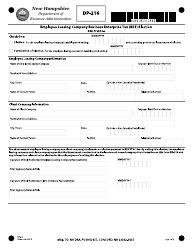

This version of the form is not currently in use and is provided for reference only. Download this version of

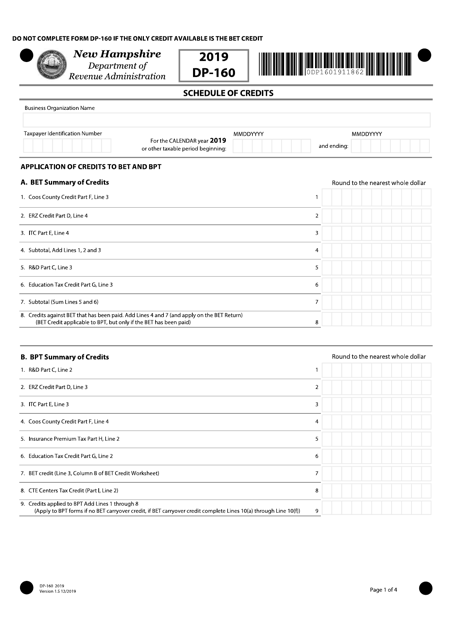

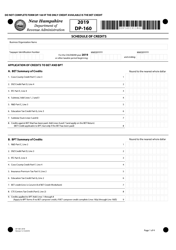

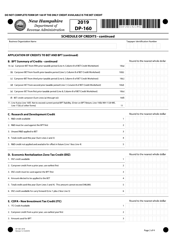

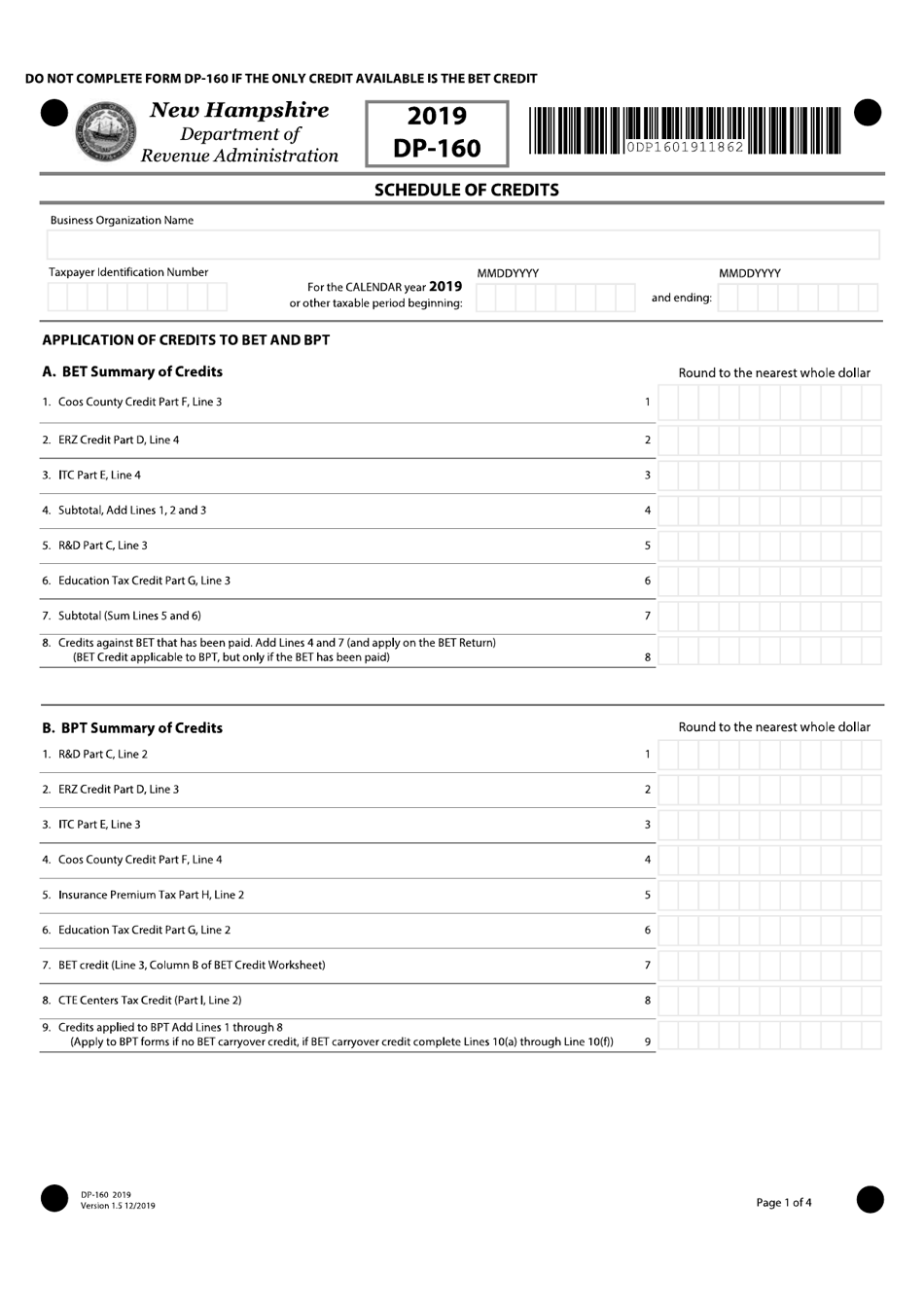

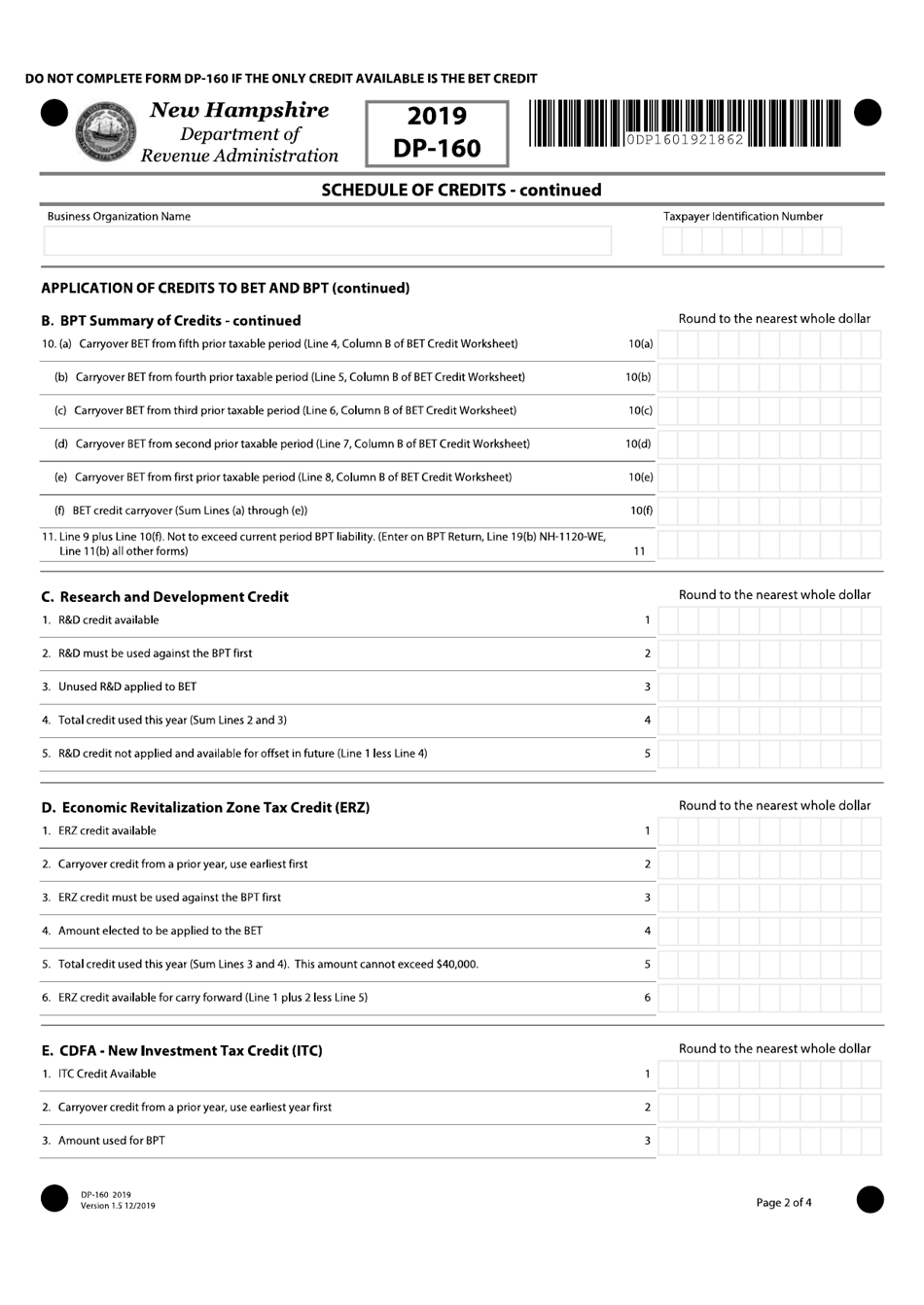

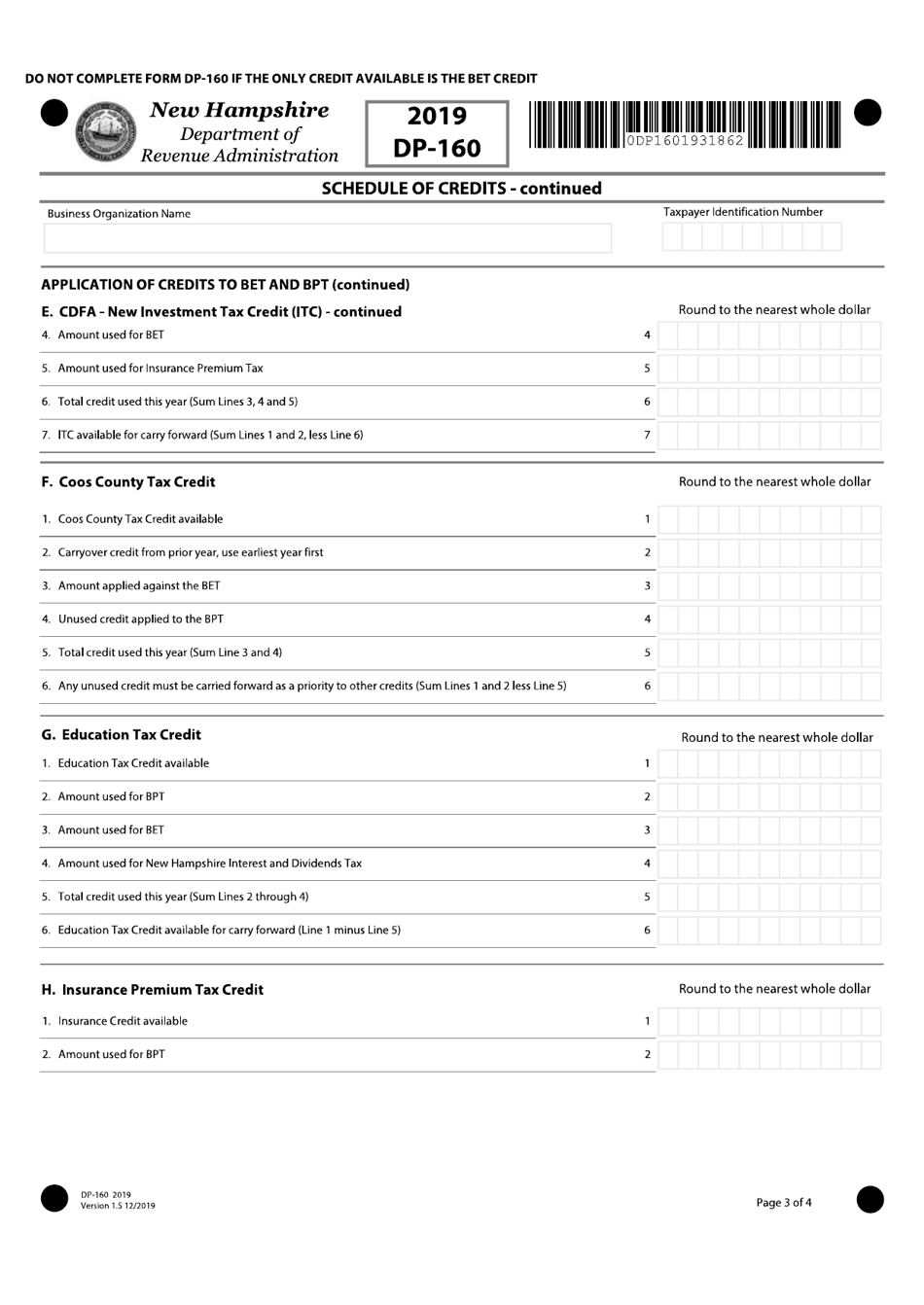

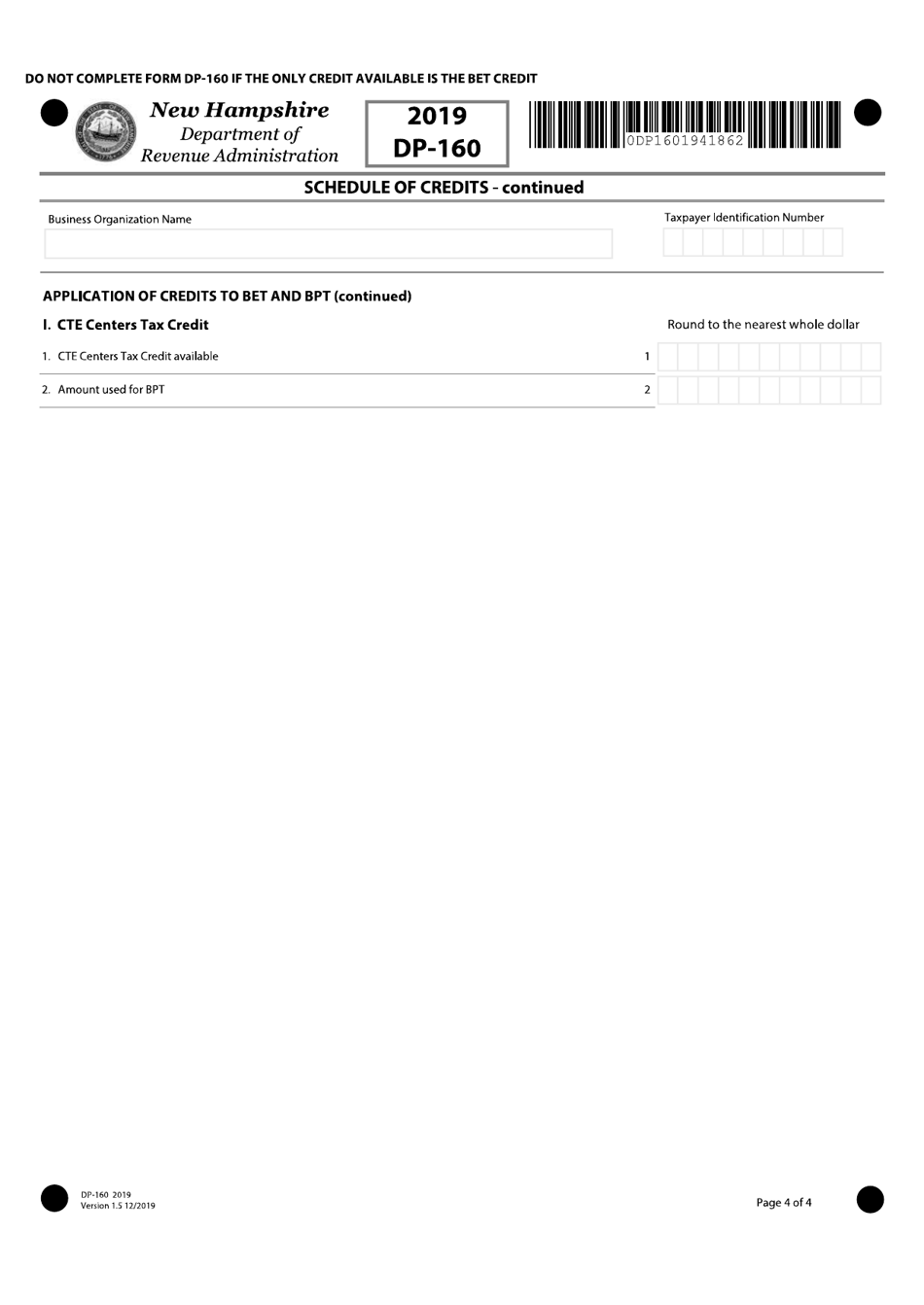

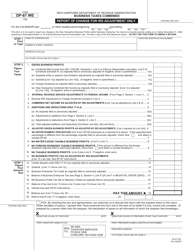

