This version of the form is not currently in use and is provided for reference only. Download this version of

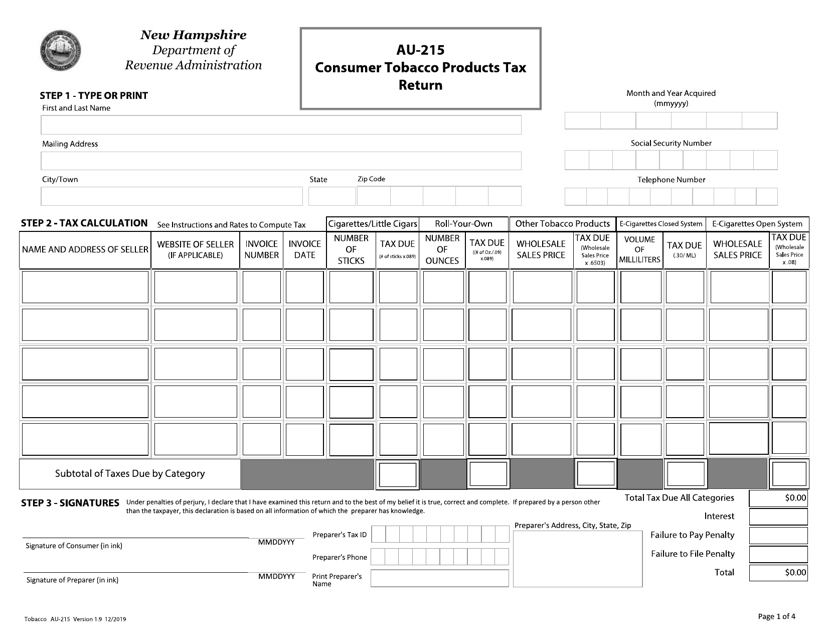

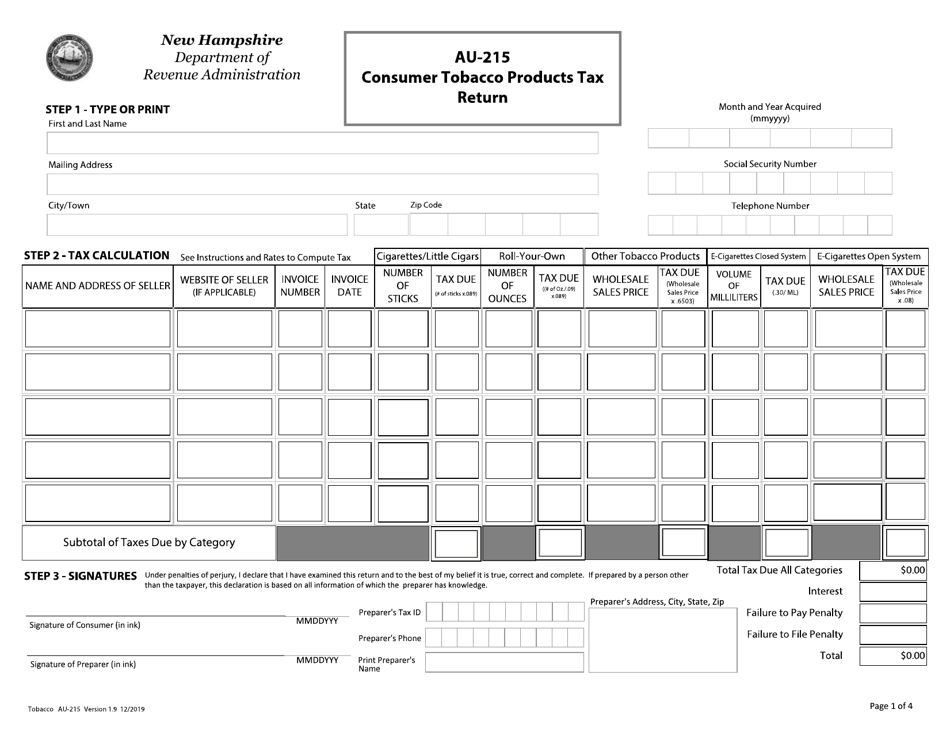

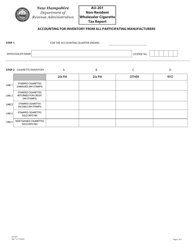

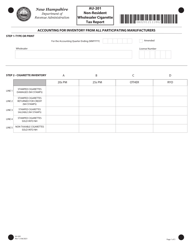

Form AU-215

for the current year.

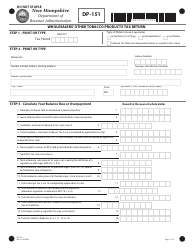

Form AU-215 Consumer Tobacco Products Tax Return - New Hampshire

What Is Form AU-215?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-215?

A: Form AU-215 is the Consumer Tobacco Products Tax Return.

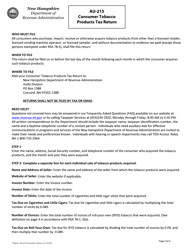

Q: Who is required to file Form AU-215?

