This version of the form is not currently in use and is provided for reference only. Download this version of

Form DP-151

for the current year.

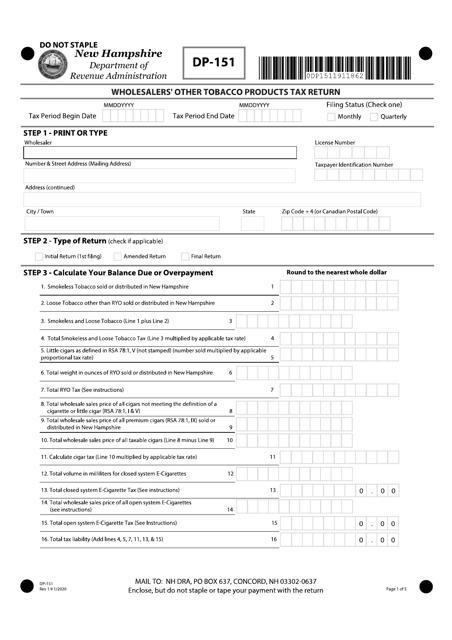

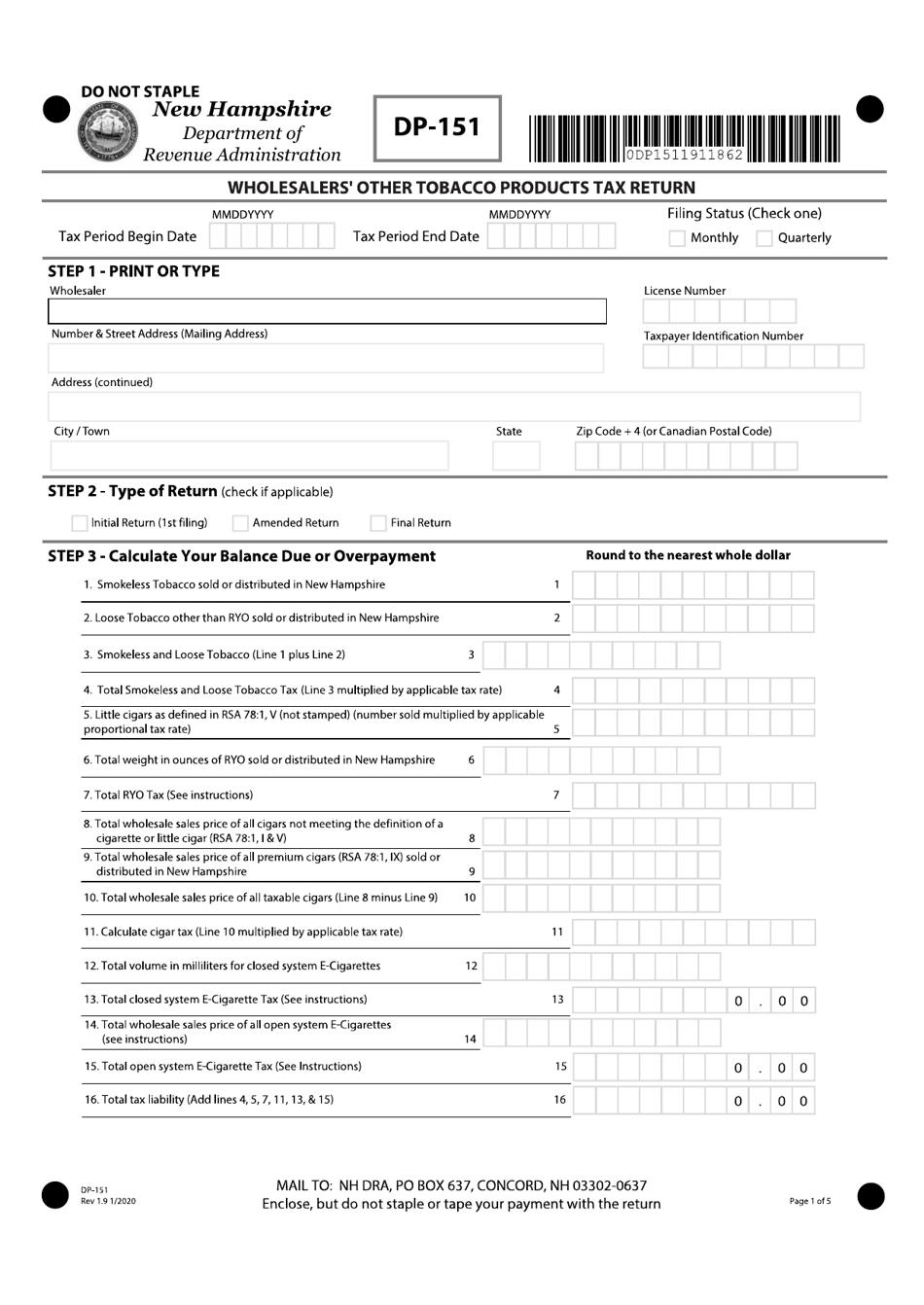

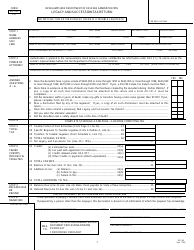

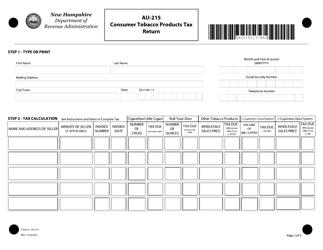

