This version of the form is not currently in use and is provided for reference only. Download this version of

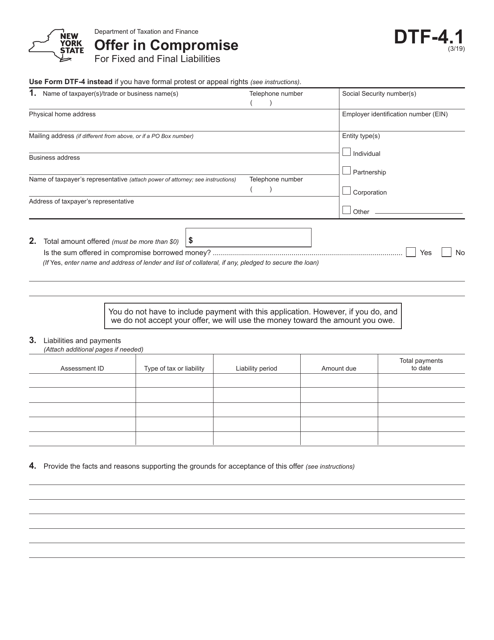

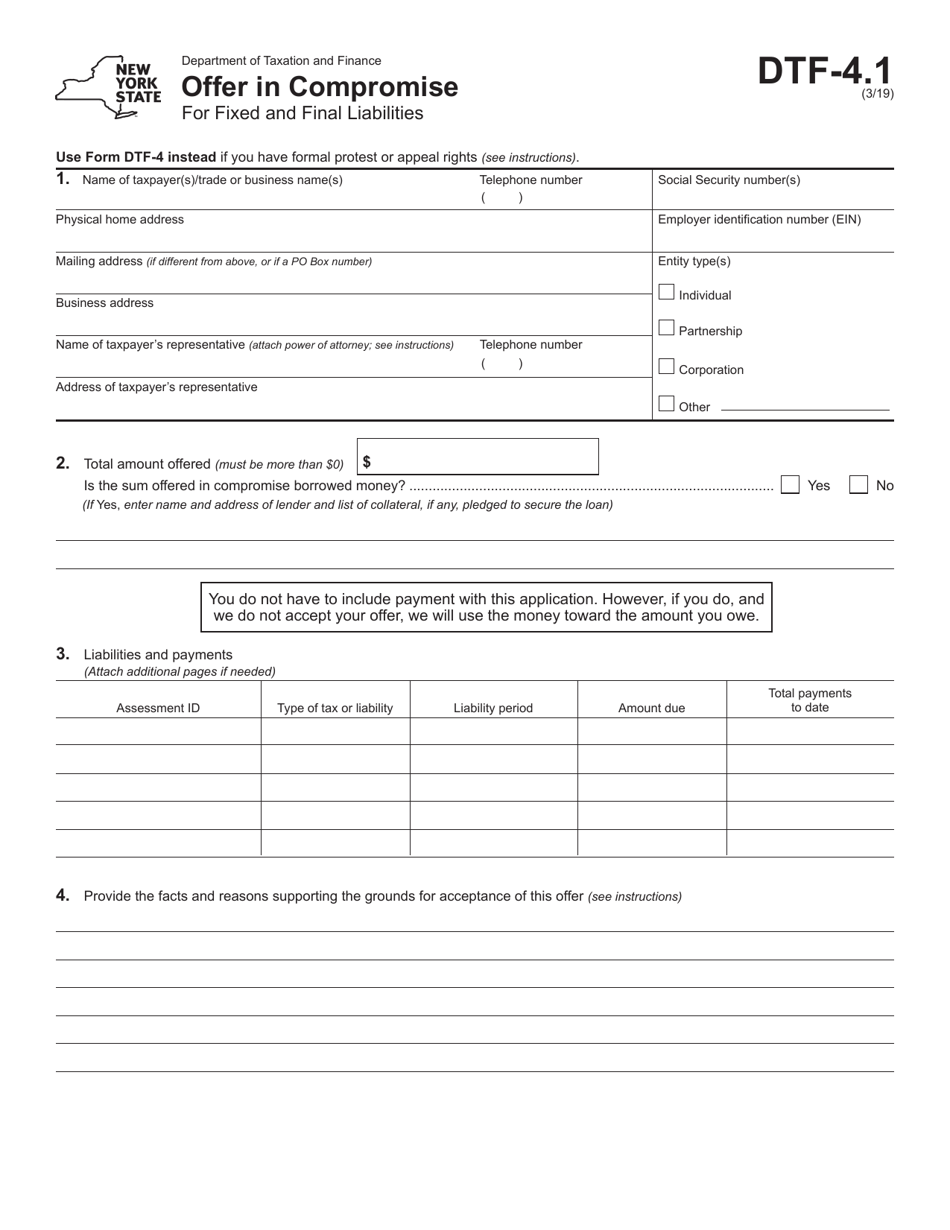

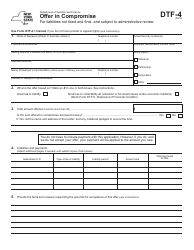

Form DTF-4.1

for the current year.

Form DTF-4.1 Offer in Compromise for Fixed and Final Liabilities - New York

What Is Form DTF-4.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-4.1?

A: Form DTF-4.1 is the Offer in Compromise for Fixed and Final Liabilities in New York.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the full amount.

Q: Who can file Form DTF-4.1?

A: Any individual or business with fixed and final liabilities in New York can file Form DTF-4.1.

Q: What are fixed and final liabilities?

A: Fixed and final liabilities refer to tax liabilities that have been determined and are not subject to further appeal.

Q: What is the purpose of Form DTF-4.1?

A: The purpose of Form DTF-4.1 is to request an offer in compromise to resolve fixed and final tax liabilities.

Q: Is there a fee to file Form DTF-4.1?

A: Yes, there is a non-refundable $250 application fee to file Form DTF-4.1.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-4.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.