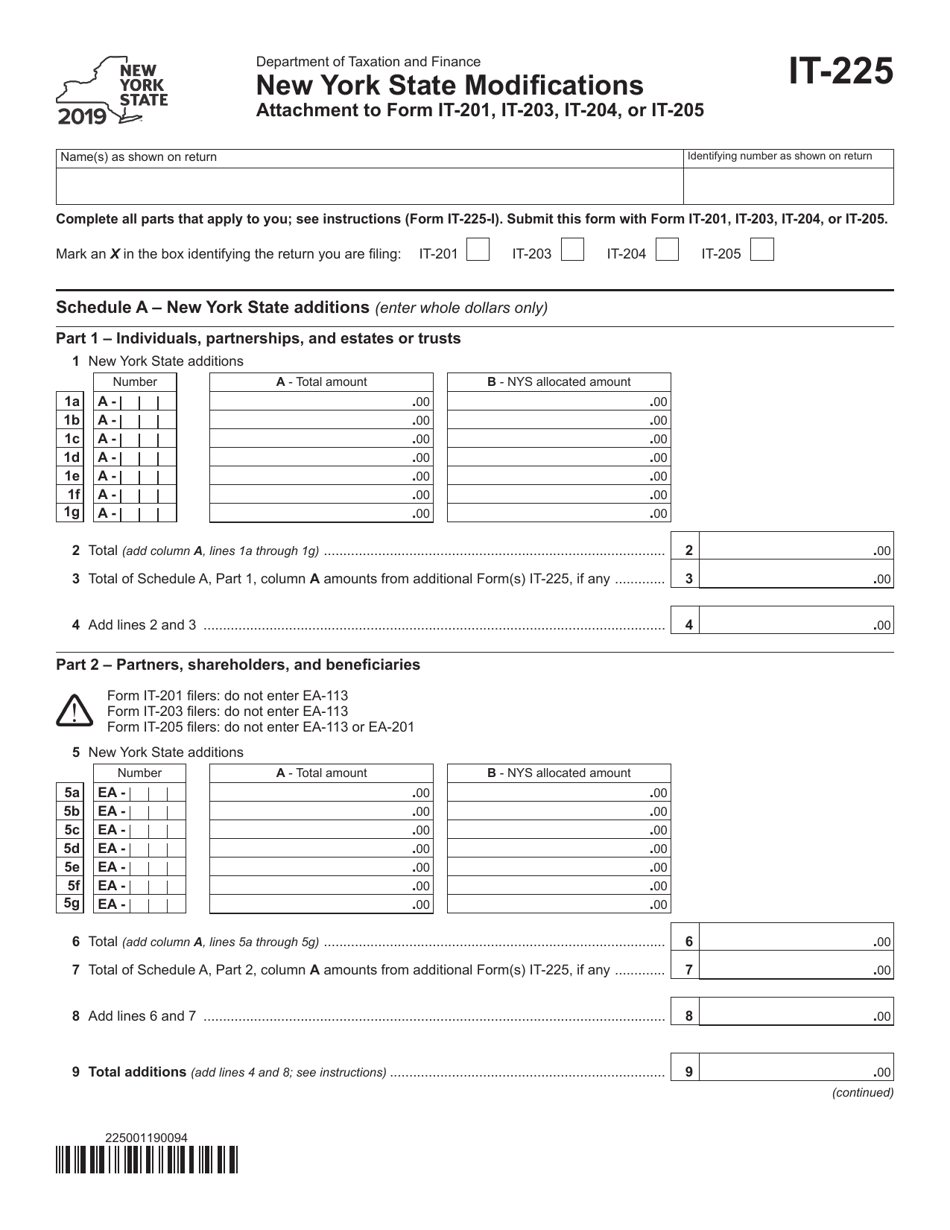

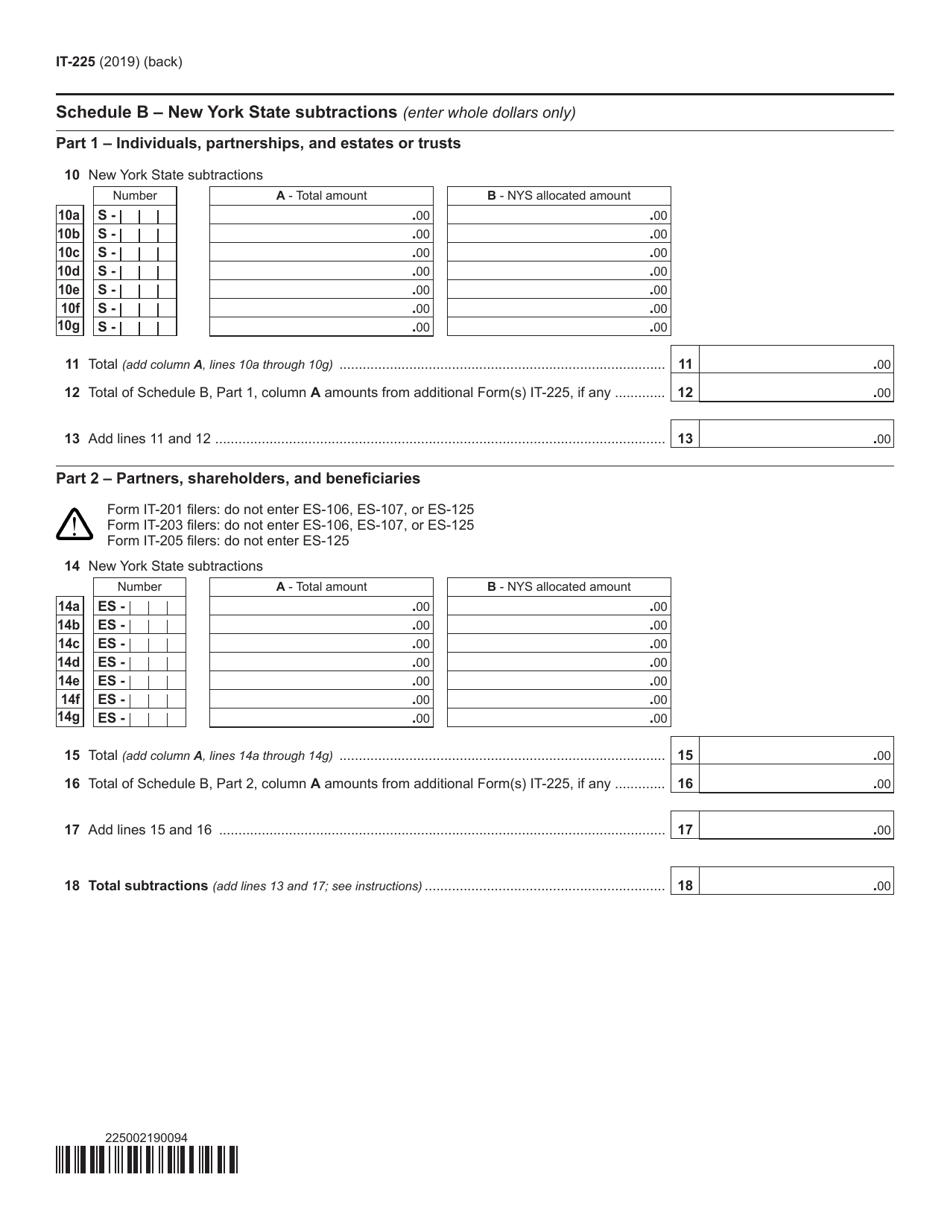

Form IT-225

for the current year.

Form IT-225 New York State Modifications - New York

What Is Form IT-225?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-225?

A: Form IT-225 is a tax form used in New York State to report any modifications to your federal income tax.

Q: Who needs to file Form IT-225?

A: You need to file Form IT-225 if you have any modifications to your federal income tax in New York State.

Q: What are New York State modifications?

A: New York State modifications are adjustments made to your federal income tax to reflect New York State tax laws.

Q: What is the purpose of Form IT-225?

A: The purpose of Form IT-225 is to report and calculate the modifications to your federal income tax for New York State.

Q: How do I file Form IT-225?

A: You can file Form IT-225 by completing the form and attaching it to your New York State income tax return.

Q: When is Form IT-225 due?

A: Form IT-225 is typically due on the same date as your New York State income tax return, which is usually April 15th.

Q: Are there any penalties for not filing Form IT-225?

A: Yes, there may be penalties for not filing Form IT-225 or for filing it late. It is important to file the form accurately and on time to avoid any penalties.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-225 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.