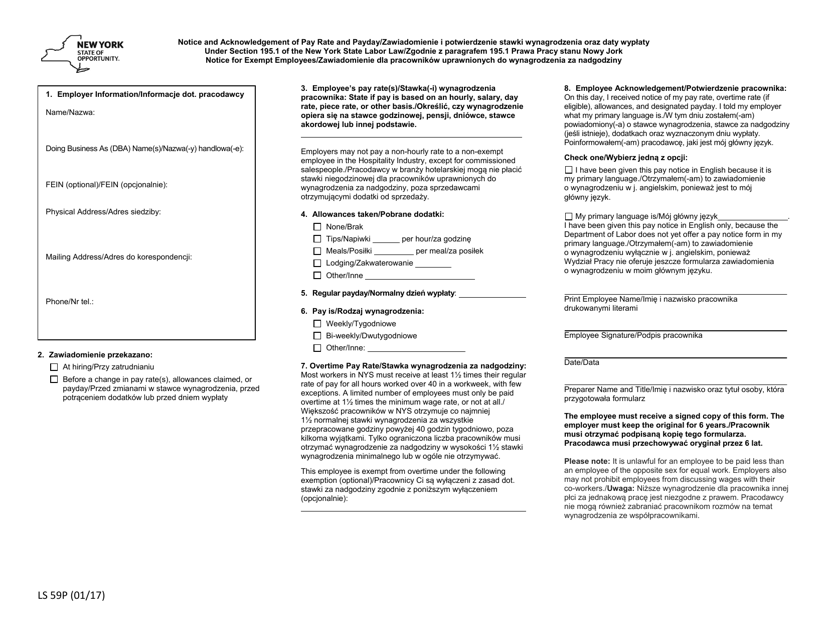

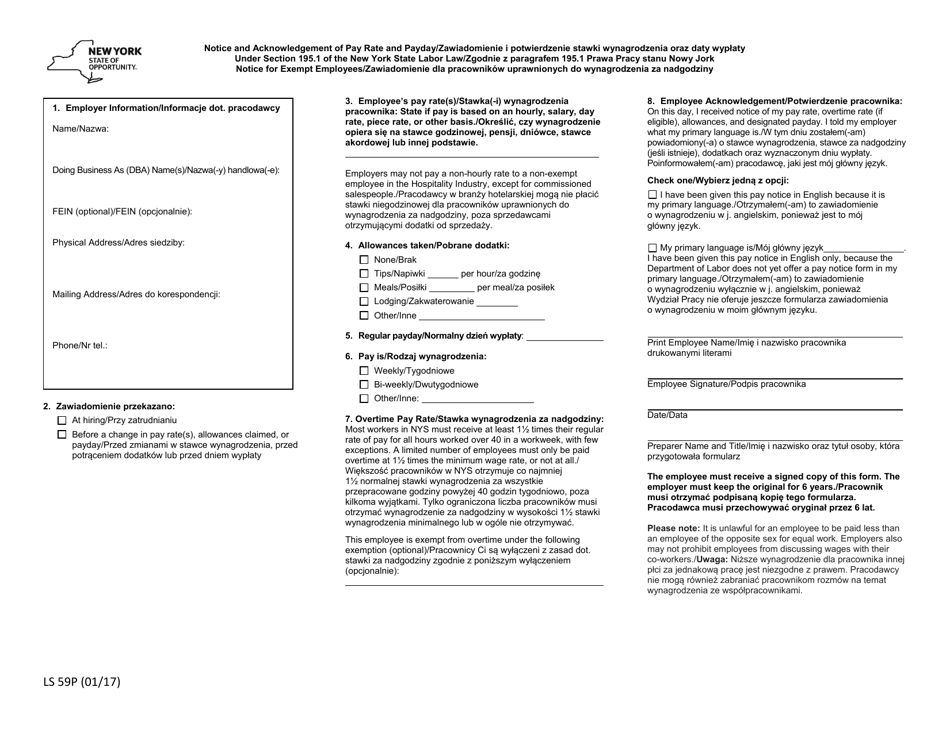

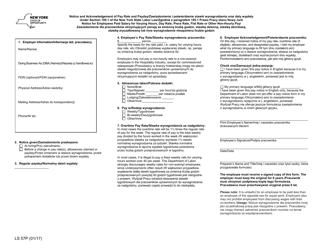

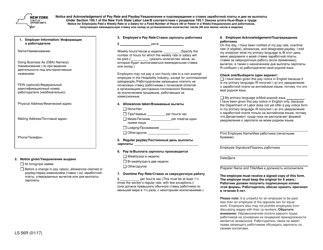

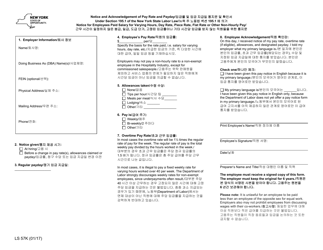

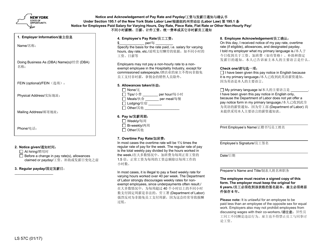

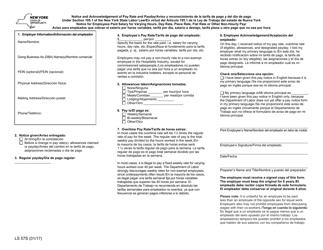

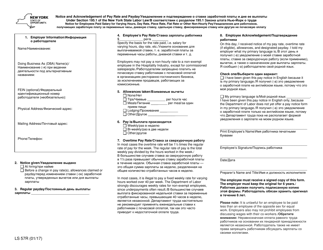

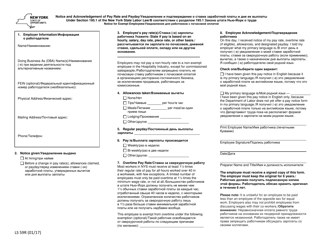

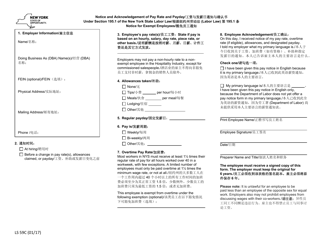

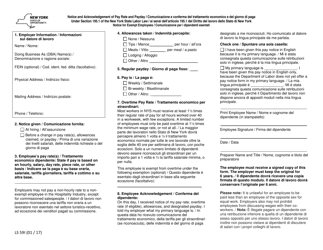

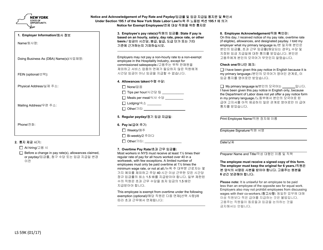

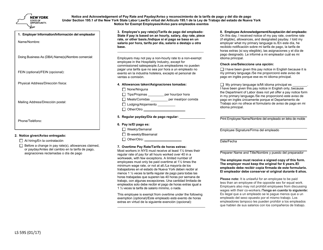

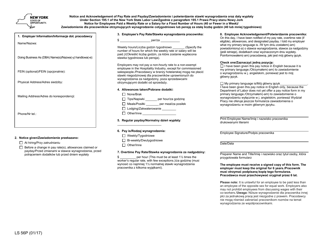

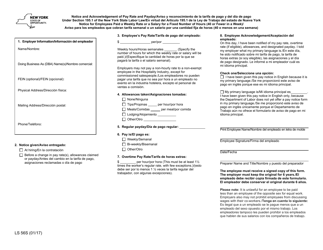

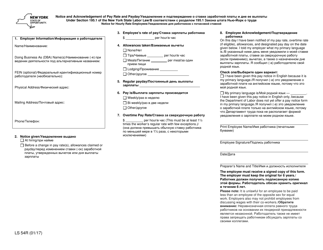

Form LS59P Pay Notice for Exempt Employees - New York (English / Polish)

What Is Form LS59P?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the LS59P Pay Notice?

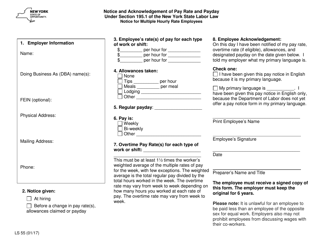