A: All manufacturers, wholesalers, and importers of consumer tobacco products in New Hampshire are required to file Form AU-215.

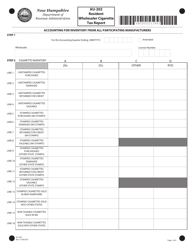

Q: What are consumer tobacco products?

A: Consumer tobacco products include cigarettes, smokeless tobacco, and other tobacco products intended for personal use.

Q: When is Form AU-215 due?

A: Form AU-215 is due on a monthly basis, and the return must be filed and the tax paid by the 25th day of the month following the end of the reporting period.

Q: What is the purpose of Form AU-215?

A: Form AU-215 is used to report and pay the consumer tobacco products tax to the state of New Hampshire.

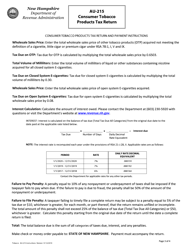

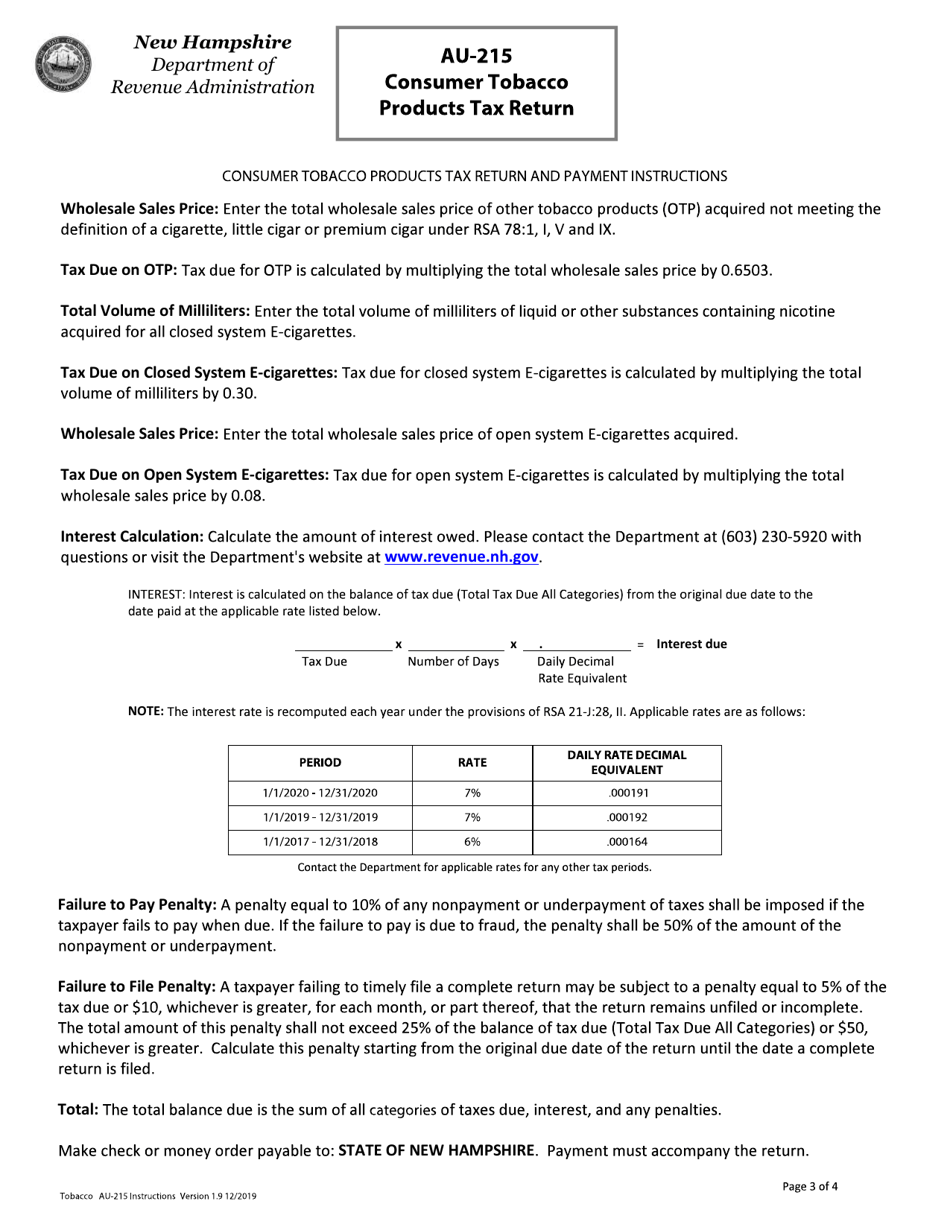

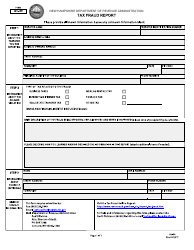

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing and non-payment of the consumer tobacco products tax. These penalties can include interest charges and additional fees.

Q: What should I do if I have questions or need assistance with Form AU-215?

A: If you have questions or need assistance with Form AU-215, you can contact the New Hampshire Department of Revenue Administration for guidance and support.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-215 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.