This version of the form is not currently in use and is provided for reference only. Download this version of

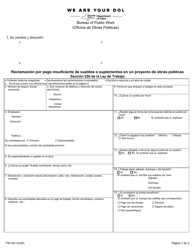

Form PW4

for the current year.

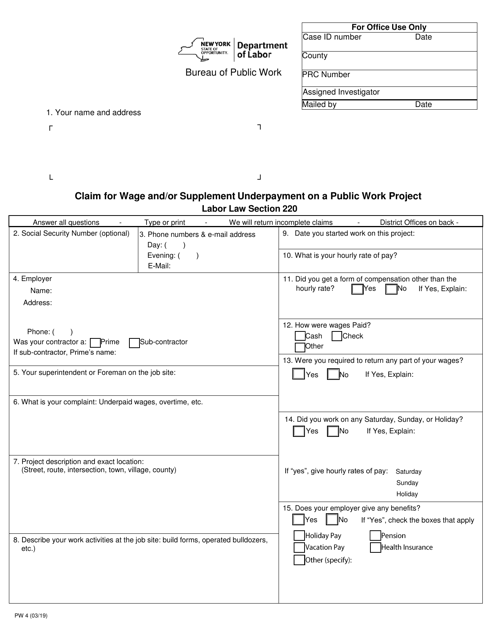

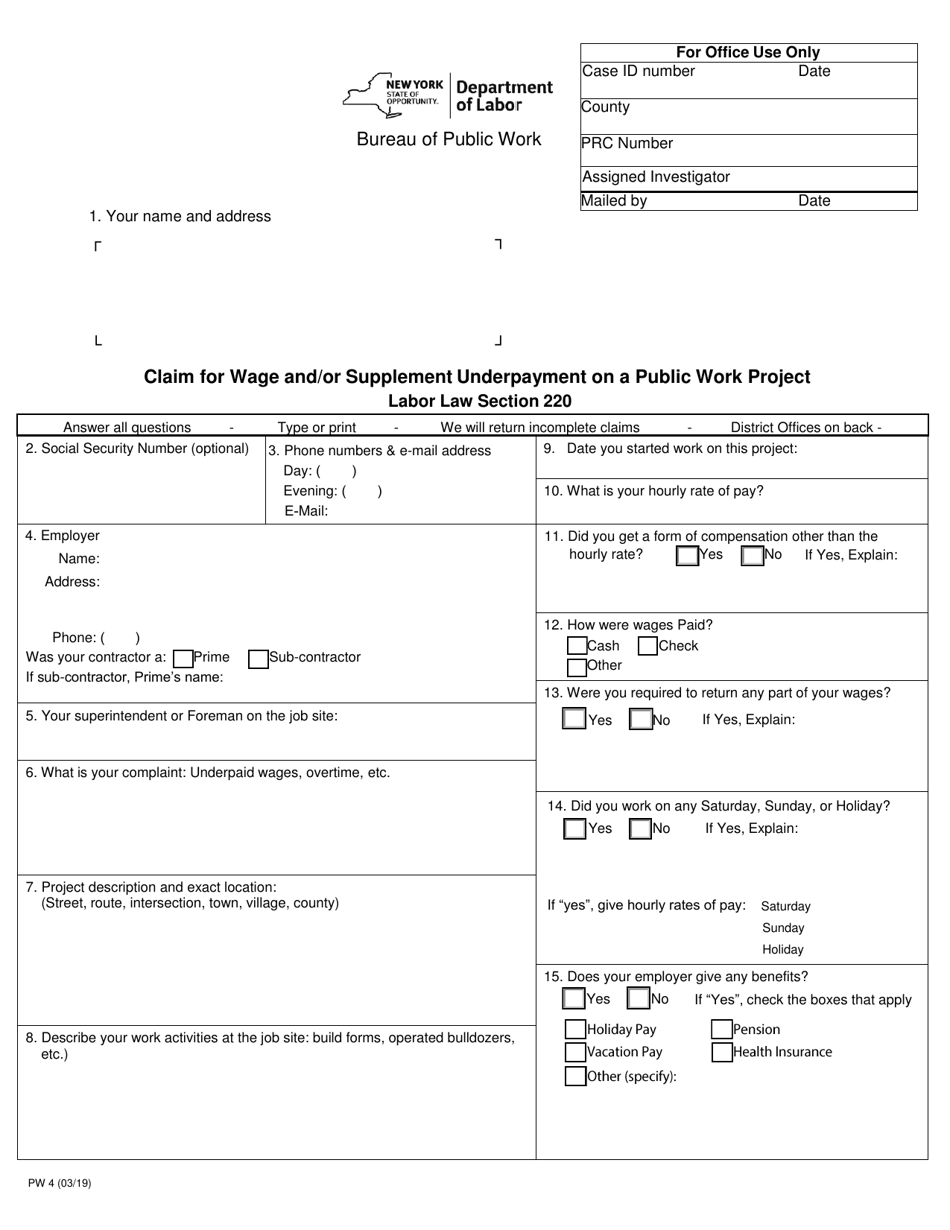

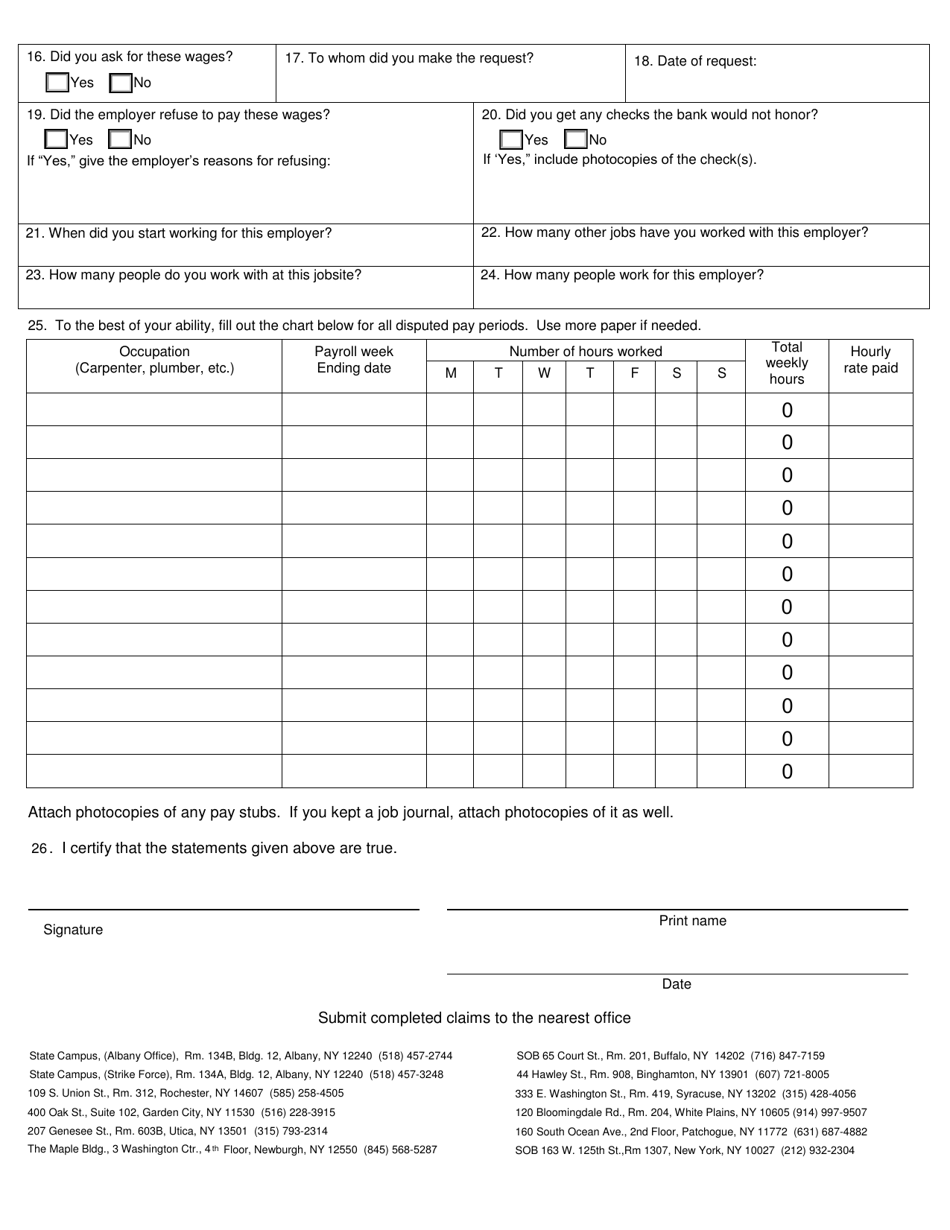

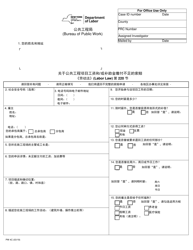

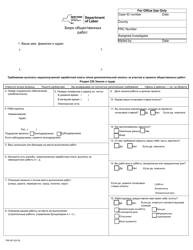

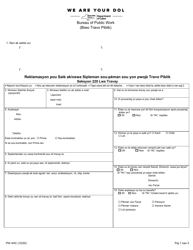

Form PW4 Claim for Wage and / or Supplement Underpayment on a Public Work Project - New York

What Is Form PW4?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PW4?

A: Form PW4 is a form used to file a claim for wage and/or supplement underpayment on a public work project in New York.

Q: What is a public work project?

A: A public work project is a construction project that is funded by government entities.

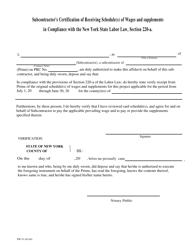

Q: Who can file a claim using Form PW4?

A: Workers who have not received full payment of wages or supplements on a public work project in New York can file a claim using Form PW4.

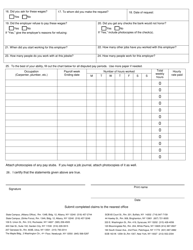

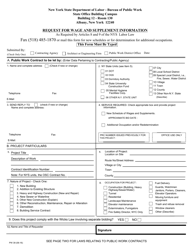

Q: How do I fill out Form PW4?

A: You need to include information about the project, your employer, and the wages and supplements you are claiming on Form PW4. You should also attach any supporting documentation.

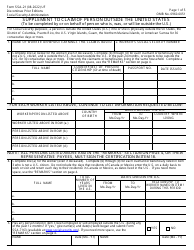

Q: Is there a deadline for filing a claim using Form PW4?

A: Yes, you must file your claim within six years from the date the underpayment was due.

Q: What happens after I submit Form PW4?

A: The New York State Department of Labor will review your claim and may conduct an investigation. They will determine whether you are owed any wages and supplements.

Q: What should I do if my claim is approved?

A: If your claim is approved, you may be entitled to receive the unpaid wages and supplements that you are owed.

Q: What should I do if my claim is denied?

A: If your claim is denied, you may have the option to appeal the decision or pursue other legal remedies.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PW4 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.