This version of the form is not currently in use and is provided for reference only. Download this version of

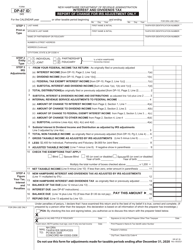

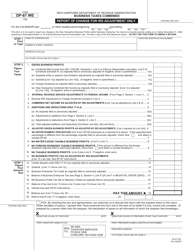

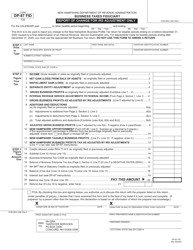

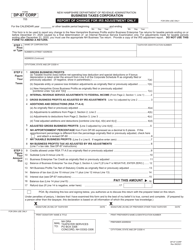

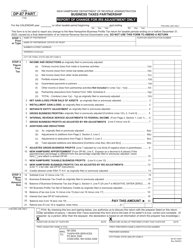

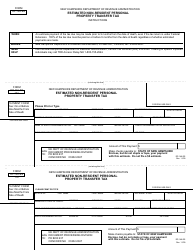

Form DP-4

for the current year.

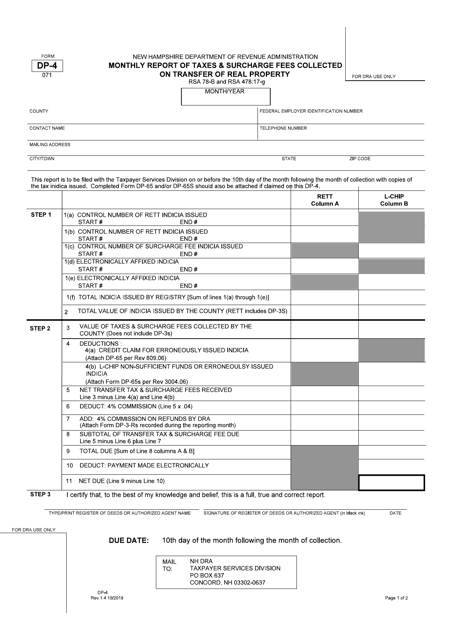

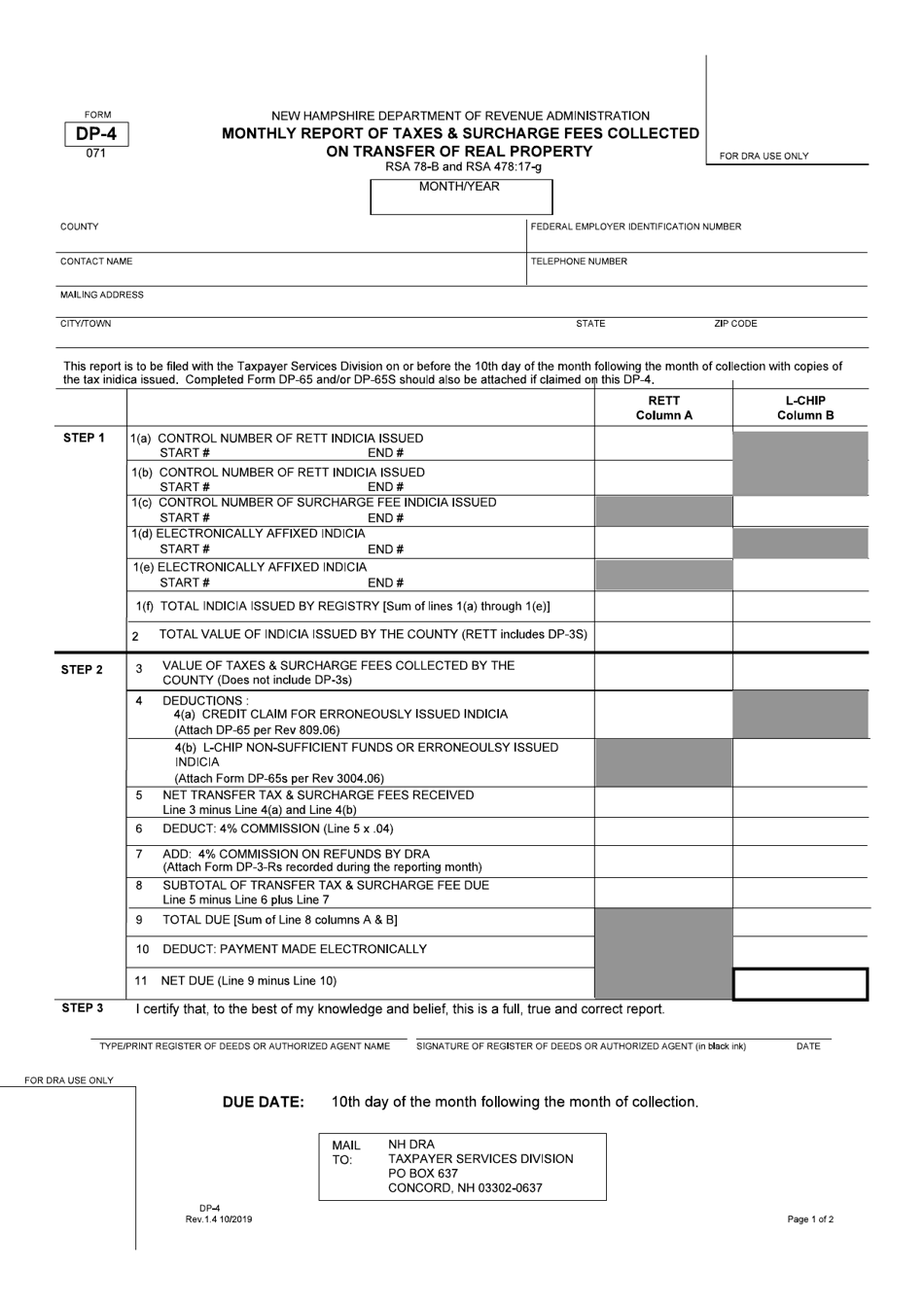

