This version of the form is not currently in use and is provided for reference only. Download this version of

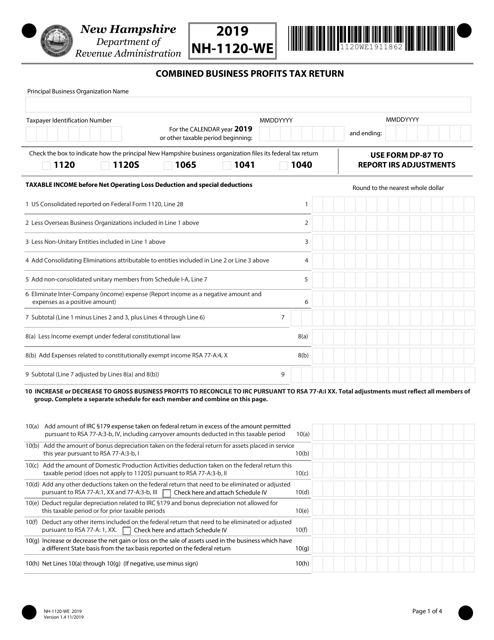

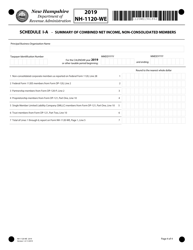

Form NH-1120-WE

for the current year.

