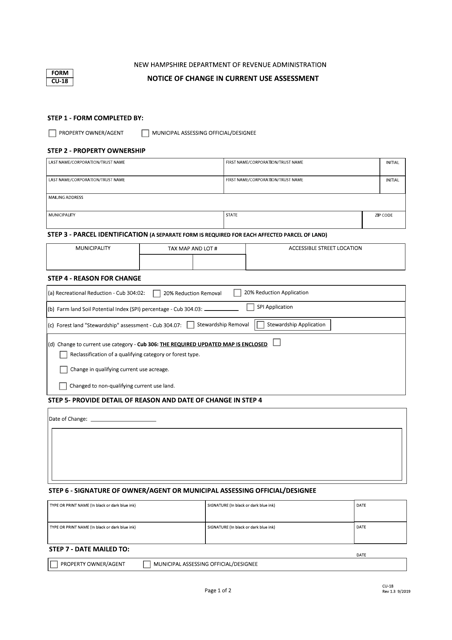

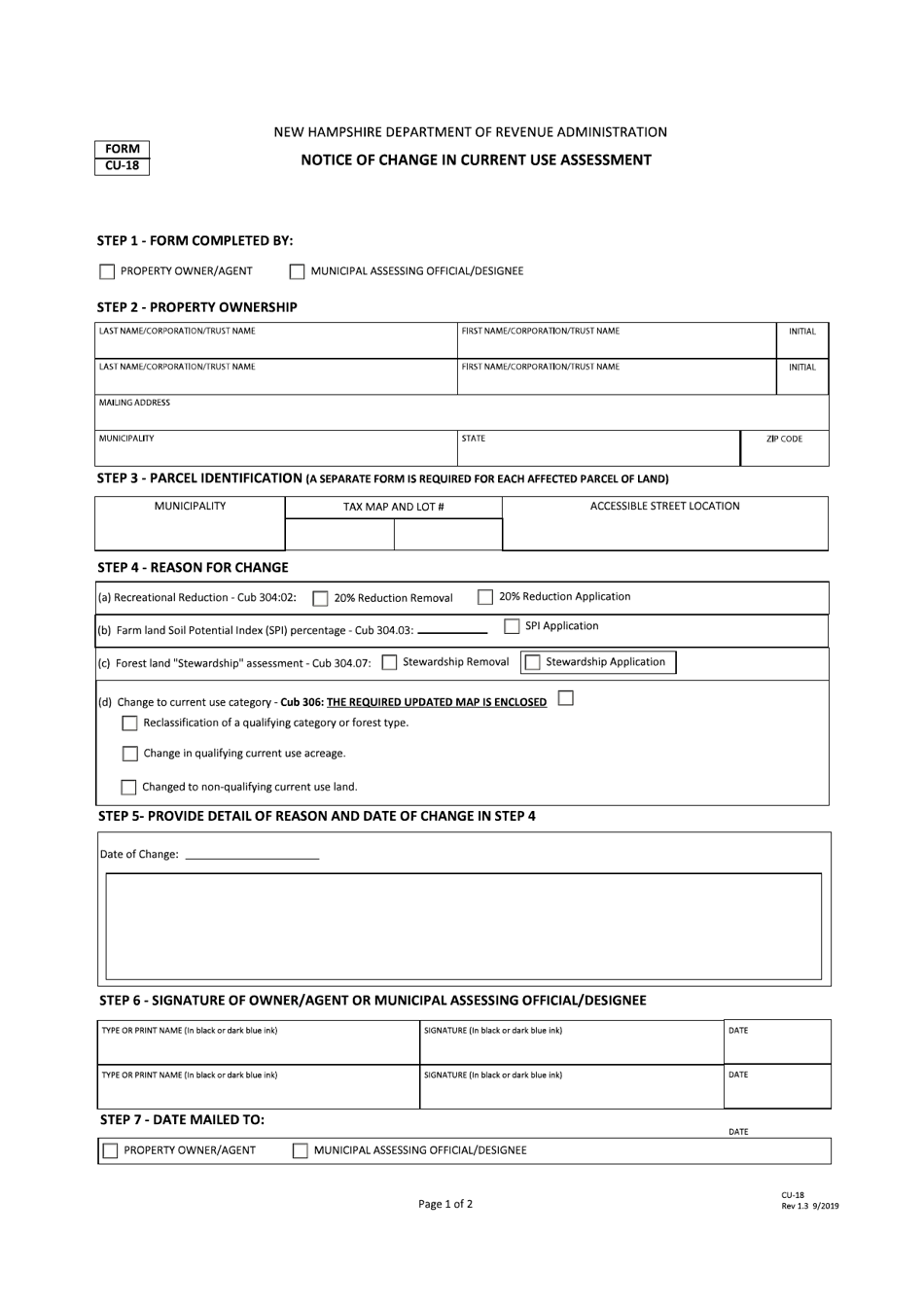

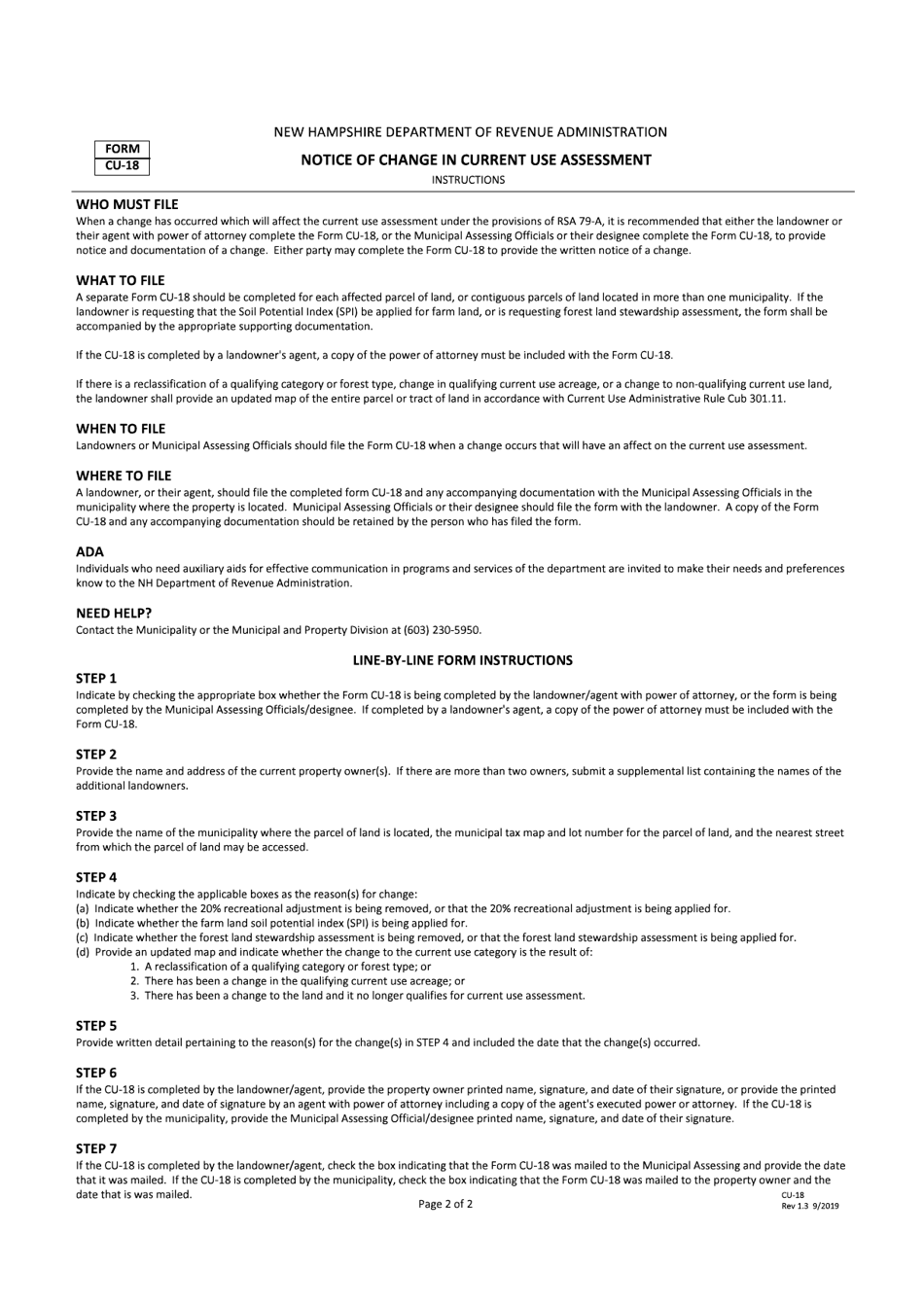

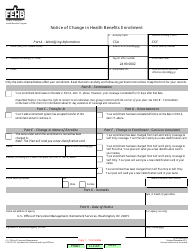

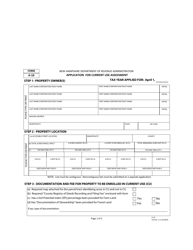

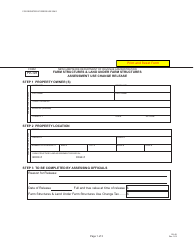

Form CU-18 Notice of Change in Current Use Assessment - New Hampshire

What Is Form CU-18?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CU-18?

A: Form CU-18 is a Notice of Change in Current Use Assessment in New Hampshire.

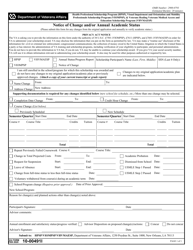

Q: What is Current Use Assessment?

A: Current Use Assessment is a program in New Hampshire that allows landowners to have their property taxed based on its current use, such as agricultural or forest land, rather than its fair market value.

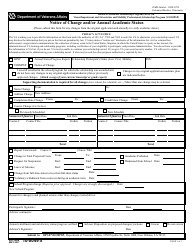

Q: Who needs to file Form CU-18?

A: Property owners who have had a change in the use of their land must file Form CU-18 to notify the local assessing officials.

Q: What changes in land use require filing Form CU-18?

A: Changes in land use that require filing Form CU-18 include converting agricultural or forest land to a different use, such as residential or commercial.

Q: When should Form CU-18 be filed?

A: Form CU-18 should be filed within 30 days of the change in land use.

Q: Are there any fees for filing Form CU-18?

A: There are no fees for filing Form CU-18 in New Hampshire.

Q: What happens after filing Form CU-18?

A: After filing Form CU-18, the assessing officials will review the change in land use and may adjust the property's current use assessment accordingly.

Q: Is Form CU-18 confidential?

A: No, Form CU-18 is not confidential and may be subject to public inspection.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CU-18 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.