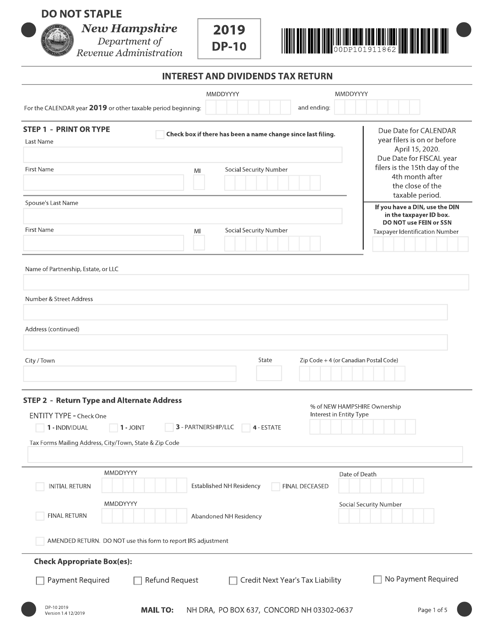

This version of the form is not currently in use and is provided for reference only. Download this version of

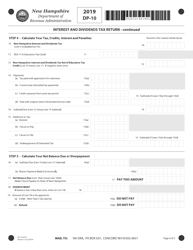

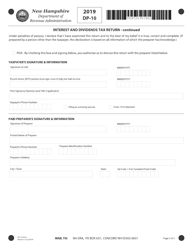

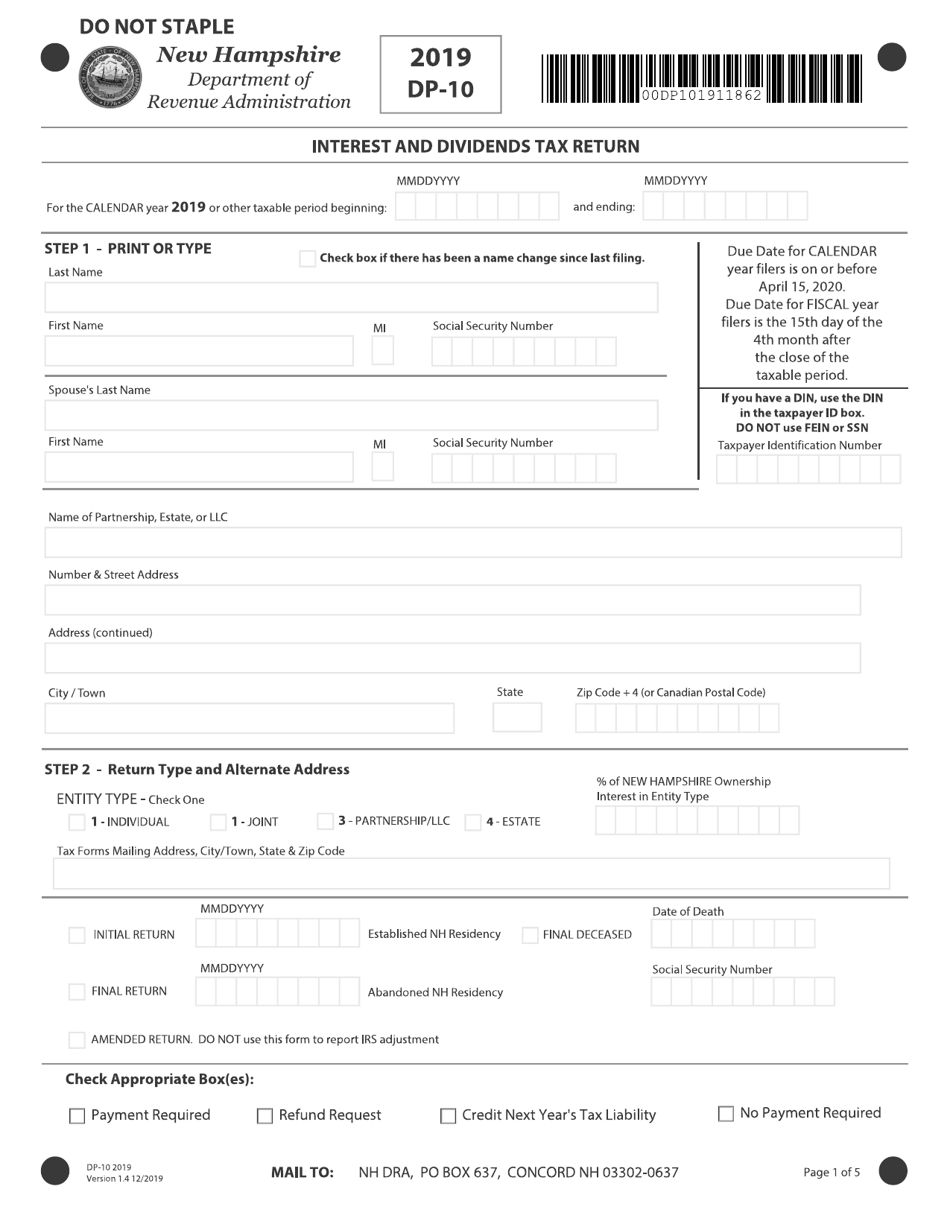

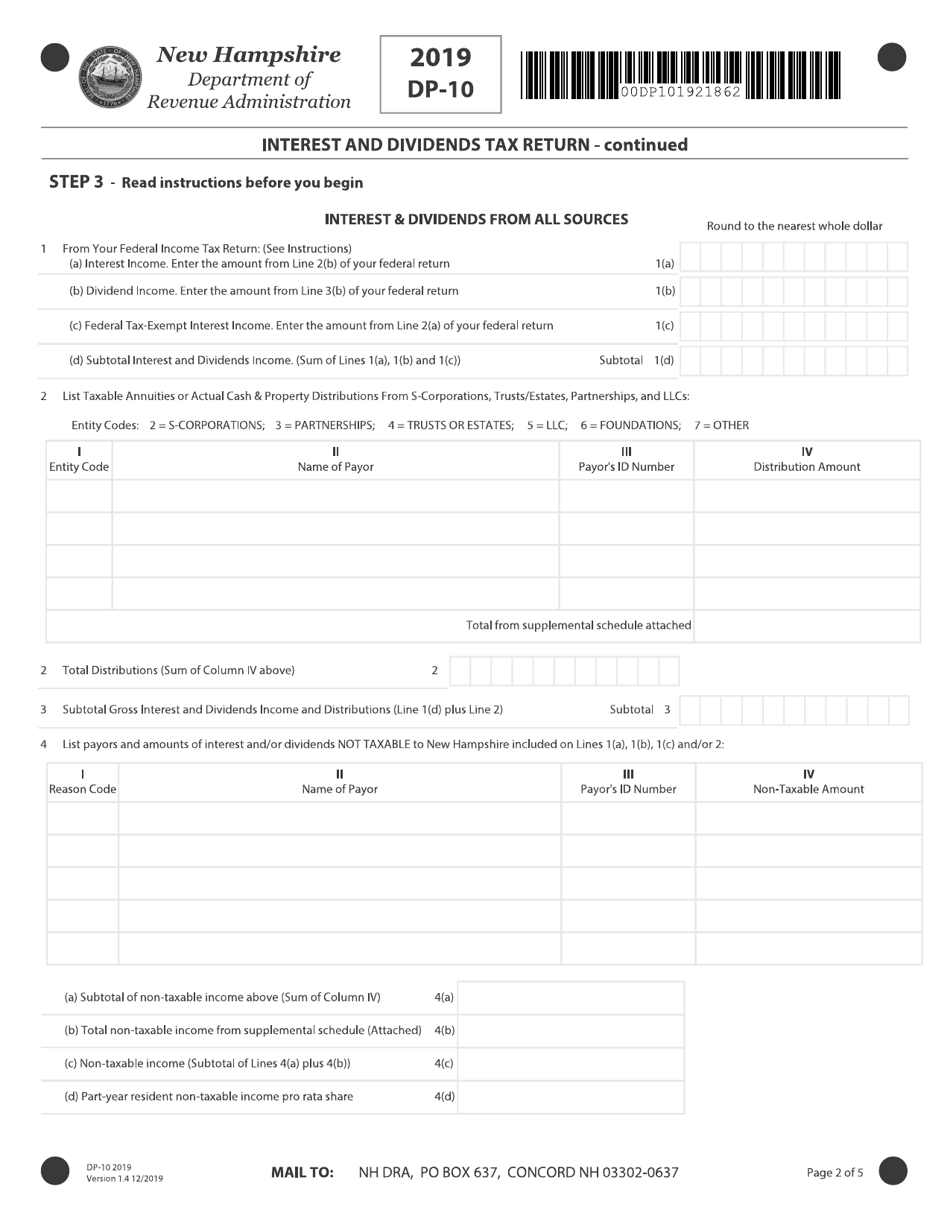

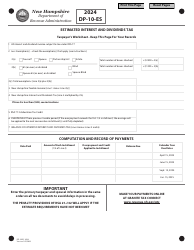

Form DP-10

for the current year.

