This version of the form is not currently in use and is provided for reference only. Download this version of

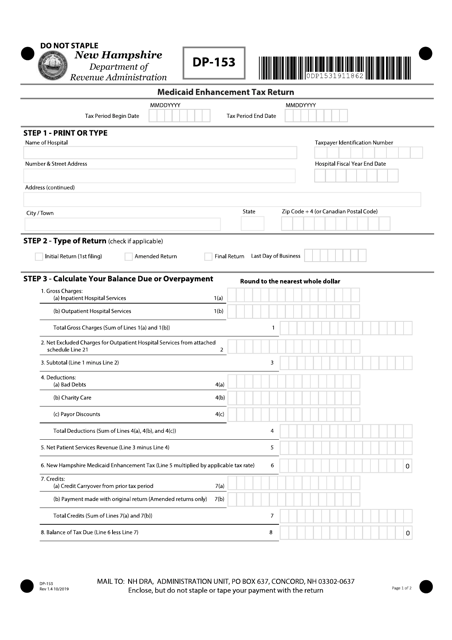

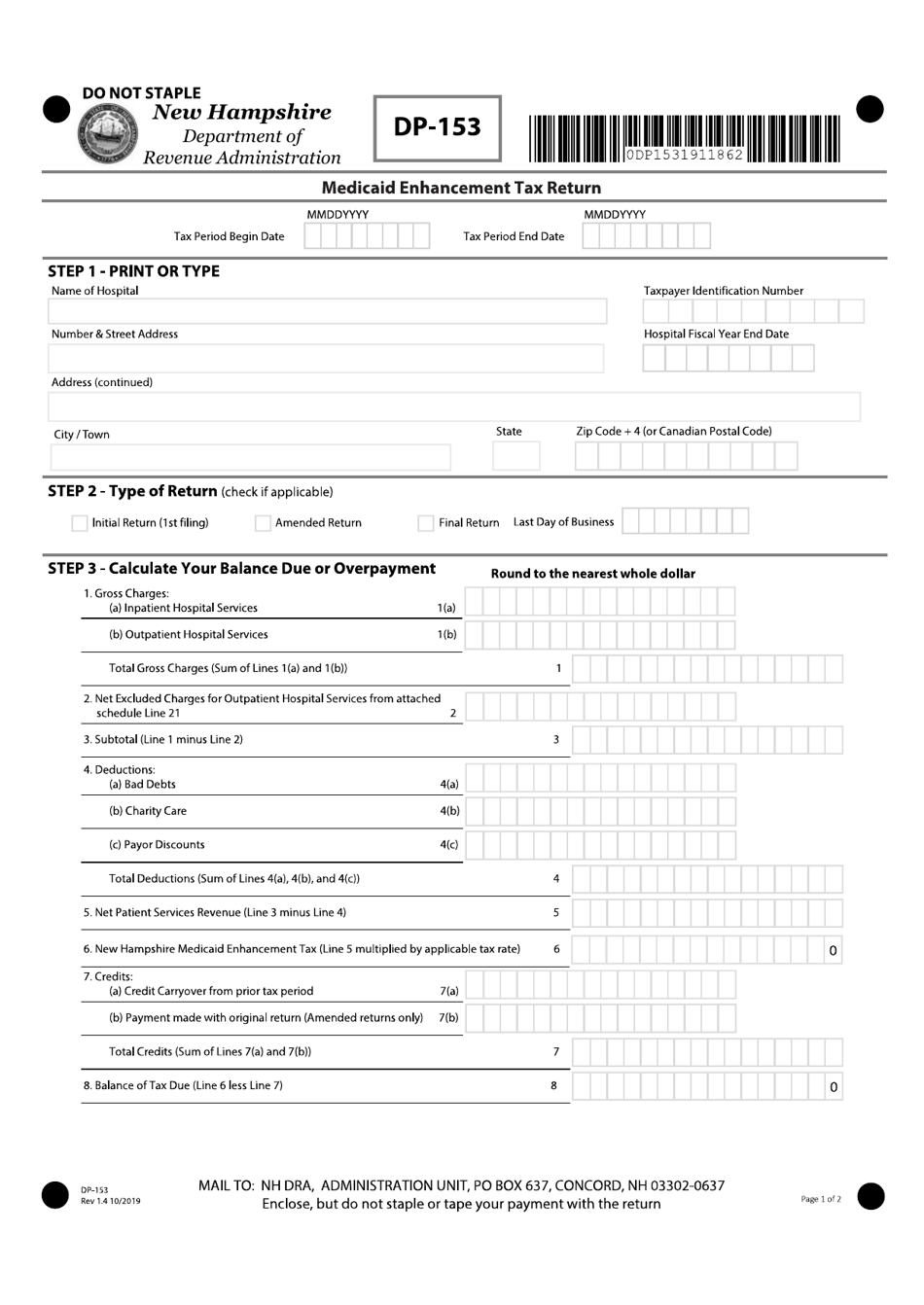

Form DP-153

for the current year.

Form DP-153 Medicaid Enhancement Tax Return - New Hampshire

What Is Form DP-153?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-153?

A: Form DP-153 is the Medicaid Enhancement Tax Return for the state of New Hampshire.

Q: Who needs to file Form DP-153?

A: Any entity that is subject to the Medicaid Enhancement Tax in New Hampshire needs to file Form DP-153.

Q: What is the purpose of the Medicaid Enhancement Tax?

A: The Medicaid Enhancement Tax is used to fund the state's Medicaid program and help support healthcare services for low-income residents.

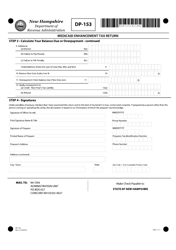

Q: What information is required on Form DP-153?

A: Form DP-153 requires information about the taxpayer's gross patient service revenues and any exemptions or adjustments that may apply.

Q: When is Form DP-153 due?

A: Form DP-153 is due on the 25th day of the month following the end of the tax period.

Q: Are there any penalties for late filing of Form DP-153?

A: Yes, there are penalties for late filing of Form DP-153. The penalty is 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-153 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.