This version of the form is not currently in use and is provided for reference only. Download this version of

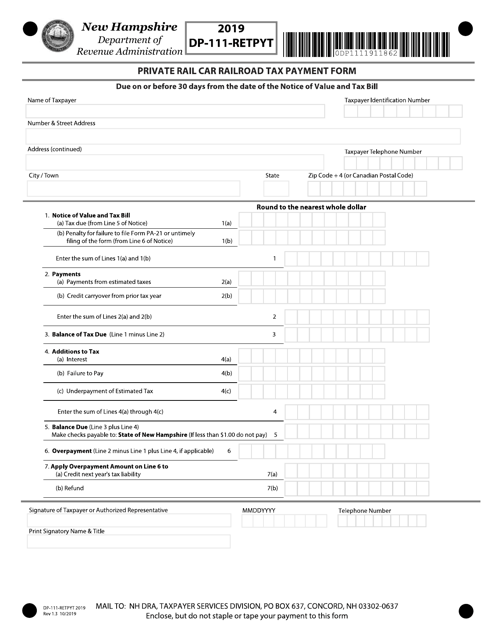

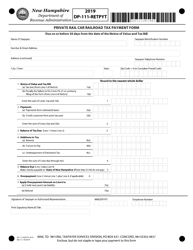

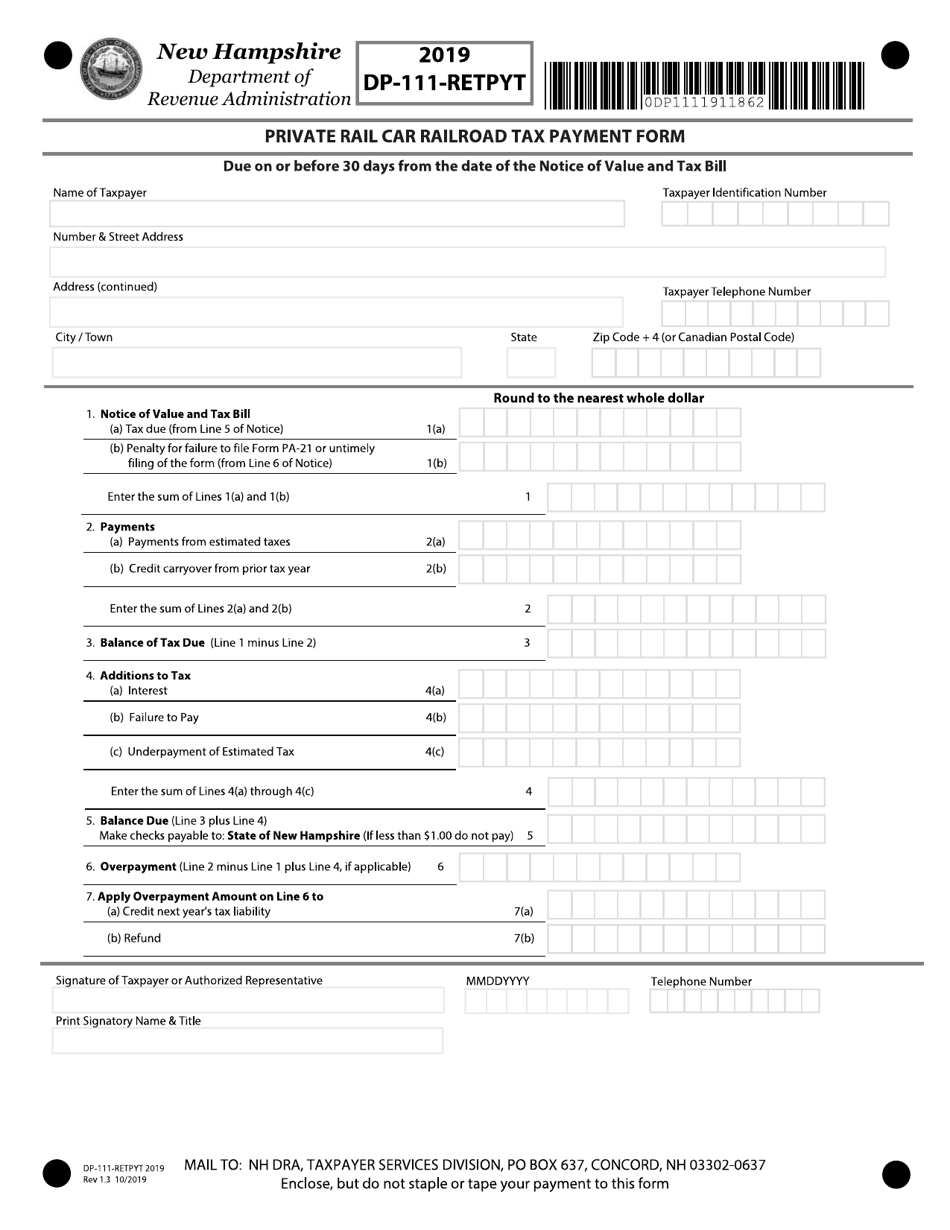

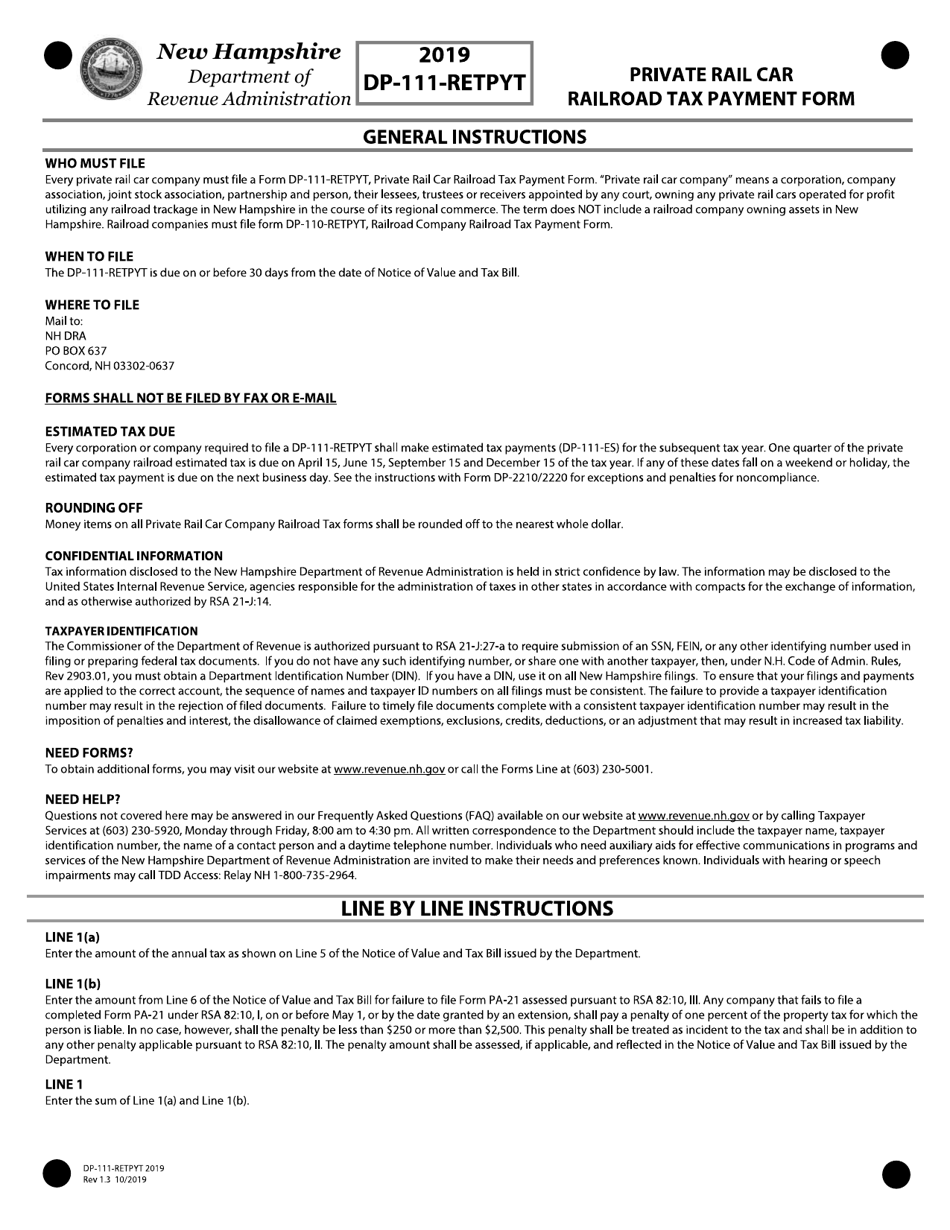

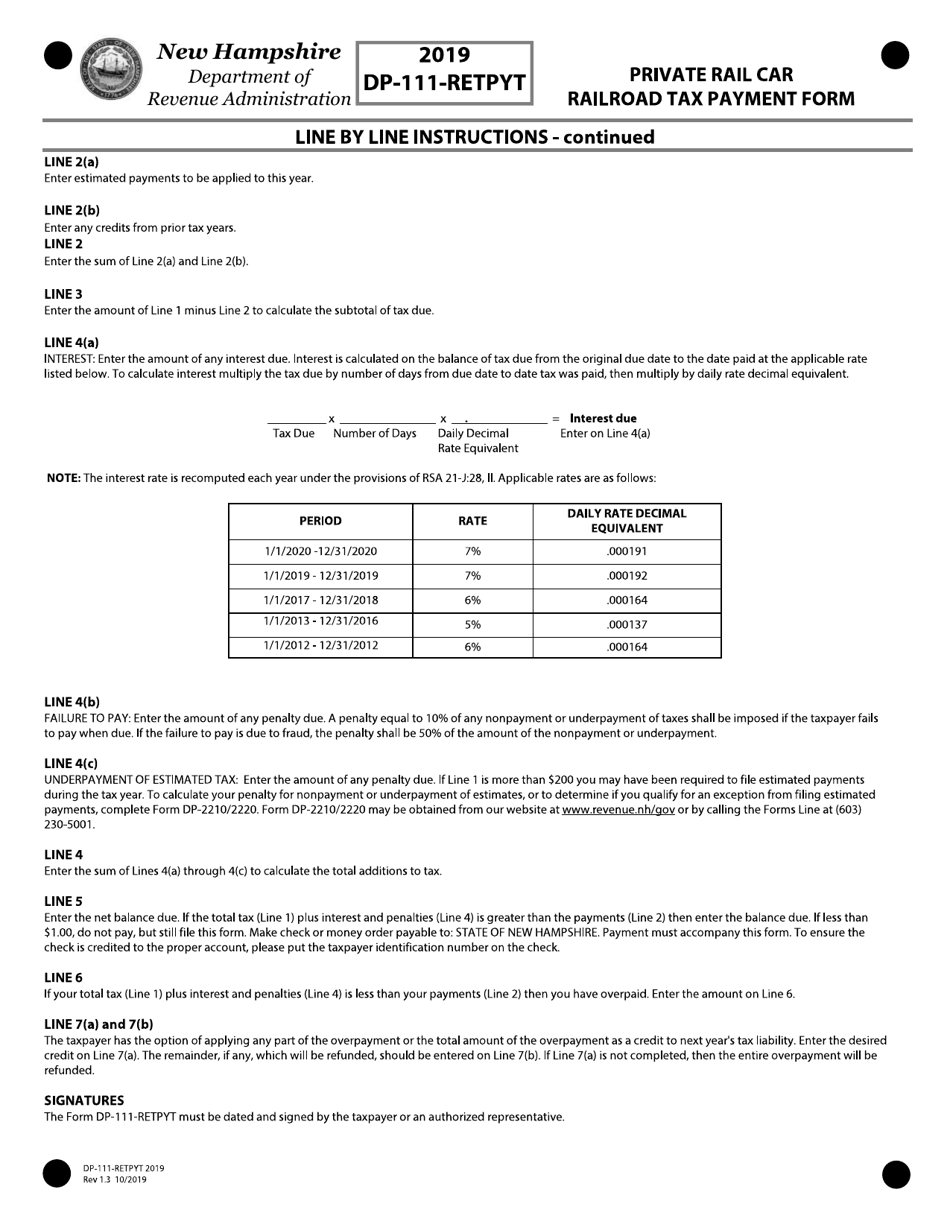

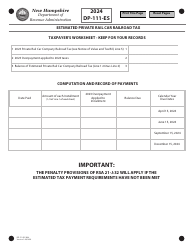

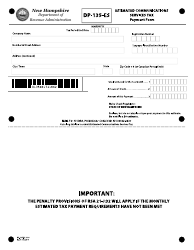

Form DP-111-RETPYT

for the current year.

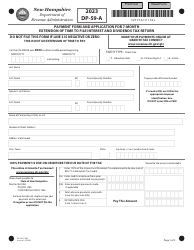

Form DP-111-RETPYT Private Rail Car Railroad Tax Payment Form - New Hampshire

