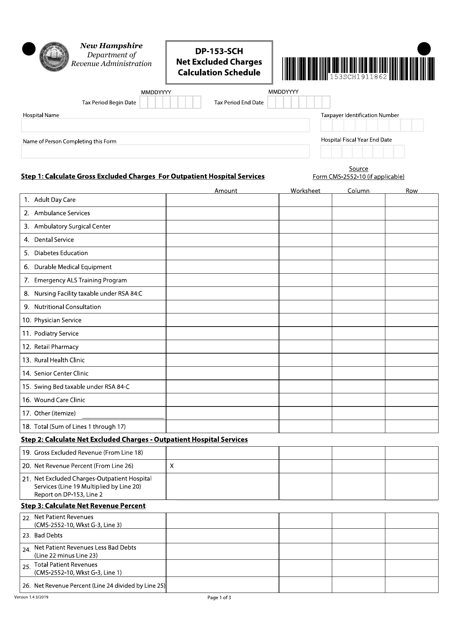

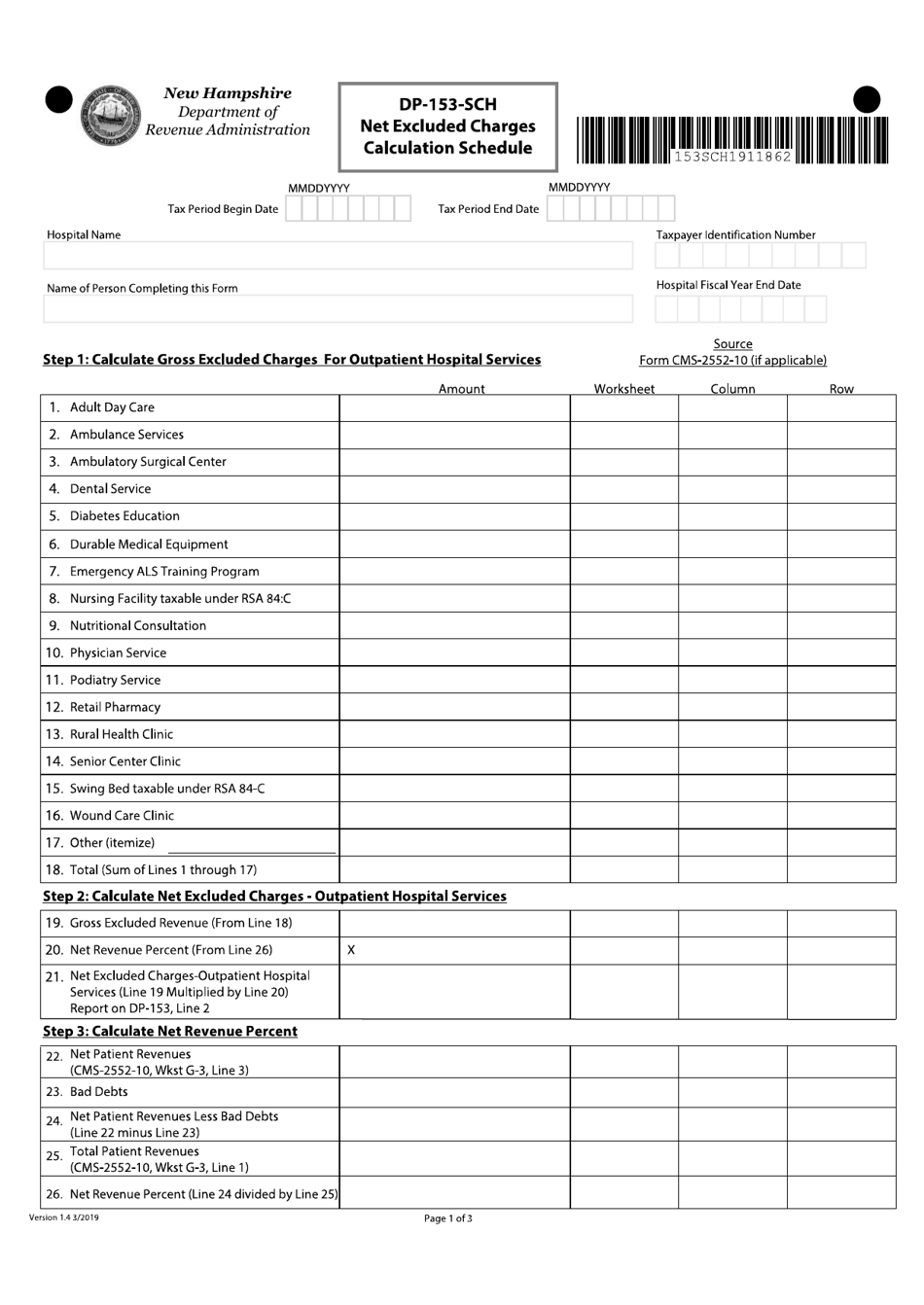

Form DP-153-SCH Net Excluded Charges Calculation Schedule - New Hampshire

What Is Form DP-153-SCH?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-153-SCH?