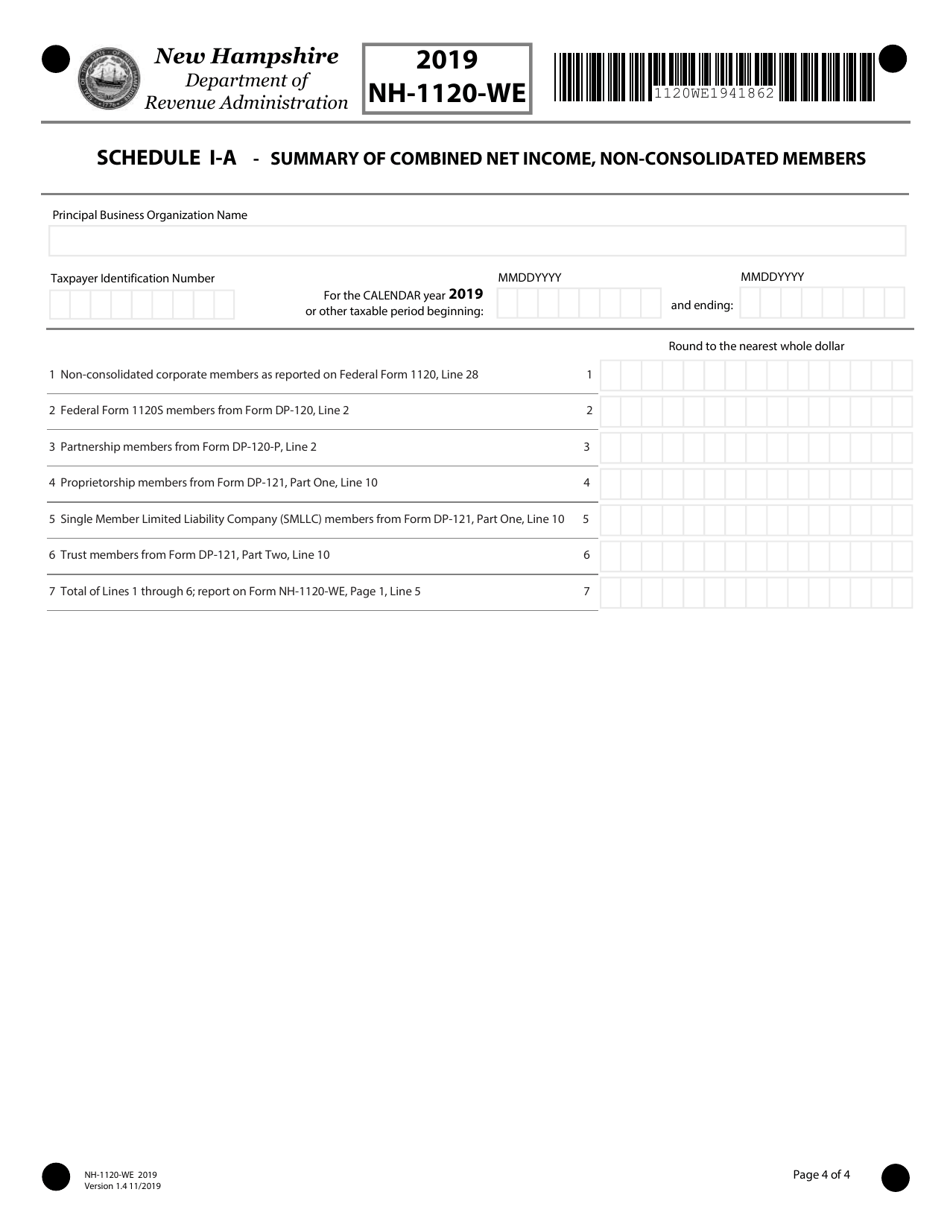

Form NH-1120-WE Combined Business Profits Tax Return - New Hampshire

What Is Form NH-1120-WE?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form NH-1120-WE?

A: Form NH-1120-WE is the Combined Business Profits Tax Return for businesses in New Hampshire.

Q: Who needs to file Form NH-1120-WE?

A: Businesses operating in New Hampshire that have a profit from business activities need to file Form NH-1120-WE.

Q: What is the purpose of Form NH-1120-WE?

A: The purpose of Form NH-1120-WE is to report and calculate the business profits tax owed by businesses in New Hampshire.

Q: When is the deadline to file Form NH-1120-WE?

A: The deadline to file Form NH-1120-WE is the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing of Form NH-1120-WE?

A: Yes, there may be penalties for late filing of Form NH-1120-WE. It is important to file the return on time to avoid penalties.