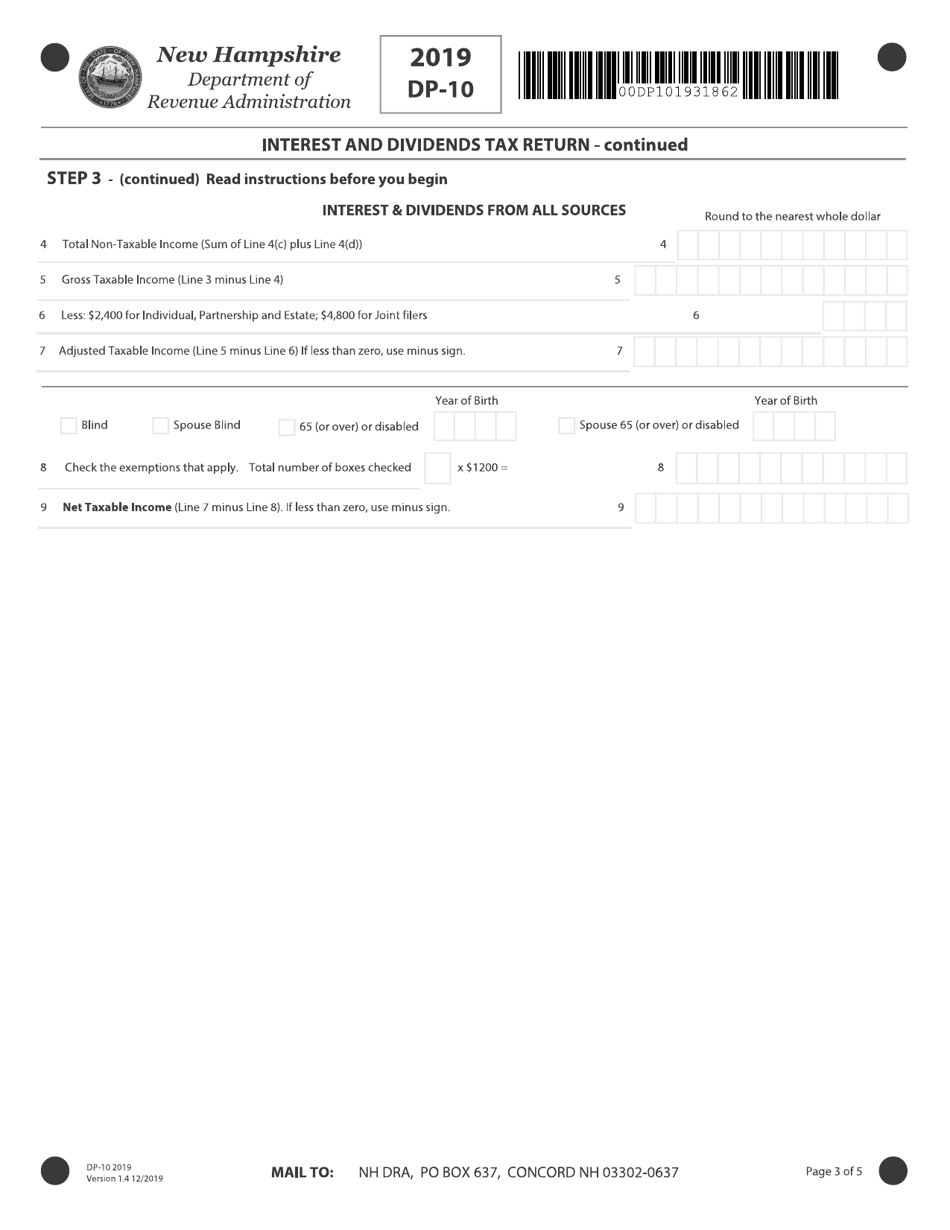

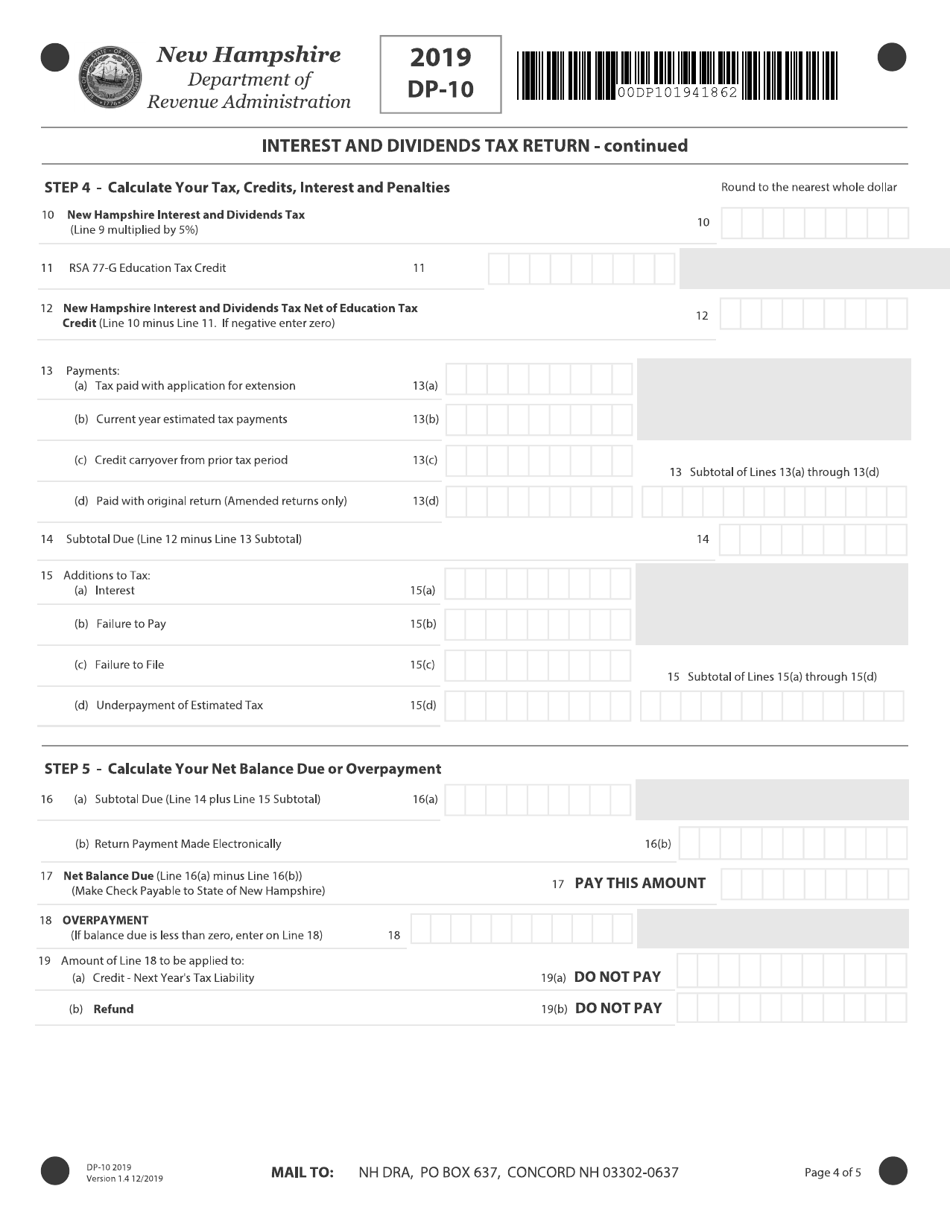

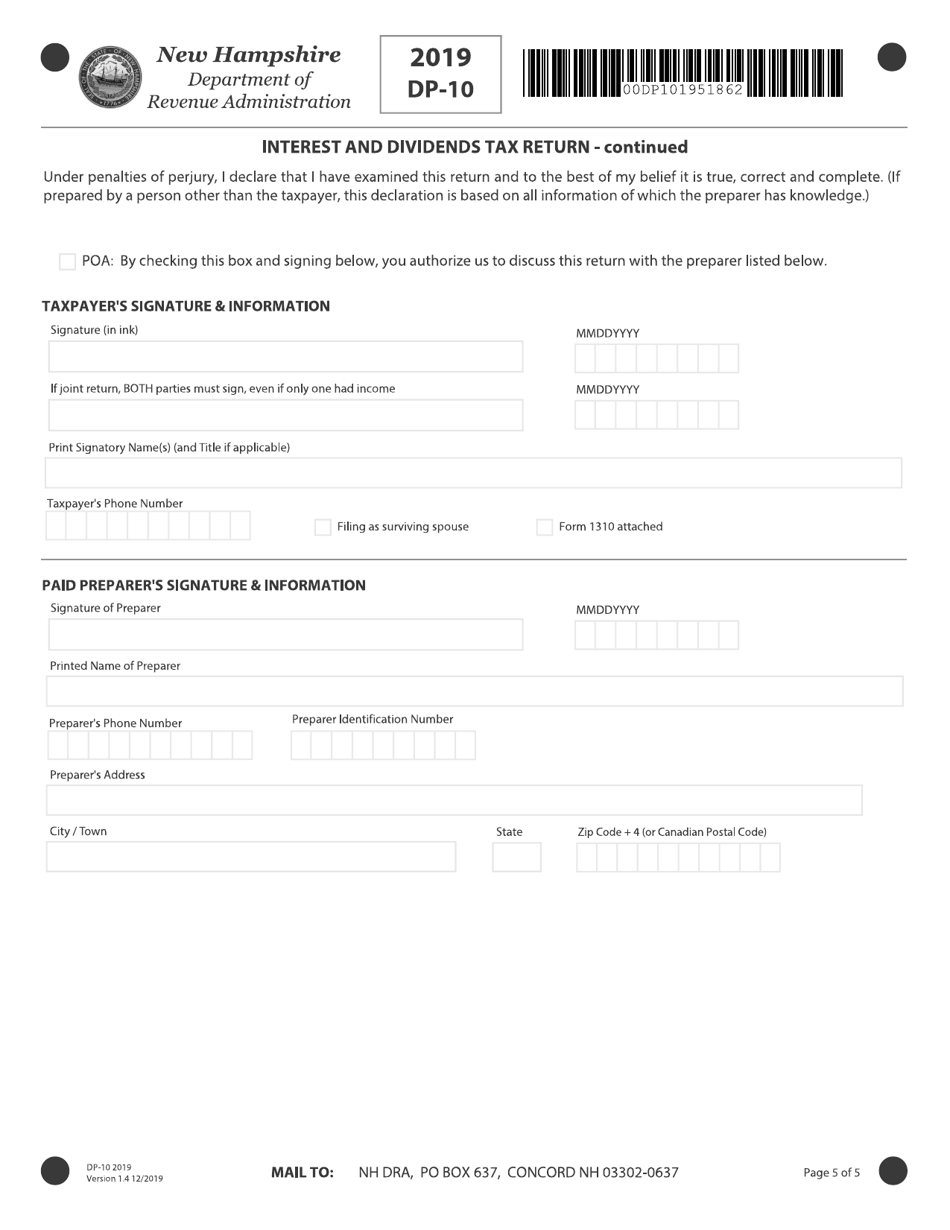

Form DP-10 Interest and Dividends Tax Return - New Hampshire

What Is Form DP-10?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

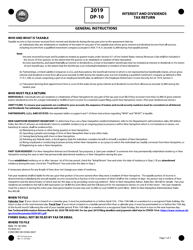

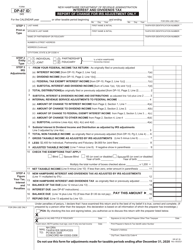

Q: What is the Form DP-10?

A: The Form DP-10 is the Interest and Dividends Tax Return for the state of New Hampshire.

Q: Who needs to file Form DP-10?

A: Any individual who received taxable interest or dividends in the state of New Hampshire needs to file Form DP-10.

Q: How do I complete Form DP-10?

A: You need to provide information about your taxable interest and dividends, as well as any adjustments or exemptions you may qualify for.

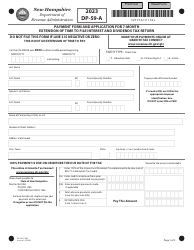

Q: When is the deadline to file Form DP-10?

A: The deadline to file Form DP-10 is April 15th of each year.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the New Hampshire Interest and Dividends Tax laws. It is important to file your return on time.

Q: Is there a minimum threshold for filing Form DP-10?

A: Yes, you are required to file Form DP-10 if your taxable interest and dividends exceed $2,400 for an individual or $4,800 for a couple filing jointly.

Q: Can I claim any deductions or exemptions on Form DP-10?

A: Yes, you may be eligible for deductions or exemptions such as retirement or pension income deductions or exemptions for low-income individuals.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-10 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.