This version of the form is not currently in use and is provided for reference only. Download this version of

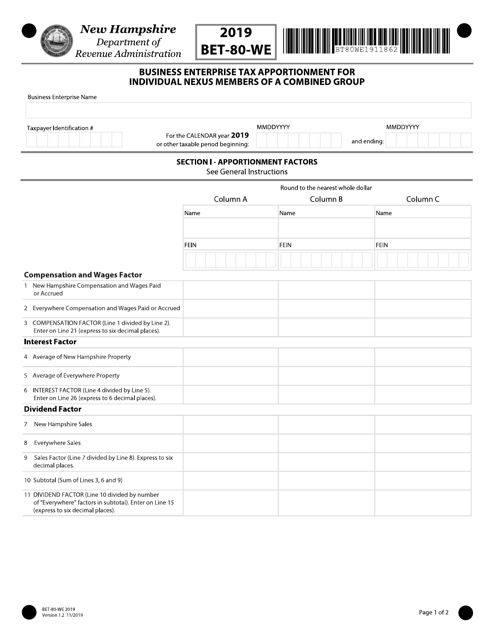

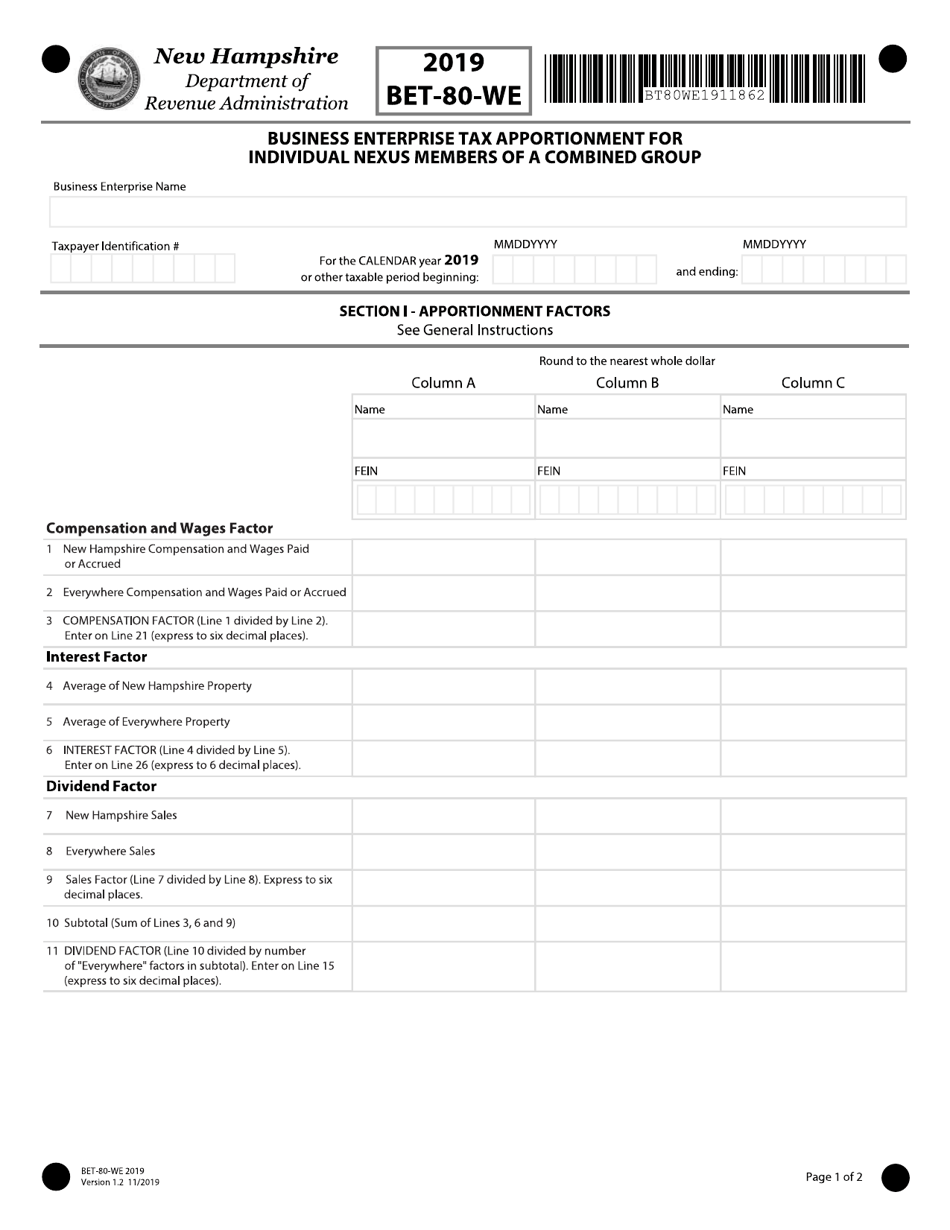

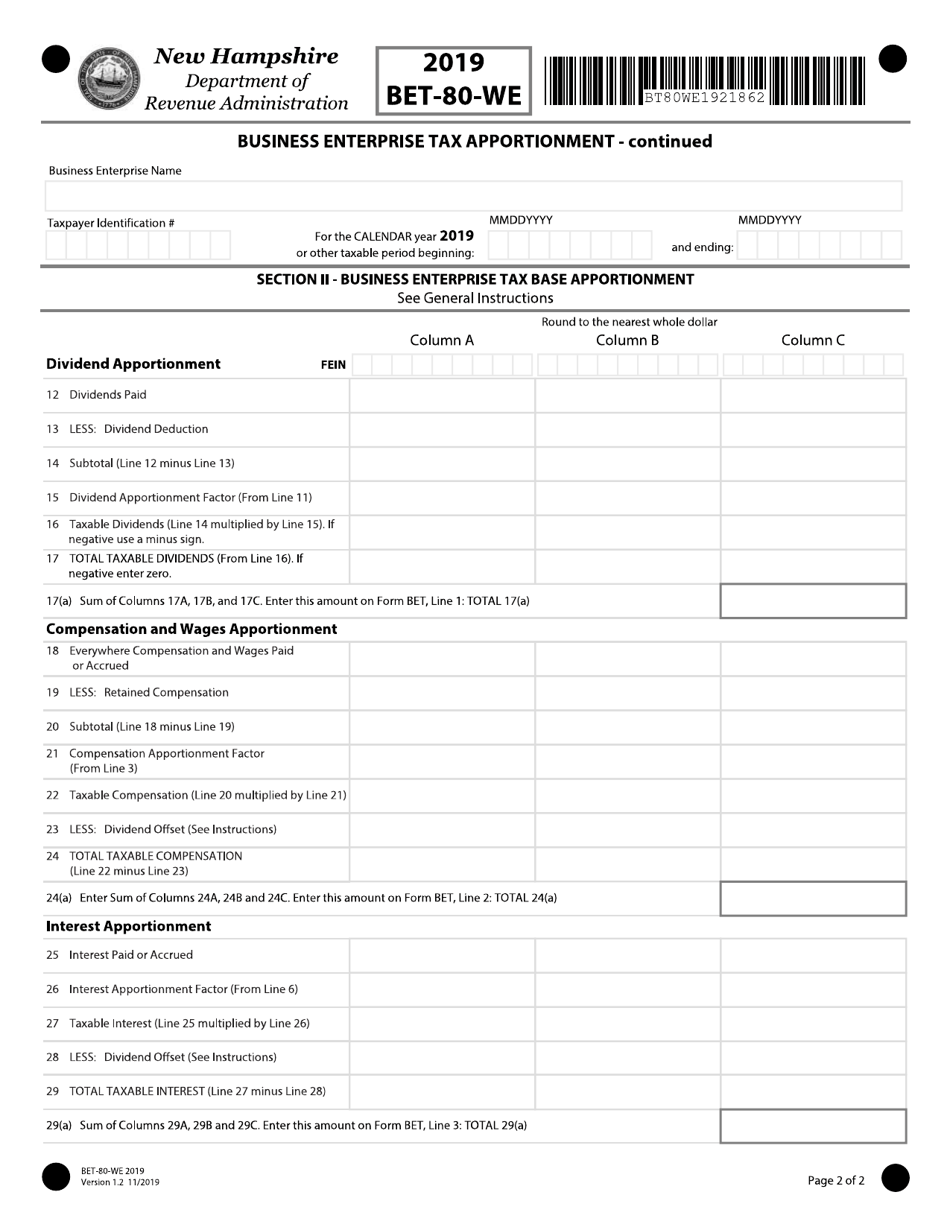

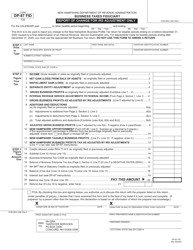

Form BET-80-WE

for the current year.

Form BET-80-WE Combined Group Business Tax Apportionment - New Hampshire

What Is Form BET-80-WE?

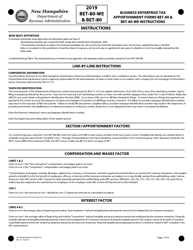

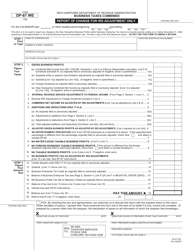

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

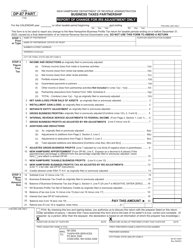

Q: What is the BET-80-WE form?

A: The BET-80-WE form is the Combined Group Business Tax Apportionment form for New Hampshire.

Q: What is the purpose of the BET-80-WE form?

A: The BET-80-WE form is used to apportion and allocate business tax liabilities for a combined group in New Hampshire.

Q: Who needs to file the BET-80-WE form?

A: Any combined group of businesses that conducts business in New Hampshire and meets certain criteria needs to file the BET-80-WE form.

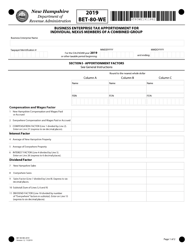

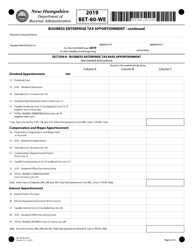

Q: What information is required on the BET-80-WE form?

A: The BET-80-WE form requires information about the combined group's income, property, and payroll in New Hampshire, as well as other necessary details for tax apportionment.

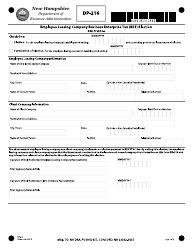

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BET-80-WE by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.