This version of the form is not currently in use and is provided for reference only. Download this version of

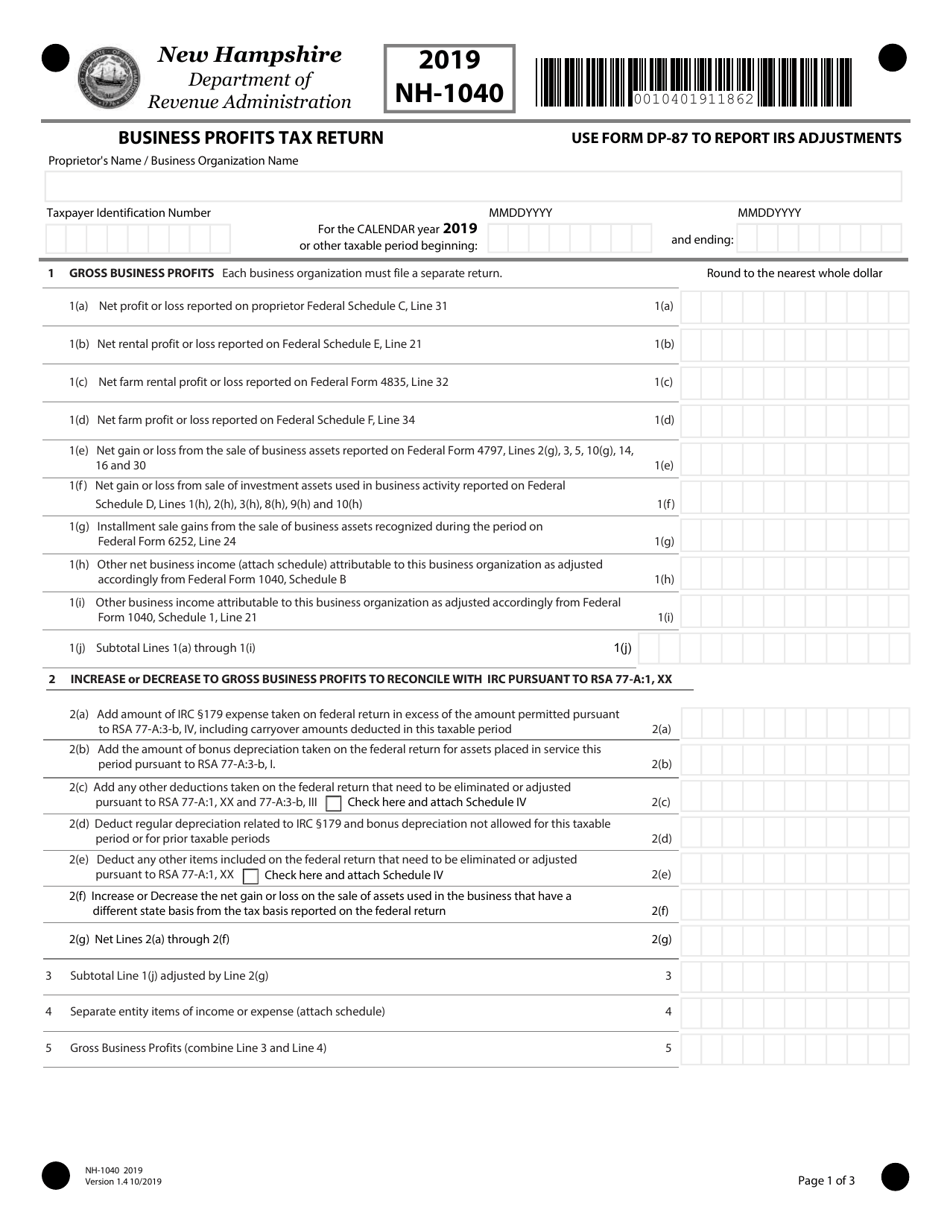

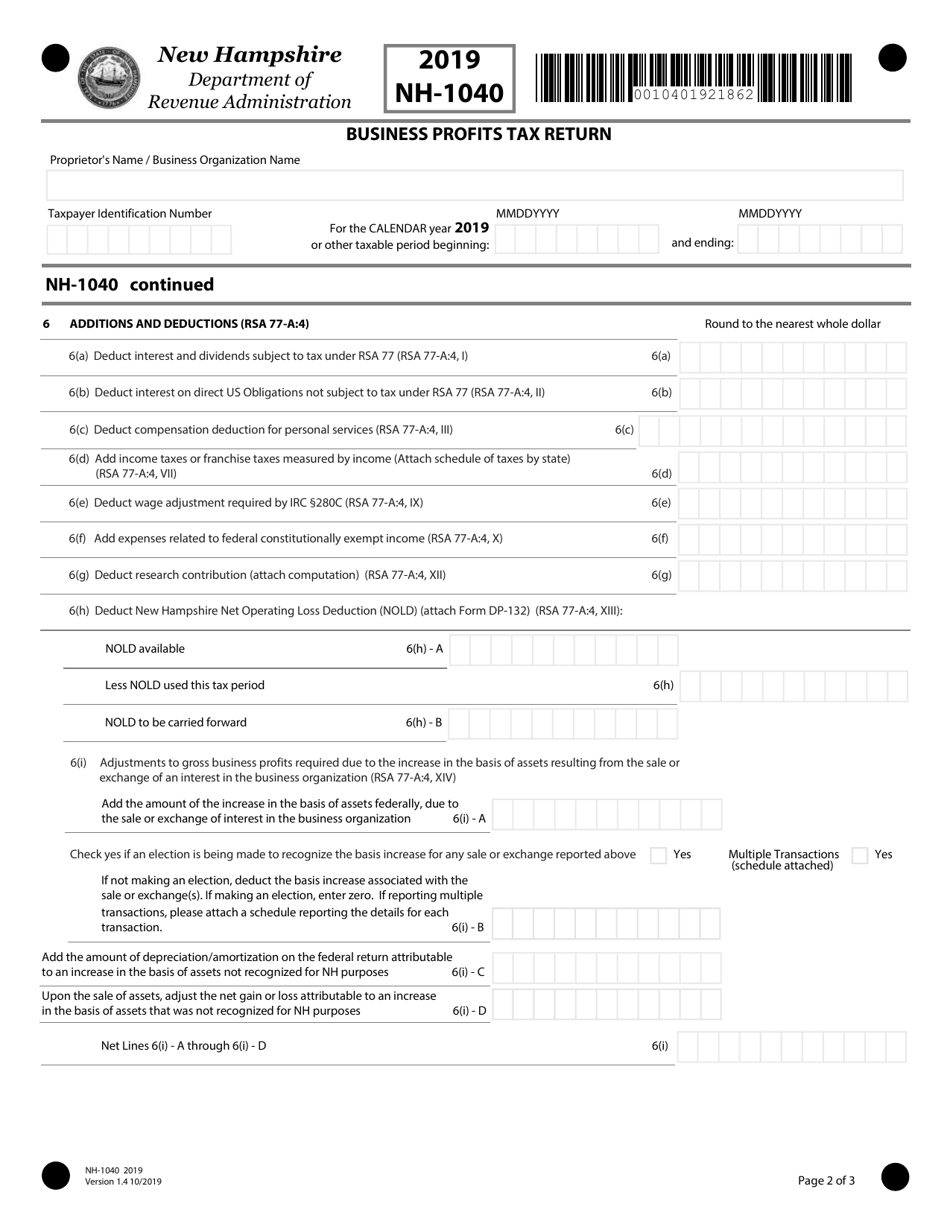

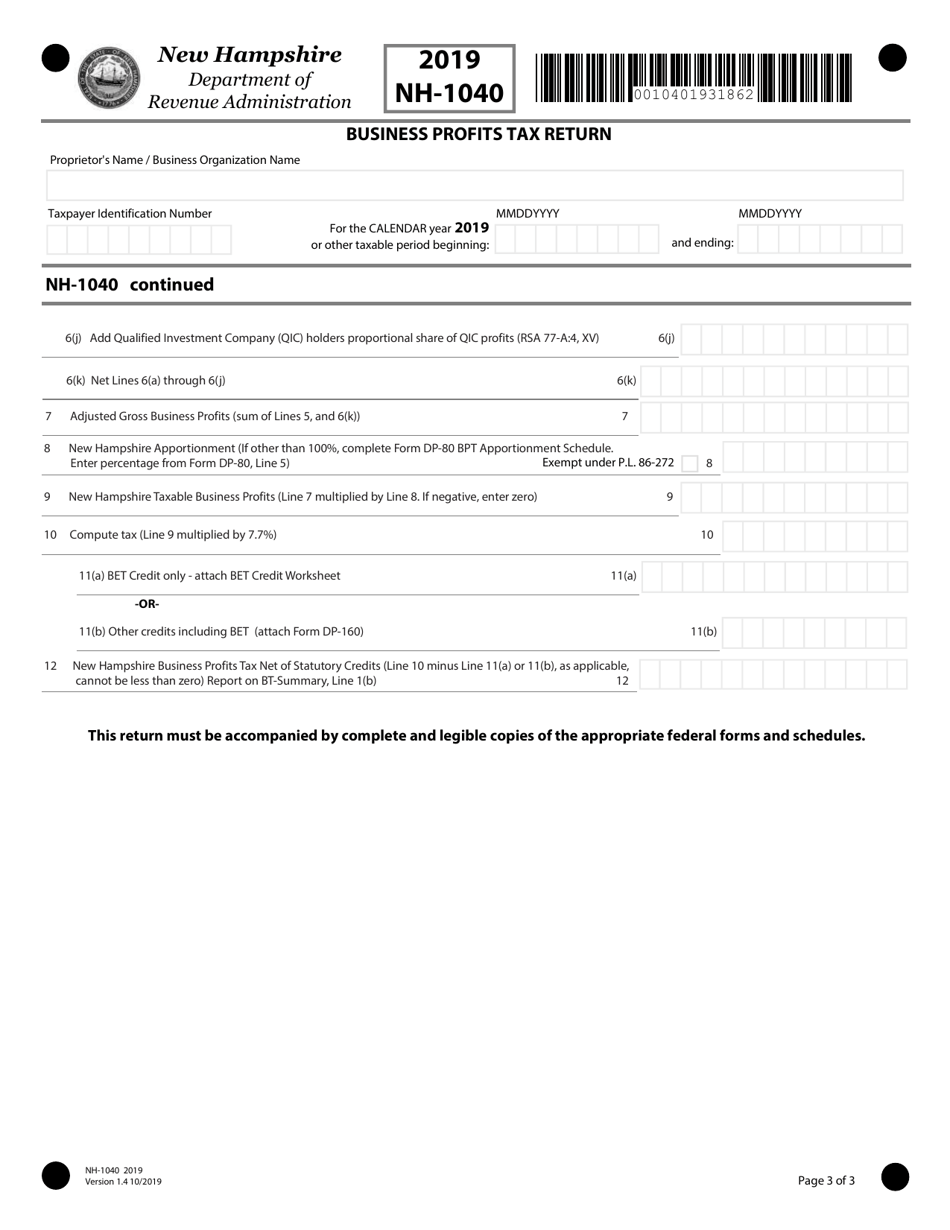

Form NH-1040

for the current year.

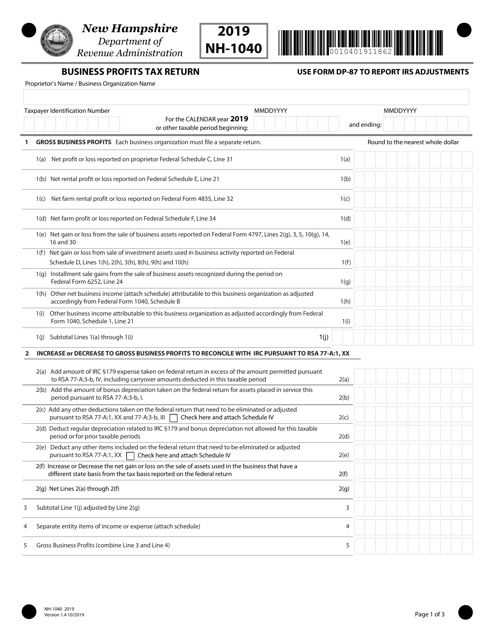

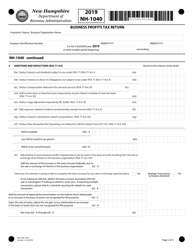

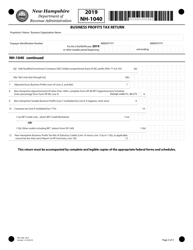

Form NH-1040 Proprietorship or Jointly Owned Property Business Profits Tax Return - New Hampshire

What Is Form NH-1040?

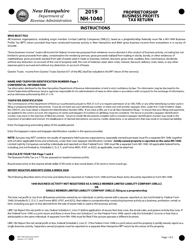

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NH-1040?

A: Form NH-1040 is the tax return form that individuals use to report profits from proprietorship or jointly owned property businesses in New Hampshire.

Q: Who needs to file Form NH-1040?

A: Individuals who have a proprietorship or jointly owned property business in New Hampshire and have generated profits from that business need to file Form NH-1040.

Q: When is the deadline to file Form NH-1040?

A: The deadline to file Form NH-1040 is April 15th of each year, which is the same as the federal incometax filing deadline.

Q: What information do I need to complete Form NH-1040?

A: You will need to provide information about your business income, deductions, and credits, as well as your personal information and any other required attachments.

Q: Can I e-file Form NH-1040?

A: Yes, New Hampshire allows taxpayers to e-file their Form NH-1040 through approved tax preparation software or through authorized tax professionals.

Q: Are there any payment requirements associated with Form NH-1040?

A: Yes, if you owe any tax after completing Form NH-1040, you will need to make a payment with your return. Failure to pay the full amount owed may result in penalties and interest.

Q: Do I need to include a copy of my federal tax return with Form NH-1040?

A: No, you do not need to include a copy of your federal tax return with Form NH-1040. However, you may need to refer to your federal return for certain information when completing the form.

Q: What if I need an extension to file Form NH-1040?

A: New Hampshire does not have a separate extension form for filing Form NH-1040. You can request an extension by filing your federal extension form and indicating the same extension for New Hampshire.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1040 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.