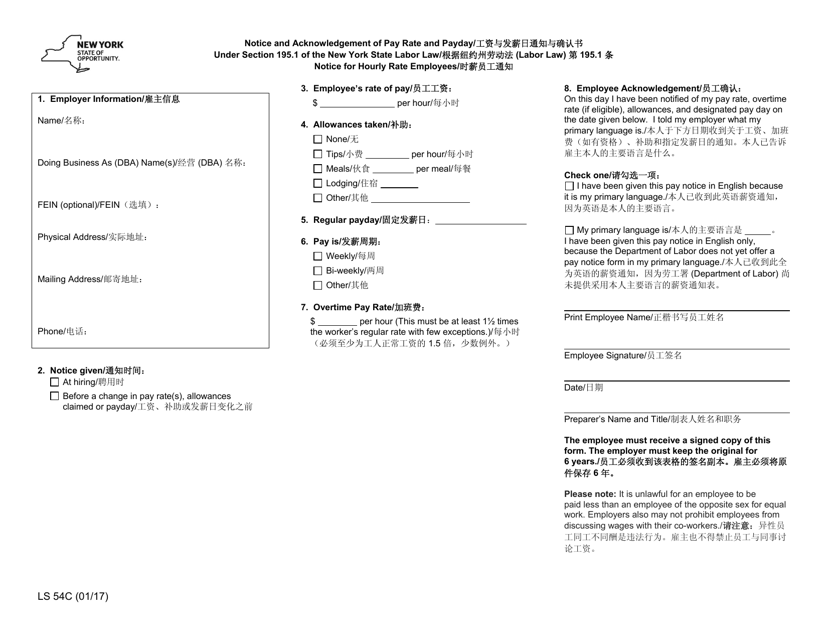

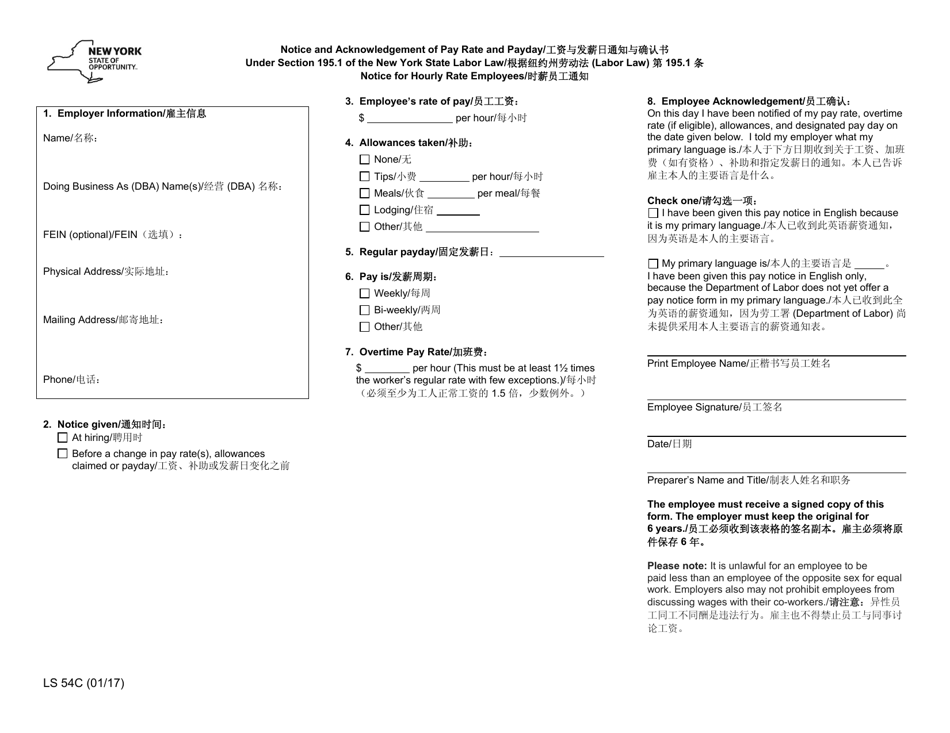

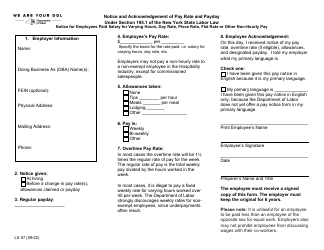

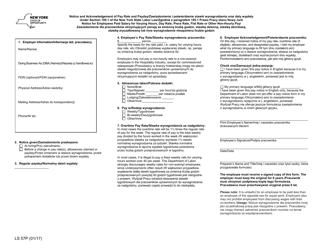

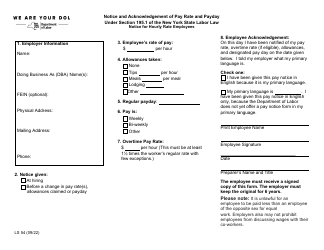

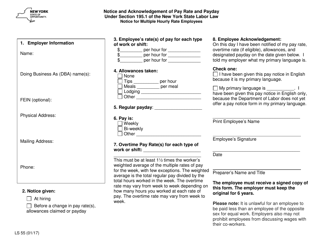

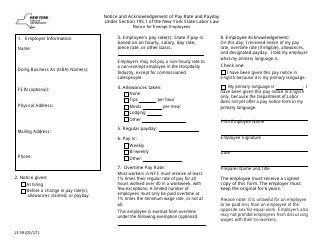

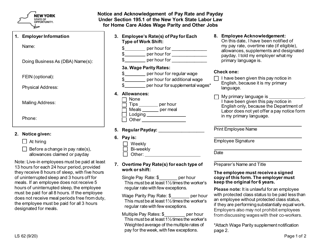

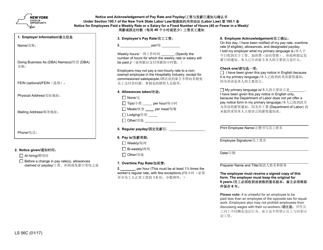

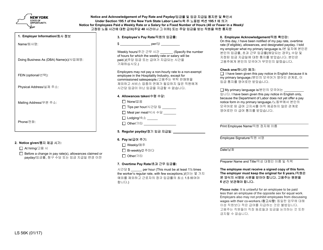

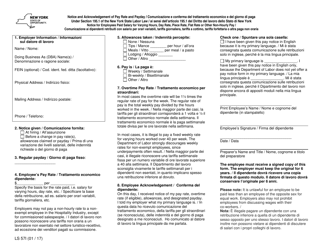

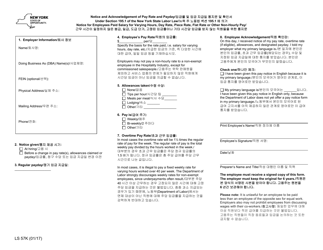

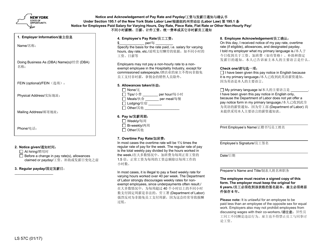

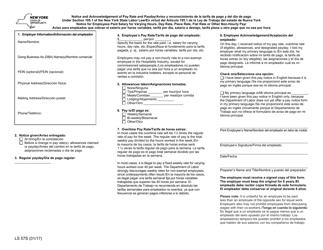

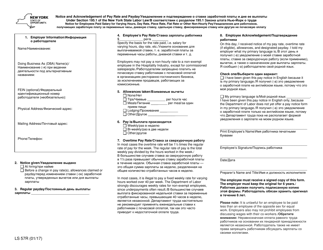

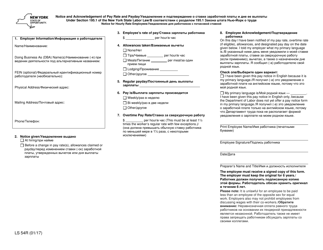

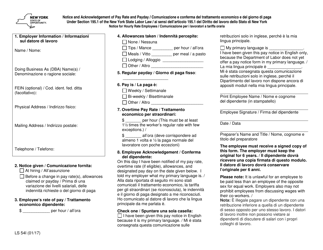

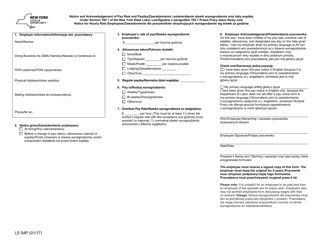

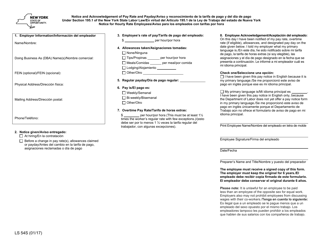

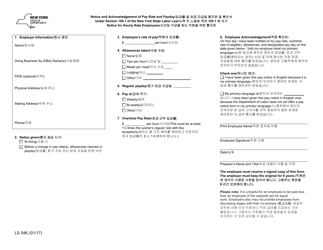

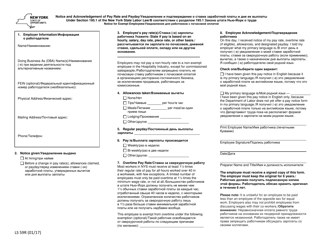

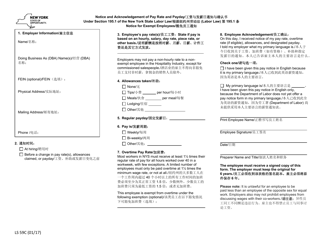

Form LS54C Pay Notice for Hourly Rate Employees - New York (English / Chinese)

What Is Form LS54C?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LS54C Pay Notice?

A: LS54C Pay Notice is a form that employers in New York must give to their hourly rate employees to inform them about their pay rate and other important information.

Q: Who should receive LS54C Pay Notice?

A: Hourly rate employees in New York should receive LS54C Pay Notice.

Q: What information does LS54C Pay Notice contain?

A: LS54C Pay Notice contains information such as the employee's pay rate, overtime rate, work hours, and other relevant details.

Q: Is LS54C Pay Notice available in both English and Chinese?

A: Yes, LS54C Pay Notice is available in both English and Chinese.

Q: Is LS54C Pay Notice mandatory in New York?

A: Yes, LS54C Pay Notice is mandatory for employers in New York.

Q: What should employees do if they don't receive LS54C Pay Notice?

A: Employees should contact their employer or the New York State Department of Labor if they do not receive LS54C Pay Notice.

Q: What should employees do if their LS54C Pay Notice contains incorrect information?

A: Employees should notify their employer and request a corrected LS54C Pay Notice with the accurate information.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS54C by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.