This version of the form is not currently in use and is provided for reference only. Download this version of

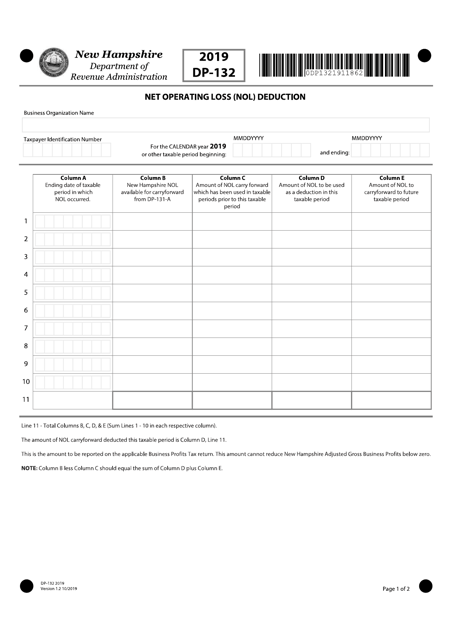

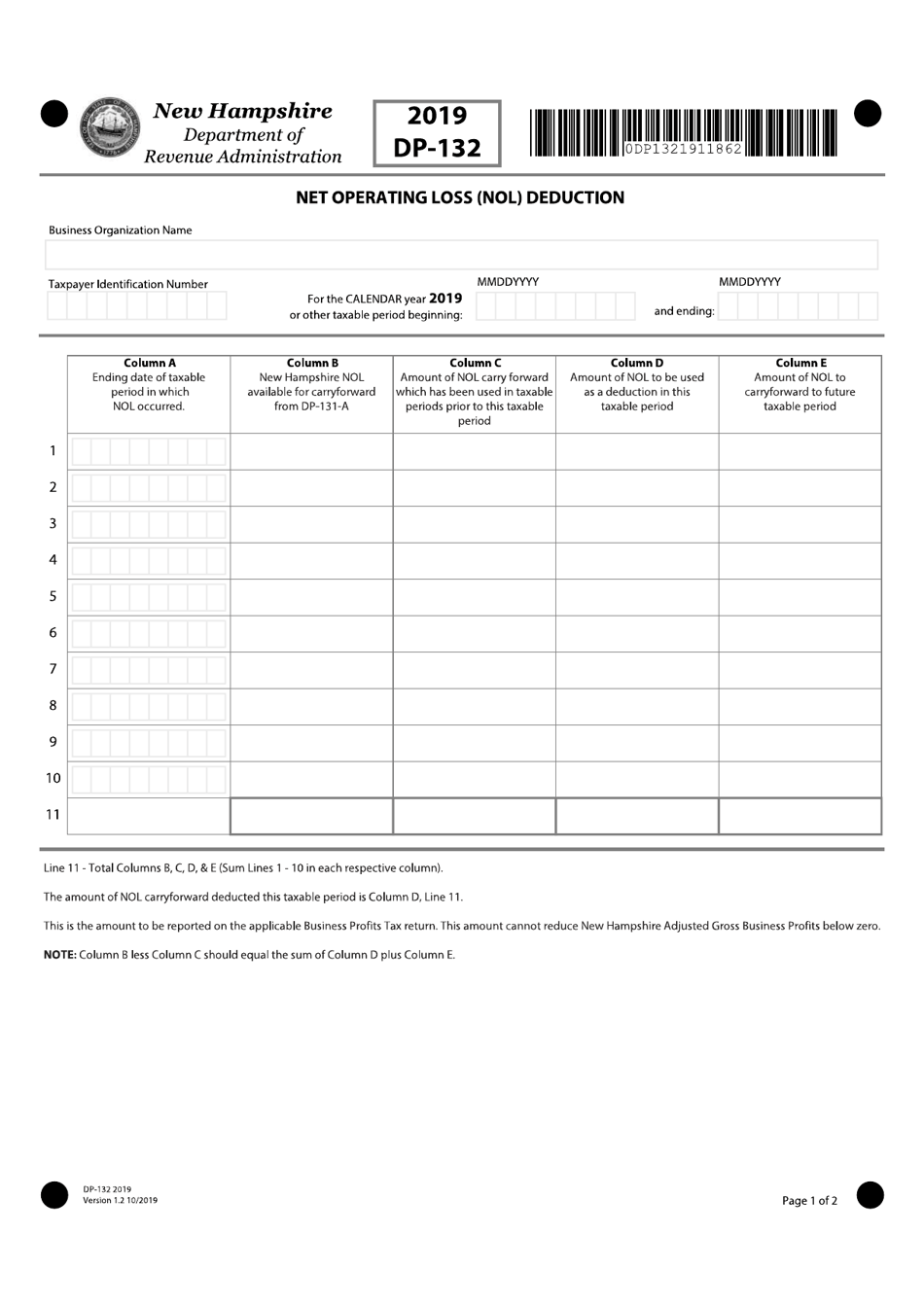

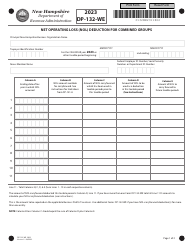

Form DP-132

for the current year.