A: Form DP-153-SCH is the Net Excluded Charges Calculation Schedule.

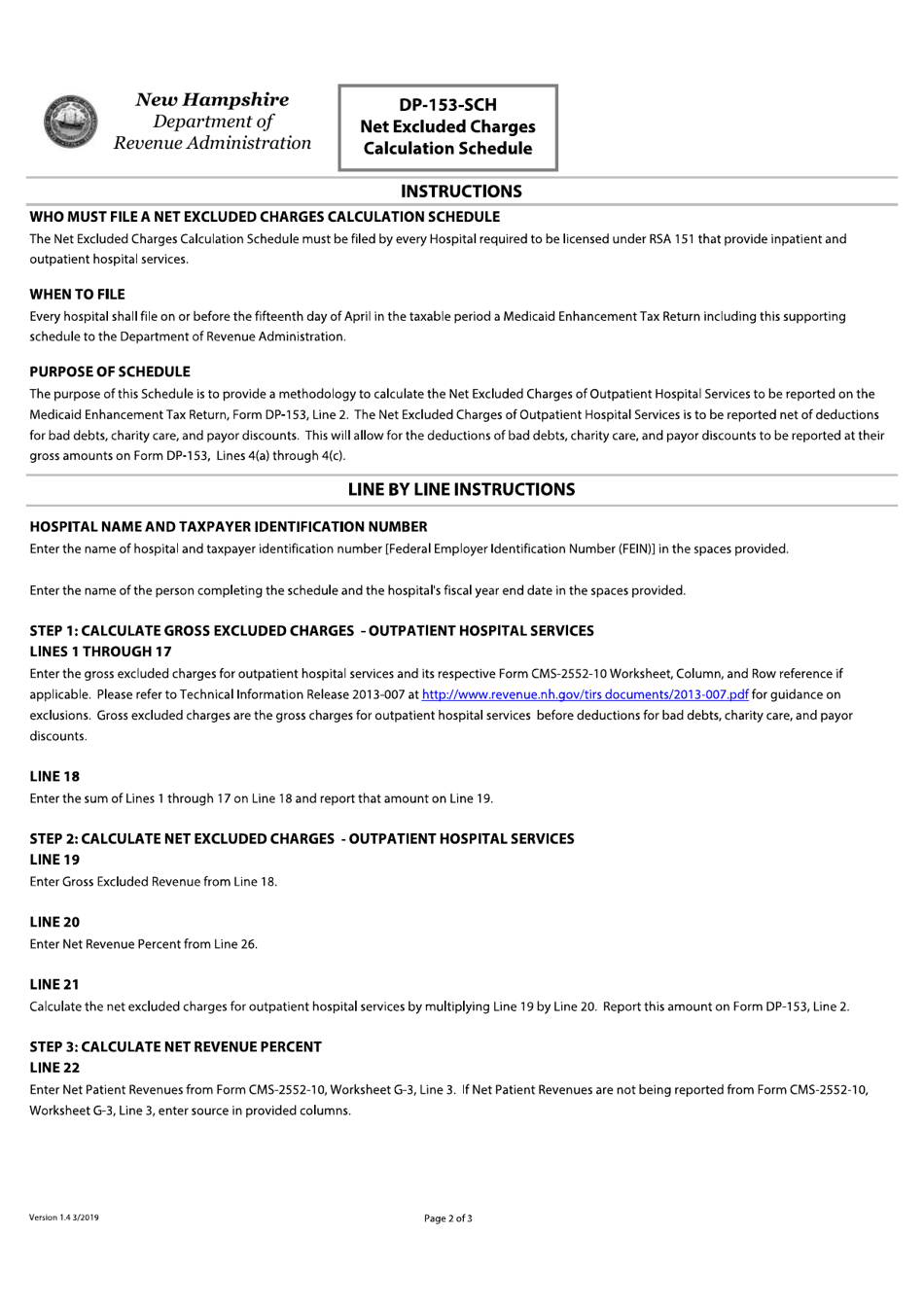

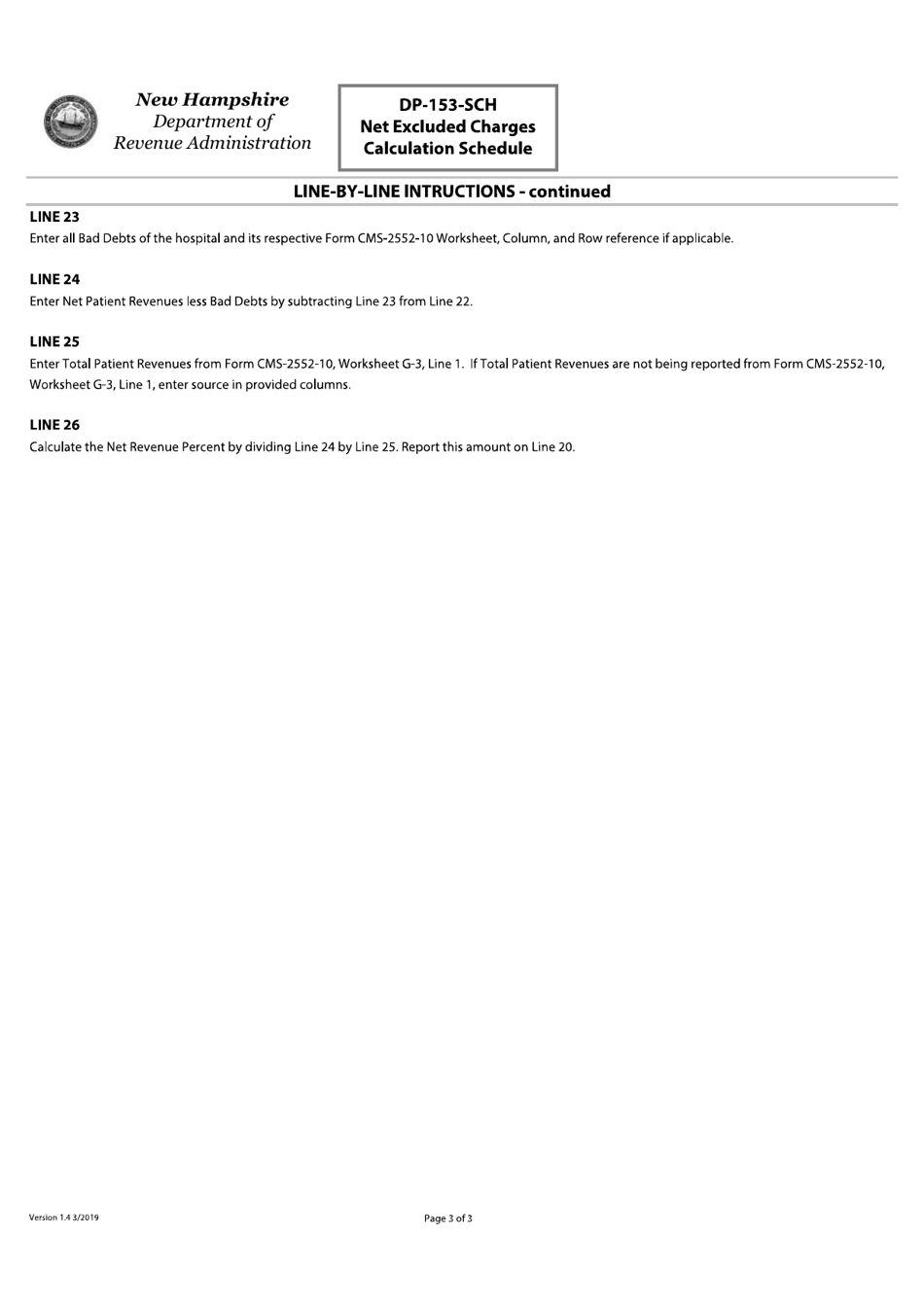

Q: What is the purpose of Form DP-153-SCH?

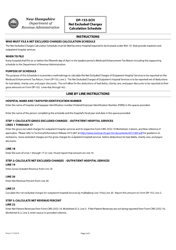

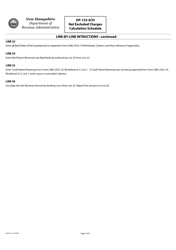

A: The purpose of Form DP-153-SCH is to calculate the net excluded charges.

Q: Who is required to use Form DP-153-SCH?

A: New Hampshire residents are required to use Form DP-153-SCH.

Q: What are net excluded charges?

A: Net excluded charges are certain charges that are not subject to taxation.

Q: Why do I need to calculate net excluded charges?

A: Calculating net excluded charges helps determine the taxable income for state tax purposes.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-153-SCH by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.