This version of the form is not currently in use and is provided for reference only. Download this version of

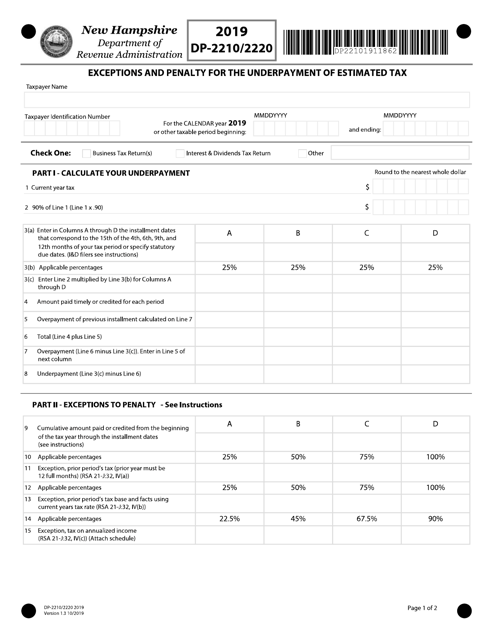

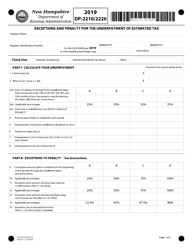

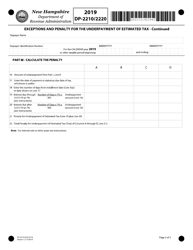

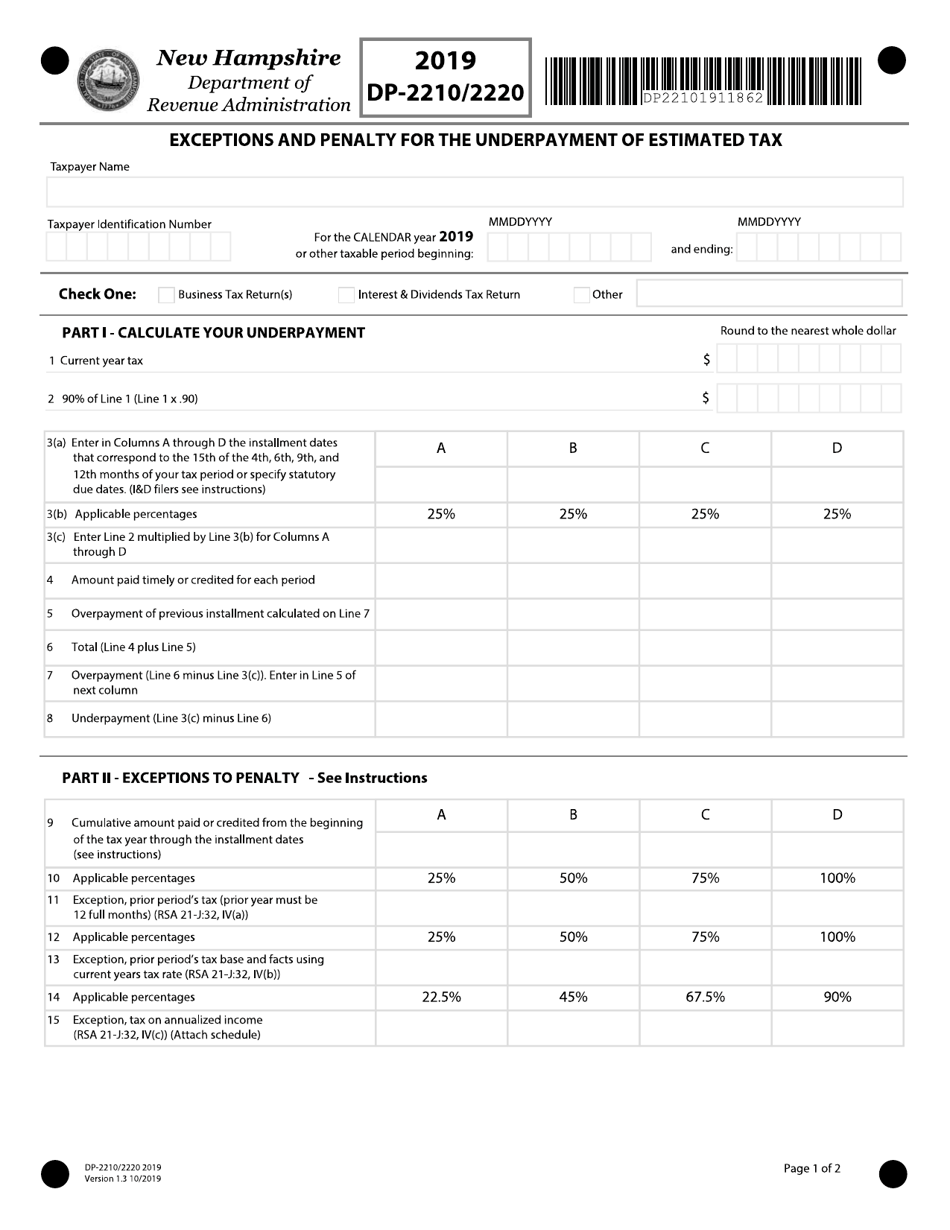

Form DP-2210/2220

for the current year.

Form DP-2210 / 2220 Exceptions and Penalty for the Underpayment of Estimated Tax - New Hampshire

What Is Form DP-2210/2220?

