This version of the form is not currently in use and is provided for reference only. Download this version of

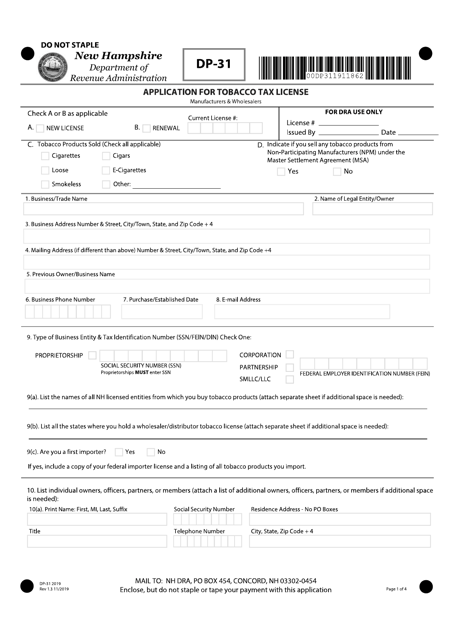

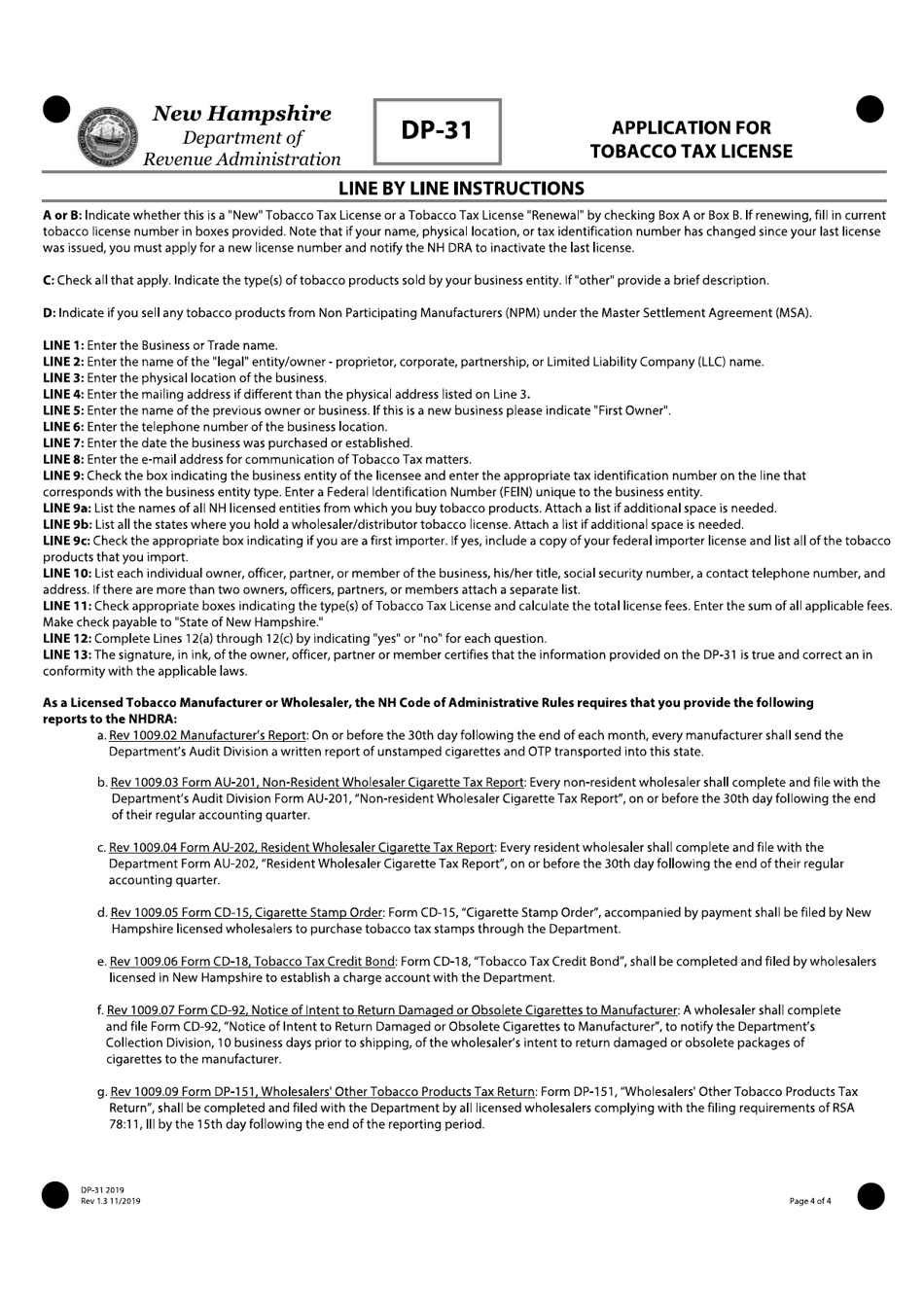

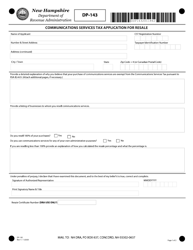

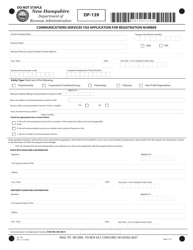

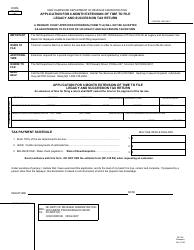

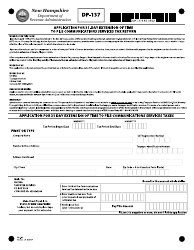

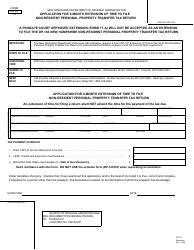

Form DP-31

for the current year.