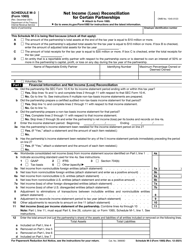

Form DP-132 Net Operating Loss (Nol) Deduction - New Hampshire

What Is Form DP-132?

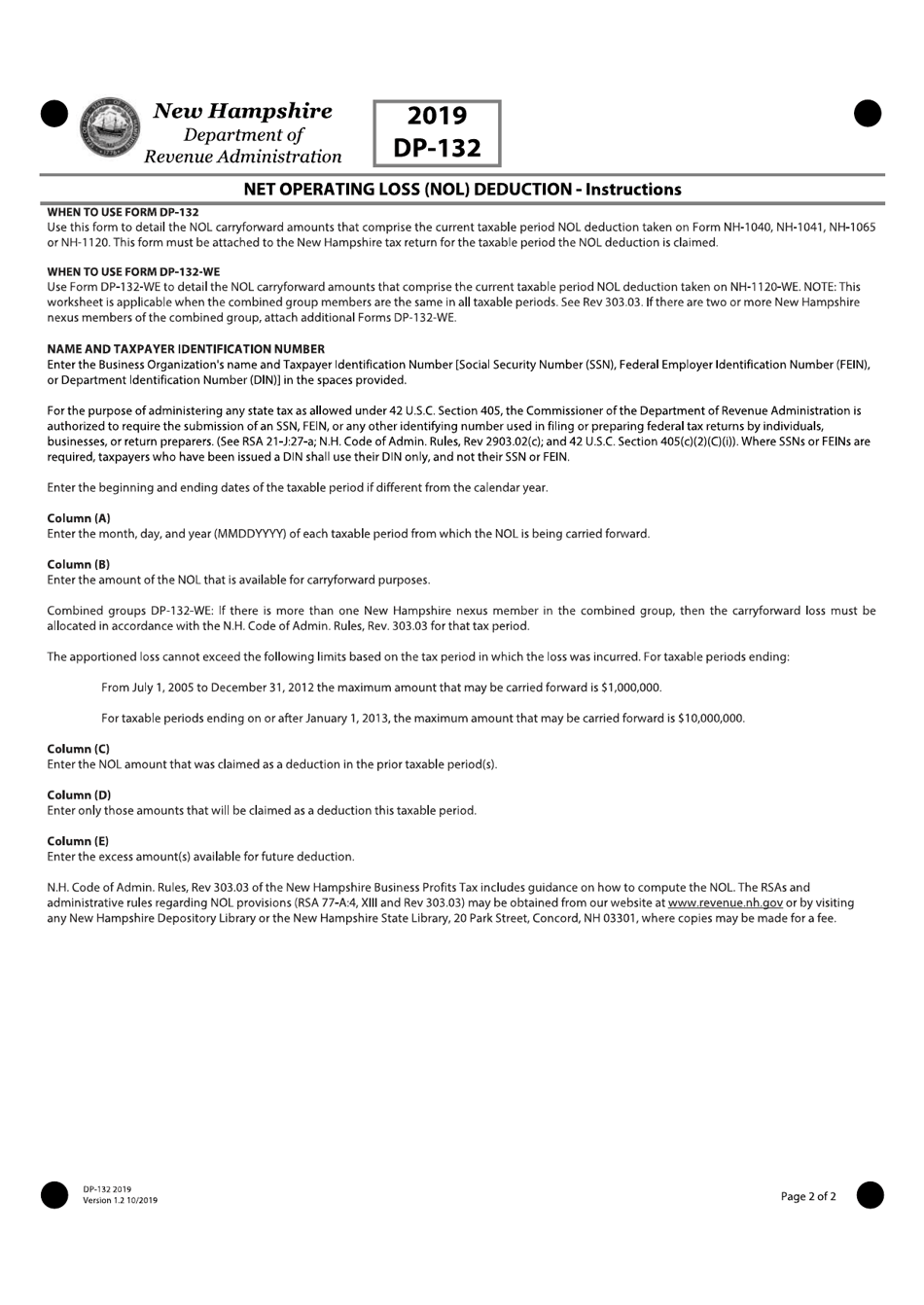

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-132?

A: Form DP-132 is a tax form for claiming the Net Operating Loss (NOL) deduction in New Hampshire.

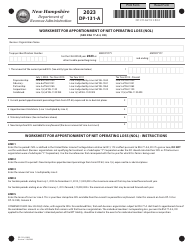

Q: What is the Net Operating Loss (NOL) deduction?

A: The Net Operating Loss (NOL) deduction allows businesses in New Hampshire to offset losses from one year against profits from other years.

Q: What is the purpose of the NOL deduction?

A: The purpose of the NOL deduction is to provide tax relief to businesses that experience financial losses.

Q: Who is eligible to claim the NOL deduction?

A: Businesses in New Hampshire that have experienced financial losses can claim the NOL deduction.

Q: How do I file Form DP-132?

A: You can file Form DP-132 by including it with your New Hampshire state tax return.

Q: What information do I need to complete Form DP-132?

A: You will need to provide details of your business income and deductible expenses to complete Form DP-132.

Q: Are there any limitations on the NOL deduction?

A: Yes, there are limitations on the NOL deduction, including a carryforward period and a restriction on the amount of the deduction.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-132 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.