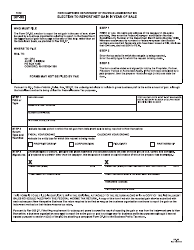

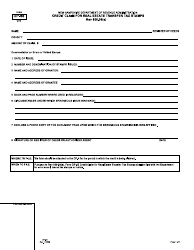

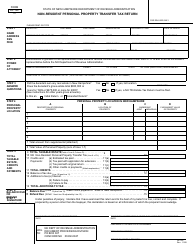

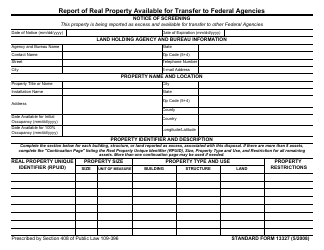

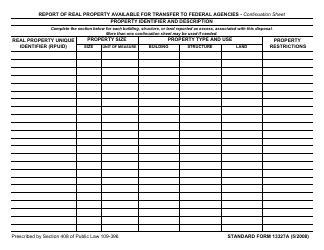

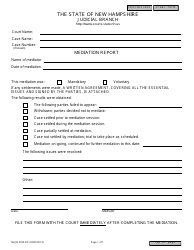

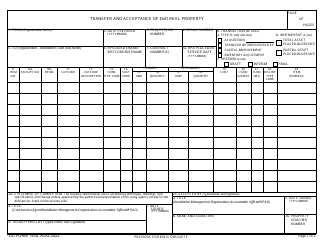

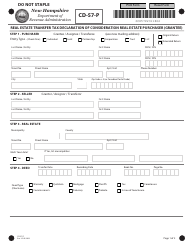

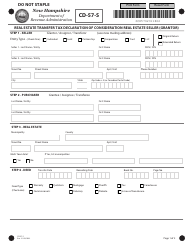

Form DP-4 Monthly Report of Taxes & Surcharge Fees Collected on Transfer of Real Property - New Hampshire

What Is Form DP-4?

