This version of the form is not currently in use and is provided for reference only. Download this version of

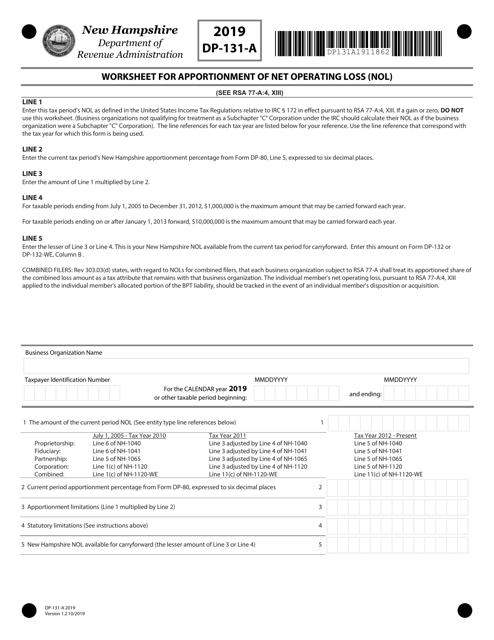

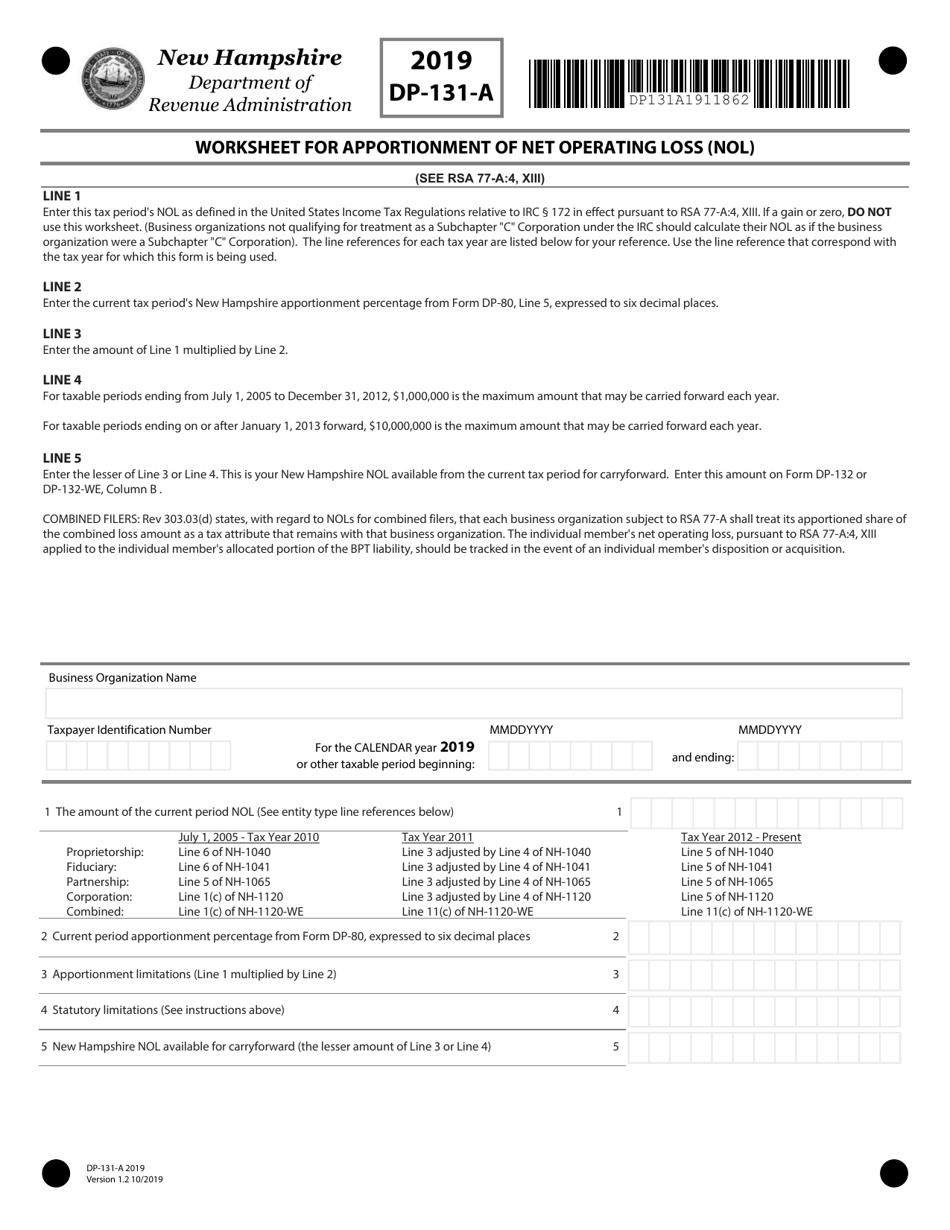

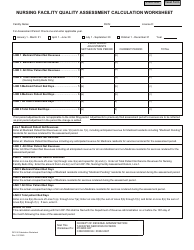

Form DP-131-A

for the current year.

Form DP-131-A Worksheet for Apportionment of Net Operating Loss (Nol) - New Hampshire

What Is Form DP-131-A?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-131-A?

A: Form DP-131-A is a worksheet used to calculate the apportionment of Net Operating Loss (NOL) in the state of New Hampshire.

Q: What is Net Operating Loss (NOL)?

A: Net Operating Loss (NOL) is the amount by which a taxpayer's deductible expenses exceed their taxable income.

Q: Why is Form DP-131-A used?

A: Form DP-131-A is used to determine the portion of a taxpayer's NOL that can be apportioned to and deducted in New Hampshire.

Q: Who needs to file Form DP-131-A?

A: Taxpayers who have a NOL and want to apportion it in New Hampshire need to file Form DP-131-A.

Q: What information is needed to complete Form DP-131-A?

A: To complete Form DP-131-A, you will need information about your NOL from your federal income tax return and income apportionment factors for New Hampshire.

Q: When is the deadline to file Form DP-131-A?

A: The deadline for filing Form DP-131-A is usually the same as the deadline for filing your New Hampshire state tax return.

Q: Are there any fees associated with filing Form DP-131-A?

A: No, there are no fees associated with filing Form DP-131-A.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-131-A by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.