Form DP-151 Wholesalers' Other Tobacco Products Tax Return - New Hampshire

What Is Form DP-151?

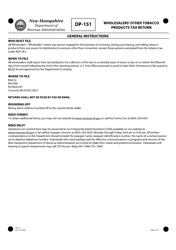

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-151?

A: Form DP-151 is the Wholesalers' Other Tobacco Products Tax Return for the state of New Hampshire.

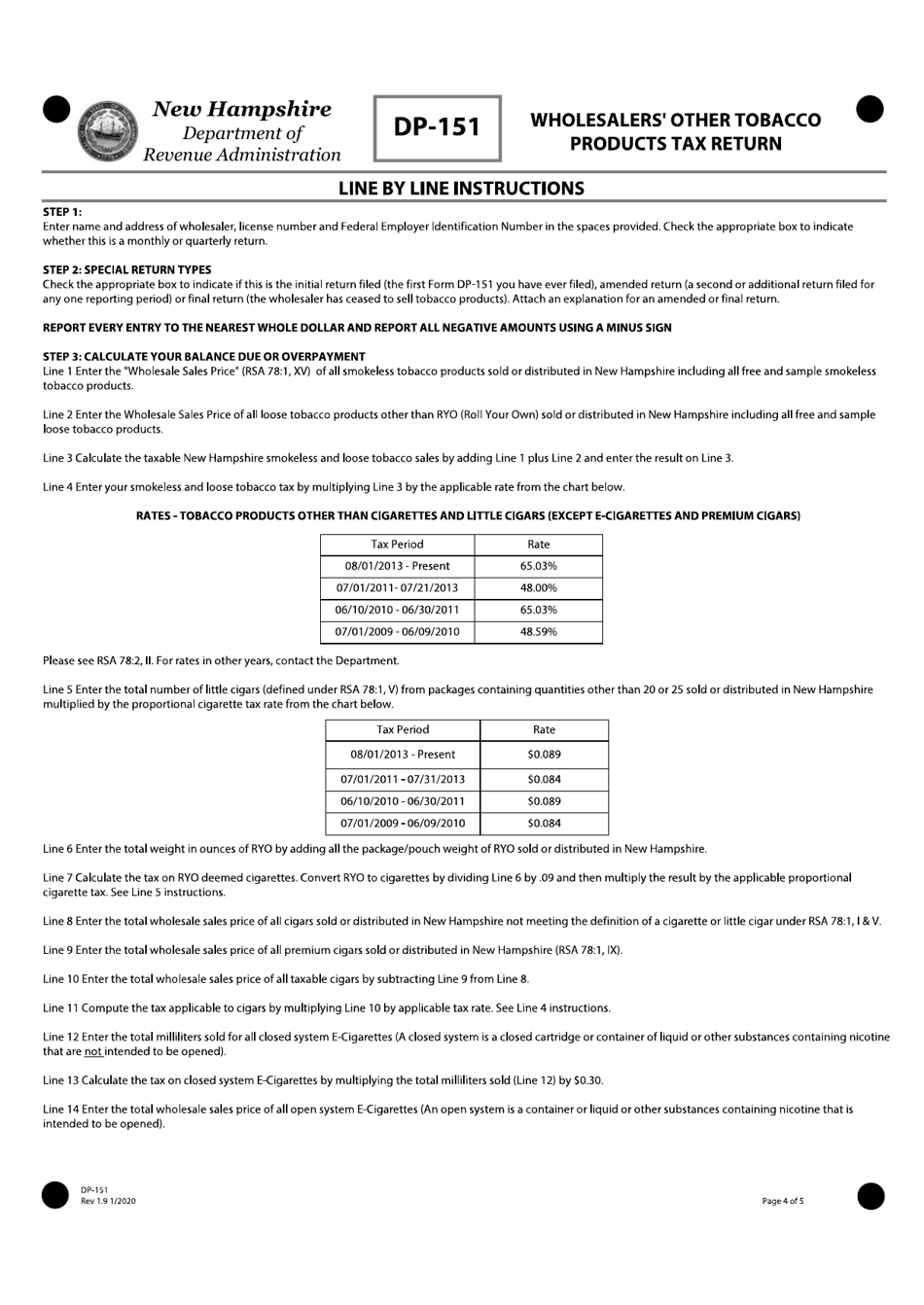

Q: Who needs to file Form DP-151?

