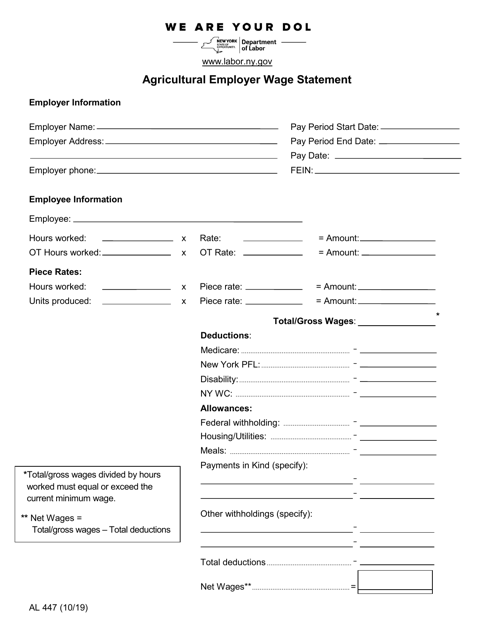

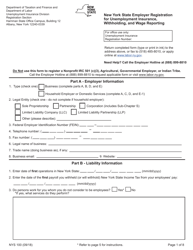

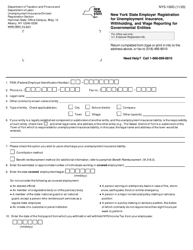

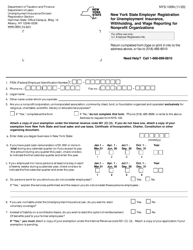

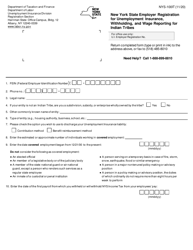

Form AL447 Agricultural Employer Wage Statement - New York

What Is Form AL447?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AL447?

A: Form AL447 is the Agricultural Employer Wage Statement for the state of New York.

Q: Who needs to file Form AL447?

A: Agricultural employers in the state of New York need to file Form AL447.

Q: What is the purpose of Form AL447?

A: The purpose of Form AL447 is to report wages paid to agricultural employees in New York.

Q: When is Form AL447 due?

A: Form AL447 is due on or before January 31st of each year.

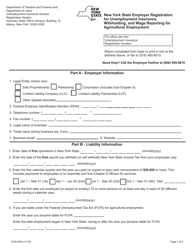

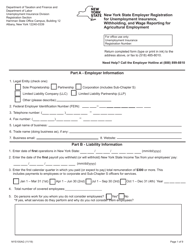

Q: What information is required on Form AL447?

A: Form AL447 requires information about the employer, employee, and wages paid, including hours worked and types of work performed.

Q: Are there any penalties for not filing Form AL447?

A: Yes, there are penalties for not filing Form AL447, including potential fines and interest charges.

Q: Do I need to provide a copy of Form AL447 to my employees?

A: Yes, you are required to provide a copy of Form AL447 to each of your employees.

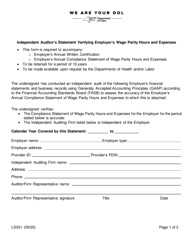

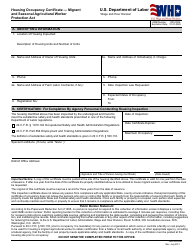

Q: What other forms do I need to file in addition to Form AL447?

A: In addition to Form AL447, you may also need to file other payroll and employment tax forms, such as Form W-2 and Form 941.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AL447 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.