This version of the form is not currently in use and is provided for reference only. Download this version of

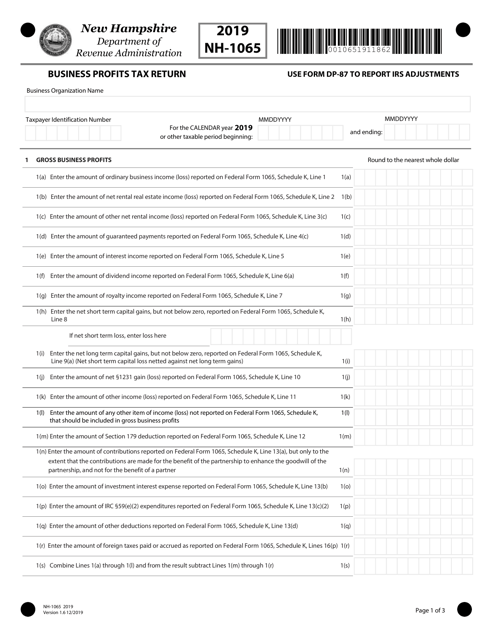

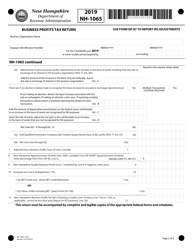

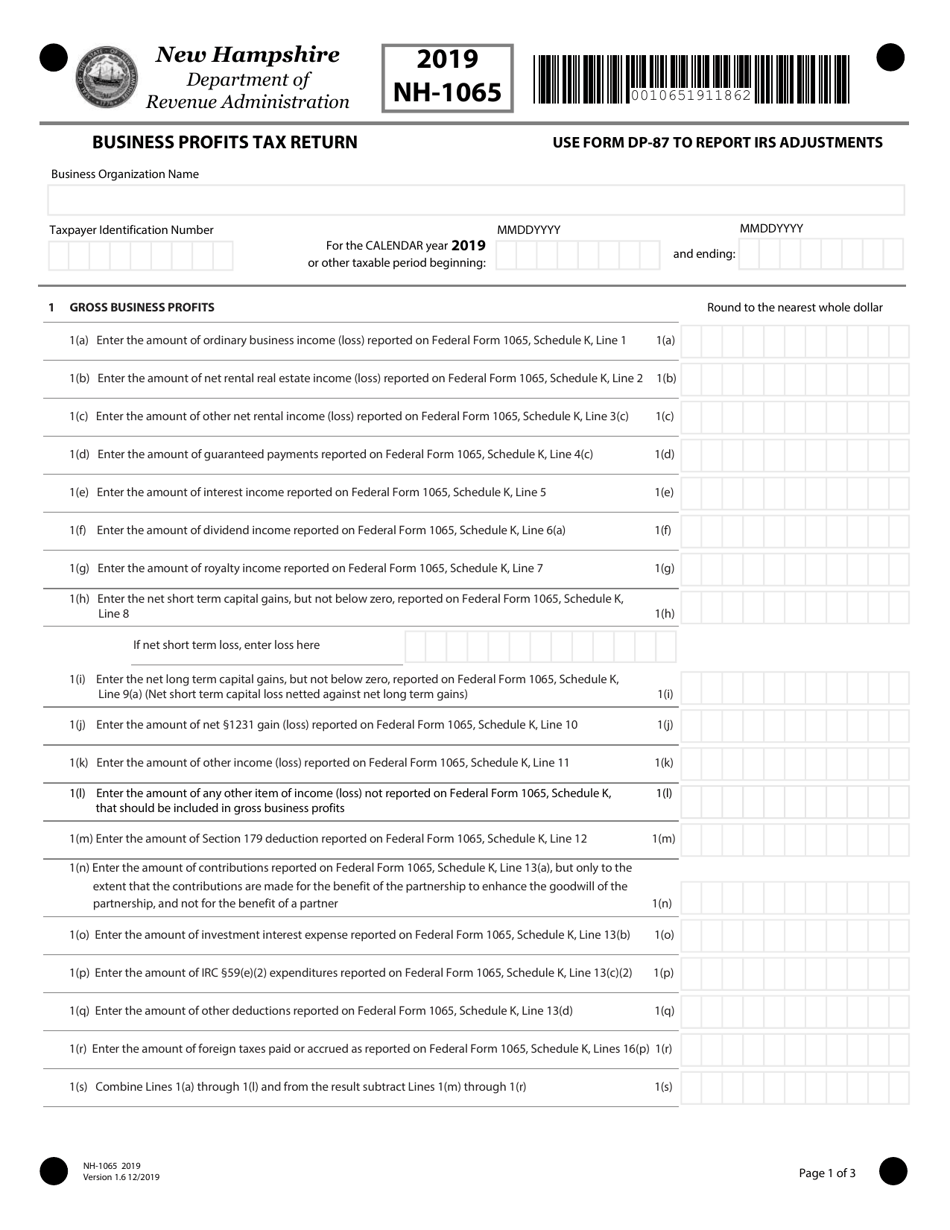

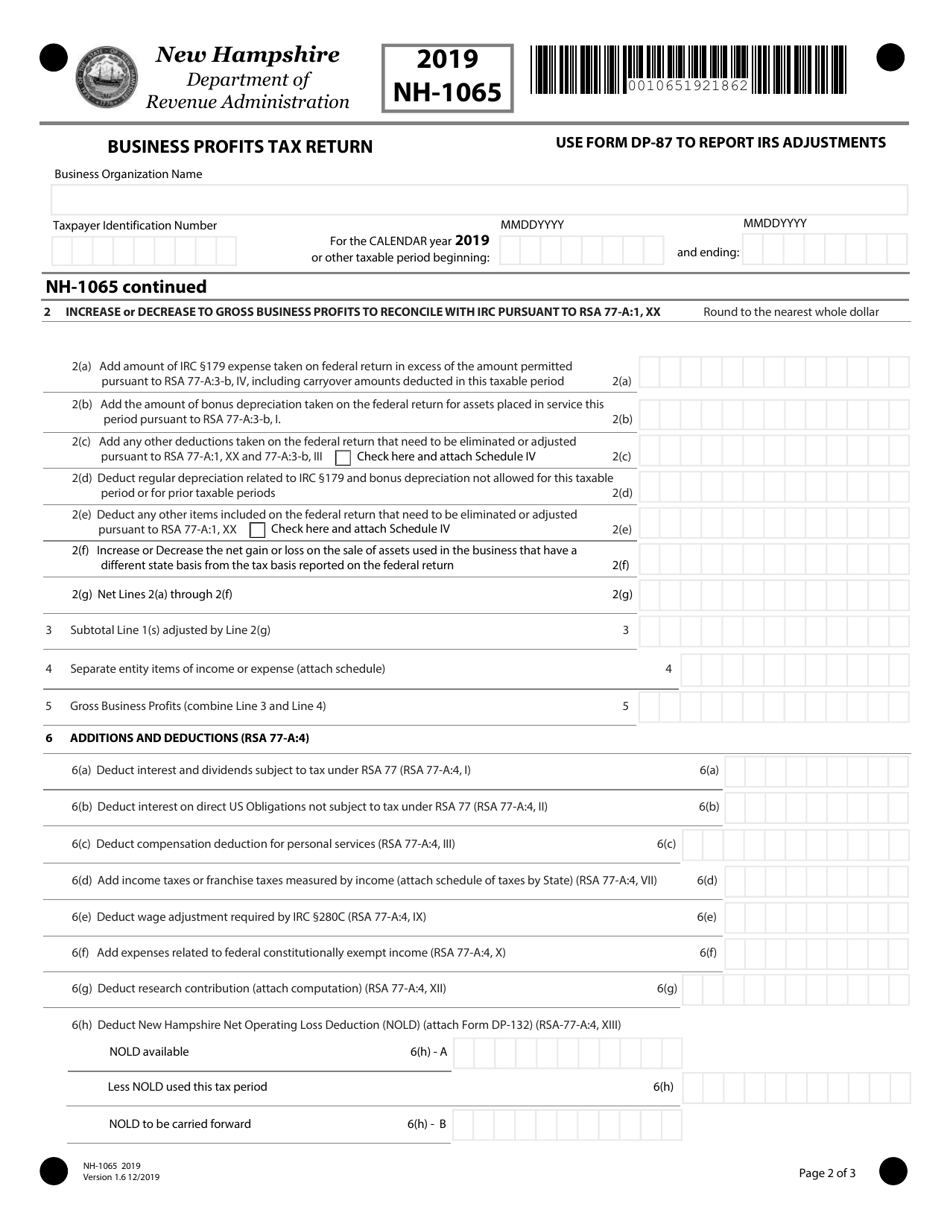

Form NH-1065

for the current year.

Form NH-1065 Partnership Business Profits Tax Return - New Hampshire

What Is Form NH-1065?

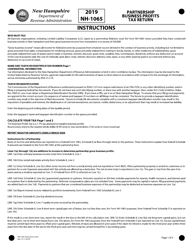

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: Who should file Form NH-1065?

A: Form NH-1065 is filed by partnerships which have business profits in New Hampshire.

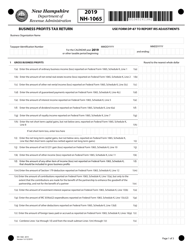

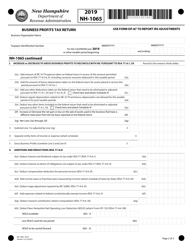

Q: What information is required to complete Form NH-1065?

A: You will need to provide information about the partnership's income, deductions, credits, and other relevant financial details.

Q: When is the deadline for filing Form NH-1065?

A: The deadline for filing Form NH-1065 is April 15th or the 15th day of the 4th month following the close of the taxable year, whichever comes later.

Q: Can I file Form NH-1065 electronically?

A: Yes, New Hampshire allows partnerships to electronically file their tax returns using approved software.

Q: Are there any penalties for late filing or failure to file Form NH-1065?

A: Yes, penalties may apply for late filing or failure to file Form NH-1065. It is important to file your tax return on time to avoid penalties and interest.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.