This version of the form is not currently in use and is provided for reference only. Download this version of

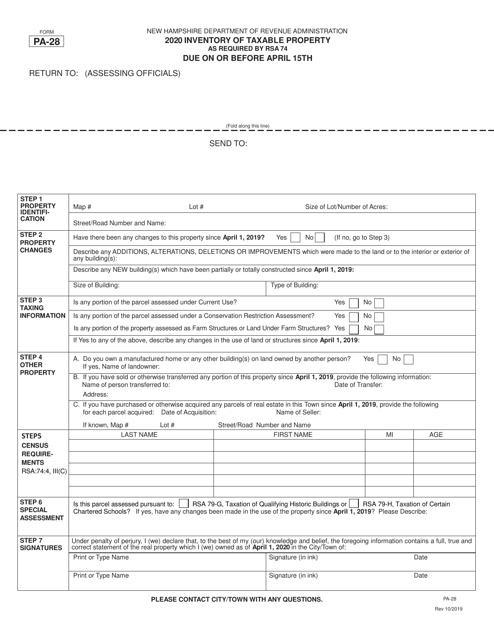

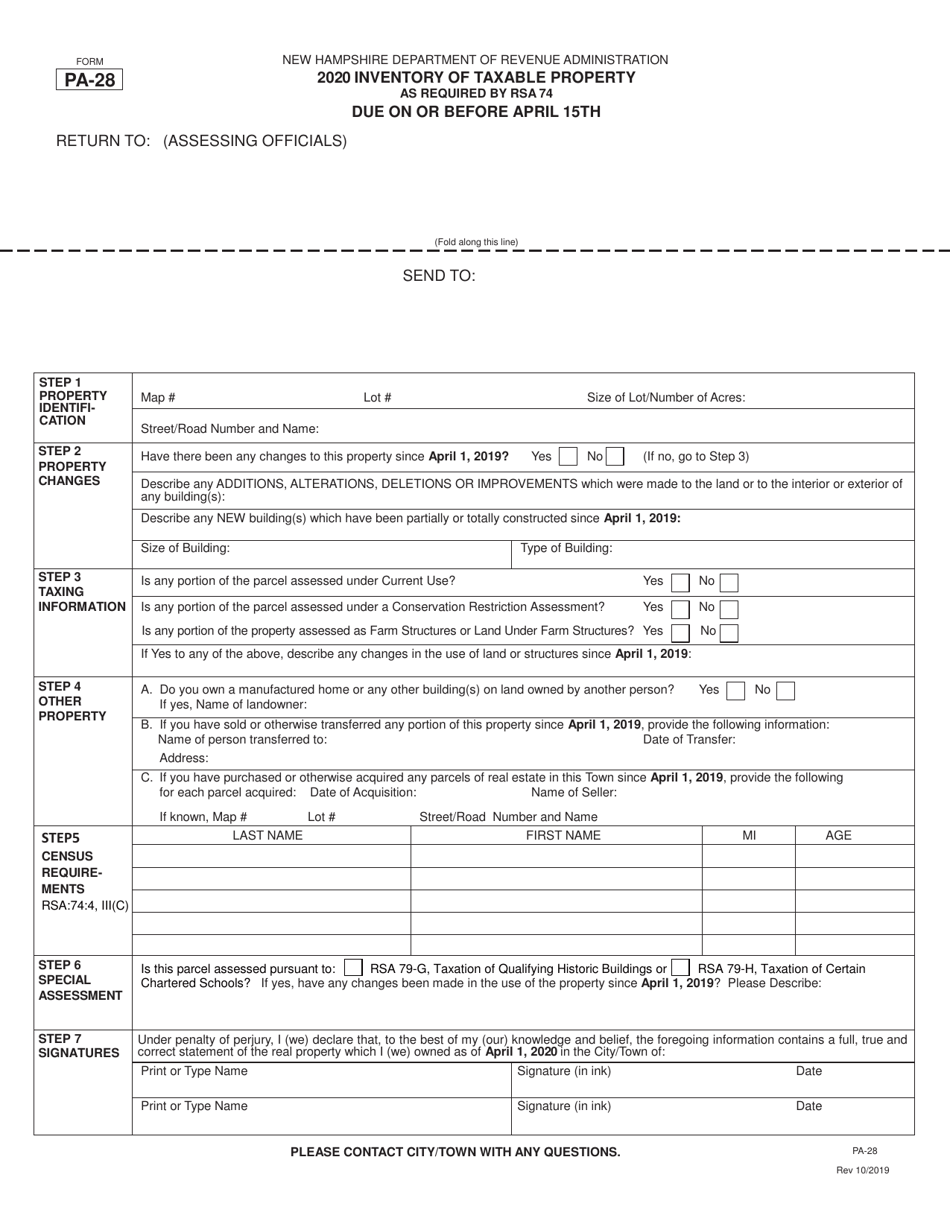

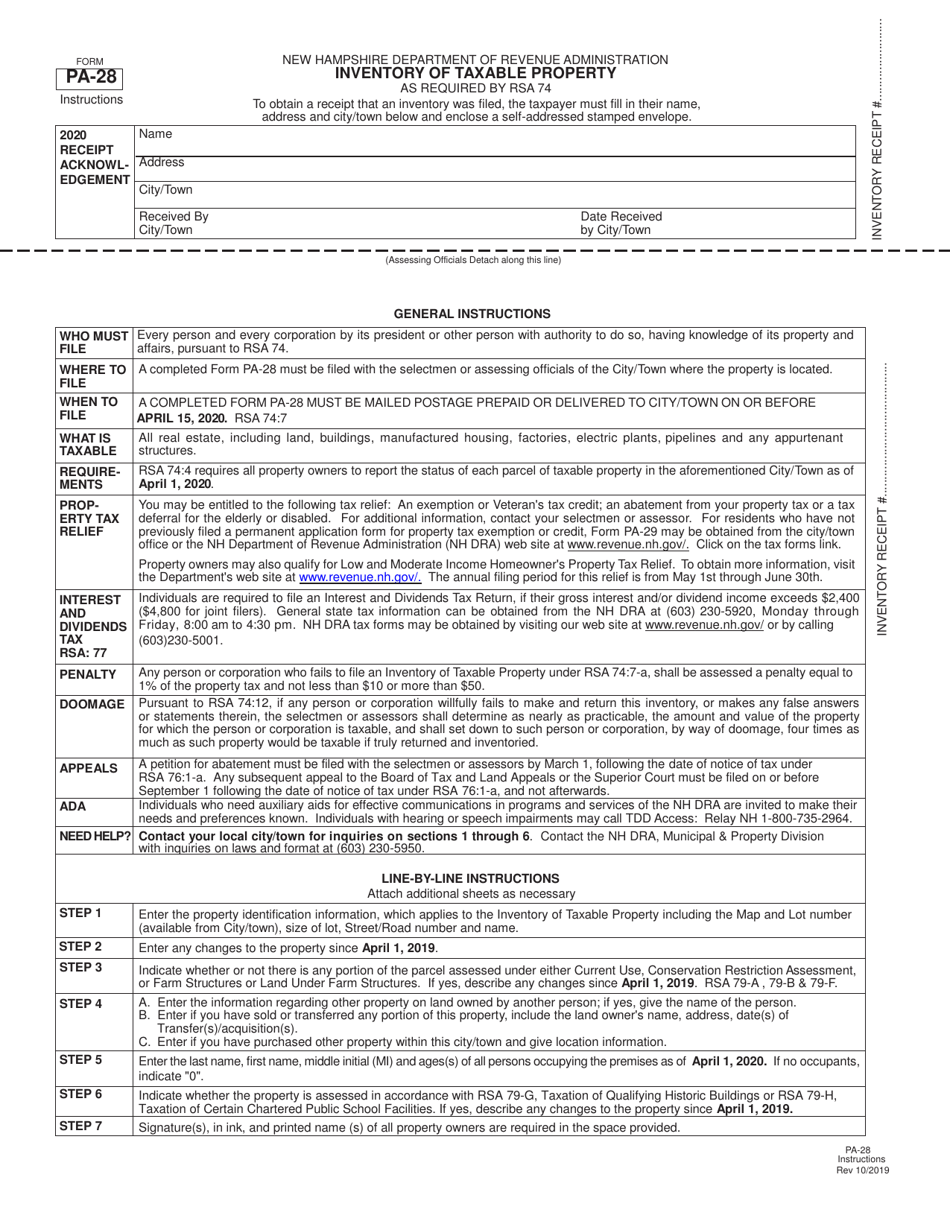

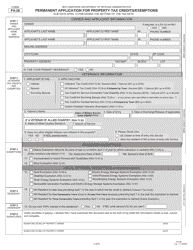

Form PA-28

for the current year.

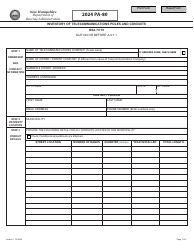

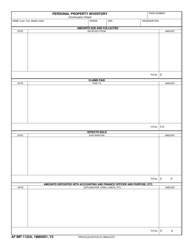

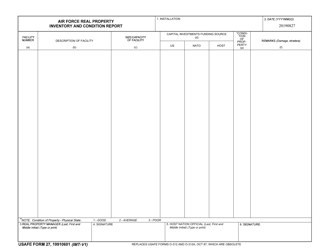

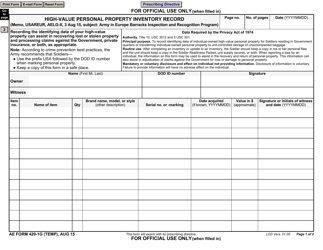

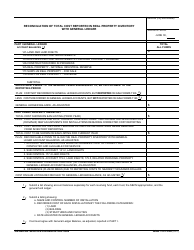

Form PA-28 Inventory of Taxable Property - New Hampshire

What Is Form PA-28?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

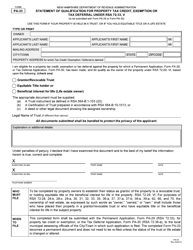

Q: What is Form PA-28?

A: Form PA-28 is the Inventory of Taxable Property in New Hampshire.

Q: Who needs to file Form PA-28?

A: Property owners in New Hampshire need to file Form PA-28.

Q: When is the Form PA-28 due?

A: Form PA-28 is due by April 15th every year in New Hampshire.

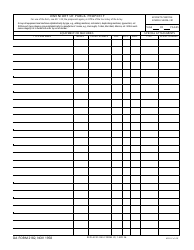

Q: What information is required on Form PA-28?

A: Form PA-28 requires information about the property owner and a detailed inventory of taxable property.

Q: Are there any exemptions or deductions on Form PA-28?

A: Yes, certain exemptions and deductions may apply for certain types of property.

Q: Is there a penalty for late filing of Form PA-28?

A: Yes, a penalty may be imposed for late filing of Form PA-28 in New Hampshire.

Q: What should I do if I need additional assistance with Form PA-28?

A: For additional assistance with Form PA-28, you can contact the New Hampshire Department of Revenue Administration.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-28 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.