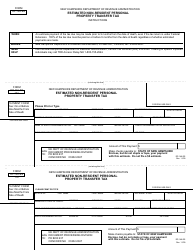

This version of the form is not currently in use and is provided for reference only. Download this version of

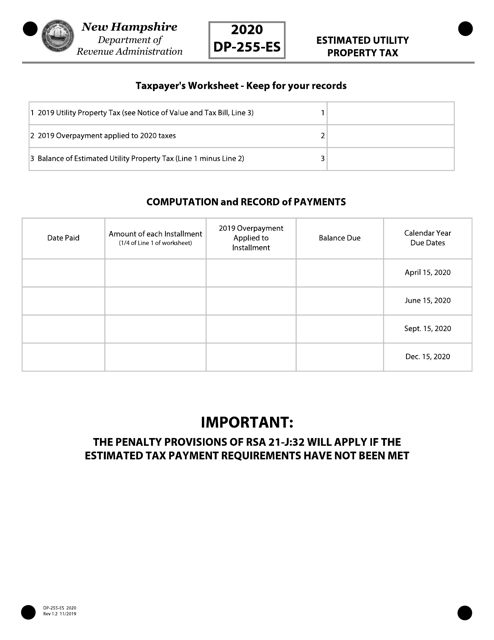

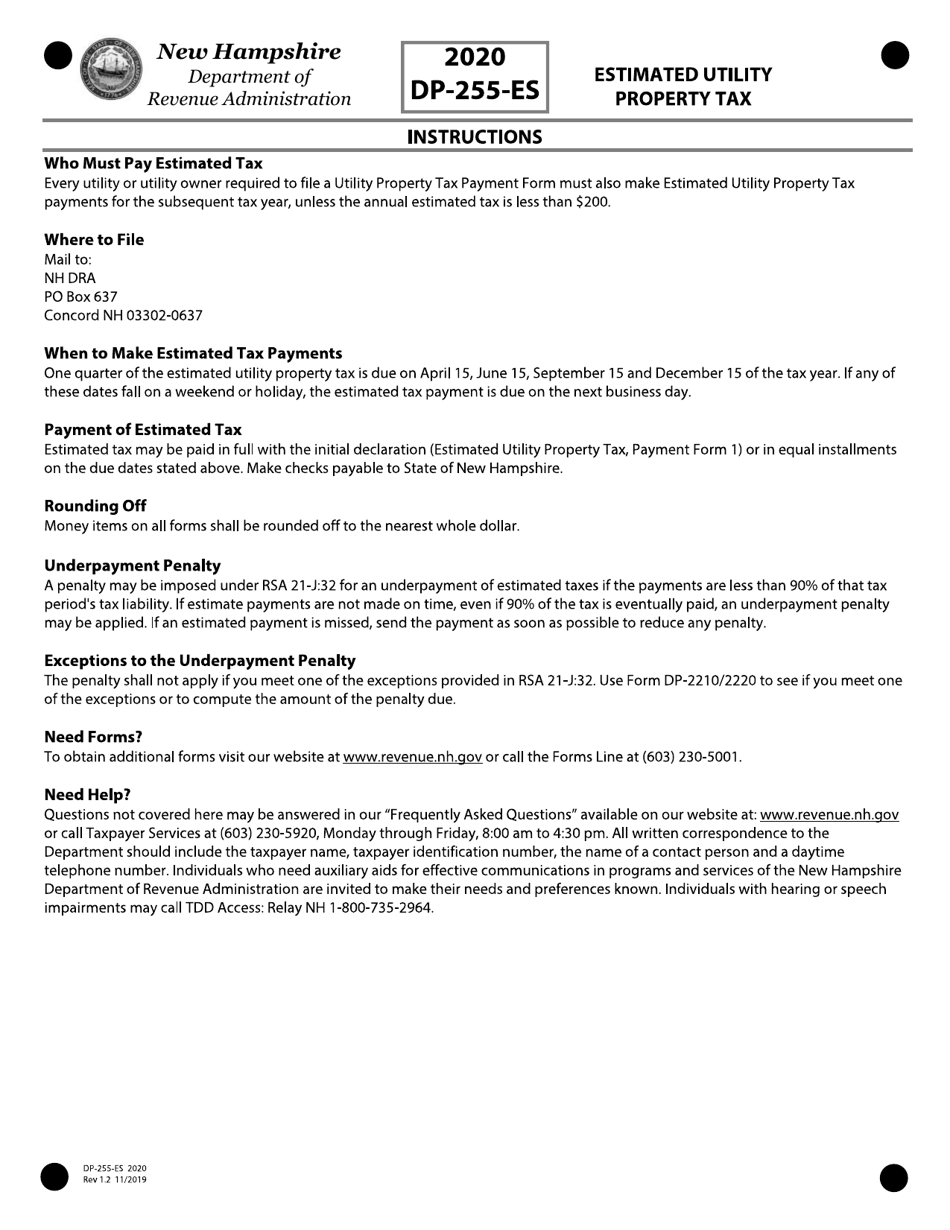

Form DP-255-ES

for the current year.