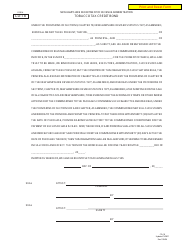

Form DP-31 Application for Tobacco Tax License - New Hampshire

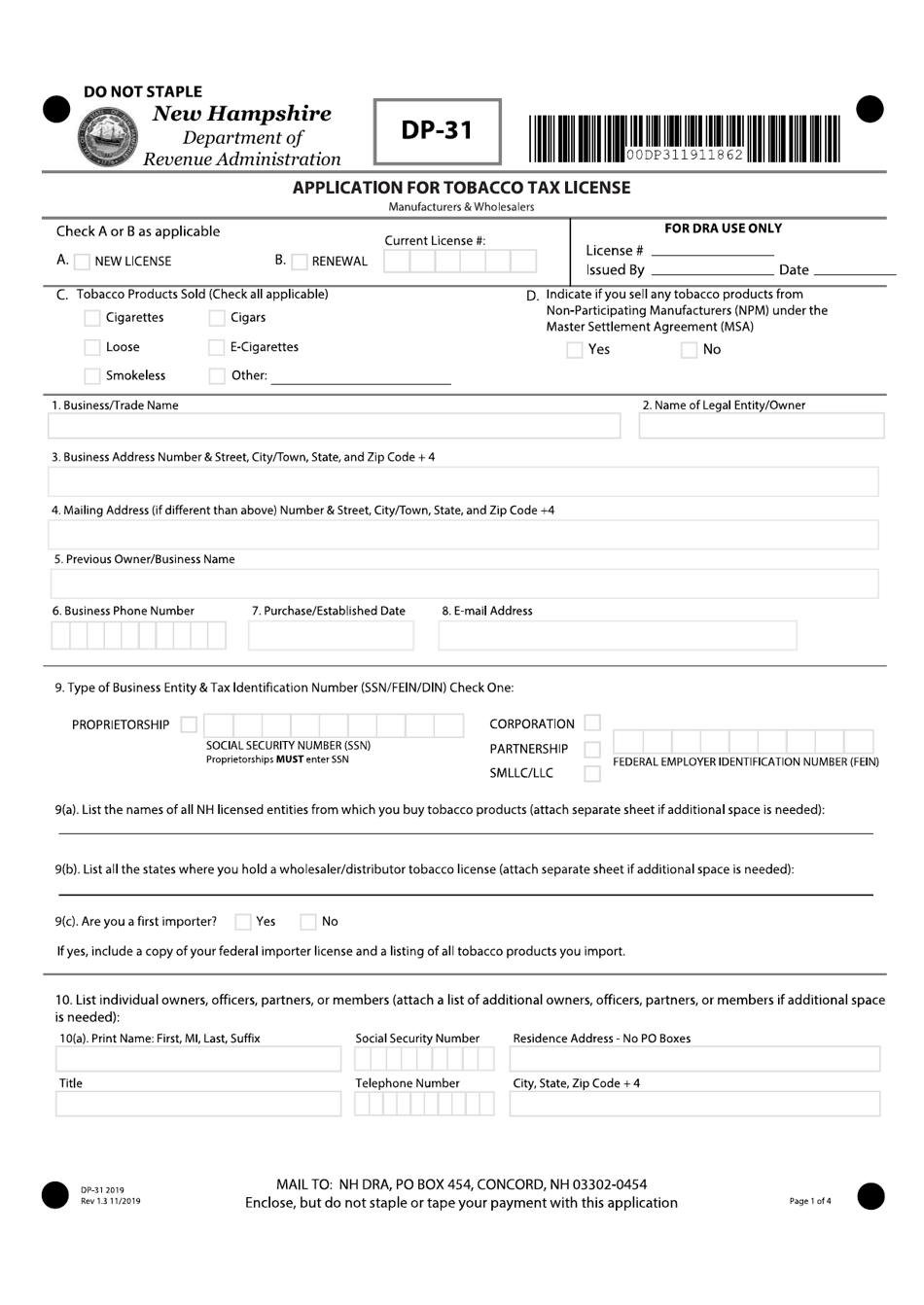

What Is Form DP-31?

