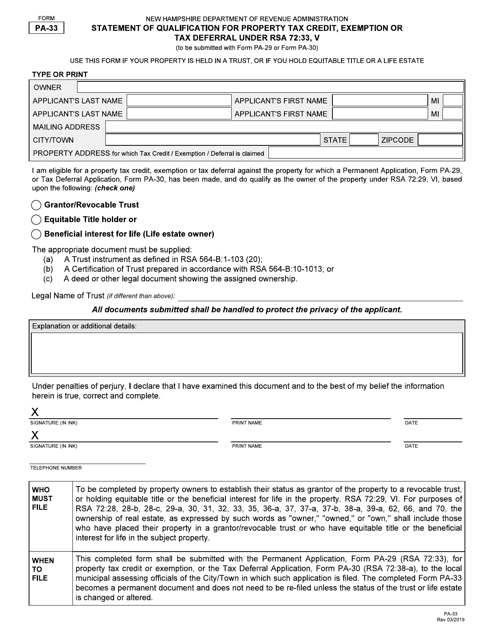

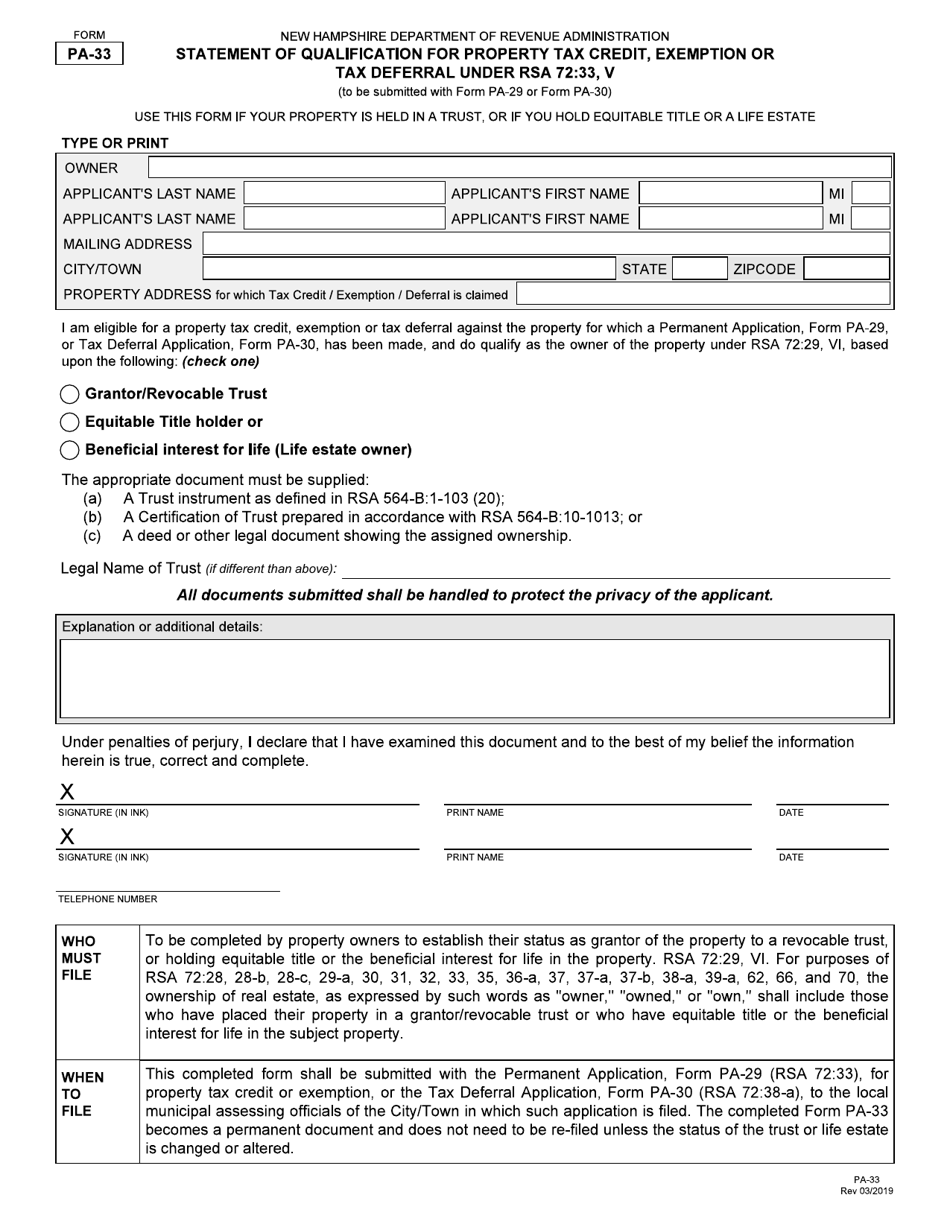

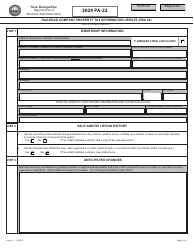

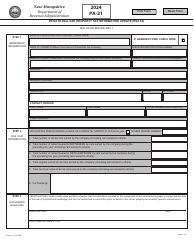

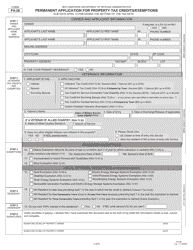

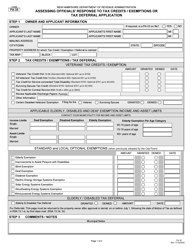

Form PA-33 Statement of Qualification for Property Tax Credit, Exemption or Tax Deferral Under Rsa 72:33, V - New Hampshire

What Is Form PA-33?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-33?

A: Form PA-33 is a Statement of Qualification for Property Tax Credit, Exemption, or Tax Deferral under RSA 72:33 in the state of New Hampshire.

Q: What is the purpose of Form PA-33?

A: The purpose of Form PA-33 is to determine if a property owner qualifies for a property tax credit, exemption, or tax deferral in New Hampshire.

Q: Who is eligible to use Form PA-33?

A: Property owners in New Hampshire who are seeking a property tax credit, exemption, or tax deferral under RSA 72:33 are eligible to use Form PA-33.

Q: What can be claimed with Form PA-33?

A: Form PA-33 can be used to claim property tax credit, exemption, or tax deferral as allowed under RSA 72:33 in New Hampshire.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-33 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.