A: Wholesalers of other tobacco products in the state of New Hampshire need to file Form DP-151.

Q: What is the purpose of Form DP-151?

A: The purpose of Form DP-151 is to report and pay the other tobacco products tax owed by wholesalers in New Hampshire.

Q: How often do I need to file Form DP-151?

A: Form DP-151 should be filed on a monthly basis.

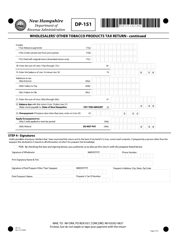

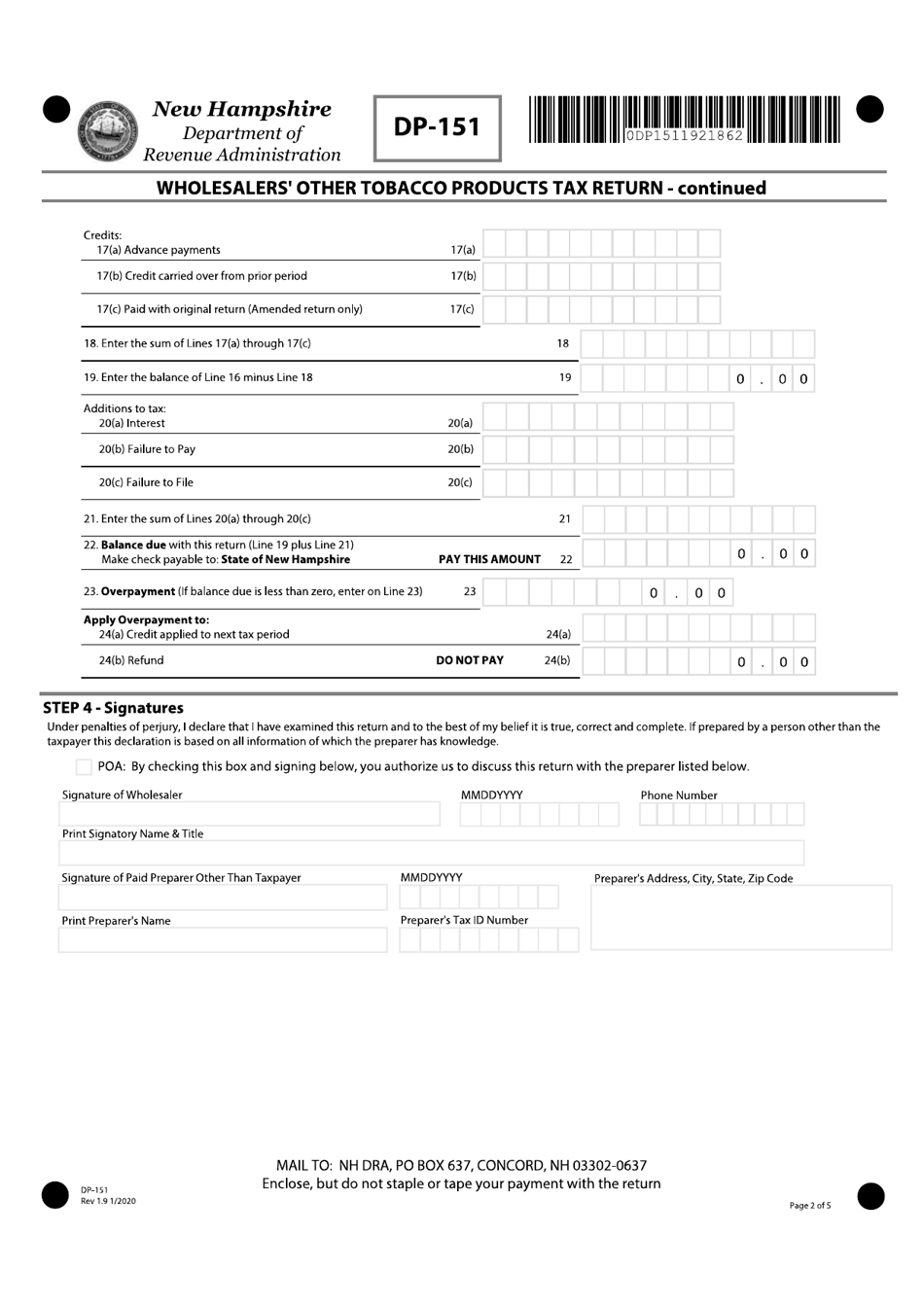

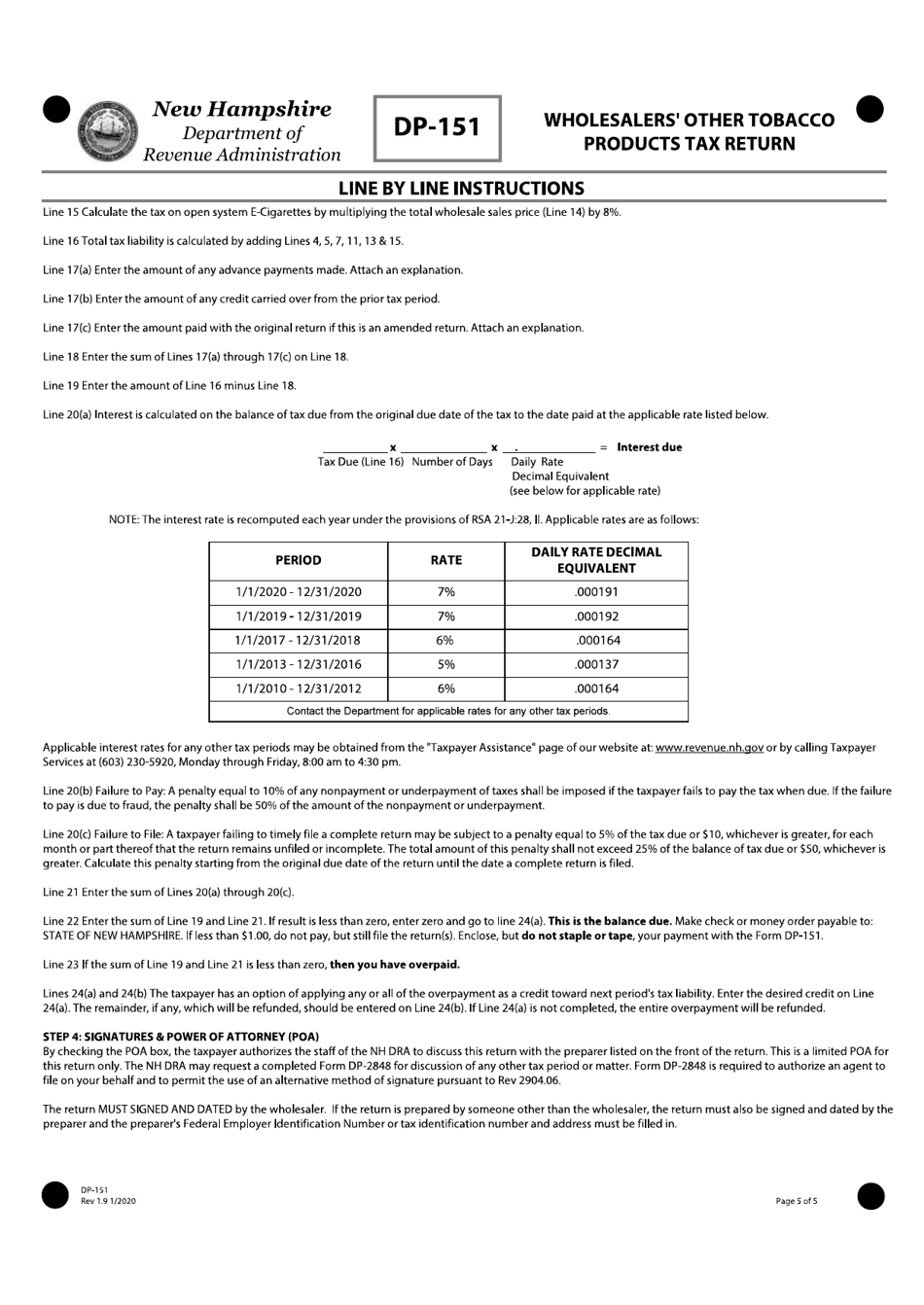

Q: What information do I need to complete Form DP-151?

A: You will need to provide information about your business, total sales of other tobacco products, and calculate the tax due.

Q: When is the due date for Form DP-151?

A: Form DP-151 is due on or before the 25th day of the month following the reporting period.

Q: What happens if I fail to file Form DP-151 or pay the tax?

A: Failure to file Form DP-151 or pay the tax can result in penalties and interest being assessed by the state of New Hampshire.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-151 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.