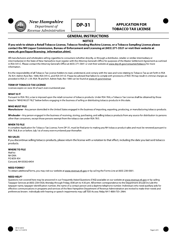

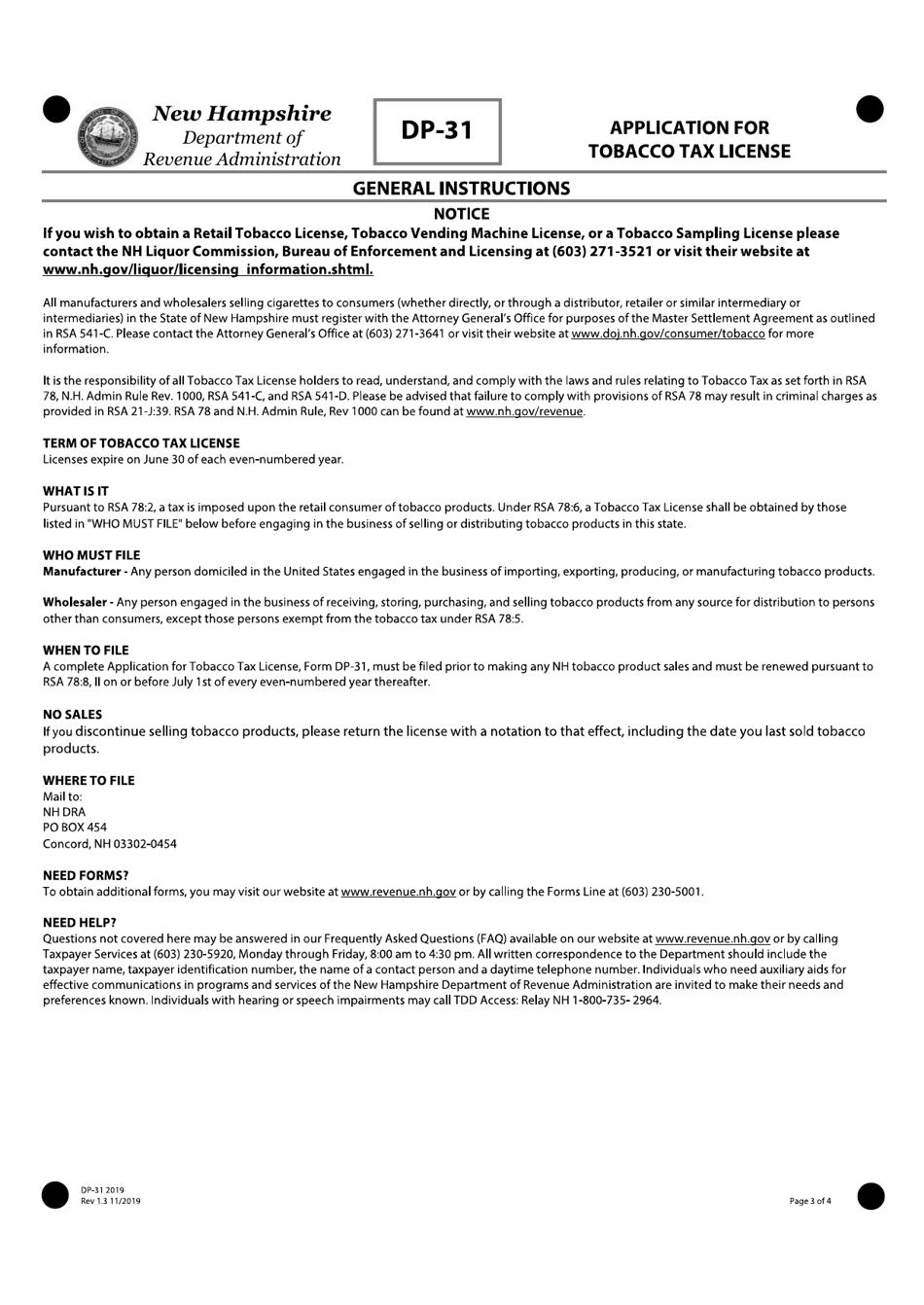

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-31?

A: Form DP-31 is the application form for a Tobacco Tax License in New Hampshire.

Q: Who needs to fill out Form DP-31?

A: Any individual or business intending to sell tobacco products in New Hampshire needs to fill out Form DP-31.

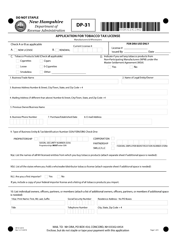

Q: What information is required on Form DP-31?

A: Form DP-31 requires information such as the applicant's name, address, contact information, business details, and other relevant information.