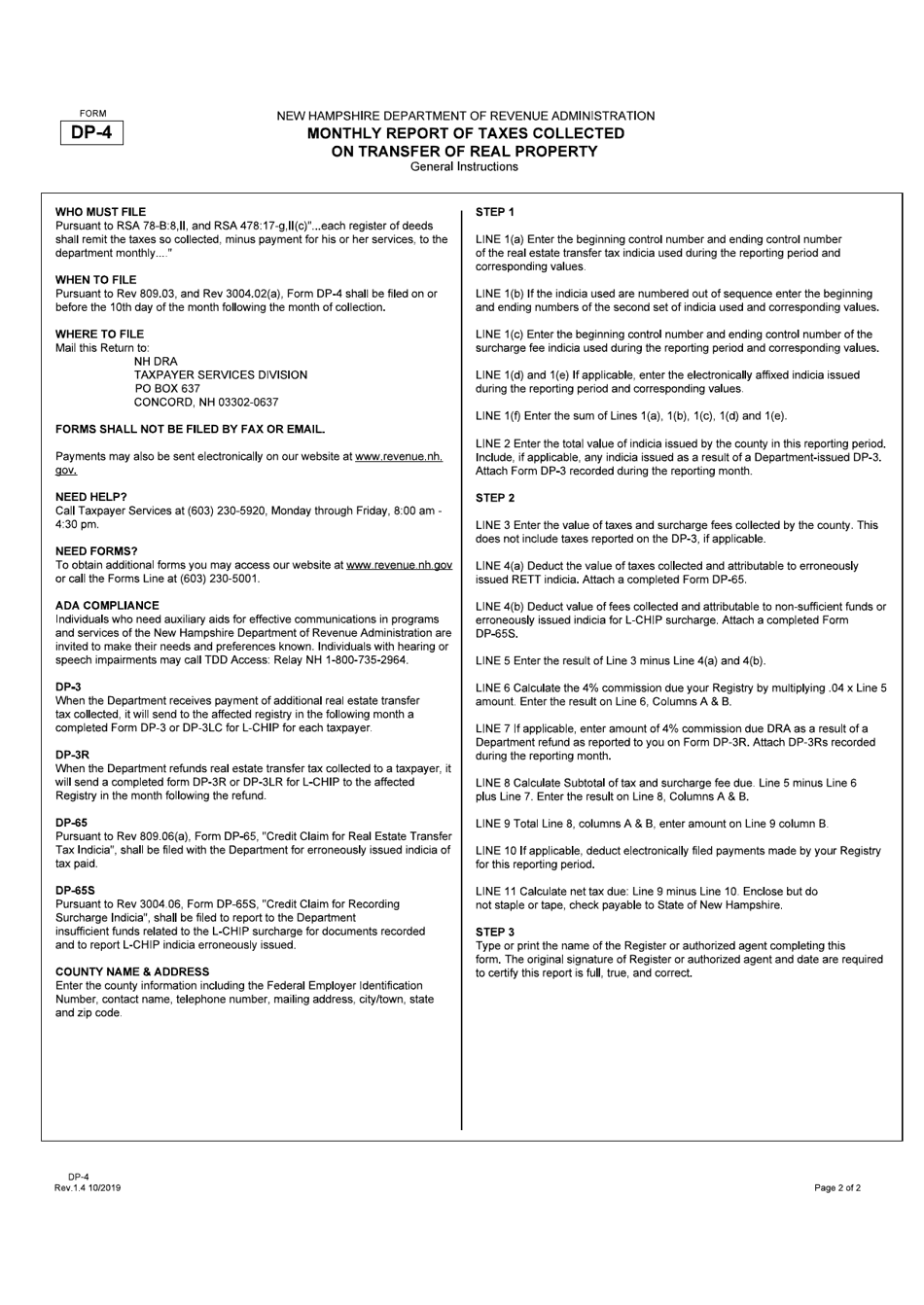

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-4?

A: Form DP-4 is a monthly report used to report taxes and surcharge fees collected on the transfer of real property in New Hampshire.

Q: Who needs to file Form DP-4?

A: Real estate transferors, attorneys or closing agents are required to file Form DP-4.

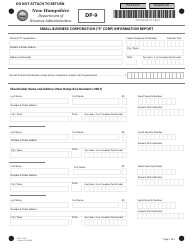

Q: What information is required on Form DP-4?

A: Form DP-4 requires information such as the names and addresses of the transferor and transferee, the sale price of the property, and the amount of taxes and surcharge fees collected.

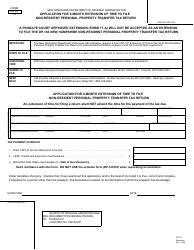

Q: When is Form DP-4 due?

A: Form DP-4 is due on or before the 15th day of the month following the month in which the transfer occurred.

Q: Are there any penalties for not filing Form DP-4?

A: Yes, failure to file Form DP-4 or filing it late may result in penalties, interest, and other enforcement actions.

Q: Is Form DP-4 confidential?

A: No, Form DP-4 is considered a public record and may be subject to disclosure under the New Hampshire Right to Know Law.

Q: Are there any exemptions to filing Form DP-4?

A: There are certain exemptions to filing Form DP-4, such as transfers between spouses, transfers to or from government entities, and transfers for no consideration.

Q: Is there a fee for filing Form DP-4?

A: No, there is no fee for filing Form DP-4.

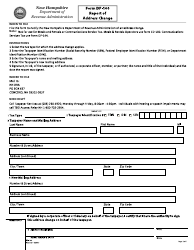

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-4 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.