A: The LS59P Pay Notice is a form used to provide pay information to exempt employees in New York.

Q: Who needs to fill out the LS59P Pay Notice?

A: Employers in New York with exempt employees need to fill out the LS59P Pay Notice.

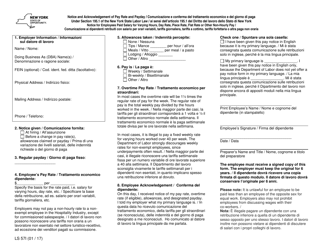

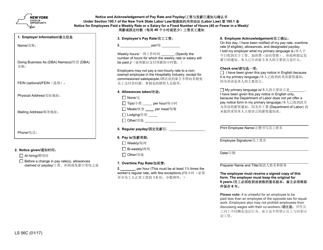

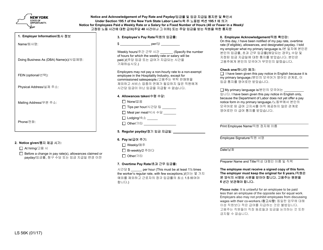

Q: What language is the LS59P Pay Notice available in?

A: The LS59P Pay Notice is available in both English and Polish.

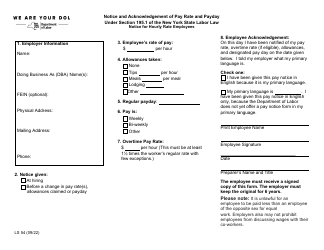

Q: What information does the LS59P Pay Notice include?

A: The LS59P Pay Notice includes information about the employee's pay rate, deductions, allowances, and total wages.

Q: Is the LS59P Pay Notice required by law?

A: Yes, in New York, employers are required by law to provide the LS59P Pay Notice to their exempt employees.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS59P by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.