Form DP-255-ES Utility Property Tax Quarterly Payment Forms - New Hampshire

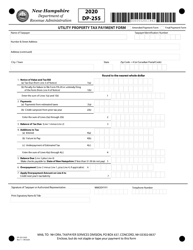

What Is Form DP-255-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

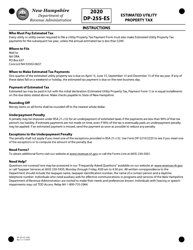

Q: What is Form DP-255-ES?

A: Form DP-255-ES is a Utility Property Tax Quarterly Payment form in New Hampshire.

Q: What is the purpose of Form DP-255-ES?

A: The purpose of Form DP-255-ES is to make quarterly payments for utility property taxes in New Hampshire.

Q: Who needs to fill out Form DP-255-ES?

A: Utility property owners in New Hampshire who are required to make quarterly tax payments need to fill out Form DP-255-ES.

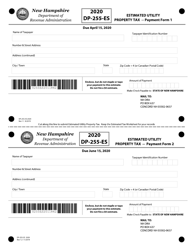

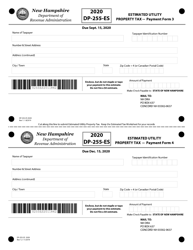

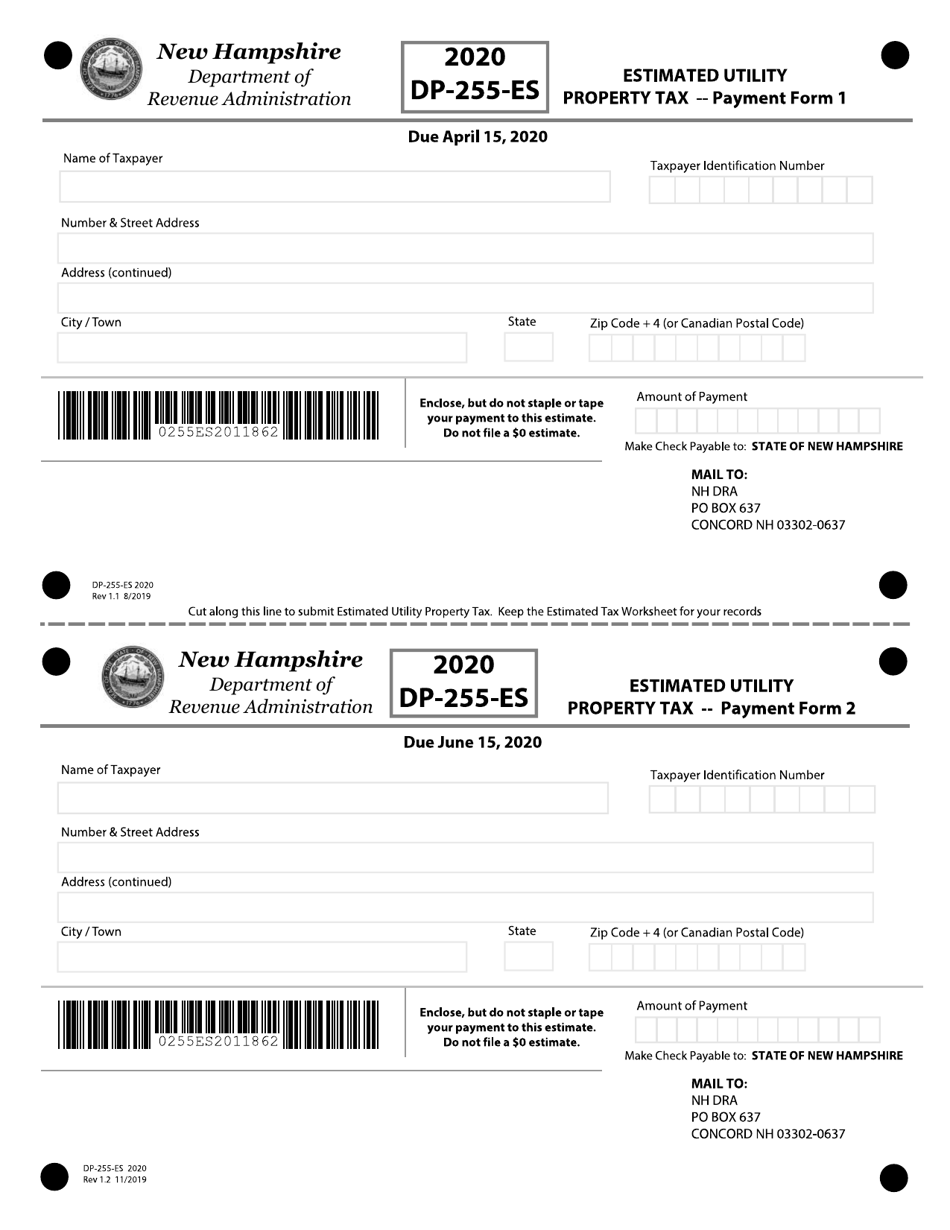

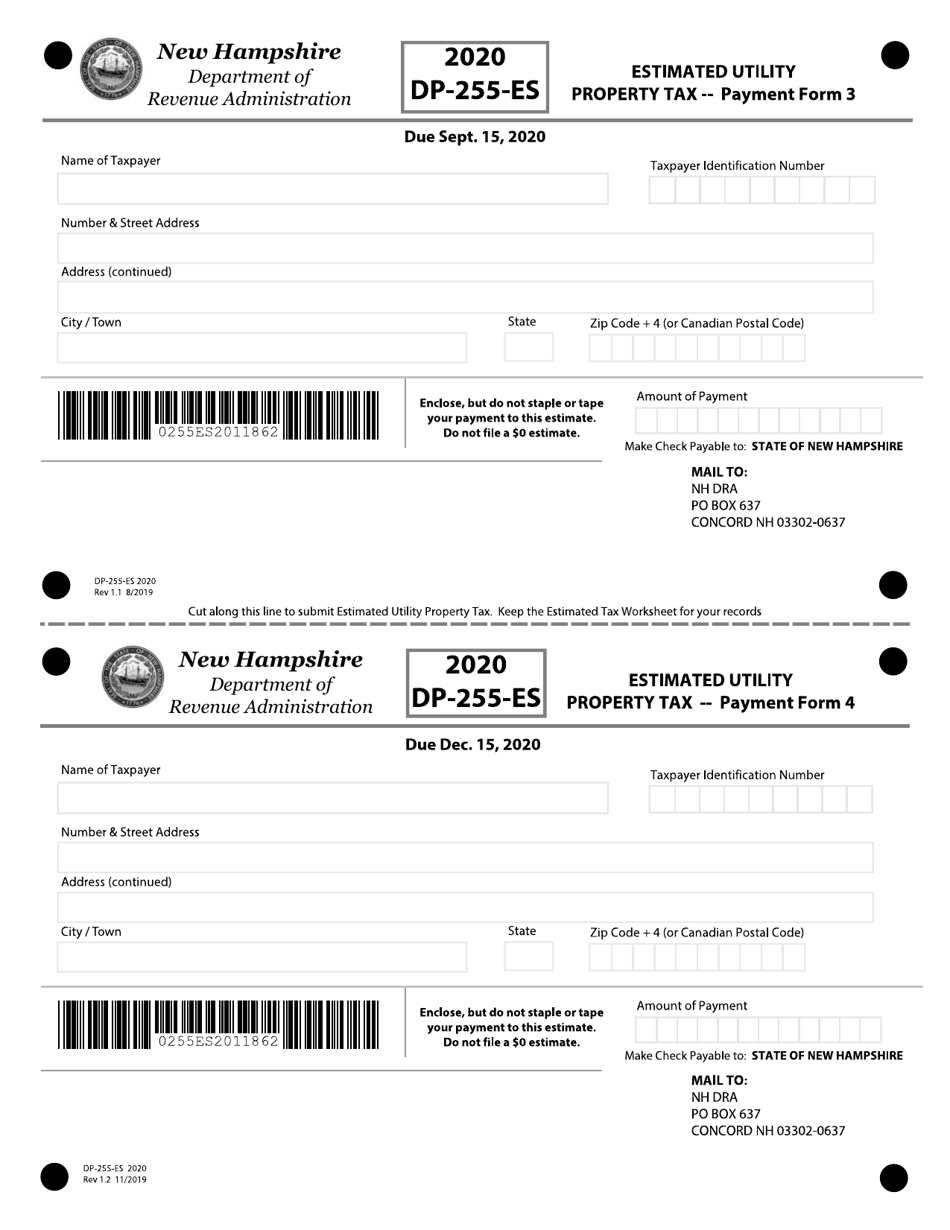

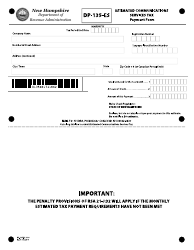

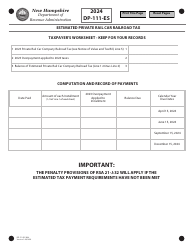

Q: What information do I need to provide on Form DP-255-ES?

