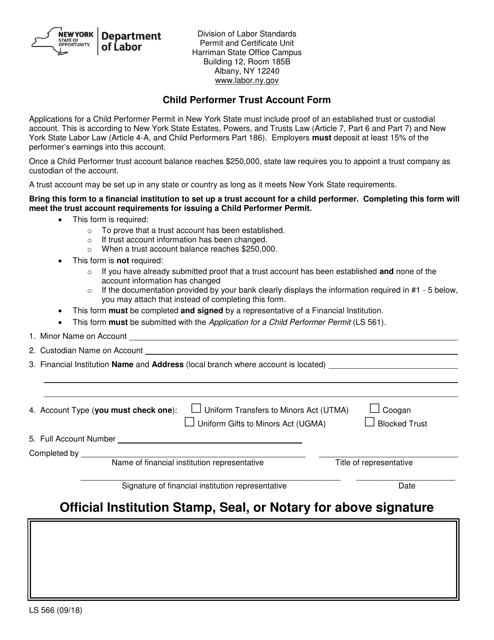

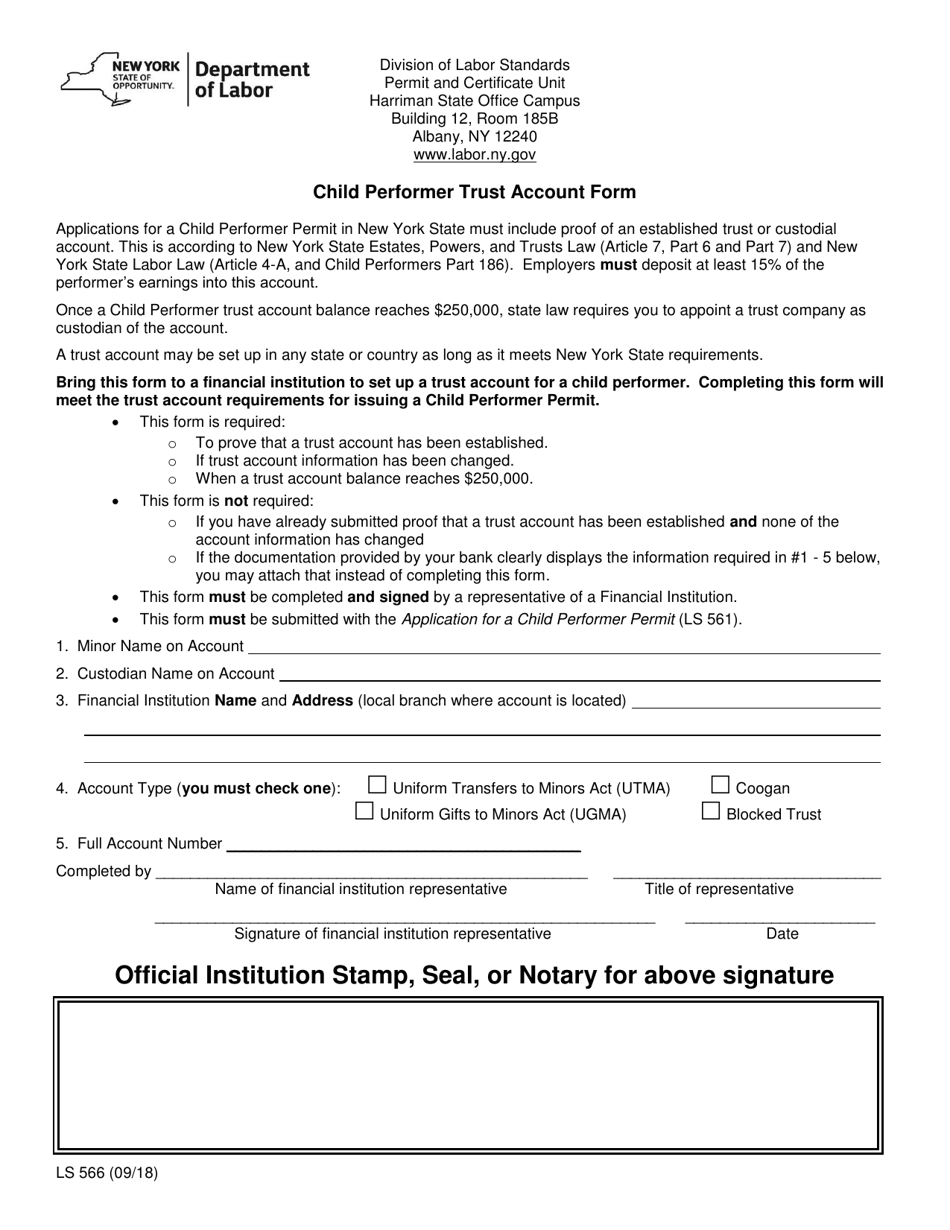

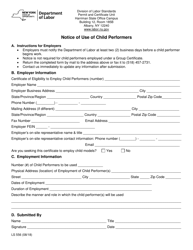

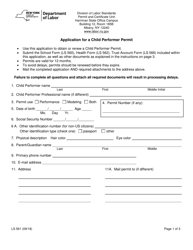

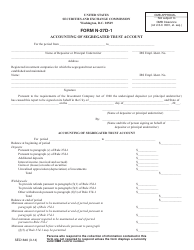

Form LS566 Child Performer Trust Account Form - New York

What Is Form LS566?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

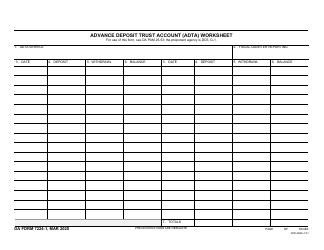

Q: What is the LS566 Child Performer Trust Account Form?

A: The LS566 Child Performer Trust Account Form is a form used in New York to establish a trust account for child performers.

Q: Why is a trust account needed for child performers?

A: A trust account is needed to ensure that earnings from performances are protected and properly managed for the benefit of the child performer.

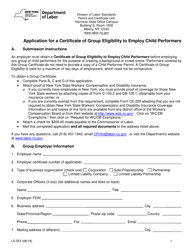

Q: Who is required to submit the LS566 form?

A: The LS566 form must be submitted by the parent or guardian of the child performer.

Q: What information is required on the LS566 form?

A: The LS566 form requires information about the child performer, the parent or guardian, and the financial institution where the trust account will be held.

Q: Are there any fees associated with submitting the LS566 form?

A: There are no fees associated with submitting the LS566 form.

Q: What happens after the LS566 form is submitted?

A: After the LS566 form is submitted, the financial institution will set up the trust account and provide the parent or guardian with the account information.

Q: Can funds be withdrawn from the trust account?

A: Funds from the trust account can only be withdrawn for the benefit of the child performer and must be approved by the New York State Department of Labor.

Q: Are there any requirements for managing the trust account?

A: The trust account must be managed in accordance with the rules and regulations set forth by the New York State Department of Labor.

Q: Is the LS566 form specific to New York?

A: Yes, the LS566 form is specific to New York and is not applicable in other states.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS566 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.