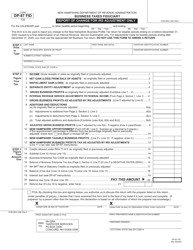

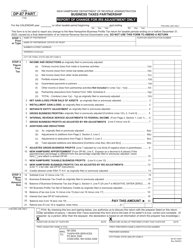

Form DP-160

for the current year.

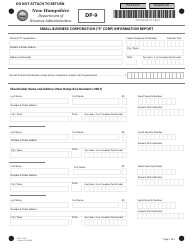

Form DP-160 Schedule for Business Enterprise and Business Profits Tax Credits - New Hampshire

What Is Form DP-160?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

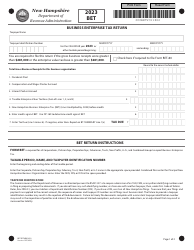

Q: What is Form DP-160?

A: Form DP-160 is the Schedule for Business Enterprise and Business Profits Tax Credits in New Hampshire.

Q: Who needs to file Form DP-160?

A: Businesses in New Hampshire that are eligible for tax credits need to file Form DP-160.

Q: What are Business Enterprise and Business Profits Tax Credits?

A: Business Enterprise and Business Profits Tax Credits are incentives provided by the state of New Hampshire to businesses that meet certain criteria.

Q: When is the deadline to file Form DP-160?

A: The deadline to file Form DP-160 is usually the same as the deadline to file the Business Enterprise Tax return, which is typically April 15th.

Q: What information do I need to complete Form DP-160?

A: You will need information about your business, including the amount of tax credits you are claiming.

Q: Are there any eligibility requirements to qualify for tax credits?

A: Yes, businesses must meet certain criteria to be eligible for tax credits. It is recommended to review the instructions provided with Form DP-160 for specific eligibility requirements.

Q: Can I claim both Business Enterprise Tax Credit and Business Profits Tax Credit?

A: Yes, businesses can claim both credits if they are eligible.

Q: Is there a fee for filing Form DP-160?

A: There is no fee for filing Form DP-160.

Q: What should I do if I have additional questions?

A: If you have additional questions, you can contact the New Hampshire Department of Revenue Administration for assistance.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-160 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.