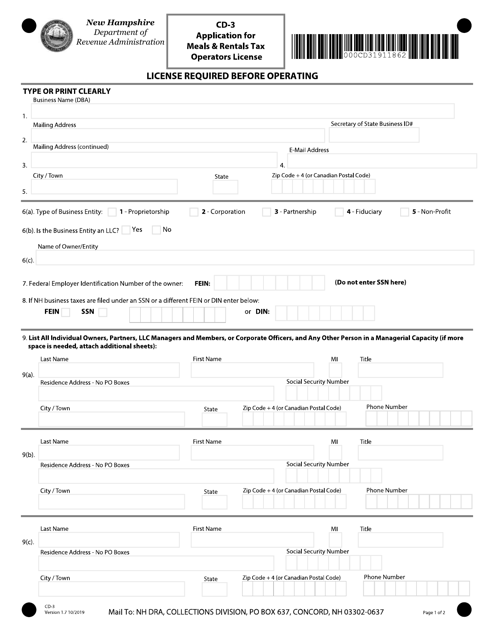

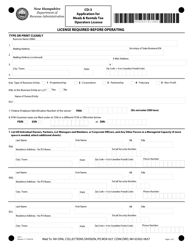

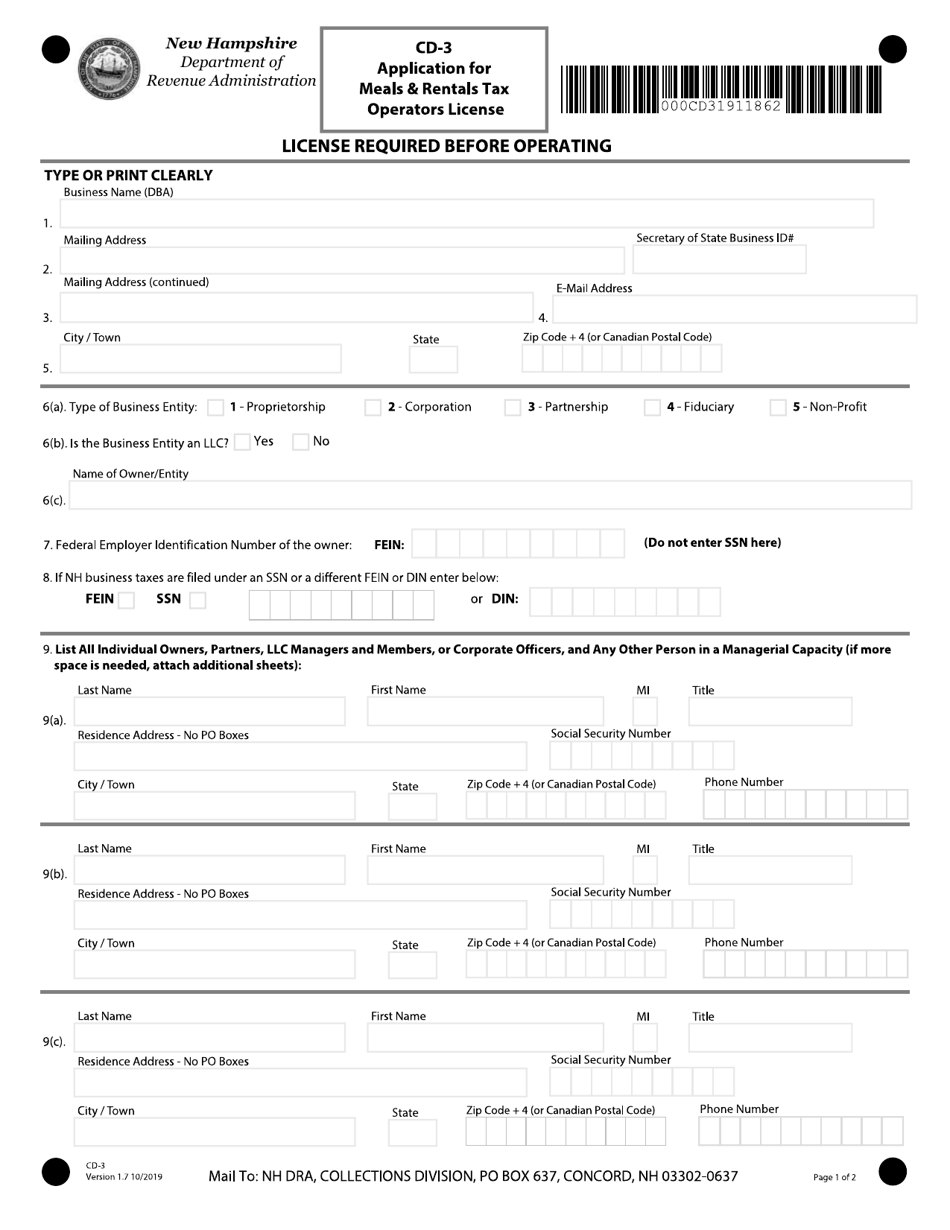

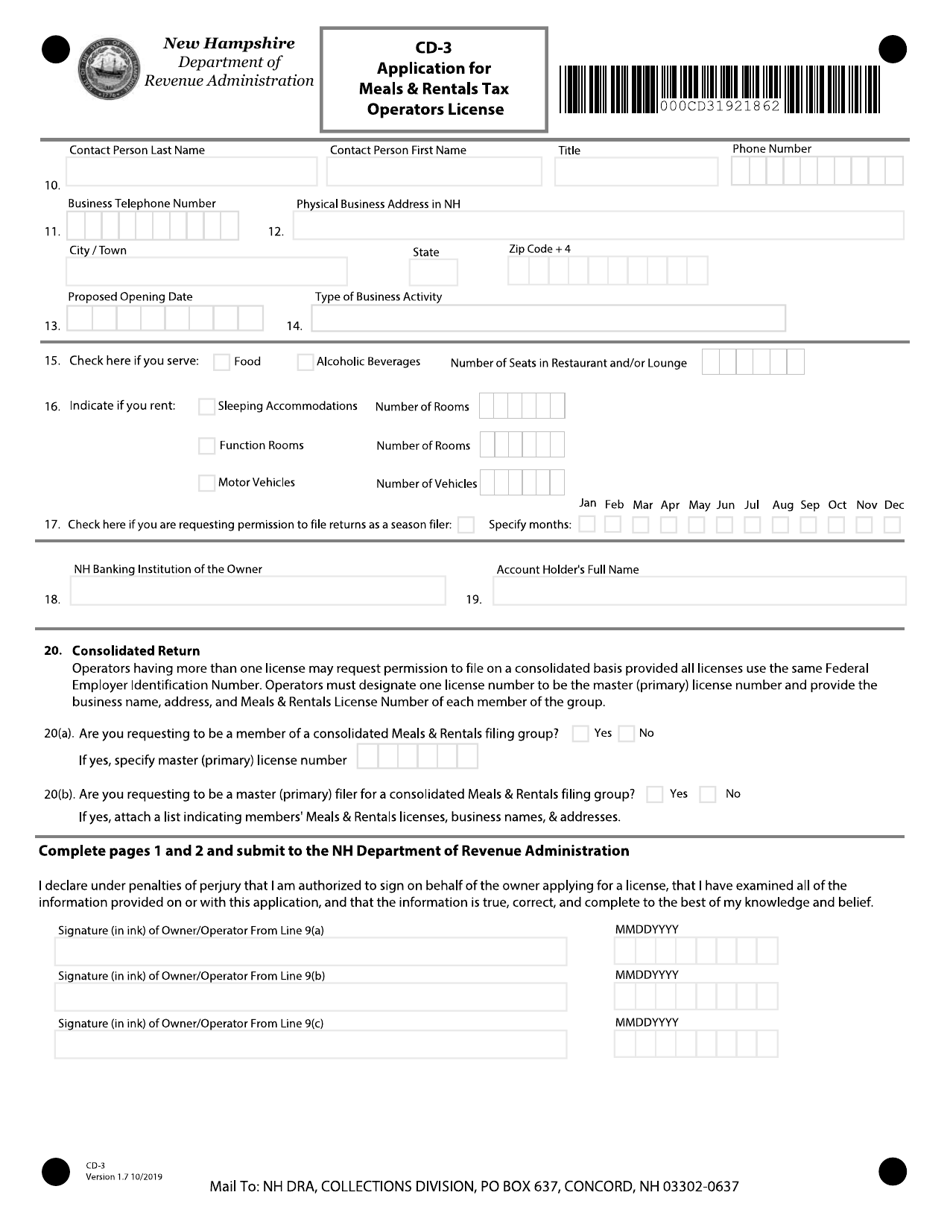

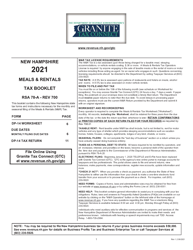

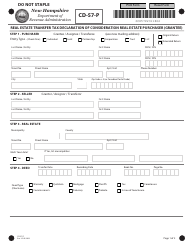

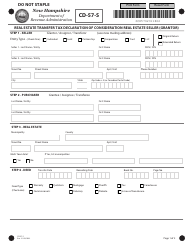

Form CD-3 Application for Meals and Rentals Tax Operators License - New Hampshire

What Is Form CD-3?

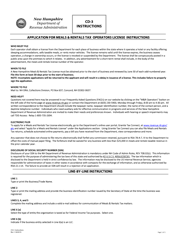

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-3?

A: Form CD-3 is the Application for Meals and Rentals Tax Operators License in New Hampshire.

Q: What is the purpose of Form CD-3?

A: The purpose of Form CD-3 is to apply for a license to collect and remit meals and rentals tax in New Hampshire.

Q: Who needs to file Form CD-3?

A: Any individual or business that operates as a meals and rentals tax operator in New Hampshire needs to file Form CD-3.

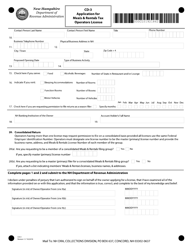

Q: What information is required on Form CD-3?

A: Form CD-3 requires information about the applicant's business, such as their name, address, and tax identification number.

Q: Are there any fees associated with filing Form CD-3?

A: Yes, there is a fee for filing Form CD-3. The fee amount is determined by the Department of Revenue Administration and is subject to change.

Q: When should I file Form CD-3?

A: Form CD-3 should be filed at least 30 days before the applicant plans to begin operations as a meals and rentals tax operator in New Hampshire.

Q: What happens after I file Form CD-3?

A: After you file Form CD-3, the Department of Revenue Administration will review your application and contact you if any additional information or documentation is required.

Q: Can I operate as a meals and rentals tax operator without a license?

A: No, it is illegal to operate as a meals and rentals tax operator in New Hampshire without a valid license.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-3 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.