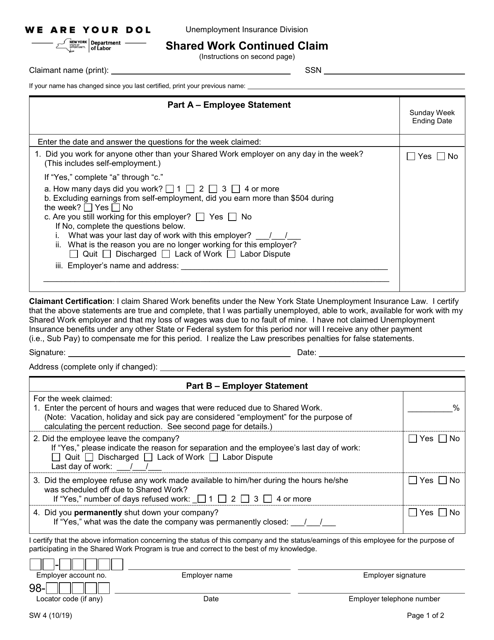

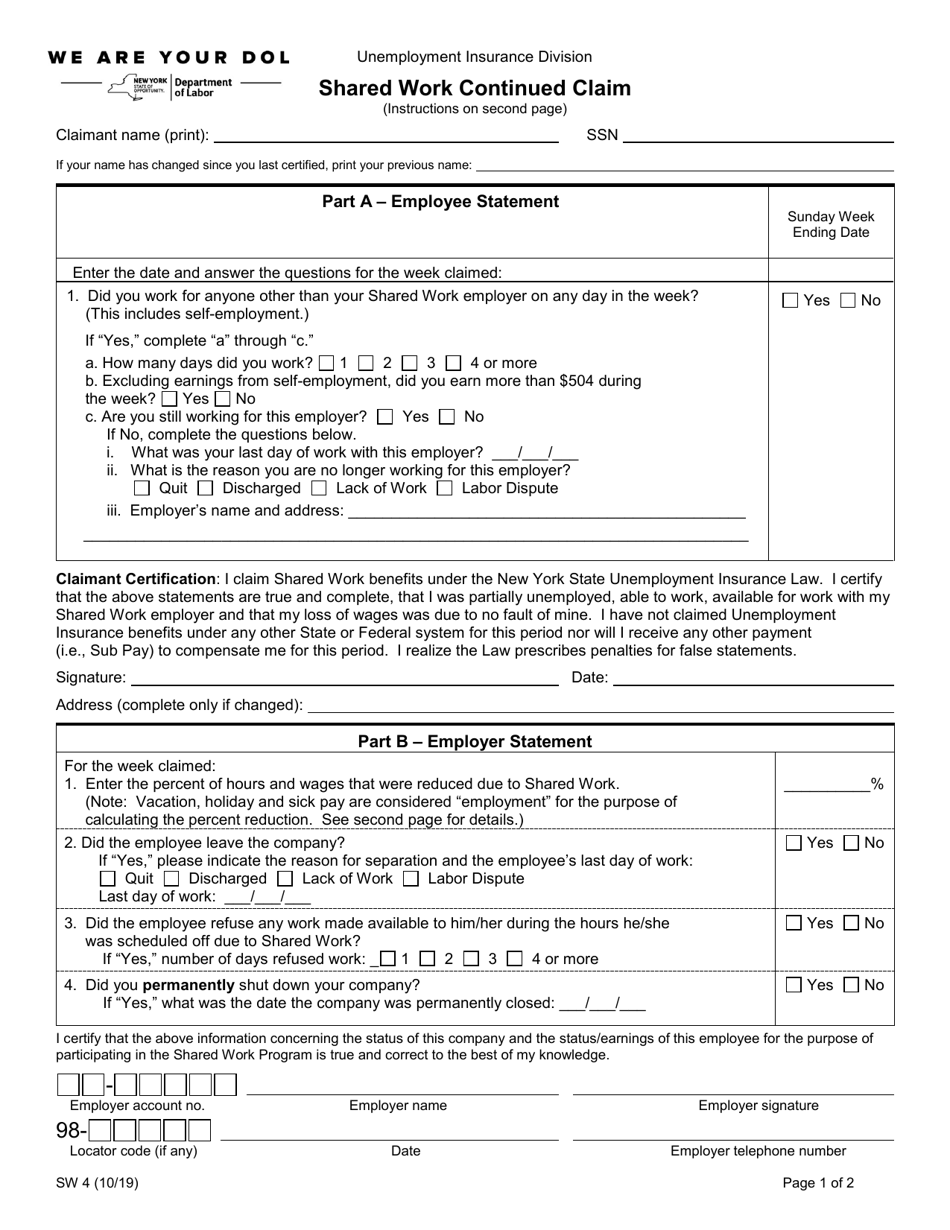

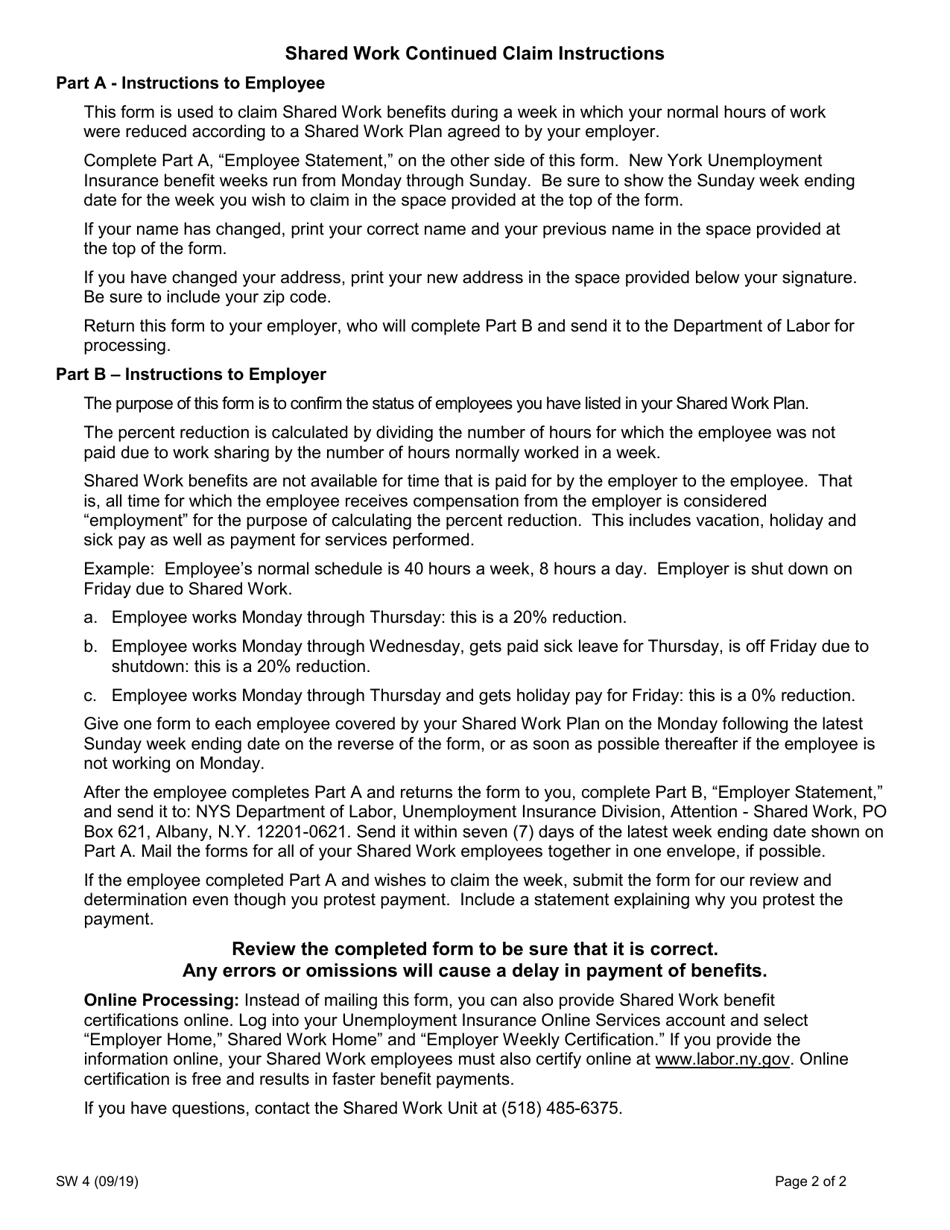

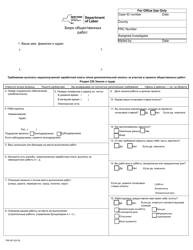

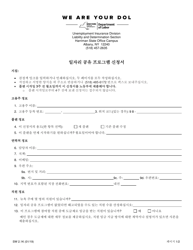

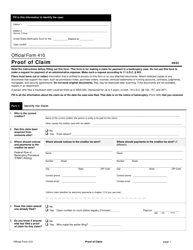

Form SW4 Shared Work Continued Claim - New York

What Is Form SW4?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

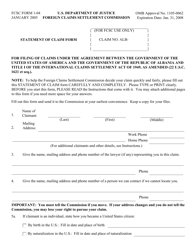

Q: What is a Form SW4 Shared Work Continued Claim?

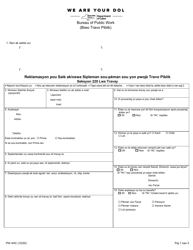

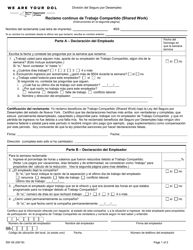

A: Form SW4 Shared Work Continued Claim is a form used in New York for individuals participating in the Shared Work Program to continue receiving benefits.

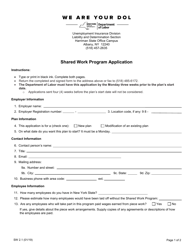

Q: What is the Shared Work Program in New York?