What Is Form DP-111-RETPYT?

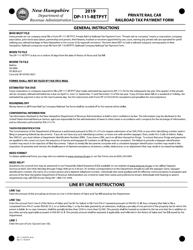

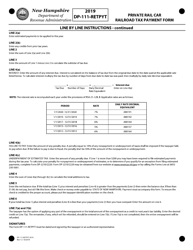

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-111-RETPYT?

A: Form DP-111-RETPYT is the Private Rail Car Railroad Tax Payment Form.

Q: What is the purpose of Form DP-111-RETPYT?

A: The purpose of Form DP-111-RETPYT is to make tax payments for private rail cars in New Hampshire.

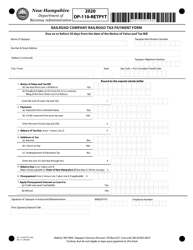

Q: Who needs to fill out Form DP-111-RETPYT?

A: Anyone who owns a private rail car and is subject to the railroad tax in New Hampshire needs to fill out this form.

Q: Is Form DP-111-RETPYT applicable in other states?

A: No, Form DP-111-RETPYT is specific to the state of New Hampshire and its railroad tax.

Q: When is Form DP-111-RETPYT due?

A: Form DP-111-RETPYT is due on or before April 15th of each year.

Q: Are there any penalties for late filing of Form DP-111-RETPYT?

A: Yes, there are penalties for late filing of Form DP-111-RETPYT, which include interest and potential enforcement actions.

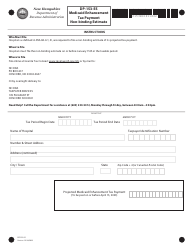

Q: Is there any additional documentation required to submit with Form DP-111-RETPYT?

A: Yes, you may need to attach supporting documentation and payment with Form DP-111-RETPYT. Refer to the instructions provided with the form for more details.

Q: What should I do if I have questions or need assistance with Form DP-111-RETPYT?

A: If you have questions or need assistance with Form DP-111-RETPYT, you should contact the Department of Revenue Administration in New Hampshire for guidance.

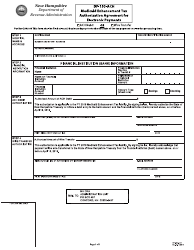

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-111-RETPYT by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.