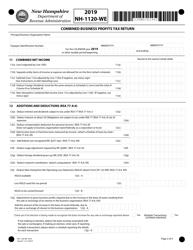

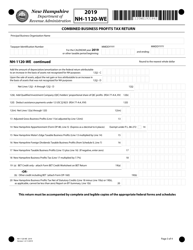

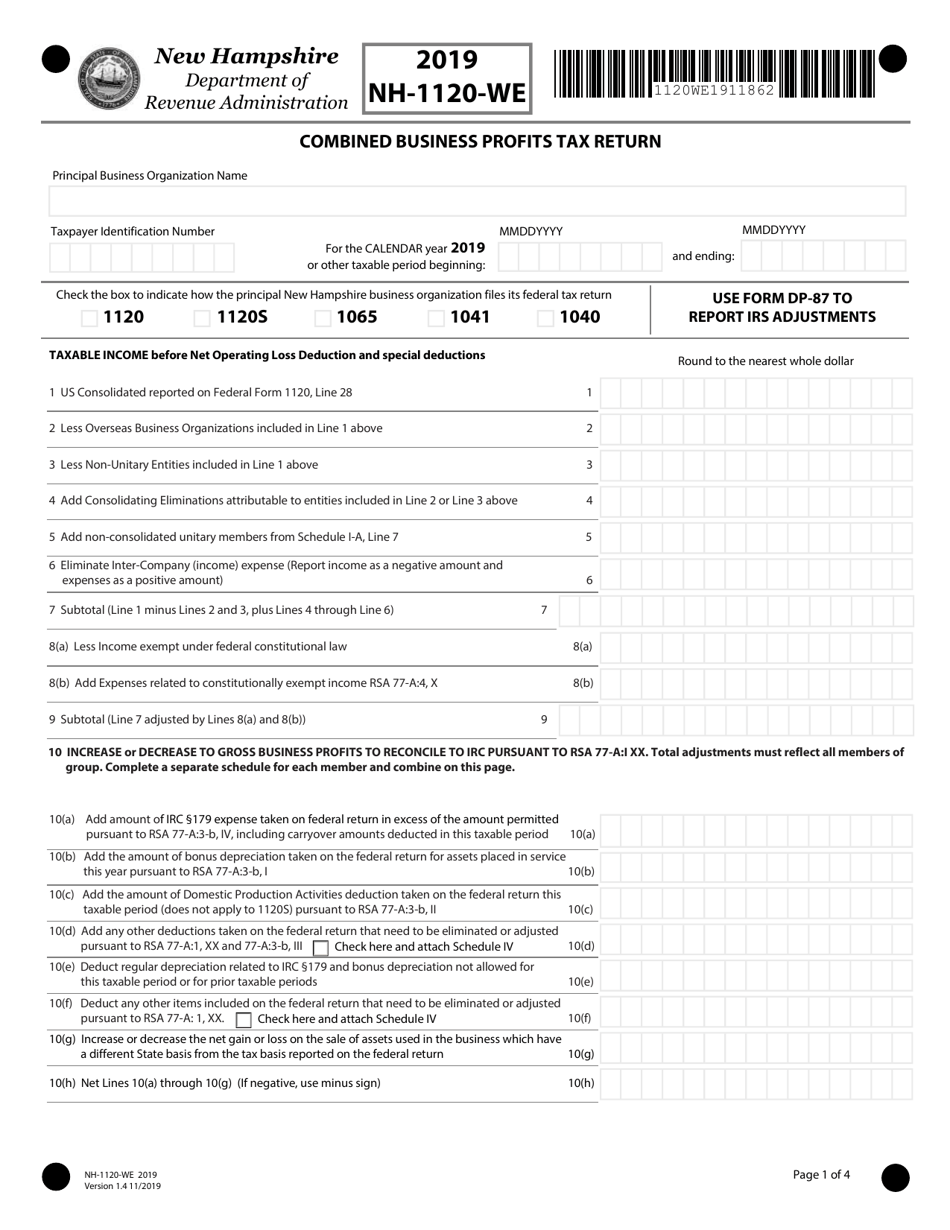

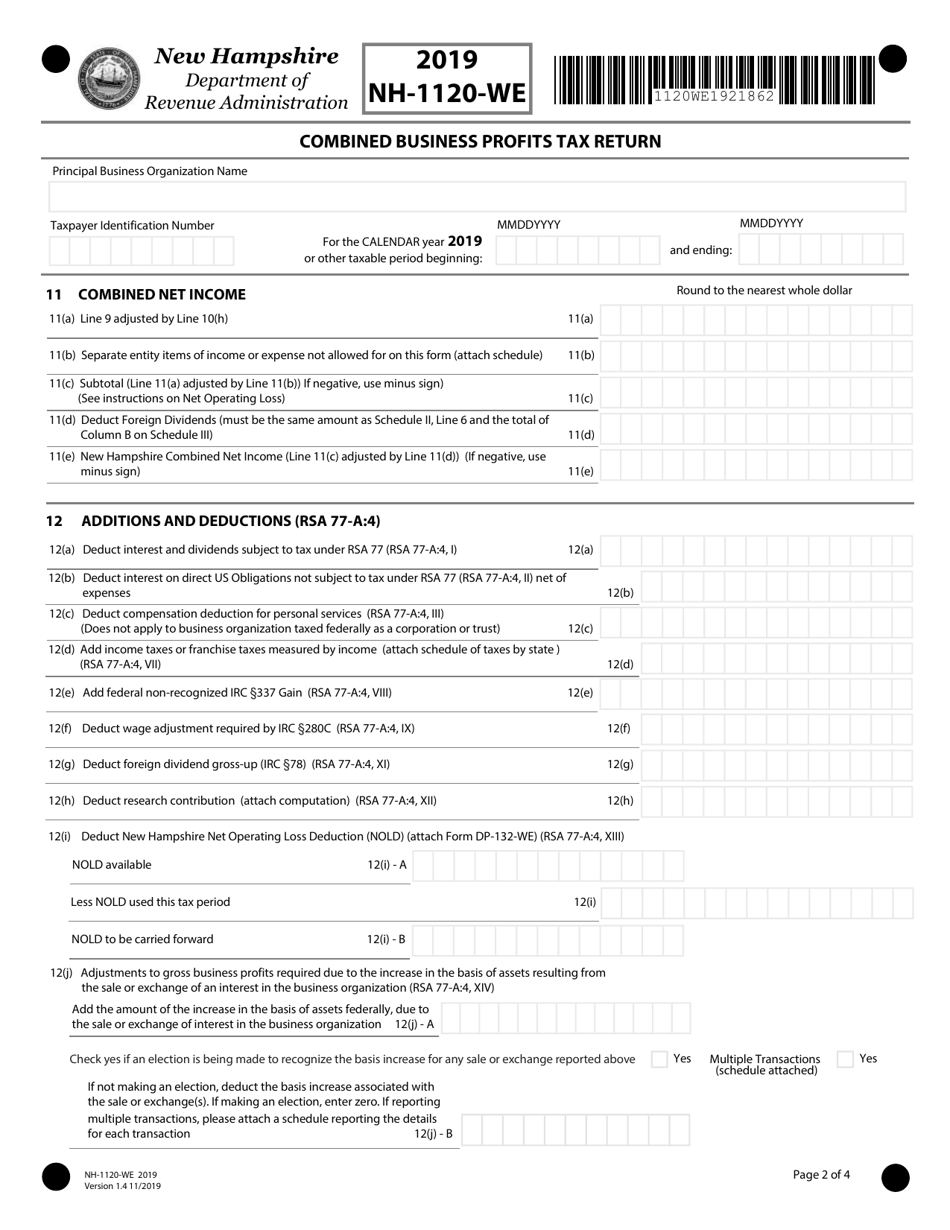

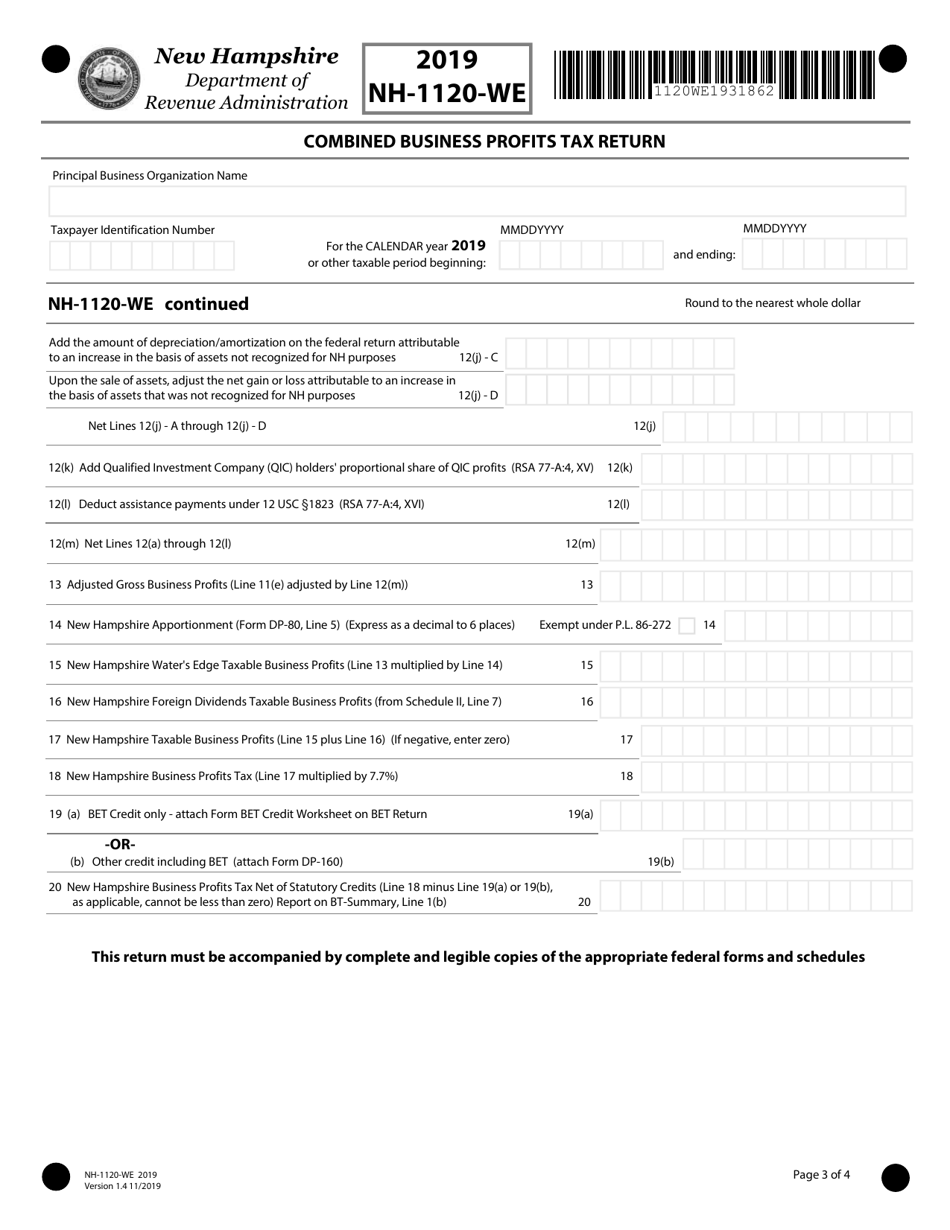

Q: What are the important sections of Form NH-1120?

A: Some important sections of Form NH-1120-WE include the income section, deductions section, and the tax calculation section.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1120-WE by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.