This version of the form is not currently in use and is provided for reference only. Download this version of

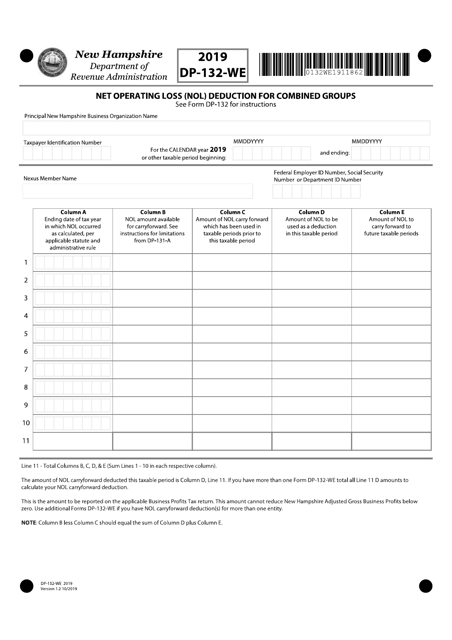

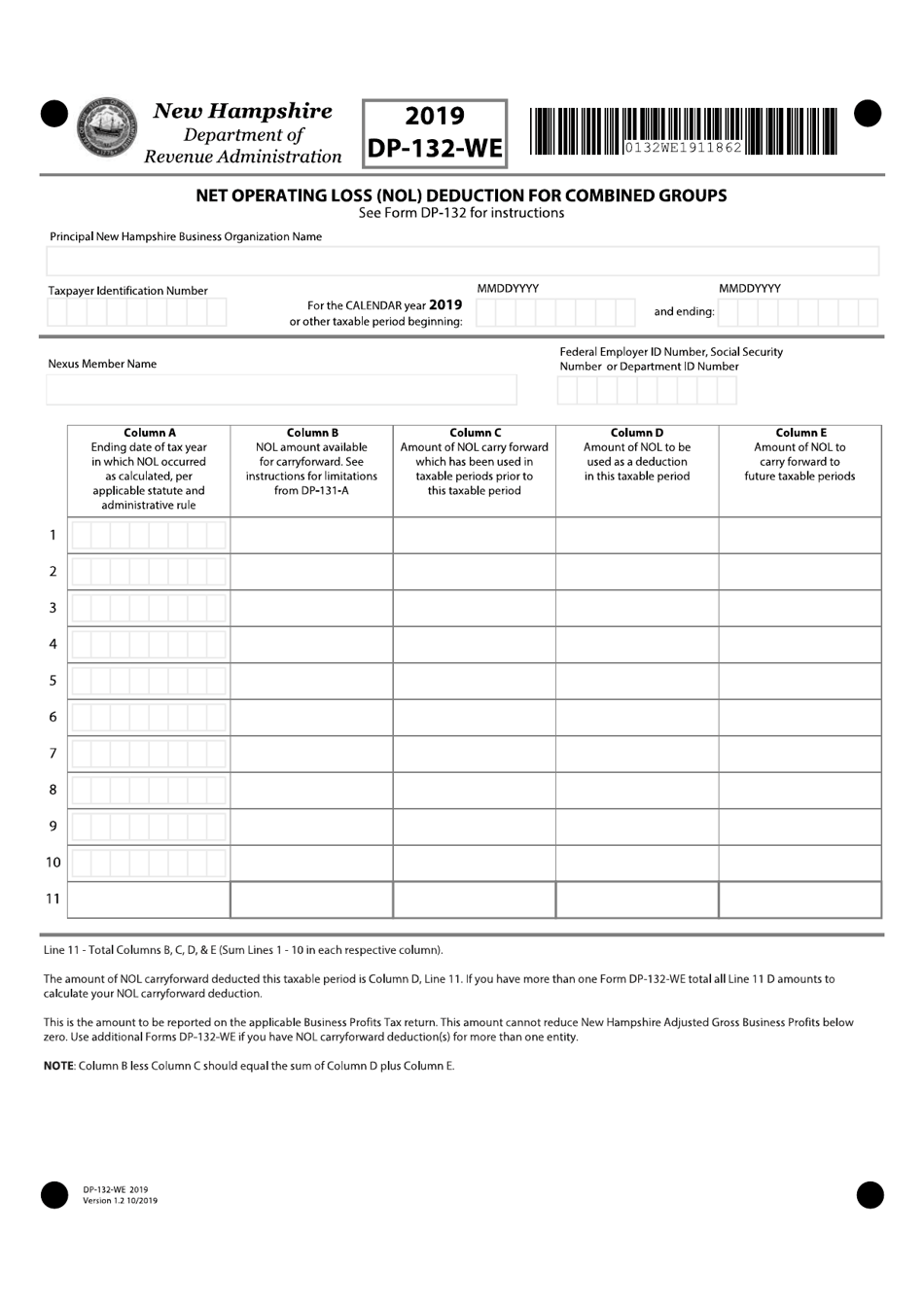

Form DP-132-WE

for the current year.

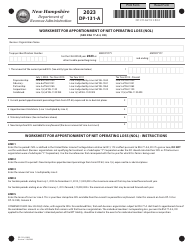

Form DP-132-WE Net Operating Loss (Nol) Deduction for Combined Groups - New Hampshire

What Is Form DP-132-WE?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-132-WE?

A: Form DP-132-WE is a form used for claiming the Net Operating Loss (NOL) deduction for combined groups in New Hampshire.

Q: What is the purpose of Form DP-132-WE?

A: The purpose of Form DP-132-WE is to calculate and claim the Net Operating Loss (NOL) deduction for combined groups in New Hampshire.

Q: Who needs to file Form DP-132-WE?

A: Form DP-132-WE needs to be filed by combined groups in New Hampshire who want to claim the Net Operating Loss (NOL) deduction.

Q: What is the Net Operating Loss (NOL) deduction?

A: The Net Operating Loss (NOL) deduction allows businesses to offset their taxable income by deducting losses from previous years.

Q: Are there any specific requirements to claim the Net Operating Loss (NOL) deduction?

A: Yes, there are specific requirements to claim the Net Operating Loss (NOL) deduction, including limits on the amount of deduction and carry-back or carry-forward provisions.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-132-WE by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.