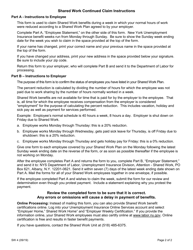

A: The Shared Work Program in New York is a program that allows employers to reduce the work hours of their employees instead of laying them off, while the employees receive partial unemployment benefits to compensate for the reduced hours.

Q: Who can use the Form SW4 Shared Work Continued Claim?

A: Employees who are participating in the Shared Work Program in New York can use the Form SW4 Shared Work Continued Claim.

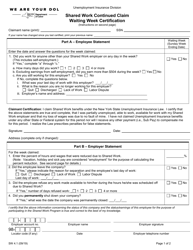

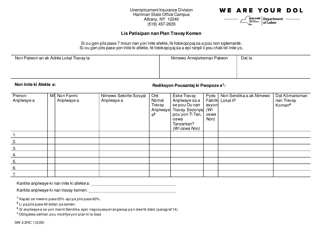

Q: What information is required in the Form SW4 Shared Work Continued Claim?

A: The Form SW4 Shared Work Continued Claim requires information such as the employee's personal details, employment details, and the number of hours worked during the claim week.

Q: How often should the Form SW4 Shared Work Continued Claim be submitted?

A: The Form SW4 Shared Work Continued Claim should be submitted every week that the employee is participating in the Shared Work Program and wants to receive benefits.

Q: Are there any deadlines for submitting the Form SW4 Shared Work Continued Claim?

A: Yes, the Form SW4 Shared Work Continued Claim must be submitted within 14 days of the end of the claim week.

Q: How long does it take to process the Form SW4 Shared Work Continued Claim?

A: The processing time for the Form SW4 Shared Work Continued Claim can vary, but it usually takes a few weeks to receive benefits after submitting the form.

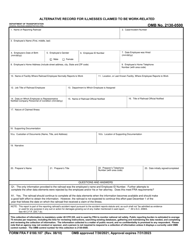

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SW4 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.