This version of the form is not currently in use and is provided for reference only. Download this version of

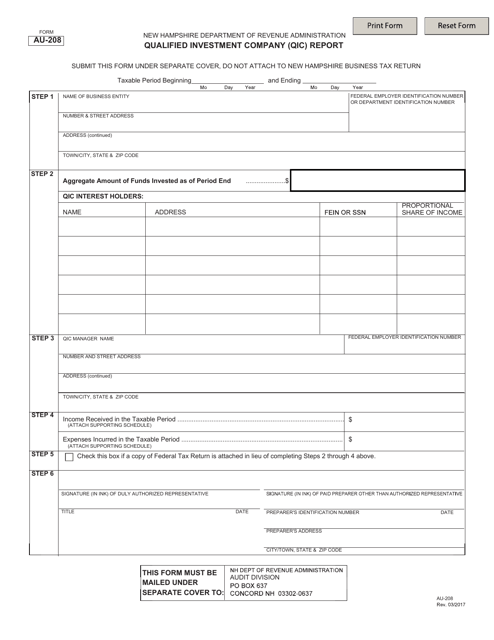

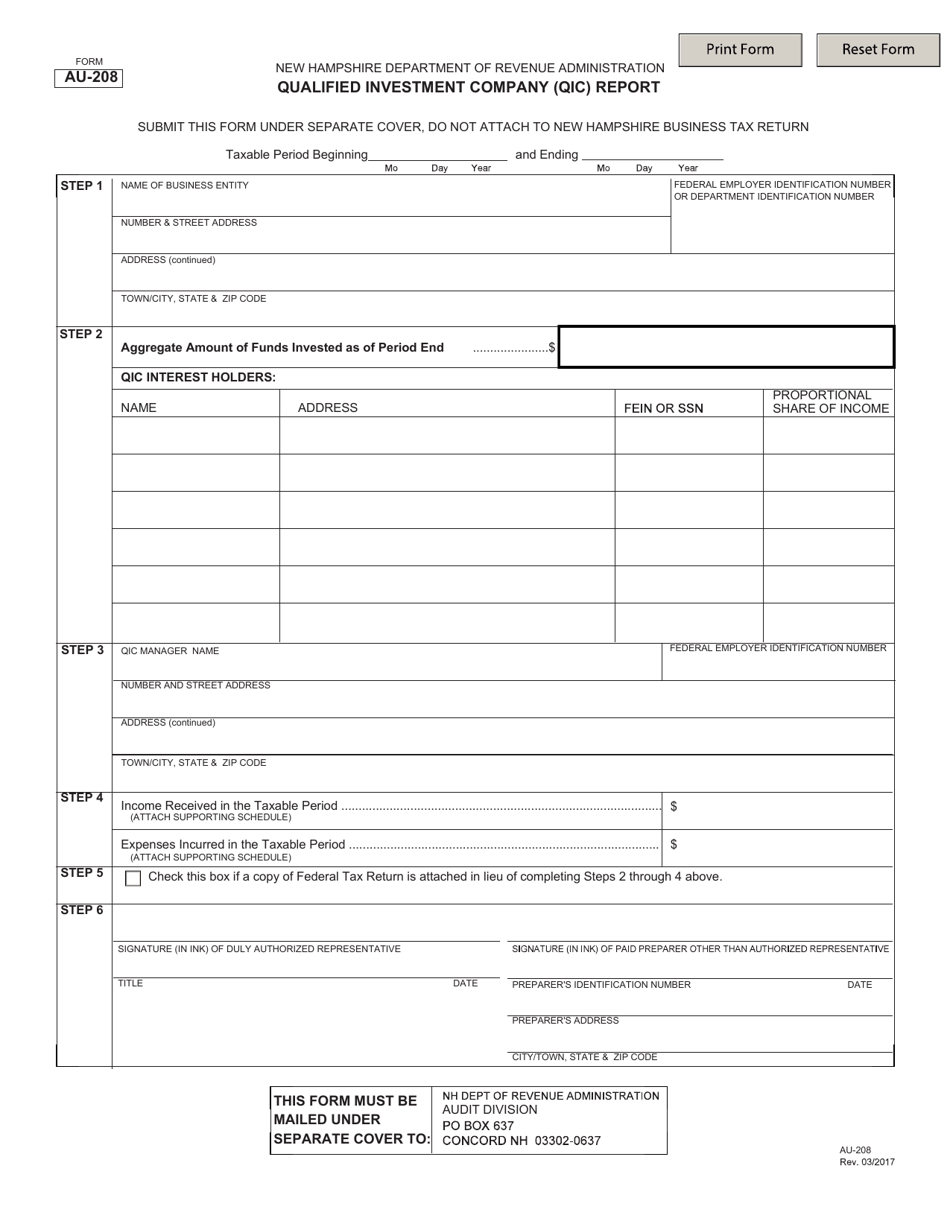

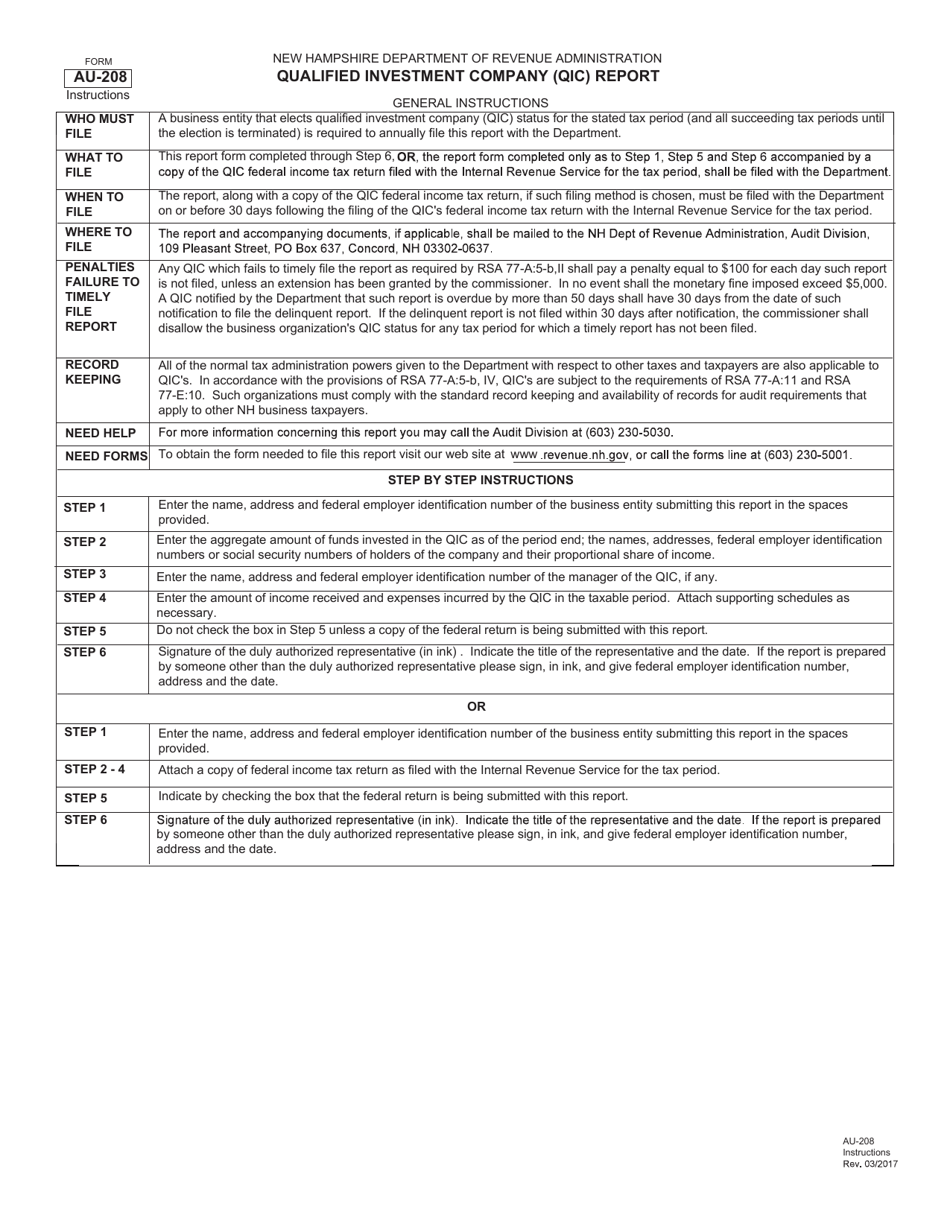

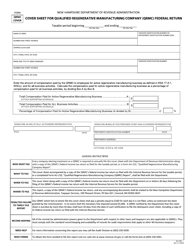

Form AU-208

for the current year.

Form AU-208 Qualified Investment Company (Qic) Report - New Hampshire

What Is Form AU-208?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-208?

A: Form AU-208 is the Qualified Investment Company (QIC) Report.

Q: What is a Qualified Investment Company (QIC)?

A: A Qualified Investment Company (QIC) is a company that meets specific regulatory requirements and elects to be treated as a QIC for tax purposes.

Q: Who needs to file Form AU-208?

A: Companies that qualify as Qualified Investment Companies (QICs) in New Hampshire need to file Form AU-208.

Q: What is the purpose of Form AU-208?

A: The purpose of Form AU-208 is to report the income and expenses of Qualified Investment Companies (QICs) in New Hampshire.

Q: When is Form AU-208 due?

A: Form AU-208 is generally due on or before the 15th day of the 4th month following the end of the QIC's taxable year.

Q: Is there a penalty for failing to file Form AU-208?

A: Yes, there may be penalties for failing to file Form AU-208 or for filing it late. It is important to file the form on time to avoid any penalties.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-208 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.