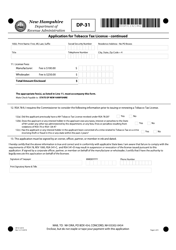

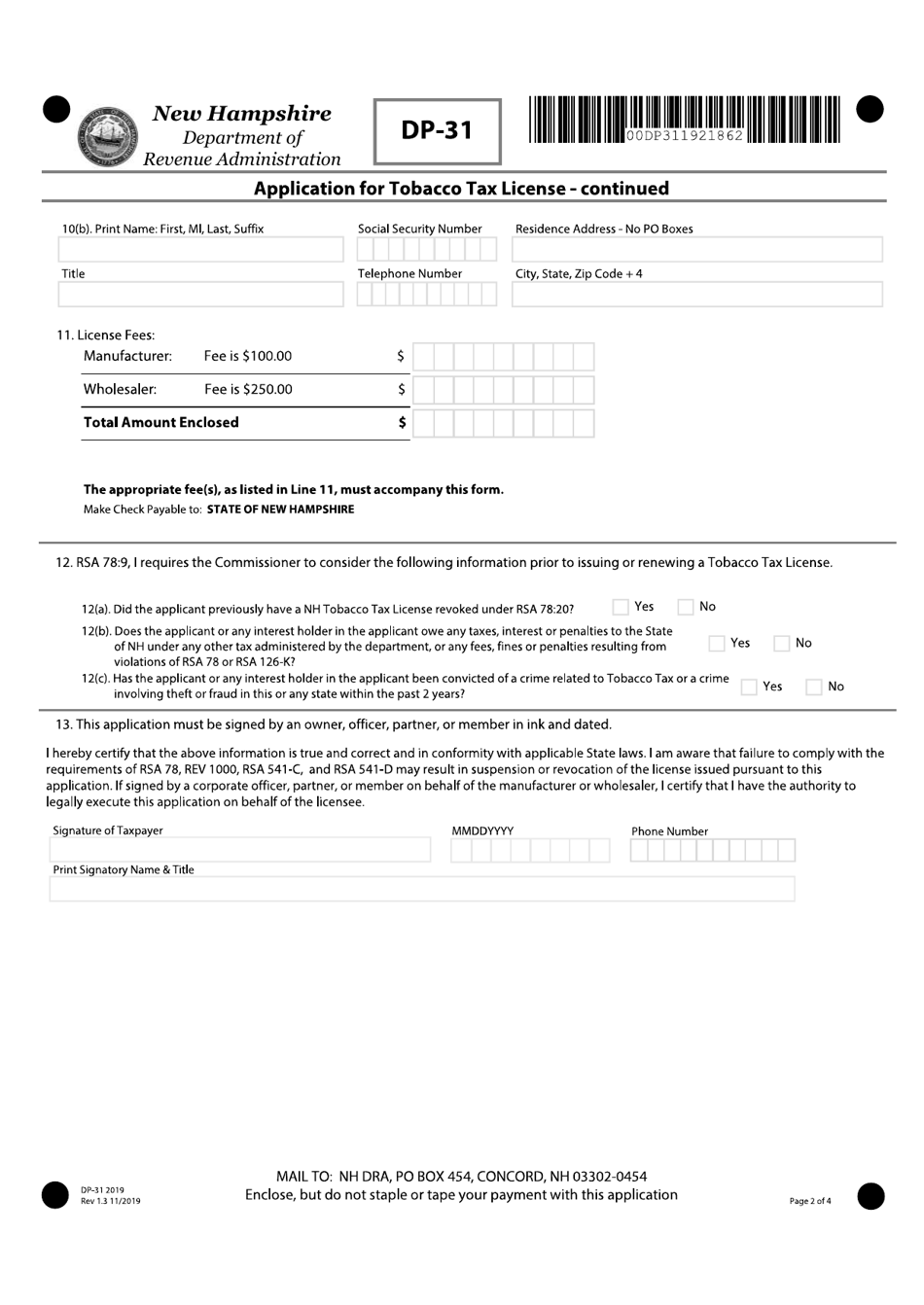

Q: Is there a fee for applying for a Tobacco Tax License in New Hampshire?

A: Yes, there is a fee required when submitting Form DP-31. The fee amount may vary and should be included with the application.

Q: How long does it take to process the application?

A: The processing time for Form DP-31 and the issuance of the Tobacco Tax License may vary. It is recommended to contact the New Hampshire Department of Revenue Administration for more information.

Q: Are there any additional requirements for obtaining a Tobacco Tax License?

A: Yes, there may be additional requirements such as obtaining a Federal Employer Identification Number (EIN) and complying with other state and local regulations. It is advisable to review the instructions on Form DP-31 and consult with the appropriate authorities.

Q: Can I sell tobacco products without a Tobacco Tax License?

A: No, it is illegal to sell tobacco products in New Hampshire without a valid Tobacco Tax License.

Q: Can I renew my Tobacco Tax License?

A: Yes, you can renew your Tobacco Tax License by submitting the appropriate renewal form and fee before the expiration date of your current license.

Q: What should I do if there are changes to my business information?

A: If there are changes to your business information after submitting Form DP-31, you should notify the New Hampshire Department of Revenue Administration in writing to update your records.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-31 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.