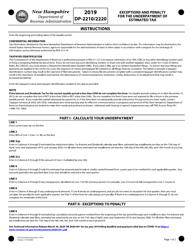

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-2210/2220?

A: Form DP-2210/2220 is a tax form used in New Hampshire to calculate exceptions and penalties for underpayment of estimated tax.

Q: Who needs to use Form DP-2210/2220?

A: Individuals and businesses in New Hampshire who have underpaid their estimated tax may need to use Form DP-2210/2220.

Q: What is the purpose of Form DP-2210/2220?

A: The purpose of Form DP-2210/2220 is to determine if a taxpayer owes any penalties or may qualify for any exceptions for underpayment of estimated tax.

Q: When is Form DP-2210/2220 due?

A: Form DP-2210/2220 is typically due at the same time as your New Hampshire state tax return, which is April 15th for most individuals.

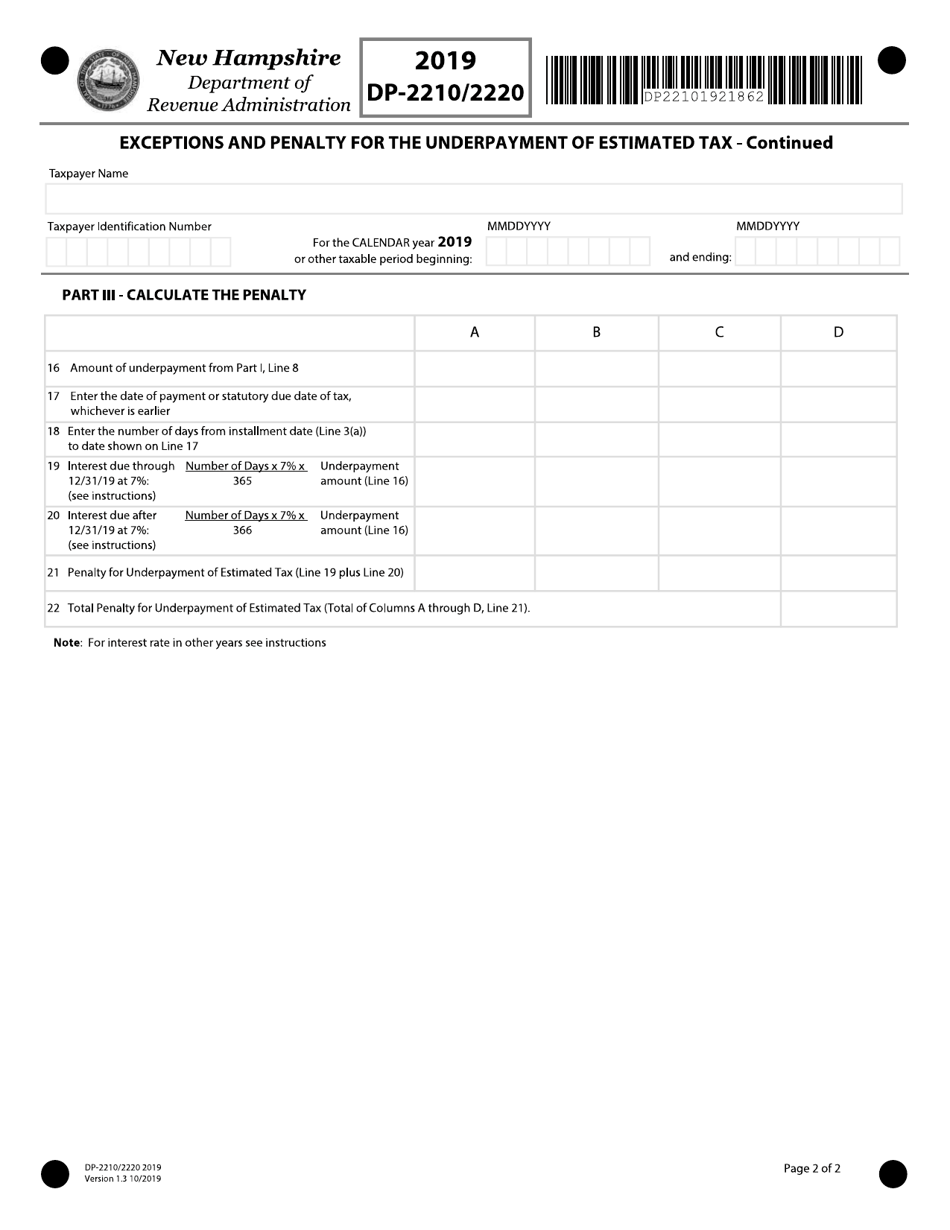

Q: How do I fill out Form DP-2210/2220?

A: Form DP-2210/2220 requires you to provide information about your estimated tax payments, actual tax liability, and any exceptions or penalties that may apply.

Q: What if I don't file Form DP-2210/2220?

A: If you had an underpayment of estimated tax and fail to file Form DP-2210/2220, you may be subject to penalties and interest on the underpaid amount.

Q: Are there any exceptions to the penalty for underpayment?

A: Yes, there are several exceptions to the penalty for underpayment, such as if you meet one of the safe harbor provisions or if your total tax liability is less than $200.

Q: Can I make estimated tax payments to avoid underpayment penalties?

A: Yes, making estimated tax payments throughout the year can help you avoid underpayment penalties by ensuring that you are paying enough tax as you earn income.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-2210/2220 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.