This version of the form is not currently in use and is provided for reference only. Download this version of

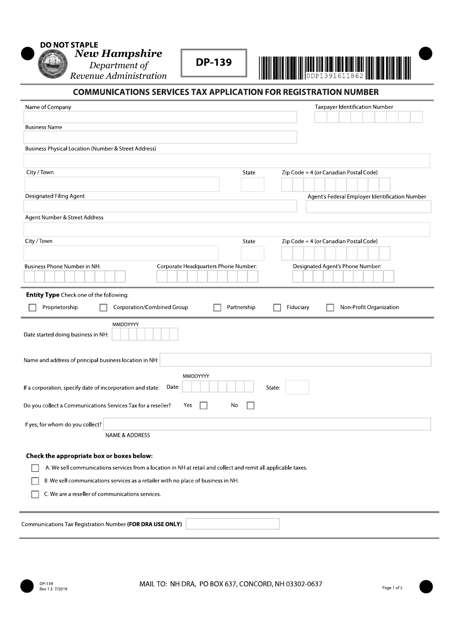

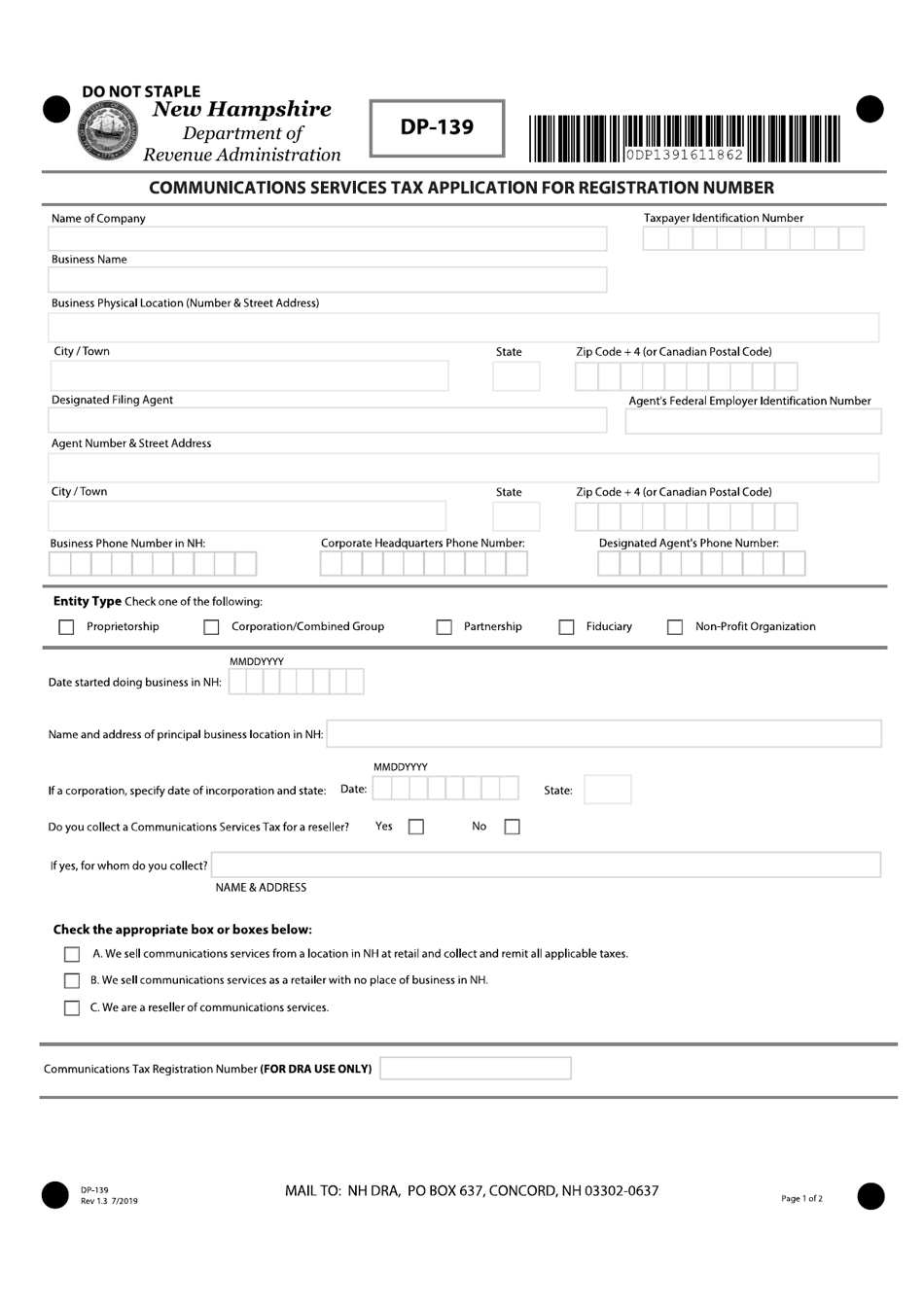

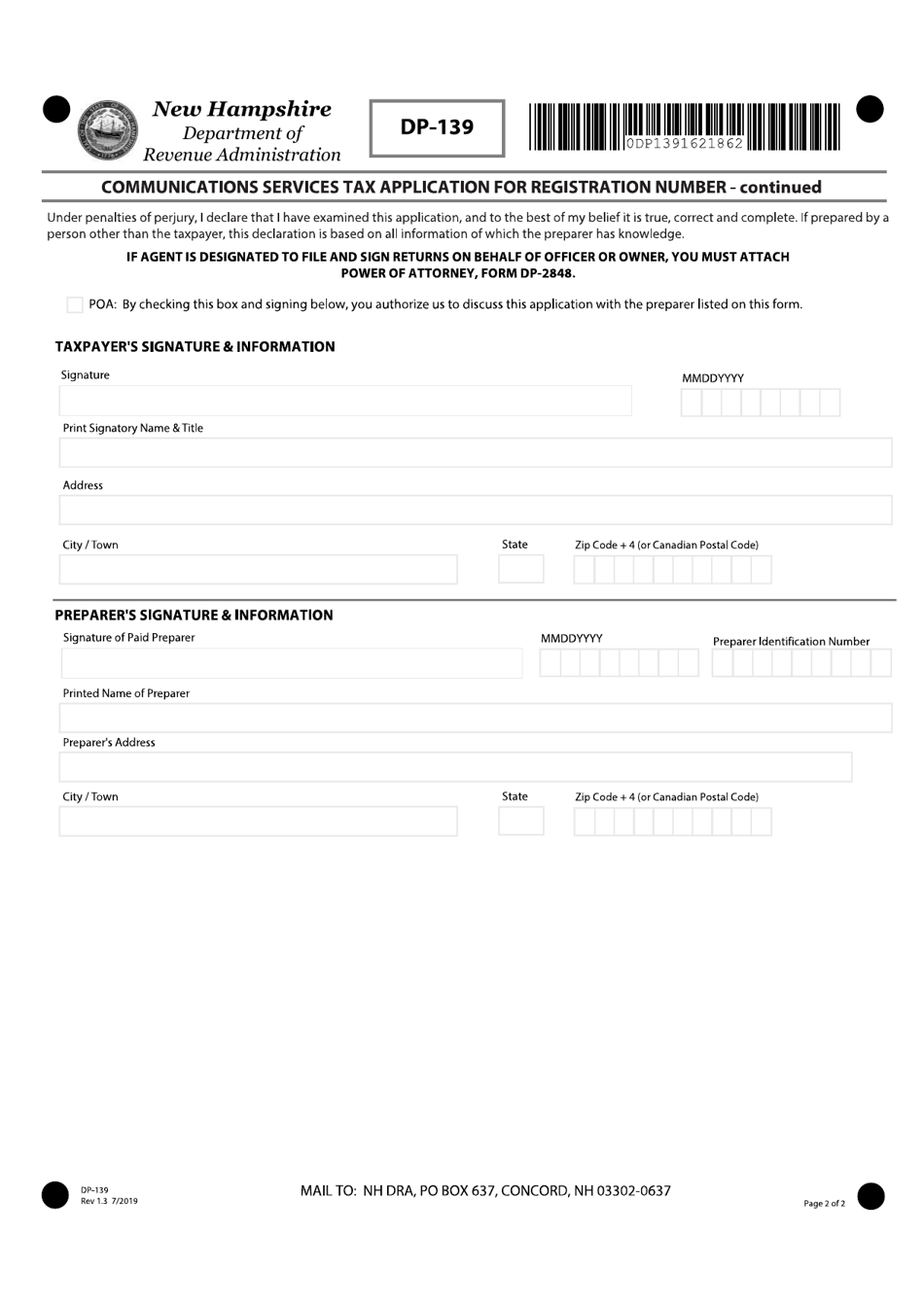

Form DP-139

for the current year.

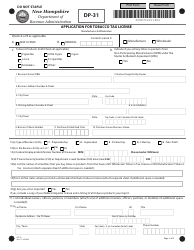

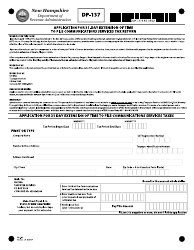

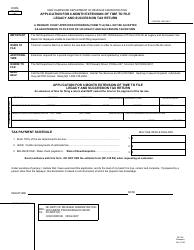

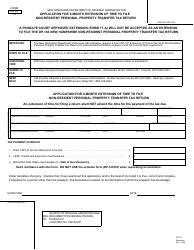

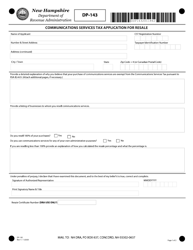

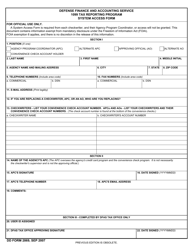

Form DP-139 Communications Services Tax Application for Registration Number - New Hampshire

What Is Form DP-139?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-139?

A: Form DP-139 is the Communications Services Tax Application for Registration Number in New Hampshire. It is used to apply for a registration number for communications services tax purposes.

Q: Who needs to use Form DP-139?

A: Any individual or business that provides taxable communications services in New Hampshire needs to use Form DP-139 to apply for a registration number.

Q: What is the purpose of the Communications Services Tax?

A: The Communications Services Tax is a tax imposed on the sale of telecommunications services in New Hampshire. It helps fund various state programs and services.

Q: How do I complete Form DP-139?

A: To complete Form DP-139, you will need to provide your name, address, contact information, and other business details. You will also need to indicate the type of communications services you provide.

Q: Are there any fees associated with the application?

A: Yes, there is a $10 fee for processing the application. This fee must be included with the completed Form DP-139.

Q: What happens after I submit Form DP-139?

A: After you submit Form DP-139 and pay the required fee, the New Hampshire Department of Revenue Administration will review your application and issue you a registration number if approved.

Q: Do I need to renew my registration number?

A: Yes, you will need to renew your registration number annually. The renewal process involves submitting Form DP-139 and the required fee.

Q: What are the consequences of not registering for the Communications Services Tax?

A: Failure to register for the Communications Services Tax can result in penalties and fines. It is important to comply with the tax requirements to avoid any legal issues.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-139 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.