A: On Form DP-255-ES, you need to provide information such as your name, address, account number, and the amount of quarterly tax payment.

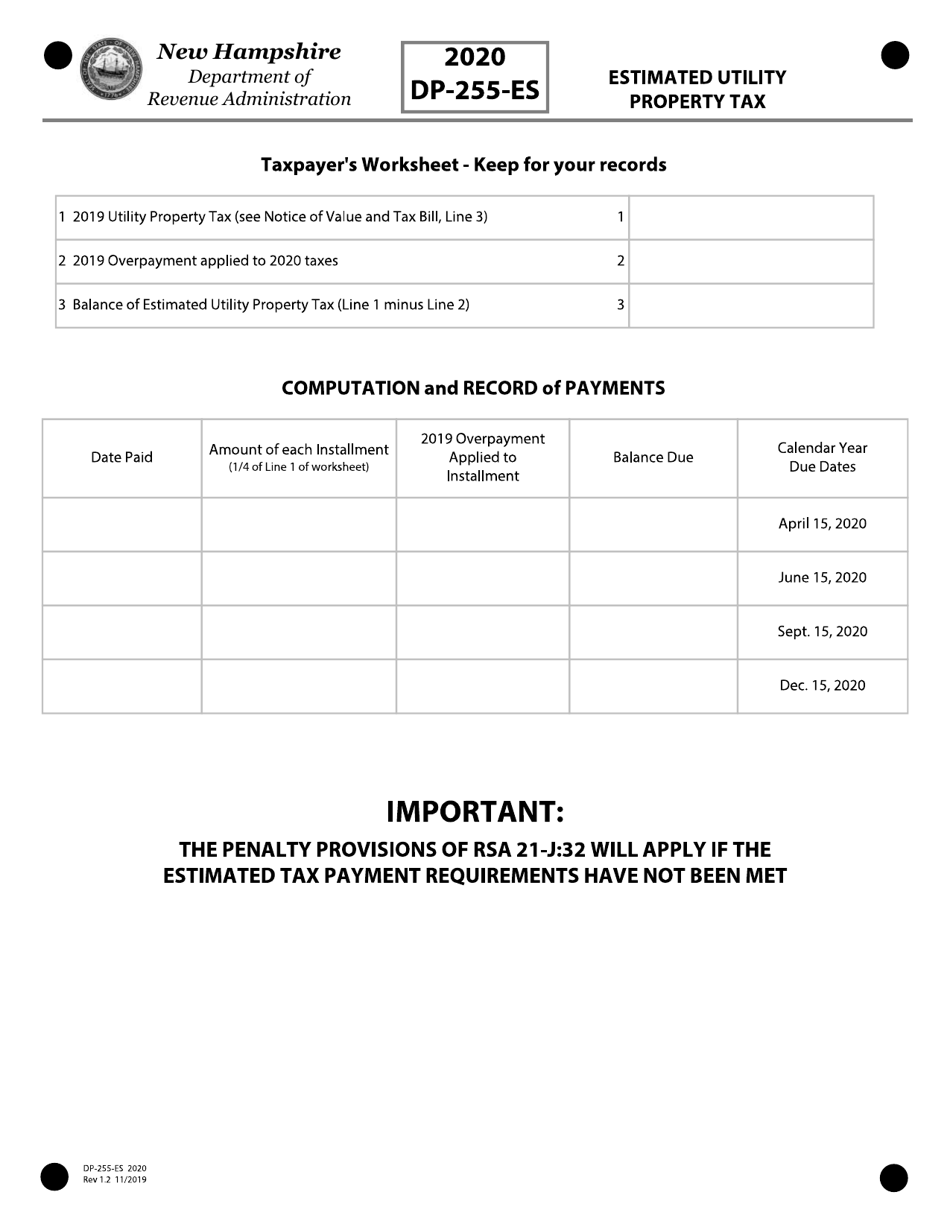

Q: When is the deadline for submitting Form DP-255-ES?

A: The deadline for submitting Form DP-255-ES depends on the specific quarter. The due dates are mentioned on the form itself.

Q: Can I pay my utility property tax in installments?

A: Yes, you can pay your utility property tax in quarterly installments using Form DP-255-ES.

Q: Are there any penalties for late payment?

A: Yes, there may be penalties for late payment of utility property taxes in New Hampshire. It is advisable to submit the form and payment on time.

Q: Do I need to file Form DP-255-ES if my utility property taxes are paid through an escrow account?

A: If your utility property taxes are paid through an escrow account, you do not need to file Form DP-255-ES. Your mortgage company or bank will handle the payments.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-255-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.