This version of the form is not currently in use and is provided for reference only. Download this version of

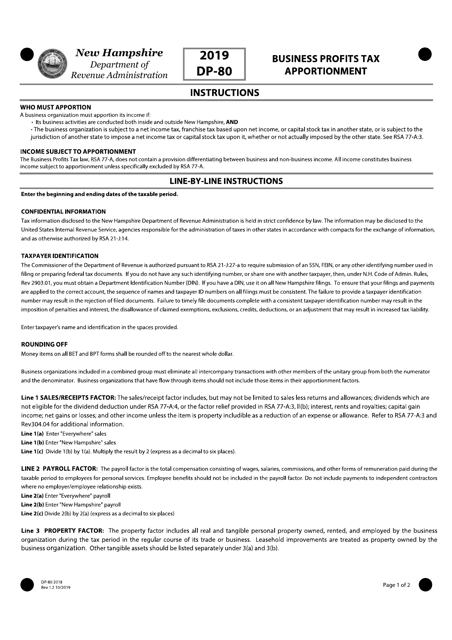

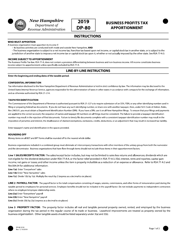

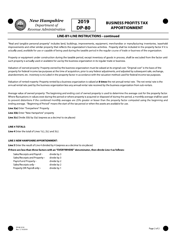

Instructions for Form DP-80

for the current year.

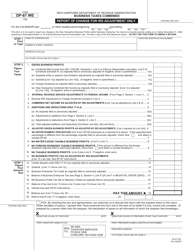

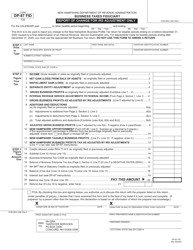

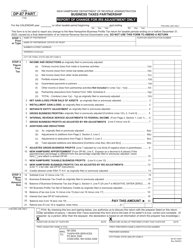

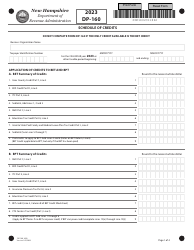

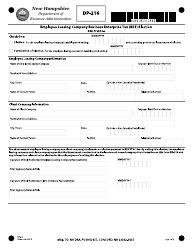

Instructions for Form DP-80 Business Profits Tax Return - Business Profits Tax Apportionment - New Hampshire

This document contains official instructions for Form DP-80 , Business Profits Tax Return - Business Profits Tax Apportionment - a form released and collected by the New Hampshire Department of Revenue Administration. An up-to-date fillable Form DP-80 is available for download through this link.

FAQ

Q: What is Form DP-80?

A: Form DP-80 is the Business Profits Tax Return.

Q: What is the purpose of Form DP-80?

A: The purpose of Form DP-80 is to report and calculate the Business Profits Tax in New Hampshire.

Q: Who needs to file Form DP-80?

A: All businesses subject to the Business Profits Tax in New Hampshire need to file Form DP-80.

Q: What is Business Profits Tax?

A: Business Profits Tax is a tax imposed on businesses in New Hampshire based on their net income.

Q: What is apportionment?

A: Apportionment is the process of dividing and allocating a business's income between different states or jurisdictions.

Q: Why is apportionment necessary?

A: Apportionment is necessary because businesses often operate in multiple states, and it ensures a fair distribution of tax liabilities.

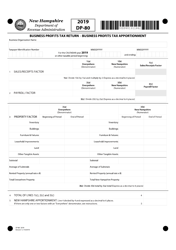

Q: What information is required for the apportionment section of Form DP-80?

A: The apportionment section of Form DP-80 requires information about the business's sales, property, and payroll in New Hampshire and other states.

Q: When is the deadline to file Form DP-80?

A: The deadline to file Form DP-80 is determined by the fiscal year end of the business.

Q: Are there any penalties for late filing of Form DP-80?

A: Yes, there are penalties for late filing of Form DP-80. It is important to file the form and pay any tax due on time to avoid penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Hampshire Department of Revenue Administration.